The month of July outperformed June as the housing market shot into its second month of rebound. “The single-family housing market is going gangbusters…It’s fully recovered from the pandemic shock and is back even stronger than last year, when it was showing its best performance in a decade,” declares Fannie May former chief credit officer, Ed Pinto.

Hot July for Housing

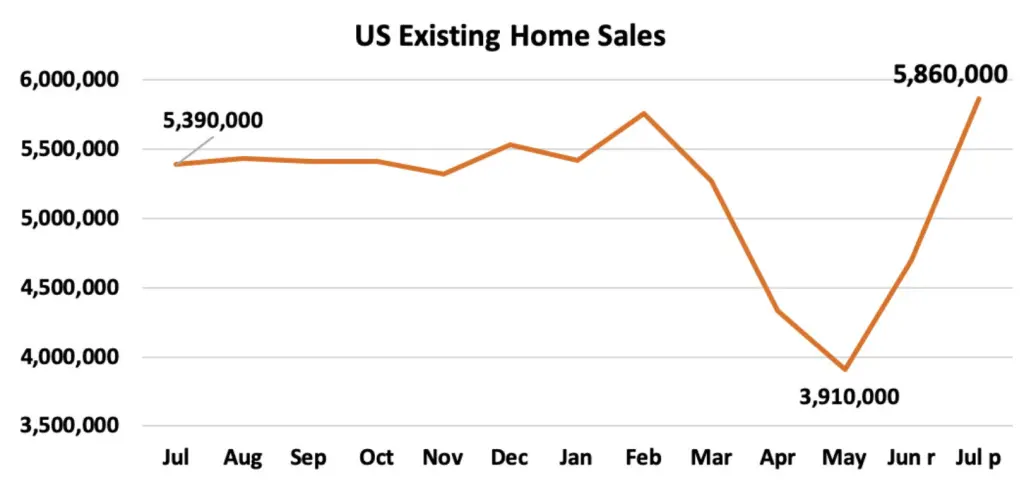

Existing homes sales continued to set a record pace in July: up almost 25%. “The housing market is well past the recovery phase and is now booming with higher home sales compared to the pre-pandemic days,” announced Lawrence Yun, National Association of REALTORS® chief economist. Every region of the country showed double-digit, month-over-month growth.

Pending home sales were also up in July, for the third month in a row. The 5.9% monthly gain is bested by a 15.5% year-over-year gain. “Home sellers are seeing their homes go under contract in record time, with nine new contracts for every 10 new listings” Yun reports.

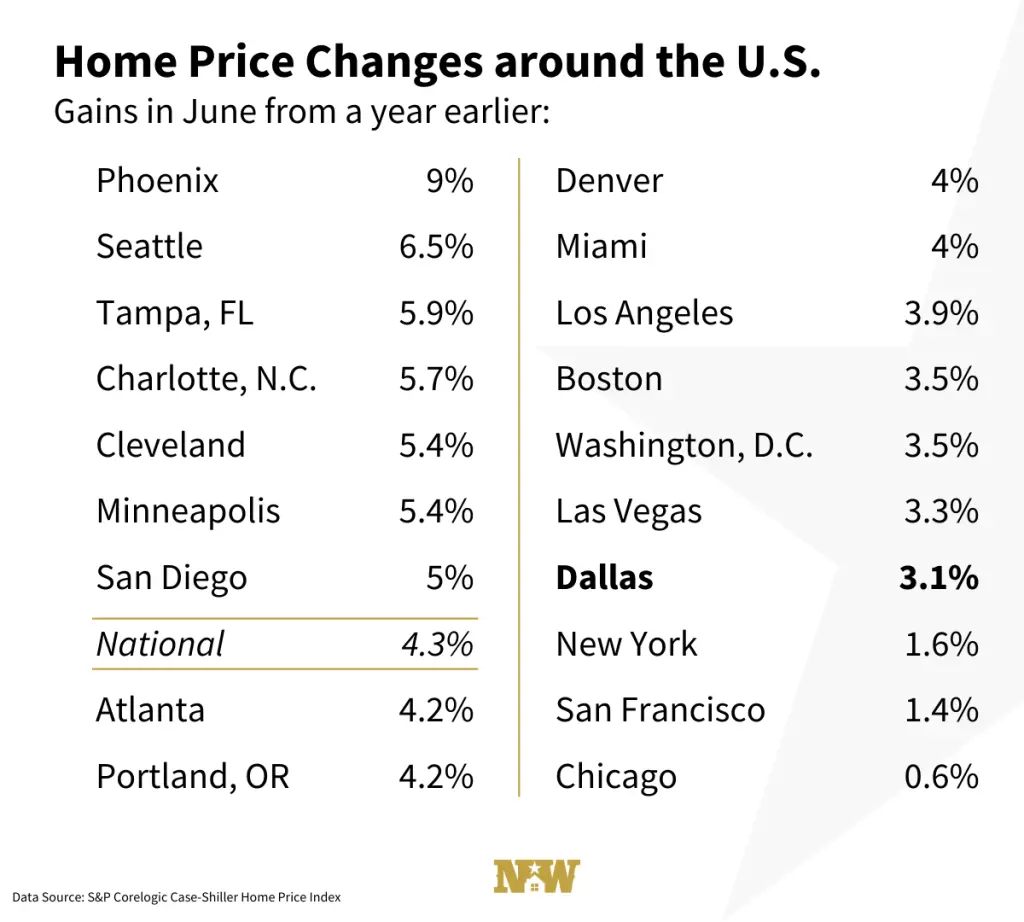

And, for the first time ever, the median home price exceeded $300,000: $304,100 to be exact. July’s 8.5% increase marks 101 straight months of year-over-year gains and nearly doubles the recently released S&P CoreLogic Case Shiller June increase of 4.3%. Home values in all 19 cities tracked by S&P were up with Phoenix retaining top spot for the 13th consecutive month.

The Realtor.com Housing Market Recovery Index also shows strength in the West with a 110.5 index, followed by the Northeast (108.2). However, the South (99.5) and Midwest (98.8) still lag slightly below the pre-COVID benchmark.

Money Matters

While mortgage applications slowed a bit in July (+1% vs. June), they are still up dramatically (+39%) when compared to a year ago. Lending standards are loosening per the Mortgage Bankers Association (MBA) and credit availability is rising. “The July data signals that lenders saw conditions improve this summer, as forbearance requests flattened, and record-low mortgage rates spurred strong levels of purchase and refinance activity,” according to Joel Kan, MBA associate vice president of economic and industry forecasting.

In fact, rate-lock data from the AEI Housing Center is reflecting extraordinary gains over 2019. Buyers secured rates with lenders on 62,000 homes (week ending July 10) with rate locks exceeding last year by more than 40%. “The lock-in date generally comes 45 to 50 days before the closing or recorded sale,” notes Pinto, which will translate into strong closings for August and September.

The Inventory Issue

Inventory continues to be constrained per NAR, down more than 21.1% versus year ago. Pent-up demand from 14 straight months of year-over-year decline means that new listings are gobbled up quickly. Time on the market continues to be four days faster than last year with the typical home spending only 60 days on the market in July.

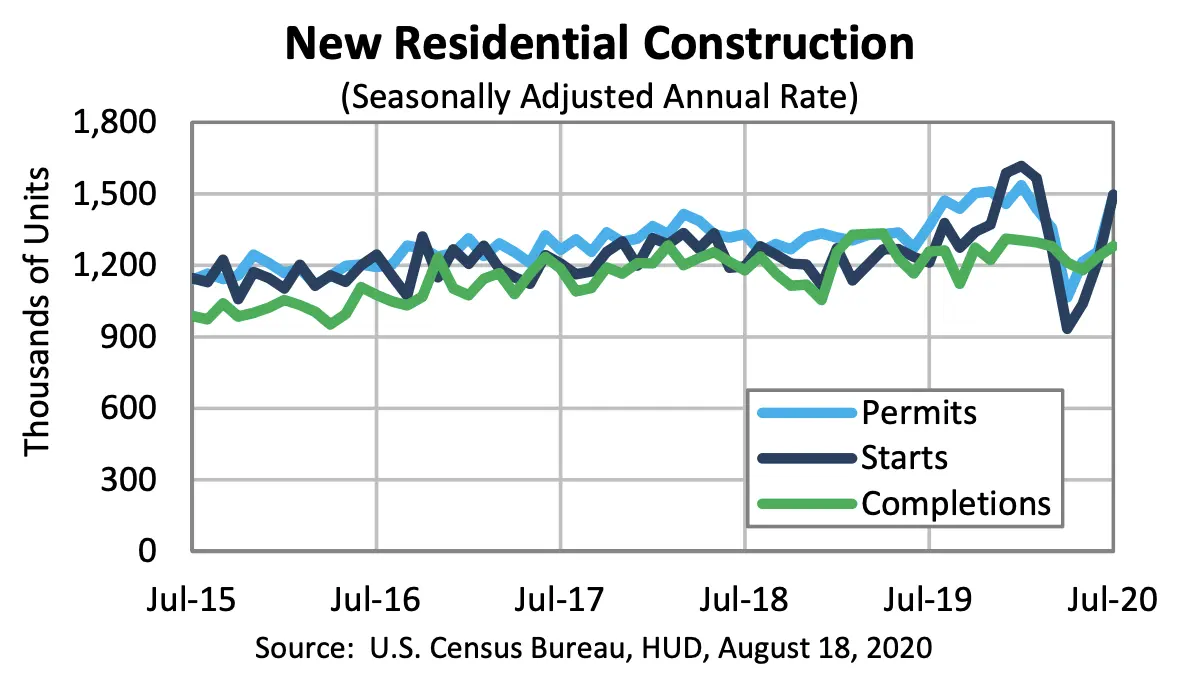

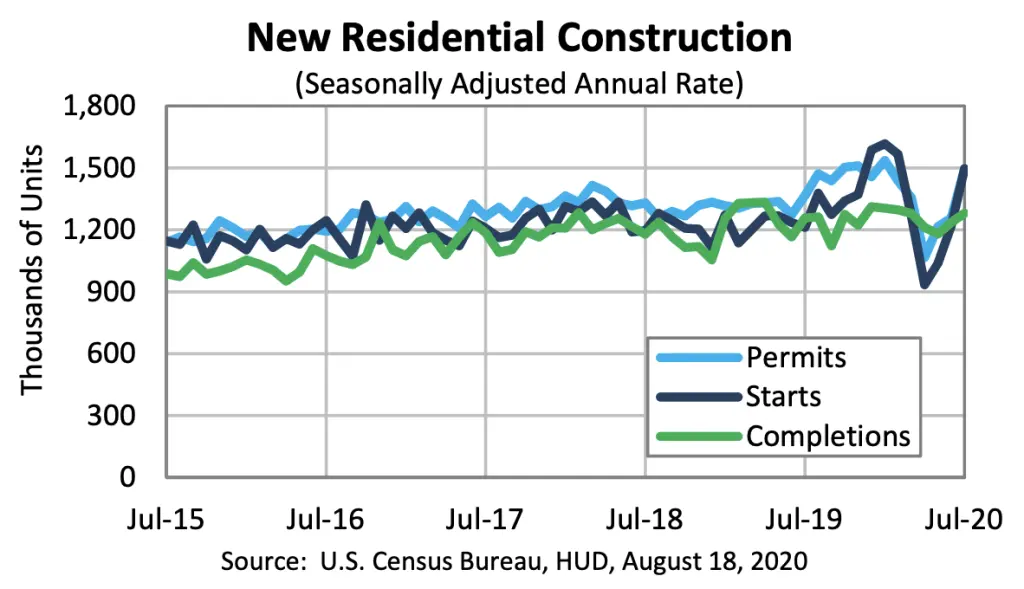

Homebuilders are back in action addressing the inventory issue. Housing starts shattered expectations in July, up 22.6% to 1.50 million units. July marks the third month of building rebound – another key factor driving the V-shaped recovery for the market.

An Eye to 2021

“With the sizable shift in remote work, current homeowners are looking for larger homes and this will lead to a secondary level of demand even into 2021,” Yun predicts.

The appeal of the suburbs is rising as affordable, larger homes beckon many buyers. According to Yale economist Robert Shiller: “the pleasure of living in a nice city is diminished by the fear of being close to other people…causing an outflow to the suburbs and far-flung places even beyond…”

Experts predict 2020 to end strong with existing home sales up compared to year ago. And Yun sees growth extending into 2021 – fueled by continued low mortgage rates and an economy he projects to expand by 4%.

How Can We Help?

The pros at New Western are scouring markets across the country to uncover value-rich opportunities for our investors. Buyers are hungry for suburban homes and savvy investors can get ahead of this new wave of demand. However, the increased demand for housing and low inventory levels could make it more difficult than ever to score a good deal.

Opportunity is out there and it is important to have the right team in your corner in order to make the most of it. If you’d like help finding your next deal, please provide your information below and request access to our exclusive inventory of off-market investment properties.