Tight supply continues to have a strong effect on the housing market. Record low rates and record-high prices are fueling a frenzied pace for home buyers.

Prices Hit Historic Highs

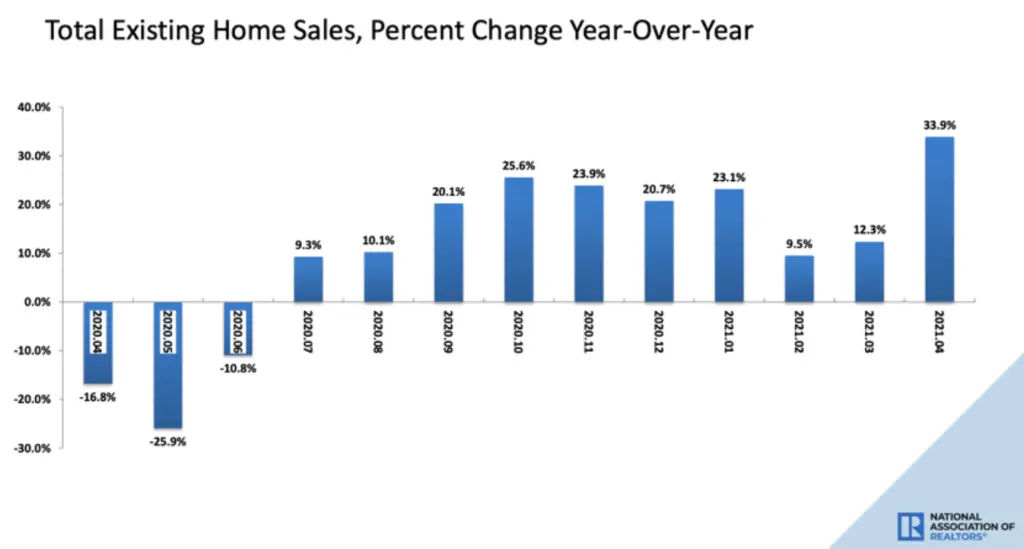

The supply shortage continues to impact existing home sales, down 2.7% in April to a seasonally-adjusted annual rate of 5.85 million units, for a third straight month of decline. That said, sales were up nearly 34% from this time last year, a marker of the strong rebound coming out of the pandemic.

“Despite the decline, housing demand is still strong compared to one year ago, evidenced by home sales from this January to April, which are up 20% compared to 2020,” noted National Association of Realtors® (NAR) chief economist Lawrence Yun. “The additional supply projected for the market should cool down the torrid pace of price appreciation later in the year,” he continued.

Pending home sales experienced a similar dynamic with signings down 4.4% versus the previous month but up 51.7% year-over-year. The Midwest was the sole exception, with affordable housing driving an increase of 3.5% versus April.

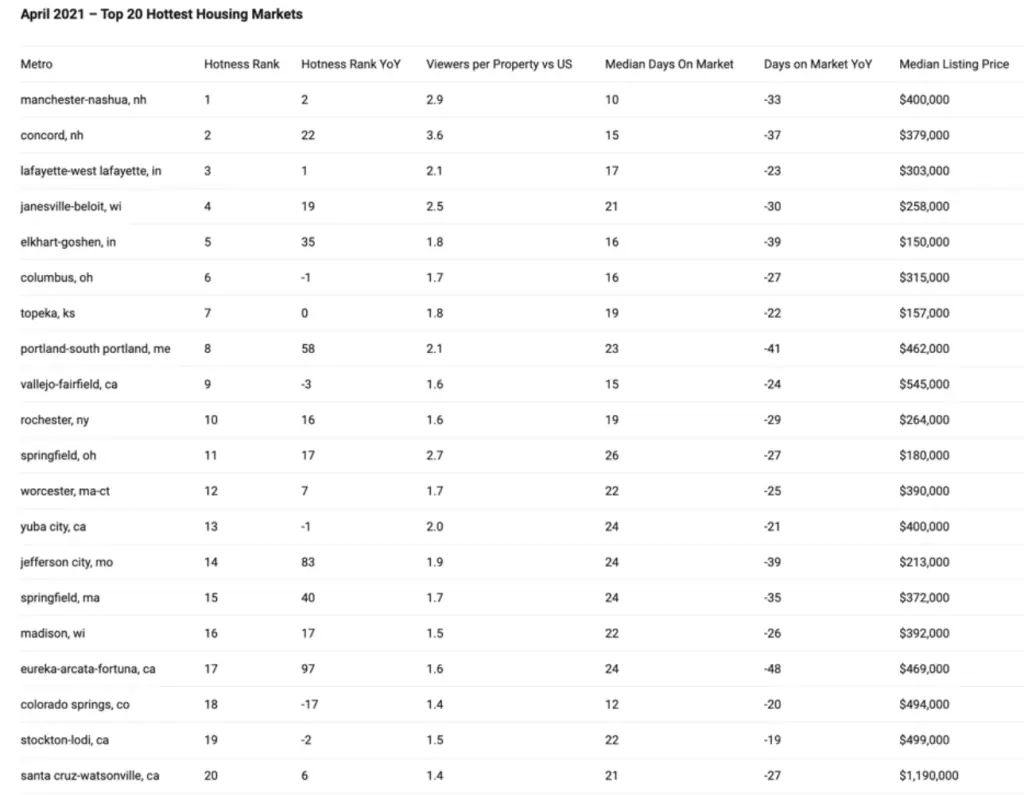

Realtor.com®’s Market Hotness Index reflects this trend with the Midwest and Northeast earning 14 of the top 20 spots on its ranking.

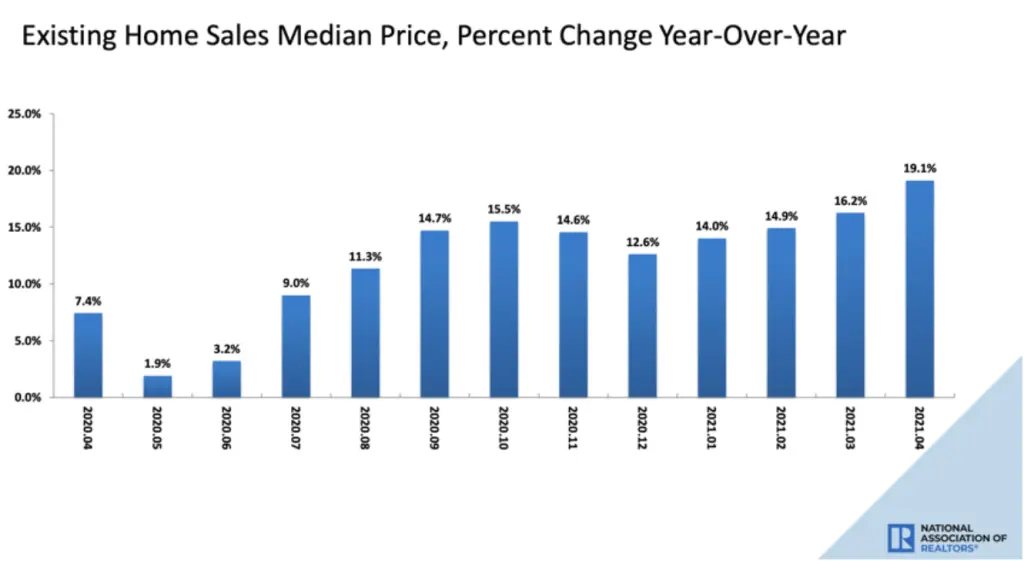

Once again, the median home price hit a record high in April at $341,600, up 19.1% versus 2020 for 110 straight months of year-over-year gains.

The latest S&P CoreLogic Case-Shiller Home Price Index reports that homes nationwide have experienced the biggest increase in more than a decade. “More than 30 years of S&P CoreLogic Case-Shiller data put these results into historical context. The national composite’s 13.2% gain was last exceeded more than 15 years ago in December 2005,” according to report author Craig J. Lazzara.

The Supply Situation

In some good news, housing inventory was up 10.5% from March to 1.16 million units with unsold inventory also up to a 2.4-month supply. Things continue to move quickly with properties averaging 17 days on the market and 88% sold in under a month.

“First-time buyers in particular are having trouble securing that first home for a multitude of reasons, including not enough affordable properties, competition with cash buyers and properties leaving the market at such a rapid pace,” Yun commented.

Consider this fact: more than 40% of potential buyers would consider buying a home sight unseen according to a recent survey by homes.com.

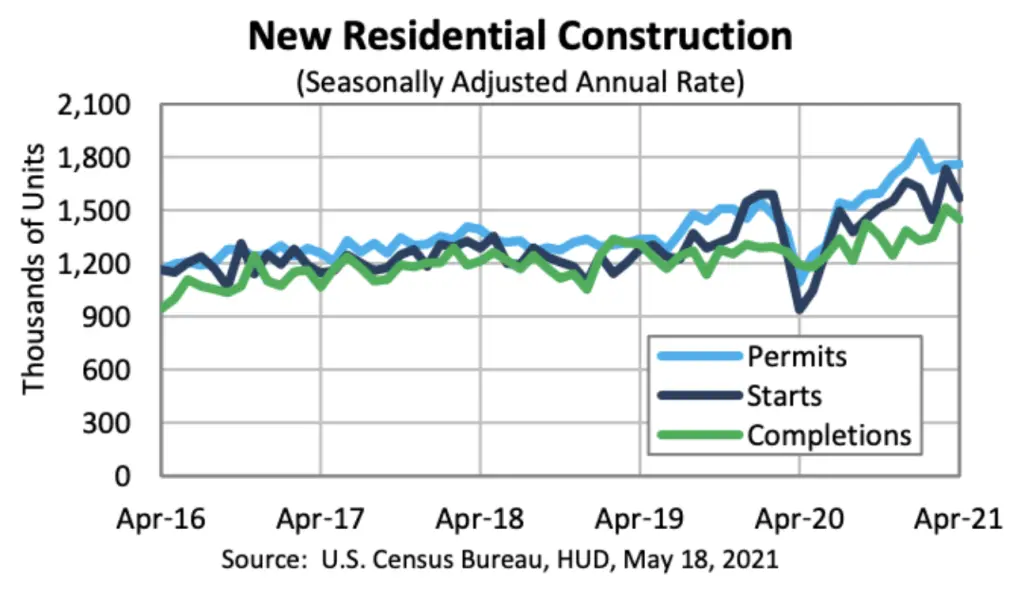

Housing starts dropped 9.5% in April but are up a whopping 67.3% from this time last year for an adjusted annual rate of 1,569,000 units. Soaring prices for lumber and other materials coupled with labor challenges are driving some builders to hold back.

According to one recent industry survey, some builders are reporting, “we are not accepting all the work that we could if we had the labor.”

Rates Fall

Mortgage rates dipped below 3% at the end of April to 2.98% for a 30-year fixed mortgage, compared to 3.23% the same time last year. Mortgage applications ended the month down .9%.

According to Mortgage Bankers Association (MBA) economist Joel Kan, “This is a sign that the competitive purchase market, driven by low housing inventory and high demand, is pushing prices higher and weighing down on activity.”

Opportunity Knocks. New Western.

Now is the time for real estate investors to lock in rates and open the door to new opportunities.

“Massive home buying demand shows no signs of abating despite some rise in mortgage rates and concerns of overheated home price growth,” according to CoreLogic deputy chief economist Selma Hepp.

With such a dynamic market, it’s critical to have a pro in your corner who can uncover the right deals to fit your investment strategy. New Western agents are constantly identifying value-rich opportunities for our clients. Let us help you discover the one that fits your strategy this summer.

Contact us to see if you qualify for access to our exclusive inventory.