Homeowners have the option of tapping into the equity in their homes with a home equity line of credit (HELOC), but is it possible to get a HELOC on a rental property?

Short answer: Yes.

Long answer: You can get a HELOC on a rental property, but the requirements will vary from lender to lender.

Before we get too far ahead of ourselves, let’s get the basics out of the way.

HELOC on a Rental Property: The Basics

Homeowners can use a HELOC (home equity line of credit) like they would a credit card. Based on your property’s value, a lender will give you a credit limit that you can draw on as you need it. Like a credit card, you can repay the money as you use it, therefore replenishing your line of credit.

It’s important to know that there are two phases to a HELOC.

Phase 1: The draw period where, instead of getting a lump sum, you can use the money as you need it. There aren’t any limits in regard to what you can and cannot use the money for. You can pay off existing debts or medical bills, do renovation projects on your properties, or use the money for a down payment on another rental property.

This phase typically lasts anywhere from five to ten years, depending on the terms set by your lender. During that time, your minimum payment covers the interest on your HELOC but you can choose to pay more per month so that it lowers what you own on the principal. In doing so, you won’t be paying as much over the life of the entire loan.

Phase 2: The repayment period is where you’re no longer able to draw on the line of credit and now you’re just paying back whatever you borrowed. Unfortunately, for the next twenty years (which is how long this leg of the HELOC lasts) is when your monthly payments will dramatically increase because you’re paying on both interest and remaining principal owed.

Pros and Cons of Getting a HELOC on a Rental Property

If you’re considering getting a HELOC on a rental property, you need to be aware of the risks and advantages that go along with it.

Pro: Lower Interest Rates

When you take out a HELOC on a rental property, the interest rate is likely to be lower than, say, a credit card or traditional refinancing. According to Bankrate, The average APR is sitting at 9.1%, as of September 20, 2023. Whereas, if you took out an unsecured loan, the average rate would be around 11%. If you were to use a credit card, the APR would be at a record high of 20.71%!

It’s worth noting that you should shop around to find the lowest HELOC rates. Bank of America, for example, starts at 7.49% and you can borrow up to $1 million. They offer a 10-year draw period and a 20-year repayment period. Of course, terms and conditions apply.

Con: Interest Rates Aren’t the Lowest Available

The interest rates for a HELOC on rental properties tend to be higher than if you’re getting a HELOC on your primary residence. Assuming you’re paying multiple mortgages (a mortgage on your primary residence and an investment property, for example), the banks will view you as a high-risk borrower.

And, since they suspect that you’re at a higher risk of defaulting on your loan, the banks will give you higher fees and interest.

Pro: Monthly Payments

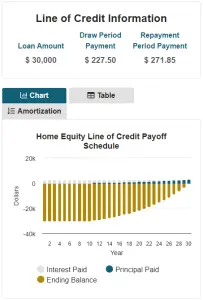

The appeal of HELOC is that you typically only have to pay the interest on your loan for the first five to ten years (the draw period). For example, if you’re approved for $30,000 HELOC with a 9.1% interest rate, your monthly payment (at minimum) will be $227.50 each month. When the repayment period kicks in, that payment will increase to $271.85.

Credit: First Merchants HELOC Payment Calculator

Con: Possible Balloon Payment

Most HELOC lenders allow you to pay over a period of time, but there are some out there who require a balloon payment at the end of the draw period. If you’re only paying the minimum payment during the draw period, you may have to pay the outstanding principal in one final payment. Depending on how you utilize that money, you may have to pay tens of thousands of dollars in one shot!

Pro: Tax Deductible

If you’re using the funds to renovate the property the HELOC is tied to, those interest payments could be tax deductible.

Con: Hard to Find

Since lenders view investment properties to be a riskier endeavor, it’s going to be harder for you to find a lender who’ll approve a HELOC on a rental property.

HELOC Requirements

In order to qualify for a HELOC on your investment property, lenders are going to have stricter requirements. Here’s a look at the requirement differences between a primary residence and an investment property.

Note: These requirements are a basic overview. The specifics will vary from lender to lender.

| Primary Residence | Investment Property | |

| Credit Score | 620 and up | 720 and up |

| Loan-to-Value Ratio | 90% | 80% |

| Cash Reserves | May not be required | At least 6 months (some require as much as 18-months in reserve), plus proof of long-term tenancy |

| Debt-to-Income Ratio | 40% | 40% to 50% |

| Equity | At least 15% | At least 20% |

| Appraisal | Not necessary | Multiple appraisals may be required |

Credit Score Requirements

- While the minimum is often 720+, requirements vary by lender. Some may accept credit scores as low as 650 or require scores of 750+ for the best rates. Always check directly with lenders.

- Interest rates are closely tied to credit scores. According to NerdWallet, borrowers with scores of 720-850 typically see APRs around 5-8%, vs. 11-15% for those with scores below 680.

Debt-to-Income (DTI) Ratio

- Many lenders limit DTI to 40-50% for rental property HELOCs. But maximum DTI allowances can range from 35% to as high as 55% depending on the lender.

- Keep DTI as low as possible. According to Bankrate, borrowers with DTIs below 30% often get the best rates.

Required Cash Reserves

- Cash reserve requirements vary greatly by lender, from as little as 3 months to over 12 months of mortgage payments.

- Cash reserves help reassure lenders that you can still make payments if tenants fail to pay rent. Higher reserves are often required for investment properties.

- Consider regional factors. In competitive rental markets, lenders may require larger reserves.

Appraisal Requirements

- Expect a full appraisal on the rental property, which determines how much equity you have to borrow against.

- Many lenders require a separate appraisal even if you recently purchased the property. Fees range from $300-$500+.

What Does the Process Look Like?

If you meet the minimum requirements and are thinking about moving forward, you’ll want to know what to expect along the way.

Step 1: Search for Lenders

Although finding lenders who offer HELOCs for rental properties can be tricky, it is in no way impossible. In fact, several well-known national lenders will work with investors seeking HELOCs. These lenders include:

- TD Bank

- Wells Fargo

- Bank of America

You don’t have to go with a national bank, of course. You can turn to local banks, credit unions, or even work with a broker who can help you find the best investment property loans. If you have an extensive network of investor friends (or are a member of an investor forum), you can ask for recommendations.

Step 2: Compare Your Options

We recommend getting quotes from different lenders. Never go with the first quote you get! The rates and terms can vary significantly from lender to lender.

There will be some lenders who offer lower interest rates but will charge higher closing costs. Some lenders will want to be paid in full after the draw period, while others offer a long repayment period.

So, opt for lenders that offer terms that you’re most comfortable with.

Step 3: Complete Your Application

After settling on which lender has the best terms and conditions, you’ll have to fill out the HELOC application. The actual application can be filled out in as little as 15 minutes if you do it online. However, be ready to submit additional documentation for the underwriting process.

The additional documentation will include (but not limited to):

- Your (and co-applicant if applicable) personal details.

- Name

- Social Security Number

- Home Address

- Phone Number

- Employer Information

- Personal Assets

- Description of assets

- Financial institutions where assets are held

- Overall value of assets

- Personal Debts

- Lender information

- How much debt is owed

- Monthly minimum payments

- Detailed accounts regarding other assets that could be used as collateral.

Step 4: Waiting for Approval

Once you’ve submitted the application and supporting documents, all that’s left to do is… Well. Wait. You could get an answer in as little as a few days, but it can take up to a few weeks. It really depends on the lender’s underwriting process and appraisal process.

Step 5: Closing

After you get the approval, you’ll have to go through the closing process where you’ll sign the legal documents and pay whatever fees are due. After closing, you’ll receive either a checkbook or a debit card to use to access the funds. Some may also let you access the funds via in-branch cash withdrawals or using electronic transfers.

You won’t be able to access the funds right away though. There’s typically a three-day waiting period (called the recission period) where you may have the ability to back out of the loan. You can learn more about the rescission period (also called the Three-Day Cancellation Rule) here.

Other Options if HELOC Isn’t Right for You

Getting a HELOC on your rental property may not be the best option for every investor. Don’t worry, though! There are a number of other viable options that you may want to consider.

Home Equity Loan or HELOC on Your Primary Residence

If your investment property doesn’t have enough equity, but you meet all other requirements, you could get a home equity loan or a HELOC on your primary residence. These are easier to get and you may even qualify for a lower interest rate since you’re putting your home up as collateral.

Cash-Out Refinance

With a cash-out refinance, you’re basically refinancing your property for a higher dollar amount and get the difference in one lump sum. This is a good option if you have a lot of equity, you could use the difference as you see fit. Plus, you aren’t going to incur an extra bill because you’re still just paying the mortgage.

Unsecured Personal Loan

An unsecured personal loan is an option if you need a large sum of money quickly. If you have great credit, you could get lower interest rates. However, you will have to start paying that money back right away. So, while you get a nice chunk of change all in one go, you have to start paying it back in 30 days.

Note: If you settle on this option, be sure to do your homework and shop around to find the best terms and rates.

Cross-Collateralization Loan

A cross-collateralization loan may be an option for those who have several investment properties with equity. With this type of loan, you can combine the equity of all of your properties to have a much larger line of credit to access. If you choose this option, you can rest easy in knowing that your properties still have some equity in them.

Credit Card

Yes, credit cards are an option, but they aren’t the best option. They have variable interest rates that are often much higher than the other options. With the right credit cards, you could reap some incredible rewards if you know how to earn (and use) the points wisely. Using your cards also means you don’t have to pull from the equity in your properties, which is always a plus.

Is It a Good Idea to Get a HELOC on a Rental Property?

Whether you’re eager to grow your investment portfolio or if you have a financial emergency, tapping into a property’s equity is a solid option for both homeowners and investors alike. A HELOC gives you the ability to draw from a large sum of money whenever you need to, regardless of what you need it for.

That being said, you have to be smart with how you use the money. You don’t want to drain the equity of your rental property all because you wanted a new car or you want to go on a luxurious vacation.

In short, smart investors know how to make their money work for them; and it’s the savvy investor who understands how to get the most of that equity by taking out a HELOC on their rental property.