This past year has been anything but predictable for the housing market. As we head into the fourth quarter, we wanted to take a look at what the experts anticipate for the coming year.

White Hot to Red Hot

According to Norada Real Estate Investment founder Marco Santarelli, “The US housing market is far from crashing in 2021 or 2022. In fact, it continues to play an important supportive role in the country’s economic recovery. Current economic conditions resemble a ‘swoosh’ pattern, with the initial impact from the lockdown followed by a gradual recovery as the economy reopens.”

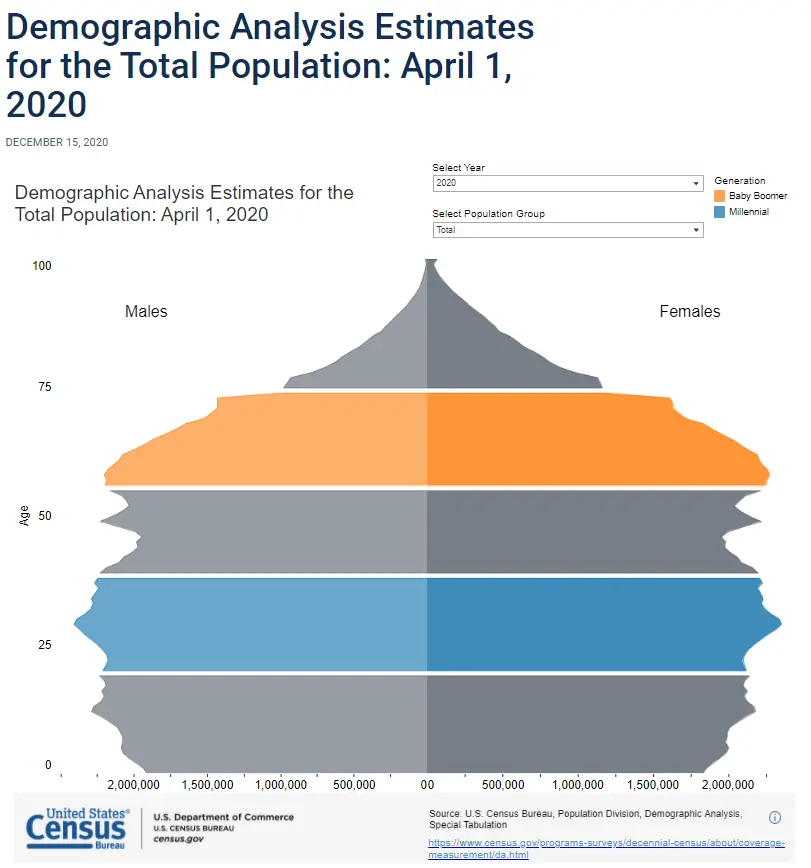

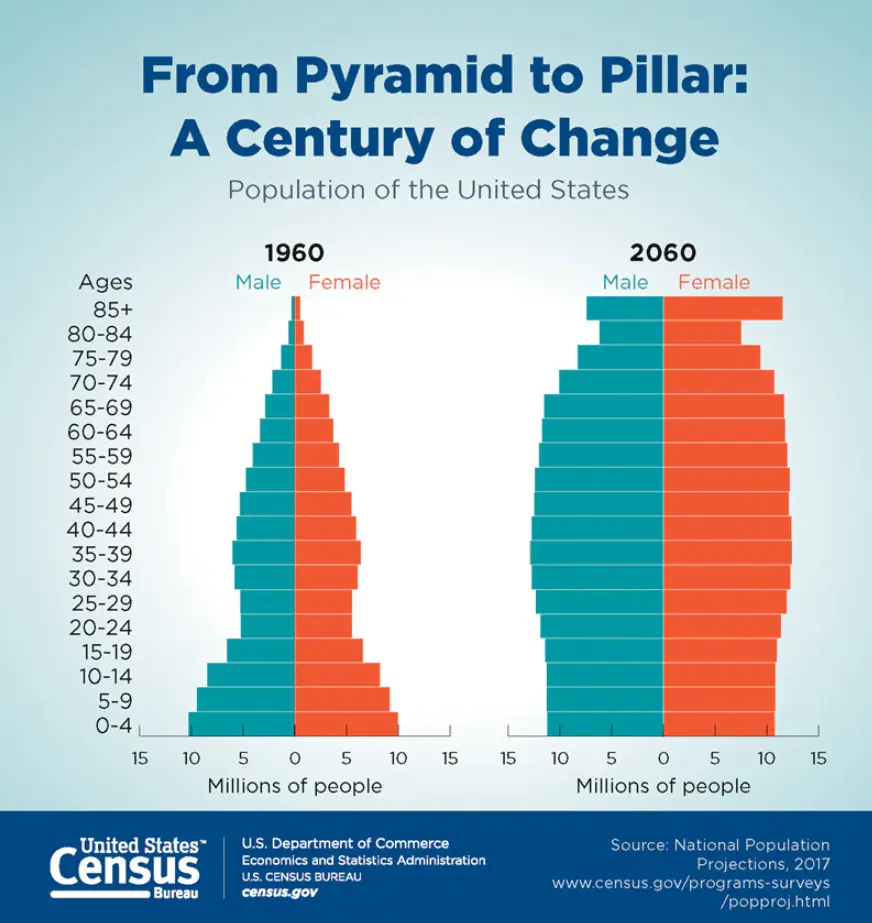

Housing Wire analyst Logan Mohtashami goes so far as to state that we are in the middle of the best housing demographic patch in history and the next two years are the sweet spot. The charts below illustrate the massive size of the 28-to-34 age group that will keep the economy pushing forward.

“During this time we will have a lot of people of first-time home-buying age that will need shelter. But housing demand won’t just be from millennials and Gen Z coming into home-buying age: we will also have our move-up, move-down, cash and investor buyers adding to the demand,” according to Mohtashami.

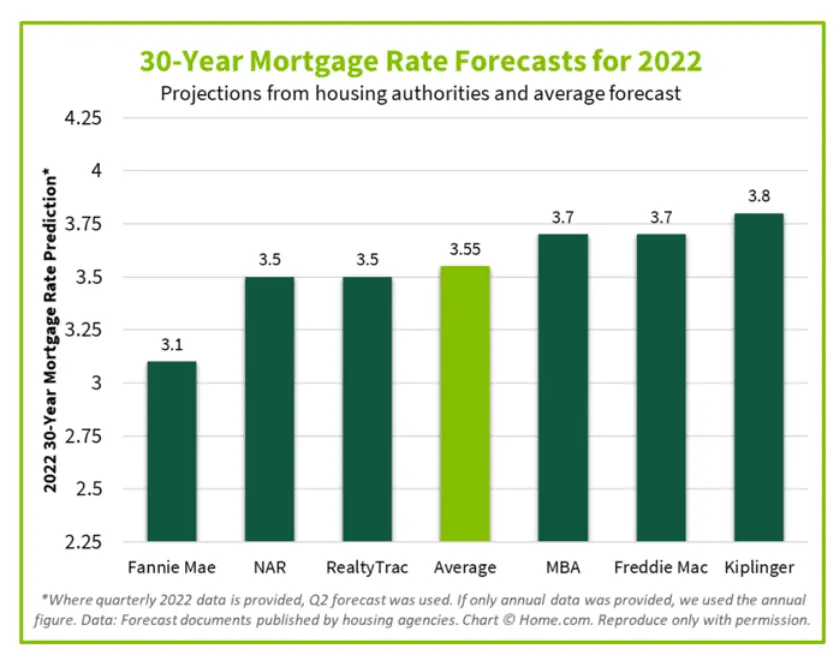

Rates Rising

The rock-bottom rates that homebuyers have enjoyed for the past year-and-a-half will not be making a return in 2022. Rates are expected to remain relatively low but will be above 3% for a 30-year mortgage. Fannie Mae predicts 3.1% while Freddie Mac and Kiplinger are at 3.7% and 3.8% respectively. Kiplinger’s forecast noted that although interest rates will head higher, they will be “nowhere near what we saw in the 1980s.”

National Association of Realtors senior economist Nadia Evangelou notes a number of factors impacting the rise. “First, [the Federal Reserve] recently pushed up its inflation estimates for this year, indicating that inflation will be around longer. The grace period for higher inflation seems to be coming to an end, as the Fed will likely raise interest rates by the middle of next year,” Evangelou explained. “When the Fed increases its interest rates, banks do, too. And when that happens, mortgage rates go up for borrowers.”

As rates rise, the rapid home price acceleration will temper, but only slightly. Freddie Mac forecasts home price growth to slow to 5.3% in 2022, compared to a projected 12.1% in 2021. However, Goldman Sachs is more bullish on home price, with its team of economists predicting home prices will grow another 16% by the end of 2022. “The supply-demand picture that has been the basis for our call for a multi-year boom in home prices remains intact,” wrote a Goldman Sachs team of economists led by Jan Hatzius in a recent note, according to Yahoo! News. “Housing inventories remain historically tight, and surveys of home buying intentions remain at healthy levels.”

Zillow takes a more moderate stance, forecasting an 11.7% appreciation in home values and describing the market as transitioning from “white hot” to “red hot.” They believe that while inventory is improving, it’s still well below pre-pandemic levels.

NAR is also expecting a somewhat calmer housing market in 2022. Chief economist Lawrence Yun anticipates existing-home sales to marginally decline to 5.99 million, compared to 6 million in 2021.

Homebuilders envision supply chain improvement by mid-next year and note that lumber price declines should offset other rising costs, allowing for potential profit margin improvement. Housing starts should improve to 1.65 million with steadier production, compared to 1.565 in 2021, driving a slower pace of existing home sales price increases of 4.4% in 2022 (vs. 14.1% in 2021) and a median home price of $353,500.

“Home price gains and the accompanying housing wealth accumulation have been spectacular over the past year, but are unlikely to be repeated in 2022,” noted Yun. “There are signs of more supply reaching the market and some tapering of demand. The housing market looks to move from ‘super-hot’ to ‘warm’ with markedly slower price gains.”

Investor Implications

While experts do not believe that the current economic conditions resemble those present during the housing bubble of 2007-2008, Fannie Mae chief economist Doug Duncan notes that “affordability remains a challenge.”

Mohtashami concurs and does not envision price gains reversing “one for one” when mortgage rates go up. Lack of supply in the existing home market drives some buyers into the new home market. However, higher rates tend to “dampen new home sales” which will slow construction growth, according to Mohtashami.

As a result, savvy investors have the opportunity to meet demand through distressed housing. Buyers who may be priced out of new construction can still benefit from all of the bells and whistles of a newly renovated home. And the opportunity for landlords remains strong as many would-be homeowners are just not able to break into the homebuyer market yet.

“The demographics are clear: demand isn’t in danger of dropping anytime soon. As the country digs out of the inventory hole (down 13.4% vs YAGO), investors have a remarkable opportunity to fill the gap. Renovating then flipping or renting is a winning formula for 2022,” according to New Western CEO Kurt Carlton.

New Year. New Opportunity. New Western.

Now is the time for real estate investors to lock in low rates before the end of the year. It’s critical to have a pro in your corner who can help you capitalize on timely opportunities in a competitive market.

New Western agents are constantly hunting down investment properties for our clients. Let us help you discover the one that fits your strategy. Contact us to see if you qualify for access to our exclusive inventory.