The summer has certainly been a hot one for housing but experts see a slight cooling ahead as we move into fall. As inventory steadies and housing starts rise, investors and homebuyers are hopeful for some price relief in the months to come.

Waiting for More

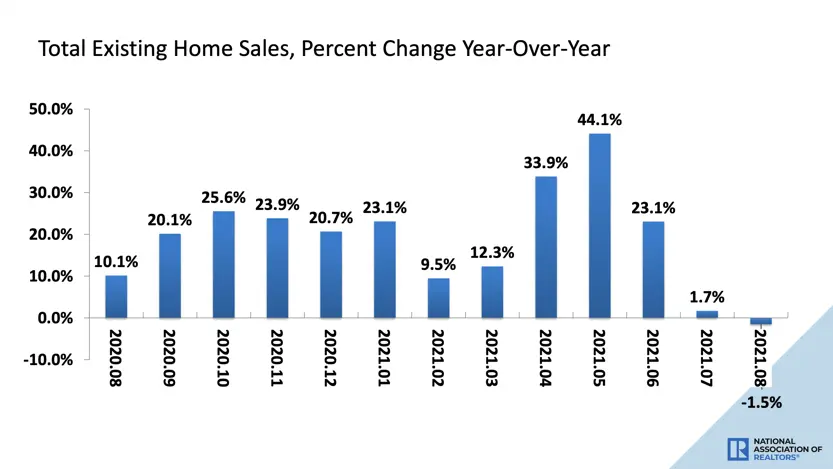

After a couple of months of increases, existing home sales fell 2% in August with all areas experiencing month-over-month and year-over-year decline. Sales were also down versus 2020, marking the first year-over-year decline in at least a year.

“Sales slipped a bit in August as prices rose nationwide,” according to NAR chief economist Lawrence Yun. “Although there was a decline in home purchases, potential buyers are out and about searching, but much more measured about their financial limits, and simply waiting for more inventory.”

On the flip side, pending home sales bounced back in August, up 8.1%. The four major U.S. regions were up as well, albeit down versus a year ago.

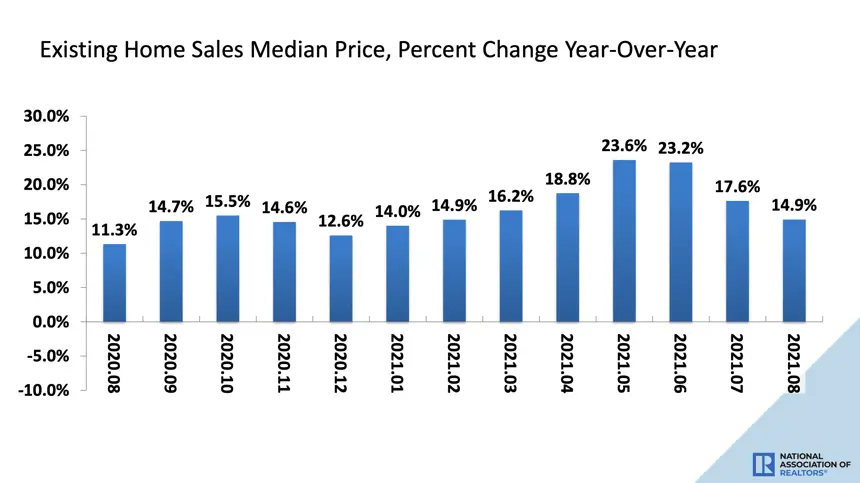

The median home price dipped again in August to $356,700 but was still up 14.9% versus 2020 for 114 straight months of year-over-year gains.

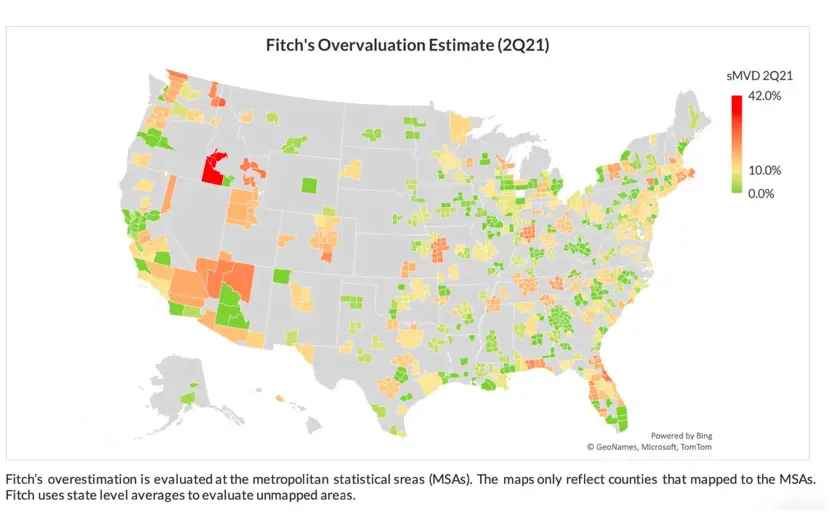

According to a recent report from Fitch Ratings, home prices in 75% of the country’s metropolitan areas are overvalued. “Approximately half of the metropolitan statistical areas are more than 10% overvalued, compared to only 4% pre-pandemic,” the report notes.

Investor Interest

Investors continue to compete with potential homebuyers—purchasing 15% of homes in August. All-cash purchases represented 22% of transactions, roughly even with July, but up from 14% in August 2020.

Flippers made an average profit of $67,000 on a national basis in the second quarter. Sunny destinations from Florida to Texas continue to prove profitable for investors.

The Inventory Issue

Housing inventory was down 1.5% in August to 1.29 million units with unsold inventory sitting at a 2.6-month supply. Properties are on the market for 17 days with 87% sold in less than a month.

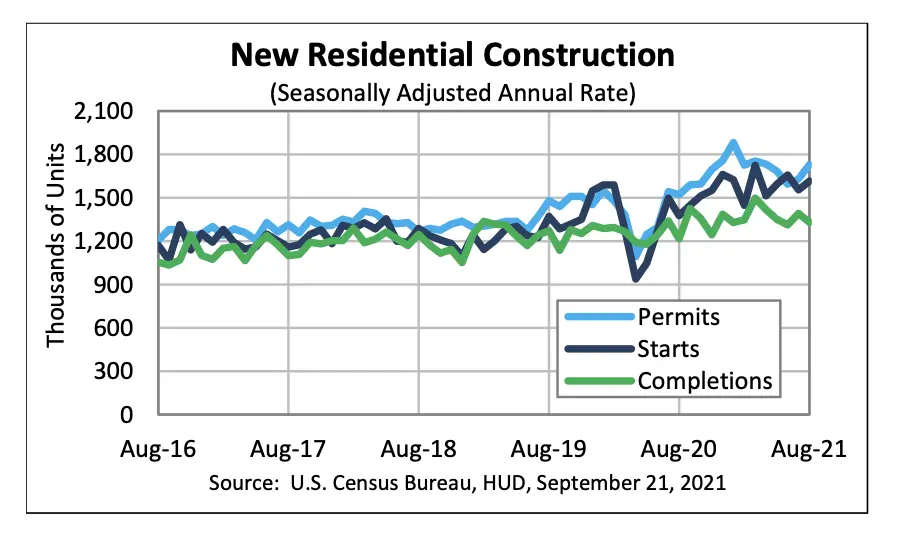

In some good news, housing starts are up nearly 4% for an adjusted annual rate of 1,615,000.

But, experts warn that the homebuilding market recovery is fragile. “Extreme production and delivery delays, along with continuing high materials costs, may lead to project cancellations and postponements…” according to Ken Simonson, the Associated General Contractors’ chief economist.

Rates Steady

Mortgage rates held below 3% for the month of August: a 30-year fixed mortgage was 2.8% at the beginning of the month and 2.87% at the end of the month. Mortgage applications ended the month up 1.6%

“The purchase index was at its highest level since early July, despite still continuing to lag 2020’s pace. There was also some easing in average loan sizes, which is potentially a sign that more first-time buyers looking for lower-priced homes are being helped by the recent uptick in for-sale inventory for both newly built homes and existing homes,” according to Mortgage Bankers Association VP Joel Kan.

What’s Ahead?

Fitch Ratings anticipates that price appreciation will slow in the year ahead and Zillow economist Matthew Speakman concurs: “the tight market conditions that have fueled the skyrocketing prices are finally showing signs of loosening.”

“All told, home price growth remains sky high, but more signals are appearing that the housing market is likely to soon start coming back to earth,” Speakman noted.

New Opportunity. New Western.

Now is the time for real estate investors to lock in low rates and capitalize on timely opportunities. With an ever-changing market, it’s critical to have a pro in your corner who can uncover the right deals to fit your investment strategy.

New Western agents are constantly identifying value-rich opportunities for our clients. Let us help you discover the one that fits your strategy.

Contact us to see if you qualify for access to our exclusive inventory.