Welcome back! Catch up on the most relevant news, data, and resources for real estate investors.

VIDEO: Changes To The Real Estate Market In The Age Of COVID-19

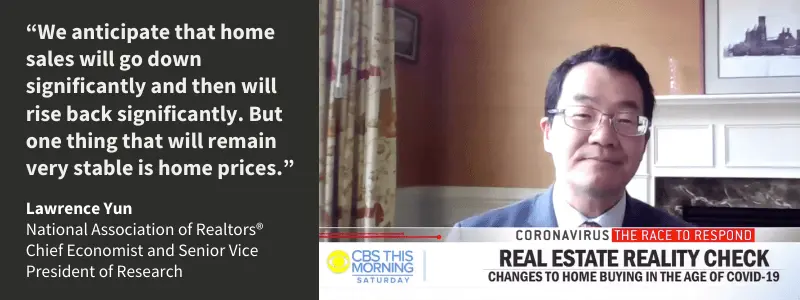

This past Saturday, CBS This Morning took a look at how the coronavirus is forcing change in the real estate market. Watch the story to learn how real estate agents in Denver and Southern California are adapting to sell properties during shelter-in-place restrictions, why the National Association of Realtors®️ Chief Economist predicts prices will remain strong, and why the CEO of an independent mortgage lender wants nothing more than to continue lending to buyers.

Could Low New Housing Starts Equal Opportunity for Flippers?

You already know this isn’t like last time. There is currently a record-low inventory of homes on the market. The data shows new construction is failing to keep up and according to CoreLogic, lower-priced homes continue to see strong demand. This could position real estate investors to fill the gap by transforming existing homes for hungry buyers, especially those just entering the market.

Unlike in 2008 when, as Realtor.com puts it, “the glut of new construction was a calling card of the Great Recession,” last year, builders didn’t meet the supply needed to alleviate the housing shortage and accommodate the growing population. With state-wide shutdown orders in place across the country, new housing starts dropped 22.3% from February to March.

Yet, demand hasn’t evaporated. “People need a place to live, and at some point, we’re going to get past the virus,” says Robert Dietz, Chief Economist of the National Association of Home Builders. “I don’t think we’ll see significant price cuts,” he continued. “There’s a lot of young people who want to attain homeownership.” As Realtor.com argues, “while many potential buyers will grapple with job losses or the prospect of them, others will be lured in by the prospect of super-low mortgage interest rates.”

Brandon Turner’s 5 Principles to Build Wealth During a Recession

On Saturday, Brandon Turner, real estate investor and co-host to of the BiggerPockets Podcast shared his top advice for real estate investors right now.

He offered several great tips, not the least of which is his reminder that “by shifting our view about this kind of economic uncertainty and being proactive, not only can you help yourself, but you can help many other people, as well…I [built] a foundation during the last recession that led me to become a millionaire as we climbed out of it, but I also helped other people in the process.”

From being the one to take action when the market overreacts to keeping the long view to relentlessly pursuing personal transformation, every investor can benefit from his perspective.

Quote of the day: “Ten years from now, you’re either going to look back and say, ‘Wow, I wasted that recession playing the victim.’ Or you’re going to look back and say, ’Thank you, God, for that opportunity. I’m glad I stepped up.‘”

How the Rent and Mortgage Cancellation Act of 2020 Would impact Real Estate Investors

The government continues to take action to offset the economic crisis caused by the coronavirus. The $484 billion coronavirus relief package passed the Senate and House earlier last week and was signed by President Trump on Friday.

There is another proposed bill on the table that would have a big impact on homeowners, tenants, landlords, and real estate investors everywhere: the Rent and Mortgage Cancellation Act of 2020.

According to an article on The Motley Fool, the bill “would eliminate rental and mortgage payments on any primary residence for the duration of the national emergency, allowing landlords and lenders to recoup losses by applying to a relief fund.” Read the full article for an in-depth look at the proposed bill and what it could mean for real estate investors.