The Housing Market Heats Up as More Americans Return to Work

With nearly 5 million people returning to work in June, Realtor.com expects another jolt to the already hot housing market. Although there is speculation unemployment could rise again as city and state recoveries are thwarted by new COVID-19 cases, higher-earning professionals haven’t been as affected by layoffs as lower-income workers. And since those workers are more likely to have funds to purchase a new home, it looks like the hot seller’s market won’t be ending anytime soon.

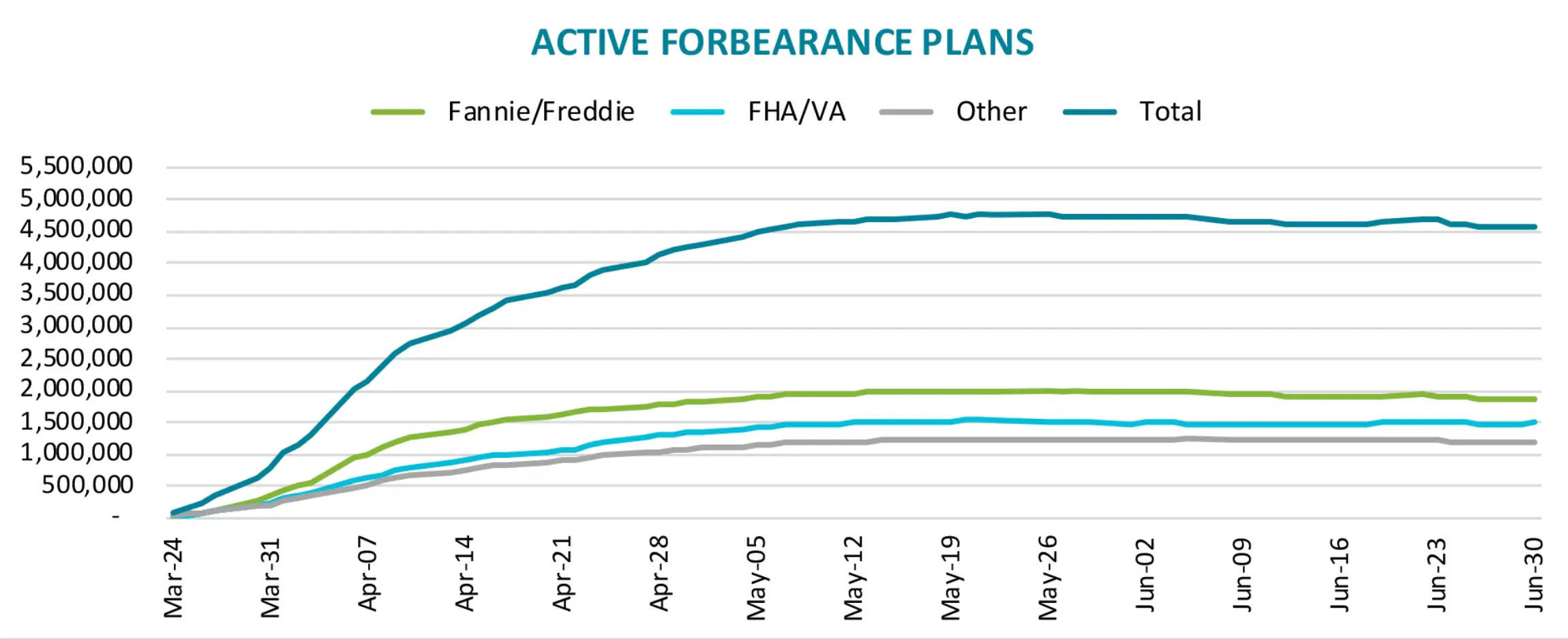

Forbearance Volumes Reverse Course For Largest Decline Yet

The latest data from the McDash Flash Forbearance Tracker shows that the number of homeowners in active forbearance has fallen once again — and by the largest amount yet. According to Black Knight, there are a couple of factors at play that could be causing the decline.

What Will The Next Stimulus Bill Include?

With new COVID-19 cases on the rise and some states having to slow their reopening plans, there is growing support for a new stimulus bill. A recent Forbes article states “the next stimulus package will be designed to help improve employment, help businesses, and possibly give another round of direct payments in the form of a stimulus check.” Learn more about the plans in Washington and what could be in store for the rest of us.

VIDEO: Burning Real Estate Questions Answered

How has the real estate market been impacted by the coronavirus pandemic? Is now the right time to invest in real estate? Where do prices go from here? In case you missed it, CNBC real estate correspondent Diana Olick answered these questions and more in a Facebook live video earlier this week.

Millennial Homeownership Delayed, Not Denied

Despite the pandemic, millennials are poised to fuel a “roaring 20s” of homeownership demand, says Chief Economist Mark Fleming. The First American Homeownership Progress Index (HPRI) released on July 1st measures how a variety of lifestyle, societal and economic factors influence homeownership rates over time. According to the report, millennials are increasingly choosing homeownership over renting as they age into the key lifestyle decisions that increase the likelihood of homeownership.