This is an unprecedented time in recent history. As a company that was born out of the market crash in 2008, we firmly believe opportunity follows in the wake of uncertainty. Now as always, our mantra remains fact over fear.

With that in mind, we’re collecting the most relevant and informative news stories, data and resources for real estate investors and bringing them straight to you. We hope this provides a bit more clarity and confidence in the midst of a chaotic world.

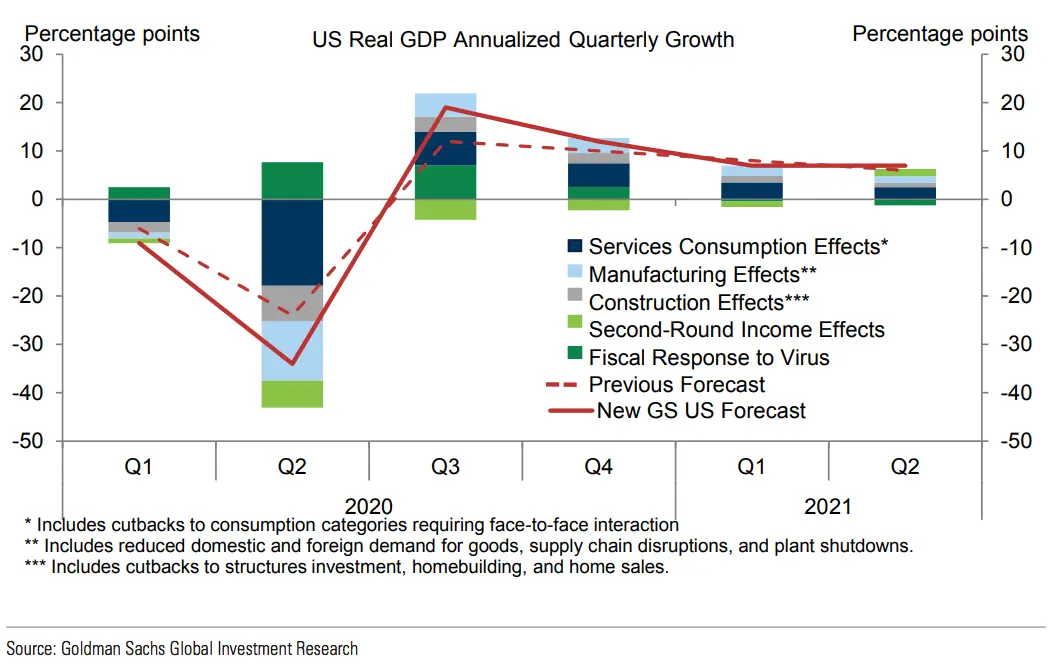

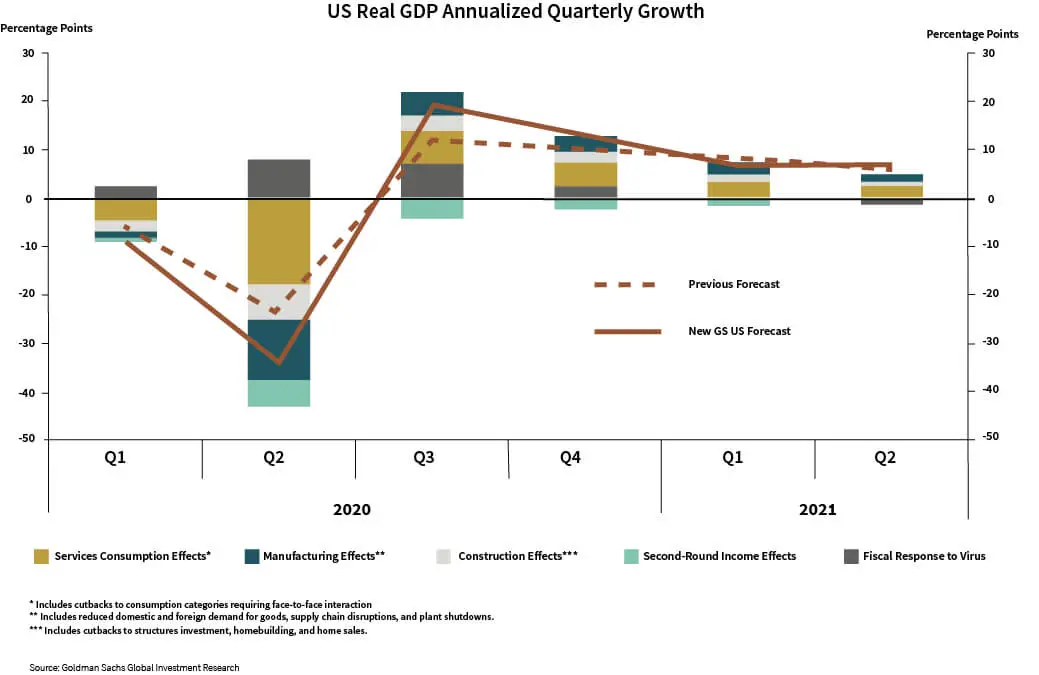

Goldman Sachs Predicts U.S. Will Go From Worst To Best

Early this week, economists at Goldman Sachs revised their view of how the Coronavirus will impact the U.S. economy. “Gross domestic product is forecast to fall 9% in the first quarter followed by a stunning 34% plunge in the second quarter…After that, Goldman expects the U.S. to see a spike higher in activity, featuring a 19% surge in Q3. That would take the U.S. from the worst quarter in history to its best.”

BiggerPockets Guide: Recession Prep 101

A new 32-page guide from BiggerPockets offers advice on investing during a financial crisis. In it, they caution against comparing the 2008 recession and our current situation. “Real estate investors could wind up in trouble if they react according to ill-informed expectations. All signs point to this coming recession being nothing like 2008.”

Chief Economist Predicts Housing Prices May Increase

In his latest update on COVID-19 and the impact to the housing market, Matthew Gardner, Chief Economist, Windmere Real Estate, reasons that due to “supply-demand imbalance as well as the belief that conventional financing rates will remain very attractive…I believe U.S. home prices are likely to stay flat to modestly higher as we move through the upcoming recession.”

This Is A Health Crisis, Not A Housing Crisis

In case you missed it, a blog post by Keeping Current Matters recently outlined the key differences between the 2008 housing crisis and the current crisis caused by COVID-19. The remind us “it’s important to take an objective look at what has transpired over the years and how the housing market has successfully weathered these storms.” Case in point: in three of the last five recessions, home values actually appreciated.