Prior to entering a home purchase translation, experienced real estate professionals will tell you to “run the numbers.” In everyday terms, running the numbers simply means considering a property objectively by looking at data and calculations.

Running the numbers can’t tell you how to feel about the paint color or the shower fixtures, but it can tell you whether or not you’re making a good financial choice.

Looking at historic fair market value is one aspect of running the numbers. This long-term data can tell you if a home’s value has grown over the years, and in turn, can give you an indication of potential growth in the future. Here’s how to run the numbers on historic fair market value.

To Find and Analyze Historic Fair Market Value You Need to Understand How Home Value Is Determined

Before diving into the finer points of how to find historic fair market value, it’s important to understand the various types of home valuation. These terms are somewhat interrelated, but each is sourced and utilized differently.

1. Historic Cost

The historic cost of a home is the actual price that was paid in previous sales transitions. This figure would be available via the local county courthouse, which records home sales prices whenever the ownership of a property changes.

2. Fair Market Value

Fair market value (FMV) refers to the estimated amount of money a home would sell for under current market conditions. It’s the perceived price that an informed, willing buyer would pay and that an informed, the willing seller would accept.

Fair market value is highly influenced by supply and demand; in a “seller’s market” fair market value rises, while in a “buyer’s market” fair market value drops.

Real estate agents determine fair market value by running a comparative market analysis (CMA), which looks at recent sales of similar homes.

Because it’s an indicator of what a buyer would be willing to pay for a home, fair market value can fluctuate based on certain factors that buyers deem desirable, such as views, amenities, and upgrades.

3. Appraised Value

The appraised value is a more objective determination of the property’s worth. Trained real estate appraisers will look at a home’s features and condition. Then, they will research nearby home sales and add or subtract value based on the similarities or differences that the property has.

Since both fair market value and appraised value take comps (comparable homes) into account, the values can be similar. But because the appraised value is based on formulas and multipliers rather than subjective preferences and market demand, mortgage companies require appraised value for their loan considerations.

Here’s why: In a hot seller’s market, sometimes buyers are willing to pay over the appraised value in order to secure the home of their dreams.

The fair market value (what it’s worth to the buyer) is different from the appraised value (the numerical determination of worth), so the buyer would need to provide the difference in cash at closing if they want to buy the home.

4. Assessed Value

The assessed value of a home is used for one purpose: to calculate property taxes. The assessed value is usually determined by a government-appointed property assessor. The assessor looks at fair market value and applies a preset ratio or percentage to come up with the assessed value.

If necessary, the assessor may also conduct a visual inspection of the property. Each local municipality has different regulations and procedures regarding the assessed value, but for the most part, the assessed value of a property is significantly lower than its fair market value.

Why is Fair Market Value Important?

Of the four valuation methods mentioned above, fair market value is the one that matters most to buyers and sellers at the time of sale, because it influences list price and negotiations.

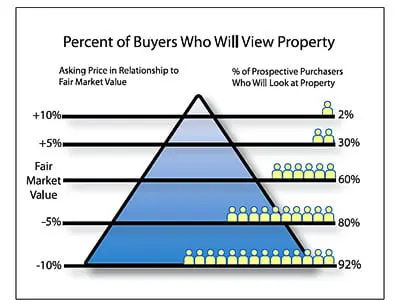

If the asking price is higher than the perceived fair market value, the property should have renovations and updates supporting the pricing.

Otherwise, offers could suffer, as buyers may consider negotiations to be too out of reach. If the asking price is lower than market value, buyers will assume that there’s a reason –– usually some kind of distress.

Image source: enjoyparkcity.com

Fair market value is also important moving forward, since it’s used as a basis for insurance claims, property donations, estate taxes, and more. Homeowners would be wise to keep up with their property’s fair market value even after completing the initial purchase.

To be clear, homeowners should also care about appraised value and assessed value, since those figures impact their mortgage and taxes respectively.

But since fair market value often informs assessed value and appraised value, it’s arguably the most important point of reference regarding real estate valuation.

The Intersection of Historical Cost and Fair Market Value

Some buyers –– investors in particular –– like to look at the historic fair market value of a home because it gives an indication of how the property may appreciate in the future. Looking at a property’s long-term trend in valuation can give the buyer more confidence that the property will be a sound investment.

The historic cost of a home can be obtained easily enough through public records. But tracking the historic cost doesn’t always provide the best data when it comes to determining true value.

For instance, a homeowner may choose to sell the home to a family member for an arbitrary sum like $1.00, a number that is completely irrelevant to value. (Sidenote: anything sold well below fair market value may be subject to gift tax by the IRS.)

As another example, an owner may have experienced some sort of hardship and sold the property for the balance on their mortgage loan, a figure that probably didn’t account for any equity gains. In both hypotheticals, ownership on the property changed hands and the sale was recorded, but the cost was not a true indicator of worth.

Instead, a savvy investor will want to look at the historic fair market value of a home as a better indicator of the property’s worth. For that kind of information, buyers will need to go beyond public records of historic costs and do a little more research.

How to Find the Historic Fair Market Value of a Home

Consider the following four information sources when determining the historic fair market price of a home.

Consult Online Tools

Turn to the internet for a first glimpse at historic fair market values. These sites are a great place to begin. If any of these searches turn up red flags, you can cross the property off your list without going any further.

Realtor.com: Simply enter the property address into the search bar, then scroll down for a graph that tracks years’ worth of Realtor’s own valuations. Note that these FMV calculations are based on an algorithm that local real estate agents sometimes call into question. So this may be a good starting point, but perhaps not an ending point in getting a true picture of historic fair market value.

Zillow.com: After entering the property address, Zillow will provide a 10-year Zestimate history (their own version of fair market value). They also show you which comps they’re using for a valuation, which can provide a frame of reference. Again, the reliability of Zillow’s formula is sometimes questioned by local agents, but it’s still one useful tool to help you get a more complete picture.

Neighborhood Scout: This pay-to-play tool is designed specifically for investors who want a detailed report for informed decision making. It includes data about appreciation history and forecasts, along with comparative analysis against neighborhood and national numbers.

FHFA Housing Price Calculator: While this doesn’t exactly show you the historic fair market value of your home, it uses similar local appreciation data to create a projection of future home worth –– which is the targeted result you’re most likely going for!

Work With a Real Estate Agent

If you’ve consulted more than one of the sources above (which you should!), you probably have figures that show a similar trend but different specifics. A local realtor can help you pinpoint a more accurate historic fair market value by interpreting the valuation data that you’ve gathered so far.

Real estate agents keep their eye on popular search tools (like Realtor and Zillow) all the time, not because they trust the numbers but because they know all their clients do!

As such, an agent will be able to tell you where each online valuation method falls short and where it tends to trend more closely with reality. Their local expertise is valuable in getting a more precise historic valuation.

A real estate agent also has access to historic data in the MLS (multiple listing service), so they’ll be able to pull those reports for you.

Check Sales Prices and Tax Assessments

As mentioned, historic cost and assessed value are not equal to fair market value. But knowing these numbers will help you get a more well-rounded look at valuation, which is your goal. Both of these figures should be public knowledge, so a simple internet search will do the trick.

Compare the historic cost and assessed value numbers against the fair market data you’ve gathered from online sources and your agent. Do these numbers tell you anything different about the history of the home?

Order a Home Appraisal

Similarly, the appraised value is also different from fair market value. But the two valuations definitely work in conjunction with one another, which means an appraiser might be a great resource in getting an idea about historic and future valuation.

An appraisal professional compares asset figures within the same real estate market, including square footage, number of bedrooms, bathrooms, and more. But they also take into account things like renovations, condition, repairs, and even appreciation.

For example, under rapidly appreciating conditions, an appraiser may be more apt to consider pending sales as comps in order to get the most up-to-date valuation.

The point is, while an appraiser doesn’t deal directly in fair market value, they are trained in home valuation. That means they may be able to offer insight regarding historical values. Try to meet your appraiser at the property near the end of their inspection (no need to be there for the whole appointment).

Ask why they chose specific comps and if they have any general thoughts on the historic values of the area, the neighborhood, and the home. Again, this information won’t be complete, but it’s one more piece to the puzzle.

Gathering information –– like historic fair market value –– is an essential step before investing in real estate. For assistance in gathering and analyzing investment-related information, don’t hesitate to reach out to our team of experienced investment professionals.

{

“@context”: “https://schema.org”,

“@type”: “BlogPosting”,

“mainEntityOfPage”: {

“@type”: “WebPage”,

“@id”: “https://www.newwestern.com/blog/how-to-find-historical-fair-market-value-of-home/”

},

“headline”: “How to Find and Analyze Historic Fair Market Value in 2023”,

“description”: “Looking at historic fair market value is one aspect of running the numbers. This long-term data can tell you if a home’s value has grown over the years, and in turn, can give you an indication of potential growth in the future. Here’s how to run the numbers on historic fair market value.”,

“image”: “https://www.newwestern.com/cache/images/shutterstock_1626375454-scaled-1-undefined.webp”,

“author”: {

“@type”: “Person”,

“name”: “Melissa Holtje”,

“url”: “https://www.newwestern.com/content-council/melissa-holtje/”

},

“publisher”: {

“@type”: “Organization”,

“name”: “New Western Acquisitions”,

“logo”: {

“@type”: “ImageObject”,

“url”: “https://www.newwestern.com/assets/nw/nw-mark-gold.svg”

}

},

“datePublished”: “2023-01-02”

}