Temperatures may be dropping but the housing market continues to hold firm as we head closer to the end of the year. Rates are rising but sales and home prices continue to increase as well. Read on to see the latest inventory numbers and what experts are predicting about omicron’s potential effect on the market.

Holding Steady

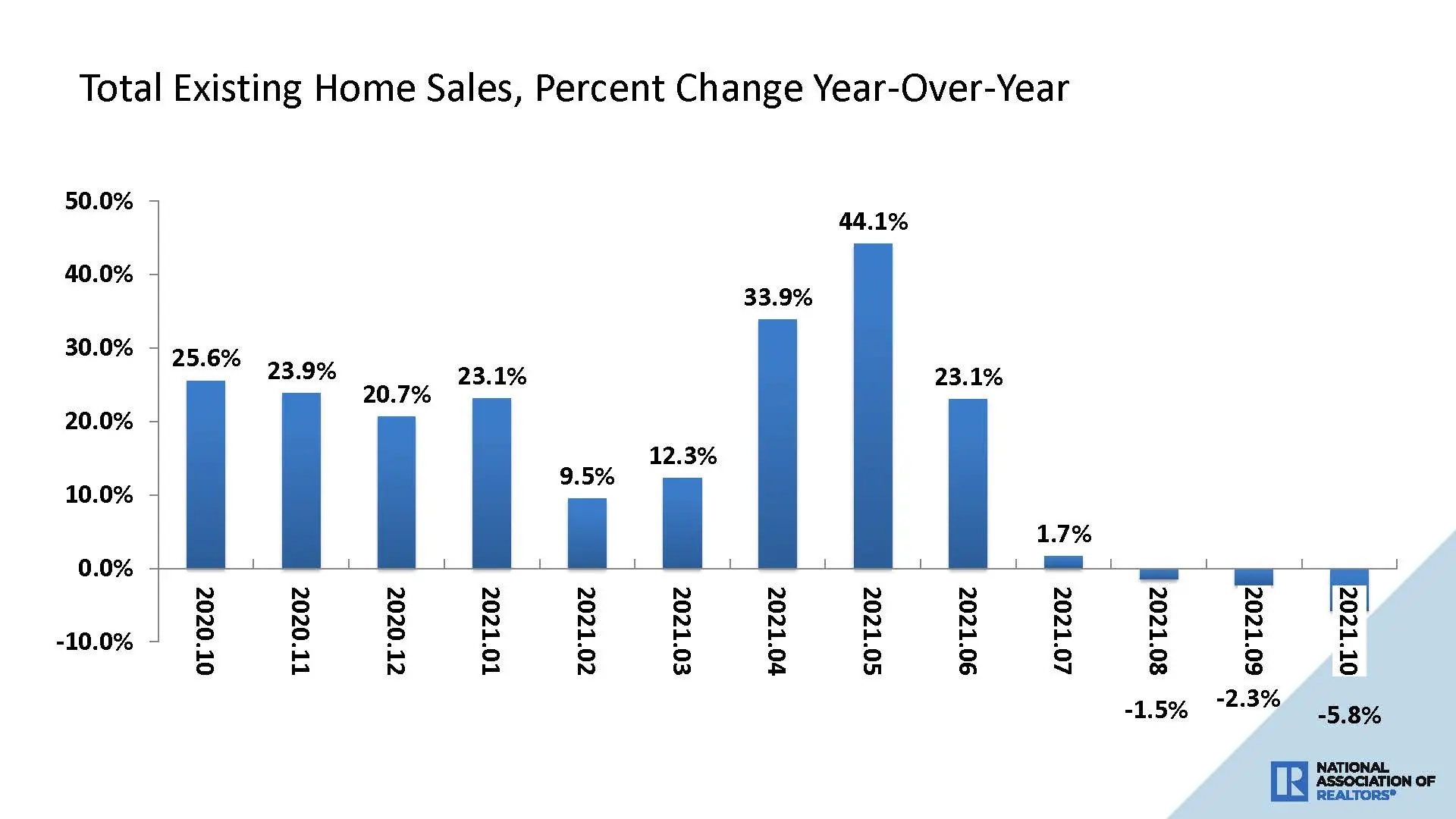

Existing home sales were up 0.8% in October for the second straight month of growth with the Midwest and South experiencing month-over-month increases. Sales continued to be down versus 2020 for the third month in a row.

“Home sales remain resilient, despite low inventory and increasing affordability challenges,” according to NAR chief economist Lawrence Yun. “Inflationary pressures, such as fast-rising rents and increasing consumer prices, may have some prospective buyers seeking the protection of a fixed, consistent mortgage payment.”

Pending home sales jumped 7.5% in October, reversing September’s dip with all regions up month-over-month. The Midwest and South were also up year over year. Experts cite rising mortgage rates and rents as incentive to buy a home now and not wait for the new year.

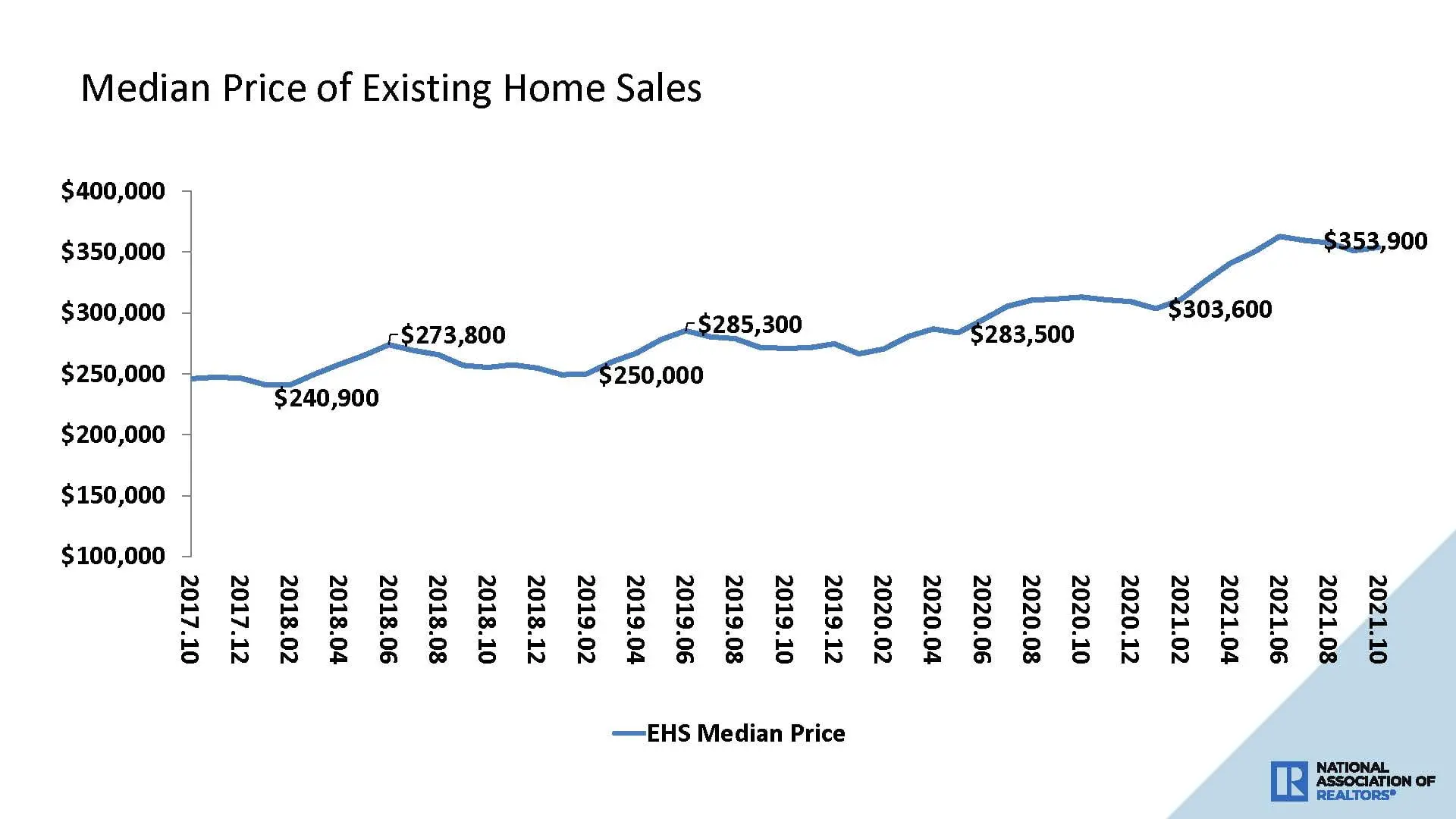

The median home price also reversed course from last month and increased to $353,900, up 13.1% versus 2020 for 116 straight months of year-over-year gains. Analysts note that this is heavily influenced by the mix of homes selling with most activity on the higher end of the market.

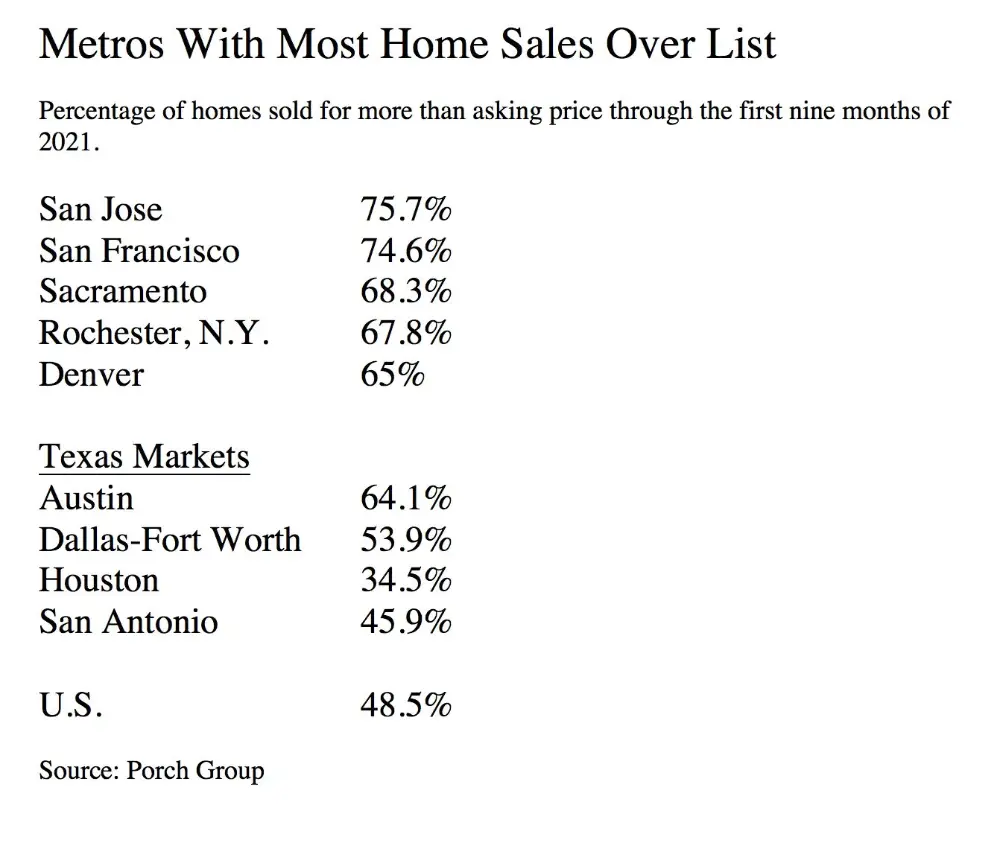

Homes are selling over asking in more than 24 of the country’s largest metros. And in San Jose and San Francisco, buyers are paying more than the listing price in nearly 75% of purchases.

Investors continue to heat up the competition—purchasing 17% of homes in October. All-cash purchases represented 24% of transactions, up from 23% in September and 19% a year ago.

The Supply Side

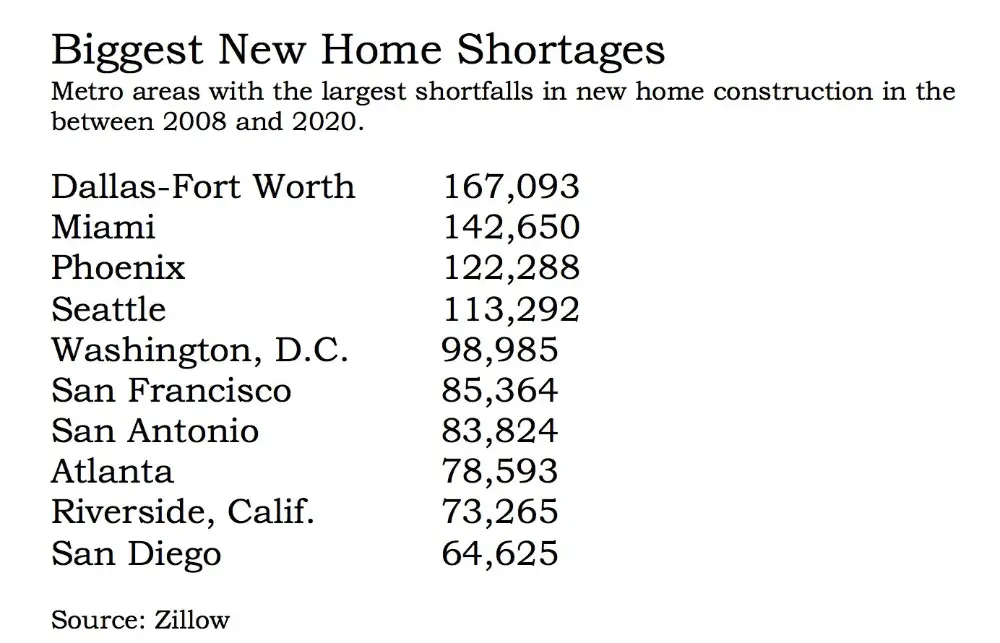

Housing inventory was down 0.8% in October to 1.25 million units with unsold inventory remaining at a 2.4-month supply. Analysts indicate that we are still in the midst of a historic inventory shortage of 1.35 million homes built since 2020. The Dallas-Fort Worth market faces the largest shortfall, followed by Miami, Phoenix, and Seattle, according to Zillow.

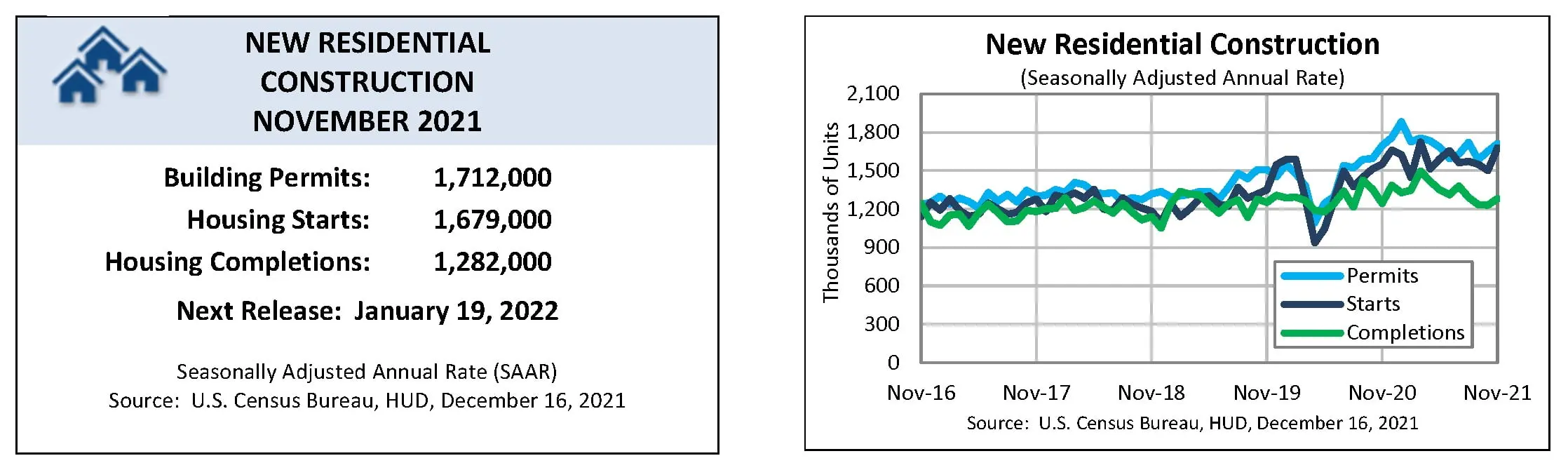

Properties remain on the market for 18 days with 82% sold in less than a month. Housing starts fell .7% to an adjusted annual rate of 1,520,000 units.

That said, homebuilder confidence remains strong. “Builders in recent months have put the pedal to the metal to get new homes up and meet a rush of demand, and we just saw the first full year of above-average construction since the mid-2000s housing crash,” according to Zillow senior economist Jeff Tucker. “This isn’t a new boom cycle of new construction so much as it’s an attempt to get even from the last bust.”

Rates Rise

Mortgage rates ended the month at a high of 3.14% for a 30-year fixed mortgage. Mortgage applications were also up 0.3%. “Purchase applications picked up slightly, and the average loan size rose to its highest level in three weeks, as growth in the higher price segments continues to dominate purchase activity,” noted Joel Kan, Mortgage Bankers Association VP of economic and industry forecasting.

The Omicron Effect?

While there may be some uncertainty around the new variant, experts comment that people still need to live somewhere. “My expectation is omicron will have just a small effect” on the housing market, predicts Realtor.com chief economist Danielle Hale. “If you look at what happened with delta, there was a bit of a drop-off in listings at least temporarily.”

Other experts concur: “I don’t think the impact on the housing market and the economy will be as severe as when COVID-19 first hit,” comments Gay Cororaton, a senior economist at the National Association of Realtors®. “This time the economy is better prepared. People are already working from home.”

Realtors also note that agents, buyers, and sellers are all now comfortable with the increased use of technology including virtual tours.

New Opportunity. New Western.

Now is the time for real estate investors to lock in rates and capitalize on timely opportunities. With an ever-changing market, it’s critical to have a pro in your corner who can uncover the right deals to fit your investment strategy.

New Western agents are constantly identifying value-rich opportunities for our clients. Let us help you discover the one that fits your strategy.

Contact us to see if you qualify for access to our exclusive inventory.