What’s Up, What’s Down, and What It All Means

Let’s start with existing home sales. The economic lockdowns continued to impact sales in April, down 17.8%. The good news? Listings remaining on the market are boosting home prices and attracting buyers, according to NAR chief economist Lawrence Yun.

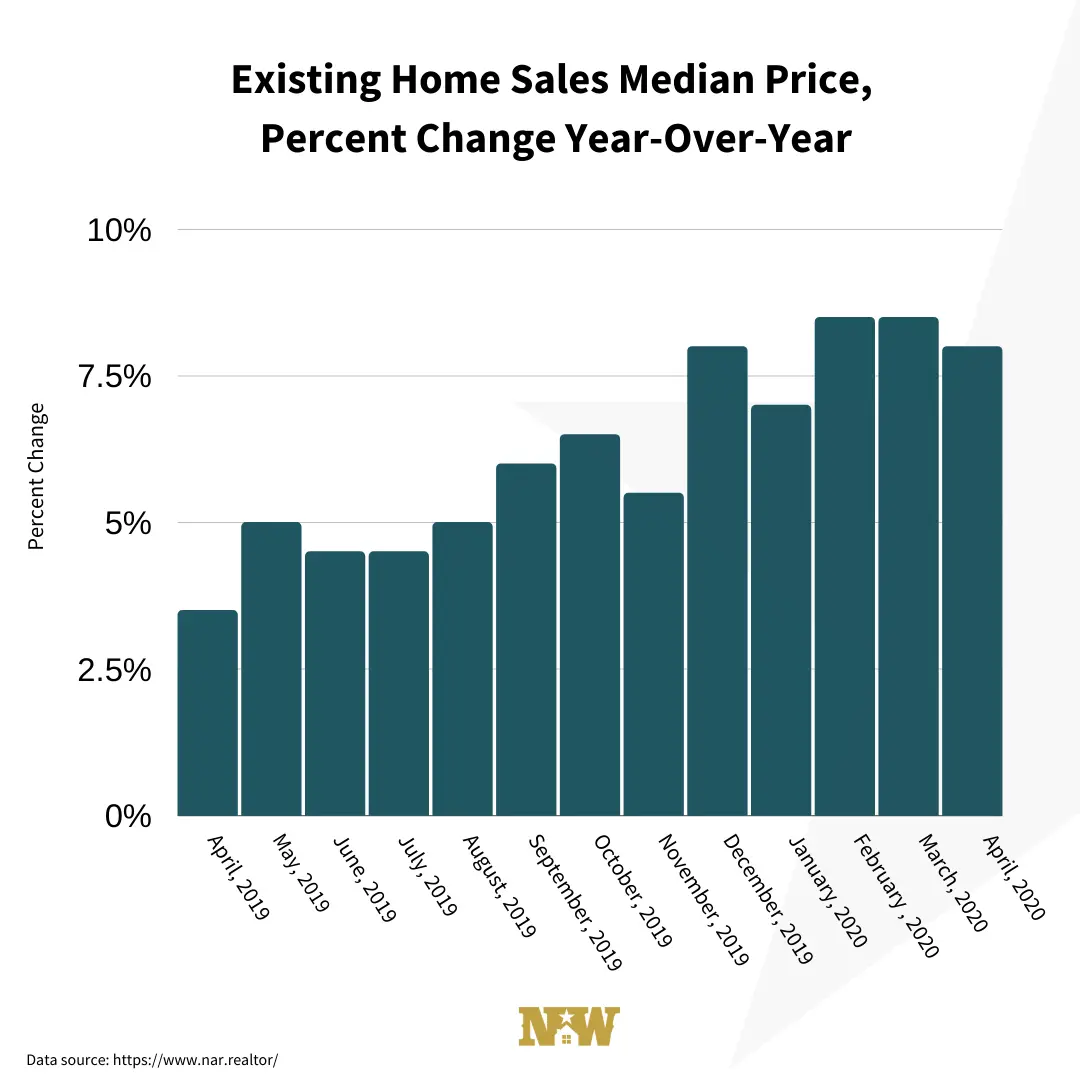

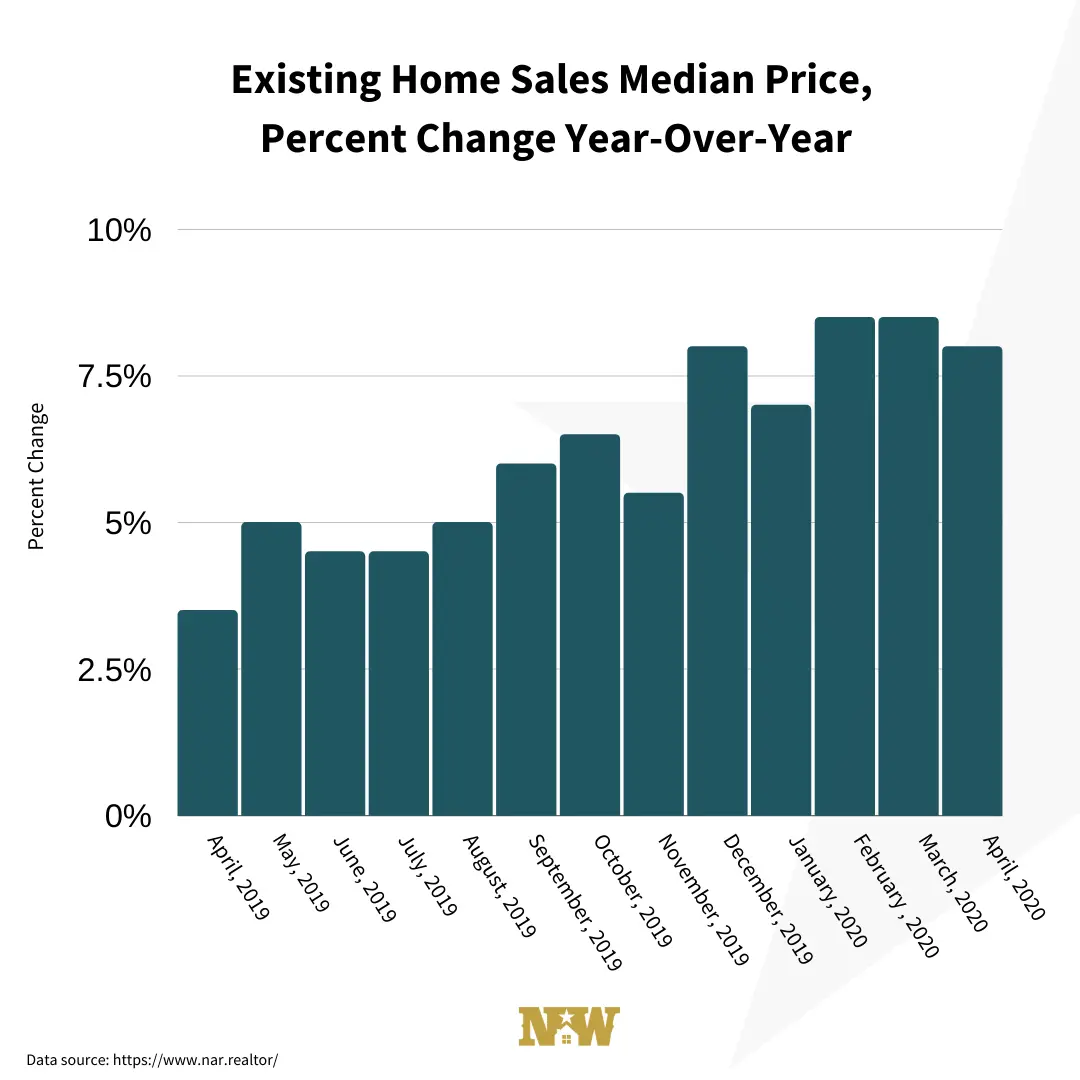

In fact, April saw the median price for existing homes up 7.4% to $286,800, marking 98 months in a row of year-over-year gains. And this wasn’t just a regional phenomenon: prices increased across the country.

Time to Climb?

Pending home sales were also down in April, for a second month in a row, per NAR. The 21.8% sales slump may just mark the lowest point since the association began tracking transactions in 2001.

What goes down must go up: Yun predicts activity will really pick up this summer as states reopen and consumers get comfortable venturing out. “The real estate industry is ‘hot’ in affordable price points with the wide prevalence of bidding wars for the limited inventory,” Yun reports.

About Supply

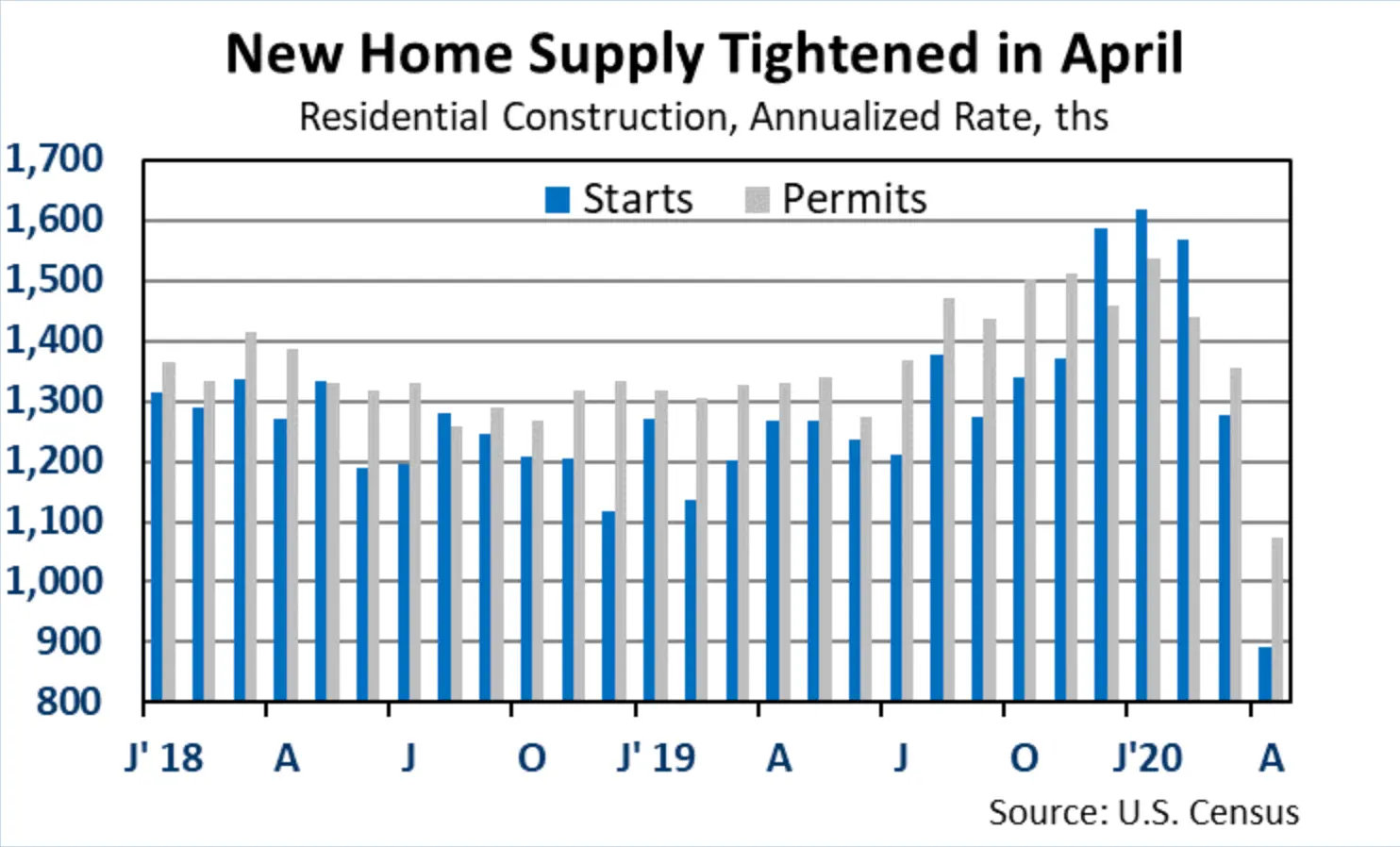

Housing inventory continues to be tight at 1.47 million units (down 1.3% from March and 19.7% vs. year ago). April marks the lowest level ever recorded for the month. A testament to limited supply: more than half of homes sold in April were on the market for less than a month.

A cutback in construction compounds the tight housing market. April housing starts fell by 30.2% and permits by 20.8%. Understandably, the Northeast took the biggest hit given the impact of the pandemic in and around New York City.

The New Normal?

Comerica chief economist Robert Dye sums up the current state of affairs: “Announcing the demise of the office may be premature, but even a partial adjustment to the new-new-normal may have lasting implications for both the residential and commercial property markets.”

As work from home and remote school continues, buyers may be looking for single-family homes over condos. The April numbers are starting to reflect this potential trend as existing condo sales showed a greater dip than single-family home sales in April.

Money Matters

The purchase loan amount is also at its highest level since mid-March as interest rates remain at record lows for both 15- and 30-year mortgages. The latter dropped to 3.24% week ending May 22, just one basis point shy of the all-time low set two weeks prior, per Freddie Mac. After spiking in mid-March, refis mostly decreased through May, though as of the week ending May 22, they were still 176% higher than last year.

“Record-low mortgage rates are likely to remain in place for the rest of the year, and will be the key factor driving housing demand as state economies steadily reopen,” according to Yun. Younger buyers are seizing this unique opportunity, and the number of first-time buyers reflects that trend: 36% of sales in April (up from 34% in March and 32% year-ago).

Moving Forward

Realtor.com is reporting new listings in April up from year-ago in 34 metro areas. Further good news: purchase applications increased 5% week ending May 29, marking seven consecutive weeks in a row of positive growth. As of the week ending May 22, there has been a 54% jump since early April. Even the hardest-hit states on both coasts are showing positive signs.

Also promising: forbearance plans have flattened and new requests are slowing as more people return to work, according to May data from Black Knight.

“The housing market is continuing its path to recovery as various states reopen, leading to more buyers resuming their home search,” notes Joel Kan, economic and industry forecaster for the Mortgage Bankers Association (MBA).

Investors Take Action

For future flippers and investors, the time is now to take advantage of off-market opportunities.

“Given the surprising resiliency of the housing market in the midst of the pandemic, the outlook for the remainder of the year has been upgraded for both home sales and prices, with home sales to decline by only 11% in 2020 with the median home price projected to increase by 4%,” according to Yun.

The pros at New Western Acquisitions are analyzing the data daily and discovering opportunities to bring to our investors. We are ready to help you find off-market opportunities that match your specific criteria. Contact us to see if you qualify for access to our exclusive inventory.