When it comes to financing a property, owner occupancy is an important consideration. Because loan terms differ based on occupancy type, lenders will often require primary home loan borrowers to sign an affidavit that states they will personally occupy the home for a certain amount of time.

But what if homeowners decide they want to rent out their primary residence before the specified time is up? Is there a way to get around owner occupancy in a mortgage contract?

The short answer is “yes, sometimes”, but the more complete answer requires a closer examination of lending practices and occupancy fraud.

What is Owner Occupied Property

In real estate, lending, and insurance terms, owner-occupancy refers to the owner residing at the property. As such, an owner-occupied property is one where the legal property owner lives full-time on the premises.

Owner occupancy is especially important to lenders because of the different terms and rates available for primary homes versus secondary homes and investment properties.

Insurance companies also write different policies based on owner-occupancy, since the risks and coverage needs are different.

In order to get owner-occupied mortgage rates, investors will sometimes live in a portion of their property while renting out other units (a common practice for multiplex owners).

When tenants apply to an owner-occupied rental property, that means the owner lives in another unit on the premises and is likely acting as an onsite landlord.

Join Now

Why Do Lenders Verify Owner Occupancy?

When applying for a loan, borrowers are asked whether the property is intended to be a primary home, secondary (vacation) home or investment property.

If the borrower indicates that the property will be their primary home, they usually are given 30 to 60 days to occupy the property. After that time, the lender may hire someone to physically verify occupancy, a practice known casually as an “occ knock”.

Lenders verify owner-occupancy because of the regulatory requirements, financial implications, and risk factors associated with owners living onsite.

Owner Occupied Loan Requirements

FHA and VA loans have some of the lowest down payment requirements––as little as 3.5% down for FHA loans and zero for VA loans. In return, these government-backed loans absolutely require owner occupancy.

FHA and VA loans are intended solely for primary residences and multi-unit properties (up to four units) where the owner lives onsite.

Similarly, buyers who participate in HUD (U.S. Housing and Urban Development) programs may be required to certify residency for a certain period of time.

For example, the Good Neighbor Next Door program requires owners to occupy the home for a minimum of three years.

Owner Occupancy and Down Payments

Conventional loan down payment requirements for primary homes are somewhat flexible based on the lender. Some lenders may be willing to underwrite a loan for a primary, owner-occupied home with as little as 3%-5% down if the borrower has a good credit score (above 620).

In contrast, conventional loans require a much higher down payment for investment properties where the owner does not live onsite. The downpayment for a single-family investment property will probably be 15% at minimum (with a credit score of 700+); investors can expect a downpayment requirement of around 25% on multi-unit properties.

Alternatively, buyers who intend to purchase a second home can usually get a loan with a 10% down payment. While these owners are required to occupy the home for a certain portion of the year, they are permitted to rent it out for income as well.

In the eyes of the IRS, properties are considered secondary personal residences if the owner occupies the home for more than 14 days or 10% of the time rented (whichever is greater). Fannie Mae and Freddie Mac usually follow these guidelines when issuing secondary home loans.

Owner Occupancy and Interest Rates

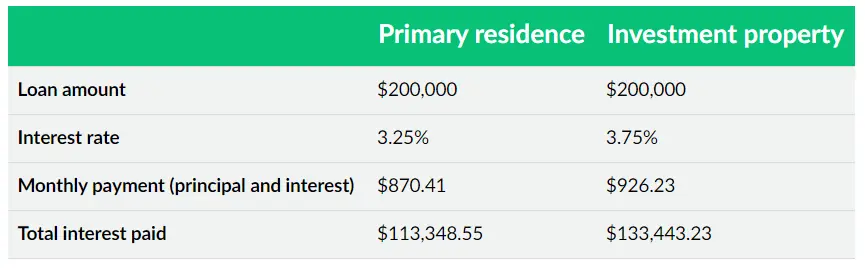

Statistically speaking, owner-occupied homes are the least likely to go into default and foreclosure. Therefore, the interest rates offered on owner-occupied properties are lower than those offered on investment properties. Typically, lenders charge .5% to 1% more in interest for investment properties that are not occupied by the owner.

Even on the low end of that expected range, non-owner-occupied borrowers experience a significant increase in their total interest paid, as illustrated below.

Source: Lending Tree

Owner Occupancy and Risk

Overall, lenders see owner-occupied properties as a lower risk, so they’re willing to offer better loan terms to borrowers who plan to live in their homes.

Because owner-occupied loan terms are so advantageous to borrowers, there’s a possibility that loan applicants would lie about their occupancy intentions.

Due to this potential for loss, mortgage lenders conduct occupancy checks to ensure that borrowers are using the property in the way that they indicated on their application.

Getting an owner-occupied loan and then not occupying the property is considered mortgage fraud because the borrower has obtained favorable loan terms under false pretenses.

How to Avoid Owner-Occupancy Mortgage Fraud

Owner-occupancy fraud (or occupancy fraud) may lead to several severe consequences, so it’s not something that buyers should mess around with.

In the event that a lack of owner-occupancy can be proven, lenders may impose penalties, fees, or stricter terms on the borrower to compensate for the mortgage fraud.

They may also call the loan due in full, and if the borrower cannot pay, the lender may begin foreclosure proceedings. In addition, as a type of misrepresentation and banking fraud, occupancy fraud is considered a federal offense.

Cases may be referred to the FBI for investigation and eventual prosecution. If proven guilty, borrowers may be subject to prison time.

To avoid these penalties, loan applicants should be vigilant in the following areas.

Never misrepresent your intention to occupy a property just to get better loan terms. Owner-occupied loan terms only apply to principal residences.

Never apply for a loan on behalf of a relative who cannot get loan approval. If you sign for the loan and you indicate that it’s a primary residence, then you need to live there, not your family member or friend.

Never apply for an investment property loan (with the expressed consideration of rental income) and then use the home as a primary residence. This is called reverse occupancy fraud.

Always clarify your move-in intentions with your lender. If you purchase a property as your primary residence but cannot move in for a few months, make sure your lender knows so that they can schedule your “occ knock” accordingly.

Always check the terms of occupancy in your mortgage. Homeowners choose to turn their homes into rentals all the time, but your mortgage contract will often stipulate a minimum owner-occupancy time frame –– one year is standard.

Do Lenders Check Owner Occupancy

While every borrower is subject to occupancy checks, there are certain red flags that will cause lenders to look more closely for occupancy fraud. A few things that would raise suspicion may include:

- Buyers who list a different mailing address than the property address.

- Buyers who also own other homes in the area, particularly a larger, nicer home.

- Buyers who have a history of frequent real estate purchases and sales. (Flippers may occupy the property while flipping, but this is a red flag nonetheless.)

- Buyers who purchase a property with tenants already living in it.

How to Get Out of an Owner-Occupancy Clause

With all of that in mind, there are legitimate reasons why a home buyer may want or need to get out of an owner-occupancy clause in their mortgage. Doing this legally all comes down to intent at the time of closing.

Most loans for primary residences stipulate that owners must occupy the property for a minimum of one year. However, there may be certain unforeseen circumstances that cause a change in plans, including the following:

- A change in an occupation that requires a move.

- A job transfer that requires a move.

- A desire to move in with a new significant other.

- A change in school zoning.

- A severe illness or death in the family.

These scenarios –– and countless others –– all represent reasons why a homeowner may want to leave a home that they purchased as their principal residence prior to that one-year mark.

Selling the property may be out of the question due to market conditions, closing costs, or long-term plans, so the property becomes a rental despite the original loan terms.

Lending companies cannot force a homeowner to live in a home when they have legitimate reasons –– or even desires –– to move. However, to get out of the owner-occupancy clause on a primary residence home loan, the owner should be able to prove that they had every intention of occupying the home at the time of purchase.

Dated documentation of whatever caused the change in plans will help to prove legitimacy when trying to get around owner occupancy. Sudden circumstances arise all the time, but it’s important to establish a timeline that backs up your plans to occupy the home at closing.

Keep records of all communications that initiate and lead to a move.

Timeline communication may include:

- Memos from your employer.

- Notifications from the school board.

- Texts with a timestamp.

- Medical diagnoses from a doctor.

With a timeline in hand, homeowners should then notify their lender prior to renting the property. It’s important to reach out to the lender proactively so that there’s no possible link to occupancy fraud.

The lender is going to find out eventually since you’ll need to change your mailing address at the very least. Better to get in front of the situation and prove without a doubt that you had occupancy intention at closing.

Bottom line: lenders take owner-occupancy very seriously and structure their rates accordingly. It is possible to get around an owner-occupancy mortgage clause. But in order to avoid bank fraud, homeowners should take care to prove they did not originally intend for the property to be unoccupied by the owner.