2020 has been a wild ride for the housing market but it appears a strong rebound is underway. The June numbers are in and up – and according to Windermere chief economist Matthew Gardner, “Housing will be a leader and not a laggard as we move through the balance of this year and into 2021.”

June Bounces Back

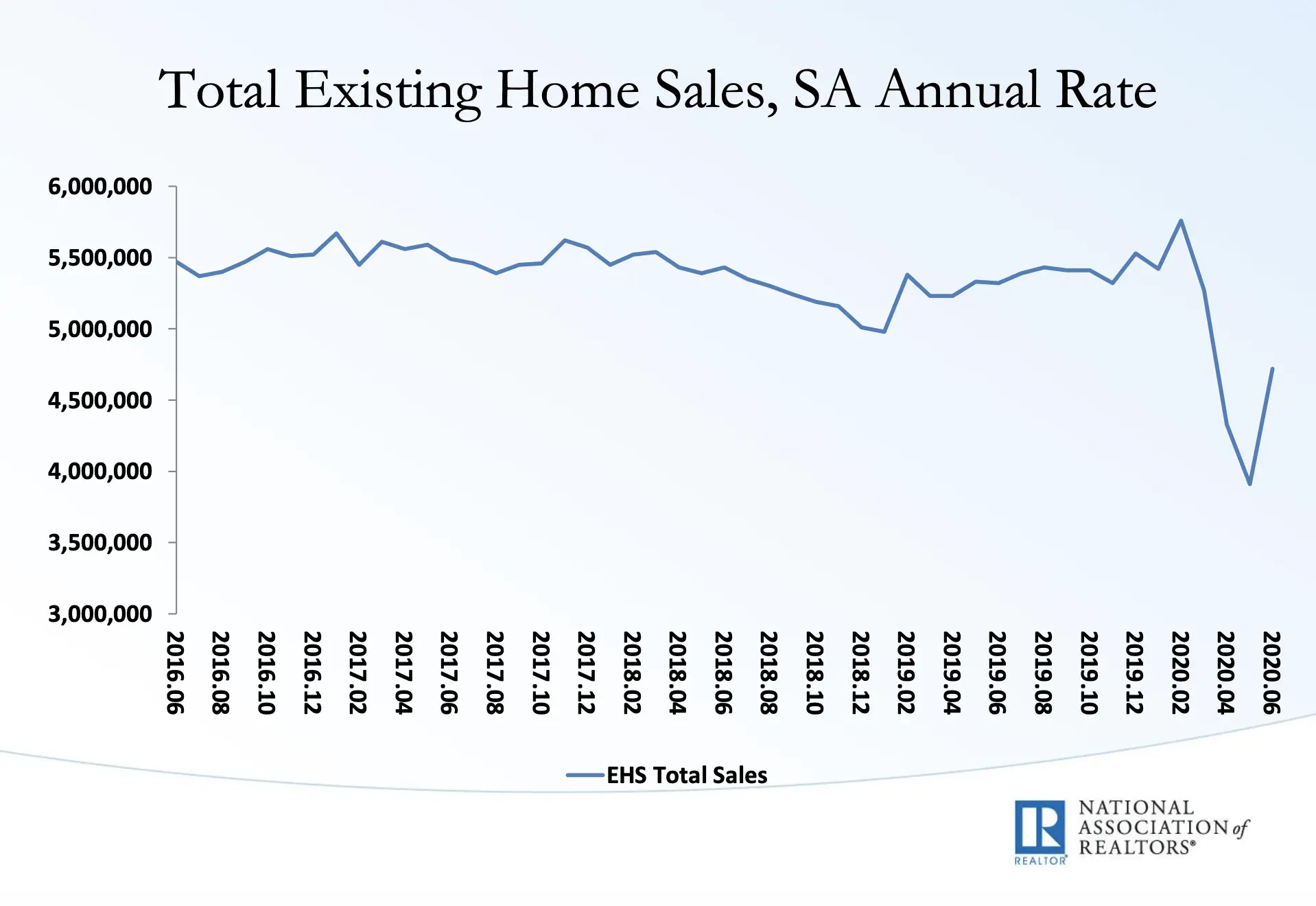

The National Association of REALTORS® reports a record rebound for existing home sales in June: a 20.7% jump from May. And this was not a regional phenomenon. Every region grew month over month with the West showing the strongest recovery.

Pending home sales also continued to rise in June for the second month in a row, up 16.6%. Activity is even up compared to last year, quite a feat given the circumstances, says NAR chief economist Lawrence Yun. “It is quite surprising and remarkable that, in the midst of a global pandemic, contract activity for home purchases is higher compared to one year ago,” Yun remarks.

Record low mortgage rates continue to help drive the market with applications up 20% vs. May. “We actually see 30-year rates falling down to about 2.75 and for sterling credit, you might get something lower than that,” says Fannie Mae top economist Doug Duncan.

That said, lending standards are tightening. According to the Mortgage Bankers Association (MBA), mortgage credit availability decreased in June. “Lenders are navigating a gradual economic and housing market recovery that is still facing headwinds from the ongoing COVID-19 pandemic,” according to Joel Kan, MBA associate vice president of economic and industry forecasting.

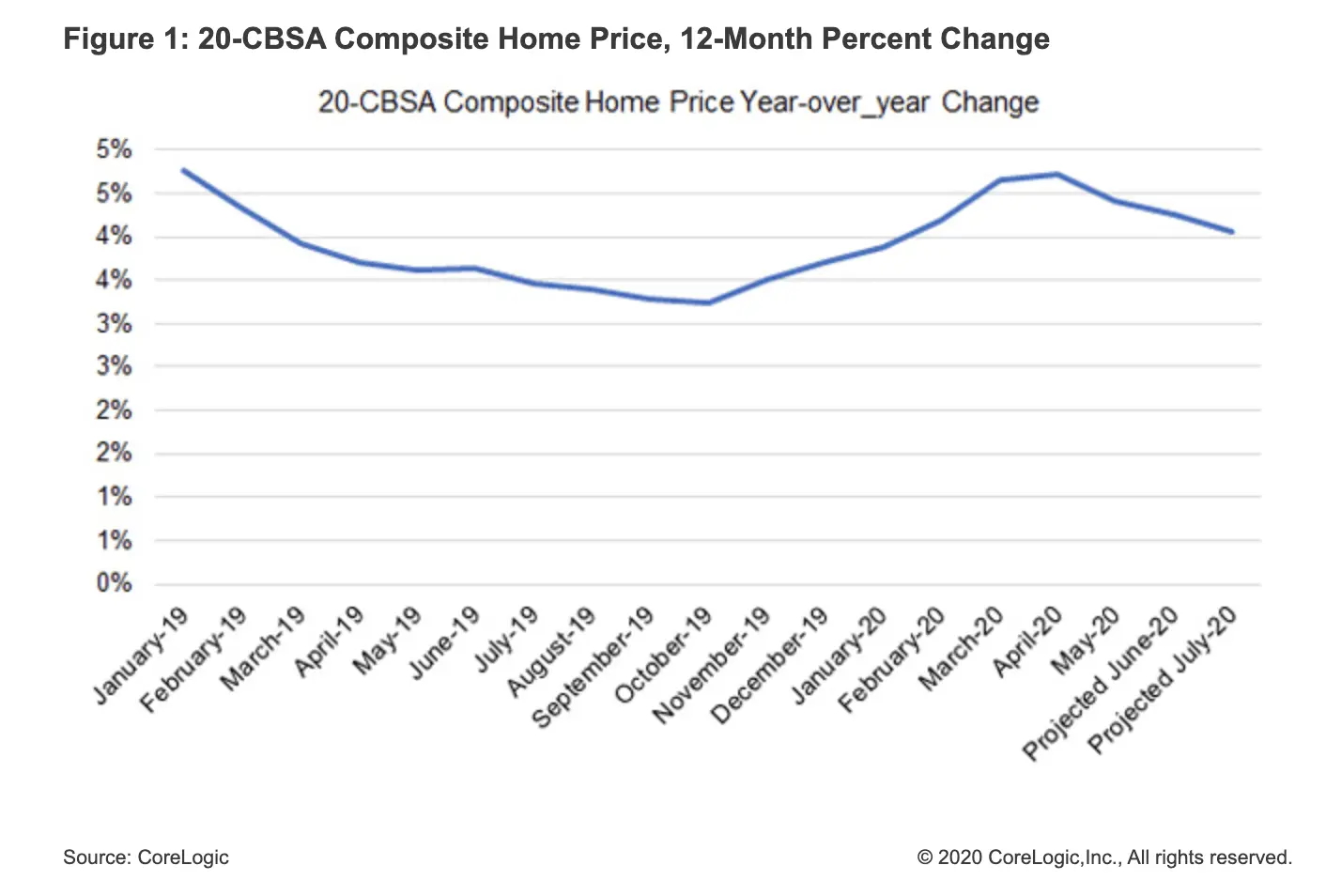

The median existing home price also continued its rise, up 3.5% to $295,300 for a record 100 straight months of year-over-year gains. The pace in June was remarkable: the largest month-over-month increase that the country has seen in more than a year. Recently released S&P CoreLogic Case-Shiller Indices project even stronger annual home price gains in June (+4.3%) and July (+4.1%).

Realtor.com is in fact reporting actual July price gains (week ending 7/25) up 9.1% vs. 2019, faster than the pre-COVID pace and the fastest pace since January 2018.

Supply and Demand

As we’ve reported at New Western, inventory remains tight, one of the top hindrances for potential buyers according to a recent survey of NAR members. In fact, Realtor.com reports June inventory down more than 27% vs. year ago – and newly listed properties down nearly 20% from 2019. To make the supply point more clear: that equals a loss of 363,000 listings compared to June of 2019.

However, when looking at month to month numbers, things are improving. New June listings are up 45% vs. May. In Gardner’s words, “We are seeing some green shoots…as sellers are starting to return to the market.”

As a result, buyers are moving quickly. More than 60 percent of homes sold in June were on the market for less than a month. Analysts are seeing the peak of the season extend into the summer as confidence increases for both buyers and sellers.

Housing starts are also up 17.3% in June, marking the second month of improvement and a solid turnaround in construction activity, according to TD economist Johary Razafindratsita. The momentum spanned all segments of the market, from multi- to single-family.

“Homebuilder confidence has more than doubled in the last three months, indicating that builders are shedding any concerns associated with rising materials costs and land shortages, and diving right into a market that they believe will see enduring demand from would-be buyers, thanks in part to record-low mortgage rates and changing buyer preferences,” notes Zillow economist Matthew Speakman.

2020: The Second Half

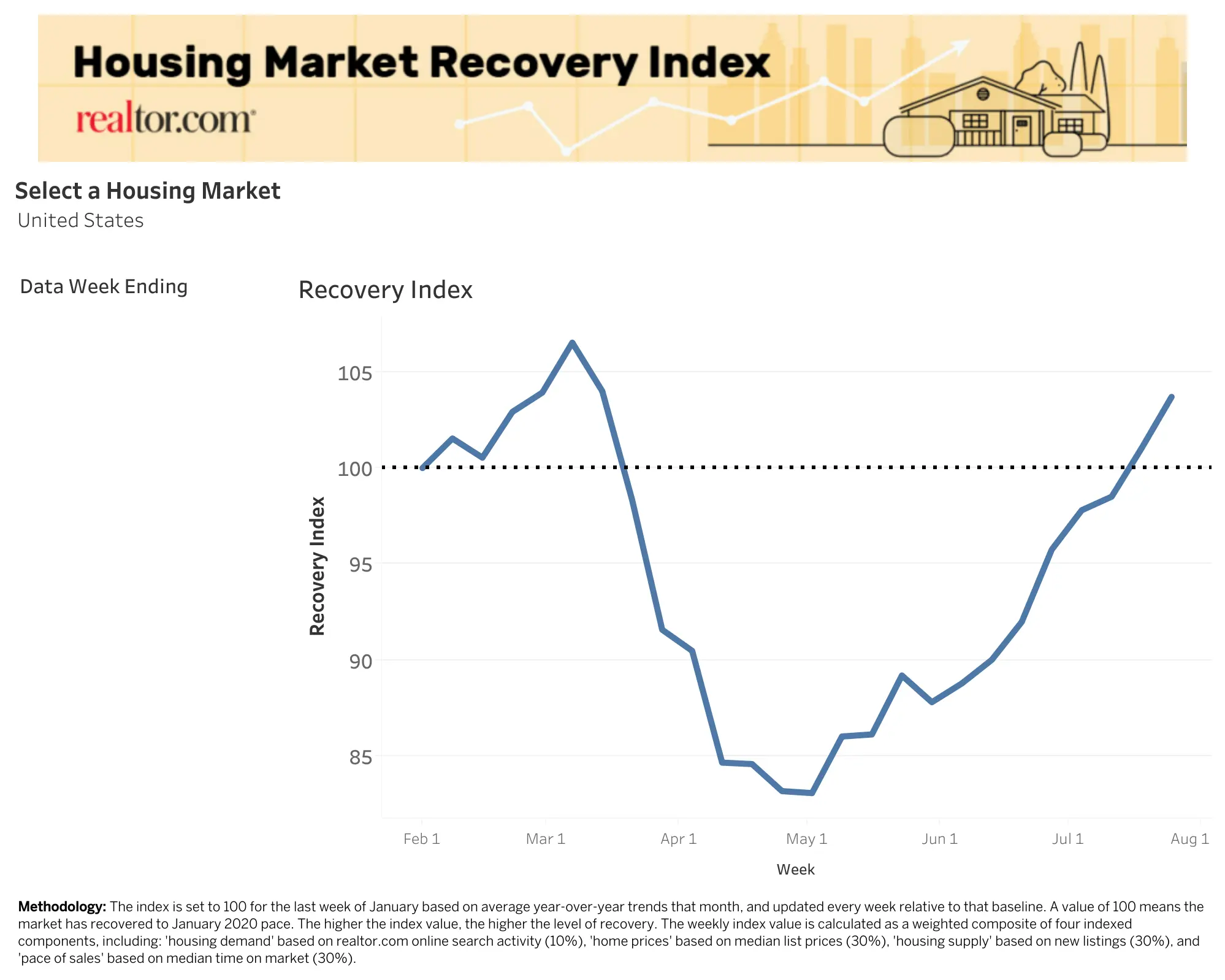

It took four months…but the U.S. housing market has rebounded, returning to the level of growth we were seeing pre-COVID, according to Realtor.com economist Javier Vivas. The Northeast in particular has shown a strong recovery and more than half of the largest 50 markets in the U.S. are now above recovery benchmarks.

“This revitalization looks to be sustainable for many months ahead as long as mortgage rates remain low and job gains continue,” according to Yun. He also sees a potential flight to the suburbs. Homebuyers seeking to avoid densely populated urban areas are no longer constricted to office buildings given the rise in remote work flexibility.

It’s a time to pounce, not pause, for investors. “Home prices rose during the lockdown and could rise even further due to heavy buyer competition and a significant shortage of supply,” Yun concludes. Gardner concurs that prices in 2020 will end higher than we saw in 2019. And Yun sees a bright 2021 as well: predicting positive GDP growth will boost sales and prices into next year.

Here at New Western, our agents are scouring markets across the country to uncover value-rich opportunities for our investors. If you’d like help finding your next deal, simply provide your information below and request access to our exclusive inventory of off-market investment properties.