We often hear that investing in real estate is a good way to build long-term wealth, but many new investors have questions about how to buy a rental property and so much more.

There is a lot of information out there and it can be overwhelming trying to wade through all that information. Our goal in this article is to make the process of buying a rental property as easy to understand, regardless of your specific situation.

There’s a lot of ground to cover, so let’s get this show on the road!

How to Buy a Rental Property in 5 Steps

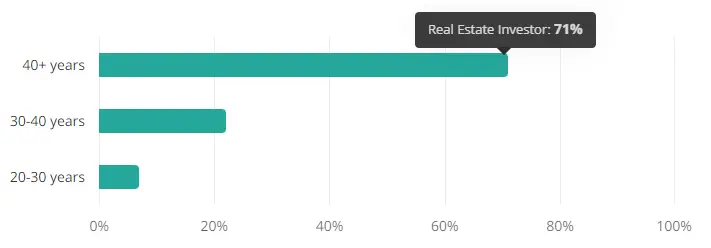

According to the National Association of Realtors (NAR), the average first-time homebuyer in 2022 was 36 years old; but, when it comes to buying their first investment property, 71% of investors are 40+ years old.

Credit: Zippia

Although investors and buyers are entering the market later in life, that doesn’t mean you can’t start investing when you’re young. According to a study conducted by Saxo, 37% of Gen Z investors chose real estate as their go-to investment strategy. Essentially, you can begin investing once you’re able to sign legal documents at 18-years old.

We point this out because you’re never too young (or old!) to begin investing in real estate. The key is knowing how to buy a rental property that has the potential to generate income. No one wants to pour hundreds of thousands of dollars into an investment and not make money!

So where do we start?

Step 1: Determine If You’re Ready to Be a Landlord

In general, managing a rental property requires more time and effort than some may think. 45% of landlords choose to handle their properties by themselves. It’s estimated that the average self-managed landlord spends around 96 hours per year managing their properties; the time being split between leasing tasks and general day-to-day stuff. This isn’t including the time it takes to learn and stay up to date on the local landlord-tenant laws.

If you don’t want to deal with managing a property and you don’t want to pay a property management firm, then buying a rental property may not be right. You can, however, look into REITs (real estate investment trusts). You can learn more about REITs in our article, “Are REITs a Good Career Choice in 2022?”

Step 2: Research, Research, Research

Before you can buy your first property, you need to do a lot of research. You need to learn as much as you can from other investors (our team of experts are more than happy to help!), online resources, and even take the REI course offered by NAR (if you’re a Realtor®).

Along with educating yourself about real estate investing as a whole, you’ll need to determine your target market. You can use online databases like Zillow or Trulia to get an idea of where people are buying and what the average rent is in the area. You’ll also want to look into things like:

- Average age of renters in the area

- Education level

- Occupation and income

- Hobbies and interests

- Marital and family status

A few examples of a target market and what they may want:

| Students | Young Professionals | Married Couples/Families | Empty Nesters/Elderly |

|

|

|

|

By knowing what kind of tenant you’re trying to appeal to, you can then choose the kind of neighborhood you’d like to invest in. RealWealth.com recommends classifying neighborhoods into four categories:

Class A: This neighborhood is the cream of the crop, so to speak. Homeowners are usually high-income earners (attorneys, doctors, executives, etc.) and they take great care of their yards. Inside the home (which tend to be only a few years old), you’ll find luxury finishes and upgrades. These properties are usually more expensive and aren’t usually the best choice for newer investors.

Class B: This neighborhood is where you’ll find the middle class (teachers, management, nurses, etc.) typically live. The homes in these neighborhoods are generally less than two decades old and the finishes are of average quality. Many of the homes in these neighborhoods are owner-occupied; but, of the single-family properties that are being rented, the properties are well cared. These neighborhoods tend to be a safe place to invest.

Class C: This neighborhood is where you’ll find a variety of working class folk (laborers, hospitality, construction, etc.) who either rent or own their homes. These properties are maintained pretty good but it’s not uncommon to find homes that need structural work or a new roof. These properties are on priced lower than the previous two classes and are a great place for investors looking to make a good profit.

Class D: These neighborhoods are… usually not the best places to be. Crime rates are usually high. Property values are extremely low. The properties themselves are derelict and in need of a lot work. It’s not uncommon to find vacant properties that are boarded up and covered in graffiti or are the base of some illegal activities. You do not want to invest in these types of neighborhoods.

Note: The REI course is geared toward established real estate agents who want to expand their expertise so they can help investors buy investment properties. However, you might be able to use what you learn to help your own investment goals.

Step 3: Do the Math

Buying rental properties isn’t just about finding a good house in a good neighborhood. A good deal has to be worth your money and effort. To figure out whether a property is a good deal, it should follow the 2% rule.

This rule basically states that the monthly rental income should equate to 2% of the total purchase price. By doing this, ideally, your property should have a positive cash flow. Of course, this rule is meant to be a guideline and not a steadfast rule that you have to adhere to because market conditions do change.

We go into more detail about the 2% rule and what metrics you should be mindful of when you’re choosing a rental property in the article, “Determining Good Deals: Is the 2% Rule a Good Guideline for Investors?”

Step 4: Secure Financing

You’d be surprised by how many people are under the impression that you can’t finance an investment property and you have to pay cash, otherwise you’re out of luck.

That’s not true.

There are a few different ways you can secure financing for your investment property. You can apply for a conventional loan, apply for an investment property loan, tap into your primary residence’s equity and apply for a HELOC or home equity loan, or get a private money loan.

Depending on your investment strategy, you may even be able to use a government-backed loan like an FHA, USDA, or VA loan for financing. Keep in mind that these loans can only be used if you intend on being an owner occupant in a duplex or triplex (also known as house hacking, which you can learn more about in our article, “The House Hacking Strategy for Beginners.“).

*If You’re Buying a Rental Property With Cash

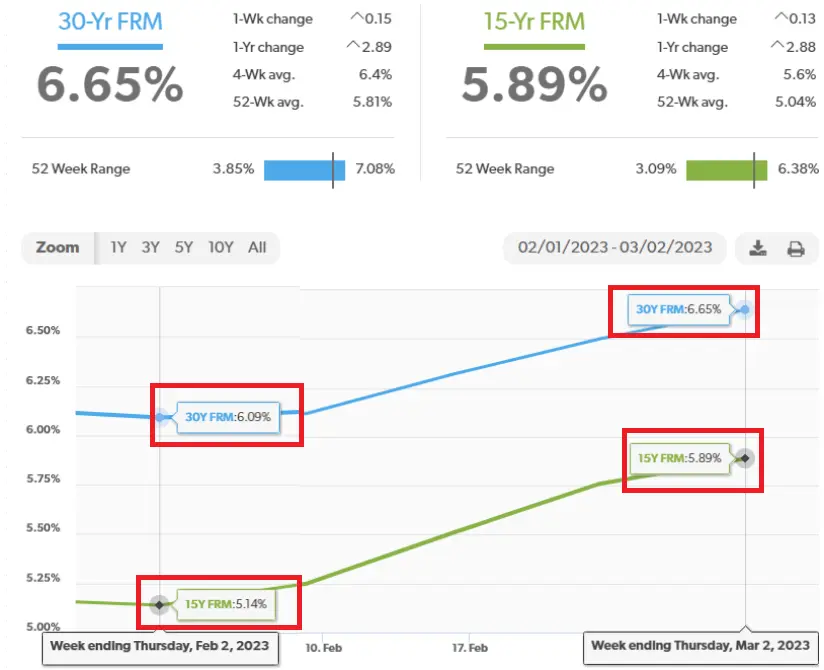

One of the benefits of buying with cash is that you don’t have to worry about paying interest. This can save you a lot of money in the long run, especially when you consider that mortgage rates could rise even further. Why, in a month’s time, it increased from 6.09% for a 30-year FRM in February 2, 2022 to 6.65% as of March 2, 2022.

Credit: Freddie Mac

Other benefits to paying cash include having 100% equity and any rent generated is all profit (minus expenses like taxes, insurance, and property management fees). Also, if you’re paying cash, you’ll have more negotiation power, which can be incredibly useful when you’re dealing with a motivated seller.

With that in mind, it’s important to be wary of the possible pitfalls of paying cash. For starters, your cash-on-cash return will be lower because you’ve invested a larger sum of your own money than if you were to finance. Also, since you won’t be making any mortgage payments, you’re losing out the ability of claiming the interest you would have paid come tax time.

Also, paying cash for a single property means you’re missing the opportunity to pursue other investment properties. Let’s say you buy a property at $200,000 in cash. You’re only getting money from a single rental property.

However if you split that money up and put $50,000 on four properties, you’re receiving rent from four tenants, thus increasing your tax deductions and monthly cash flow. Also, let’s not forget you’re expanding your investment portfolio!

When it comes to paying cash or financing, the choice lies heavily on your financial situation and what you feel comfortable with.

*If You Want to Buy a Rental Property With $0 Down

Despite what it may sound, you do have to put money down on an investment property — nothing is ever truly free. That said, there are ways you can buy a rental property without draining your savings to pay the costs.

Some of the most common ways investors drum up cash for their investments include:

- Renting your primary residence and then buying a new place to live.

- Leveraging your home’s equity to buy the investment property

- House-hacking

- Work with a partner

- Consider a rent-to-own property

- Take over the existing mortgage on a property

- Take out a hard money loan

Q: Can You Buy a Rental Property With Bad Credit?

It is possible to buy a rental property with bad credit, but it is going to be much more challenging because it’s unlikely that you’ll qualify for conventional loan with favorable terms. That said, you can use similar financing options as if you were trying to buy a rental property with no money down.

You can explore all of the possible ways you can finance your investment by reading our in-depth guide: What Are the Best Ways to Finance Your Investment Property? Learn from the Experts.

Step 5: Choose the Property and Make an Offer

You’re ready to take on the responsibilities of being a landlord and you’ve secured financing. Now it’s time shop around for a good property to buy. What should you look for?

Type of Property: There are three main types of rental properties you could invest in: single-family homes, condos, and multi-family homes (think duplex, triplex, etc.). If you’re going to house hack, multi-family homes are a great option.

Turn-Key or Fixer-Upper: Do you want to buy a cheap house that needs a lot of work or are you more interested in a turn-key property? If you opt for a fixer-upper, you’ll need to take into account how much the repairs will cost.

Property Taxes: Property taxes can fluctuate as the local market changes, but they can also change based on the assessed value of your property. That means if you want to do any renovations, the property value is likely to increase, thus increasing the property taxes.

Tenant Occupied vs. Vacant: Sometimes you can find rental properties that already have tenants living there. If you come across a tenant occupied property for sale and want to buy, you’re saving time, money, and effort trying to fill the vacancy. On the other hand, if you buy a vacant property, you can fix it up and get tenants who can afford higher rent.

After choosing the property you’d like to buy, now you have to make an offer and wait for it to be accepted. If the seller doesn’t accept, you’ll have to decide if you’d like to negotiate or move on to another property.

Step 6: Due Diligence and Close

When you get the news that your offer has been accepted, now you can celebrate! But, before you get the keys, you’ll need to do your due diligence to make sure you’re ready to move ahead with the deal.

So, what should you focus on when completing due diligence?

- Is your asking rent in line with the rest of the local market?

- Have the sellers provided a comprehensive set of disclosures, if any?

- Had the home inspection uncovered issues that need to be addressed?

- Is property insurance affordable and easily accessible?

- Are there any problems with the title report?

After doing your due diligence and your confident that everything is on the up-and-up, you can finally close on the property.

Can You Buy a Rental Property Through an LLC?

Yes, you can buy a rental property through an LLC.

It’s not uncommon for real estate investors to buy rental properties under an LLC, or a limited liability corporation. They choose to do this because it protects the investor from losing their personal assets (their home, vehicles, savings, etc.) should they get sued by an angry tenant.

For example, let’s say you have a tenant who slips in the bathtub and they break a leg. If they try to sue you, you’d only lose your rental property (because the LLC technically owns it) instead of your personal assets like your home or car.

You can learn a little more about forming an LLC for rental properties in our article, “Can I Rent From My Own LLC? Yes, But Should You?”

Final Thoughts About How to Buy a Rental Property

The idea of becoming a landlord can be an overwhelming thought for new investors and that’s understandable. There’s a lot of money involved and if you’re not careful, you could be making some of the worst financial decisions in your life.

Yet, it can be one of the best decisions if you have the proper guidance and a team of experts you can reach out to for advice. Whether you want to learn how to buy a rental property, discover the top upgrades for rental properties in 2023, or figure out if a duplex should be your first investment property, New Western’s Warriors has your back.