Ongoing supply constraints continue to push prices higher for homebuyers. That said, rates are rising and so are housing starts, suggesting a calmer year ahead. Read on to see what experts predict for the coming months.

Holding Steady

Existing home sales dropped 4.6% in December, reversing three straight months of gains with all four major regions experiencing month-over-month declines. However, 2021 sales in total increased 8.5% vs. 2020 to 6.12 million—the highest annual level since 2006.

“December saw sales retreat, but the pullback was more a sign of supply constraints than an indication of a weakened demand for housing,” noted NAR chief economist Lawrence Yun.

Pending home sales also fell in December (-3.8%) with all regions down month-over-month and year-over-year. “The market will likely endure a minor reduction in sales as mortgage rates continue to edge higher,” Yun explained.

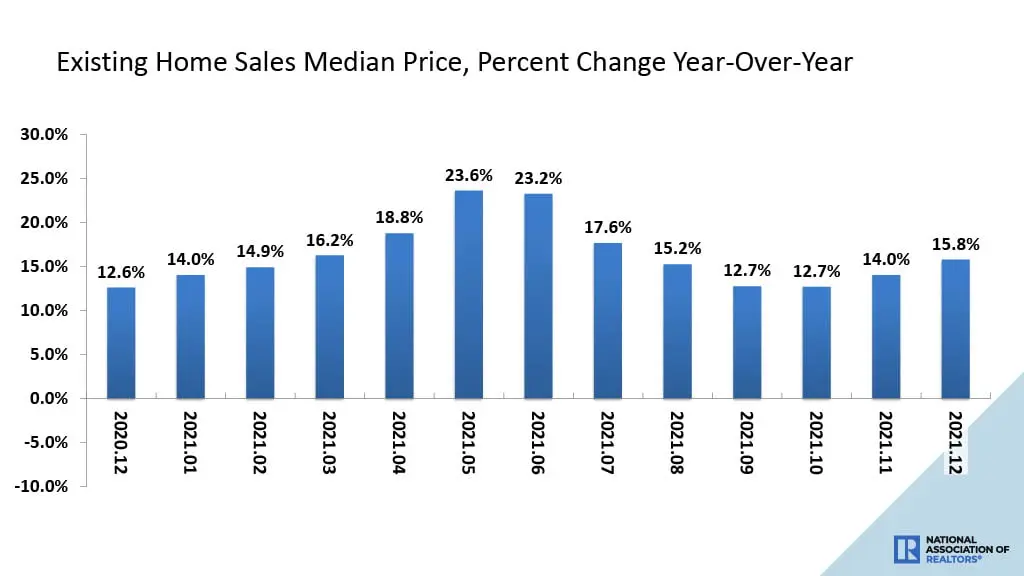

The median home price rose 15.8% to $358,000 with prices up in all regions for 118 straight months of year-over-year gains, continuing the longest-running streak on record.

Investors kept competition strong as they purchased 17% of homes in December. All-cash sales represented 23% of transactions, down from November but up 19% versus year-ago.

2021 proved to be quite profitable for home sellers with an average return of $94,092. “What a year 2021 was for home sellers and the housing market all around the U.S.,” remarked ATTOM chief product and technology officer, Todd Teta. “Prices went through the roof, kicking profits and profit margins up at a pace not seen for at least a decade.”

The Supply Situation

Housing inventory fell to an all-time low of 910,000 units in December with a 1.8-month supply of unsold homes. Properties are typically on the market for 19 days with 79% sold in less than a month.

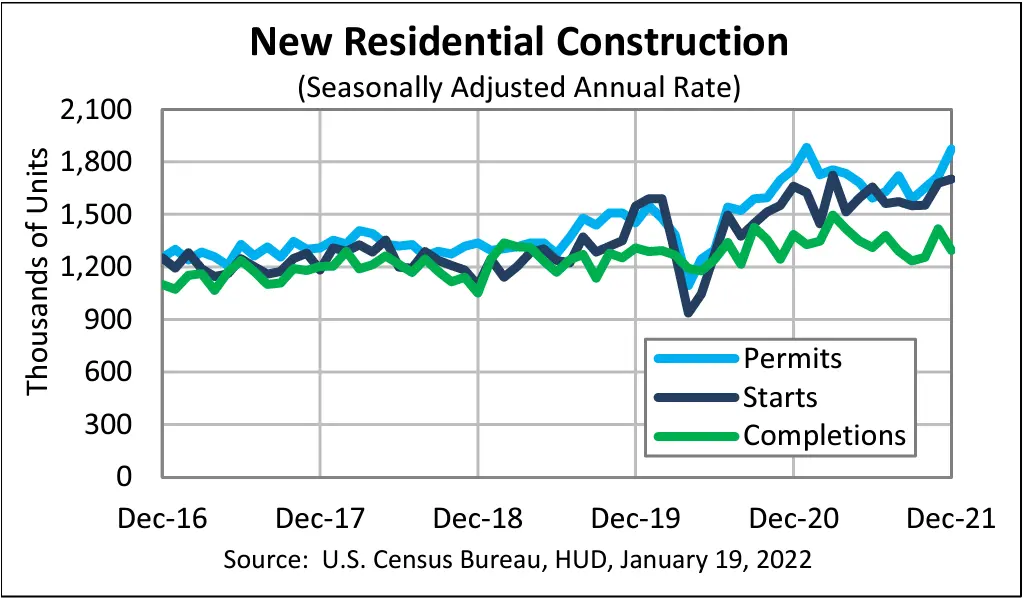

Housing starts rose slightly (1.4%) to an adjusted annual rate of 1,702,000 units.

Fannie Mae believes more supply is coming. Their recent Economic and Housing Outlook notes: “The total number of homes under construction, including both single-family and multifamily units, is the highest since 1973. Additionally, data on the number of lots being acquired and developed by homebuilders points to an increase in the total amount of homes likely to be made available for sale later this year.”

Rates Rise

Mortgage rates ended the month at 3.11% for a 30-year fixed mortgage with mortgage applications down 2.7%. “Mortgage rates continued to creep higher…as markets maintained an optimistic view of the economy,” observed Joel Kan, associate vice president of economic and industry forecasting for the Mortgage Bankers Association.

Important to note, Realtor.com chief economist Danielle Hale believes that rising rates are: “creating a sense of urgency, rather than deterring potential homebuyers, and prices continue to rise while the few homes available for sale are snapped up quickly.”

Steady Ahead

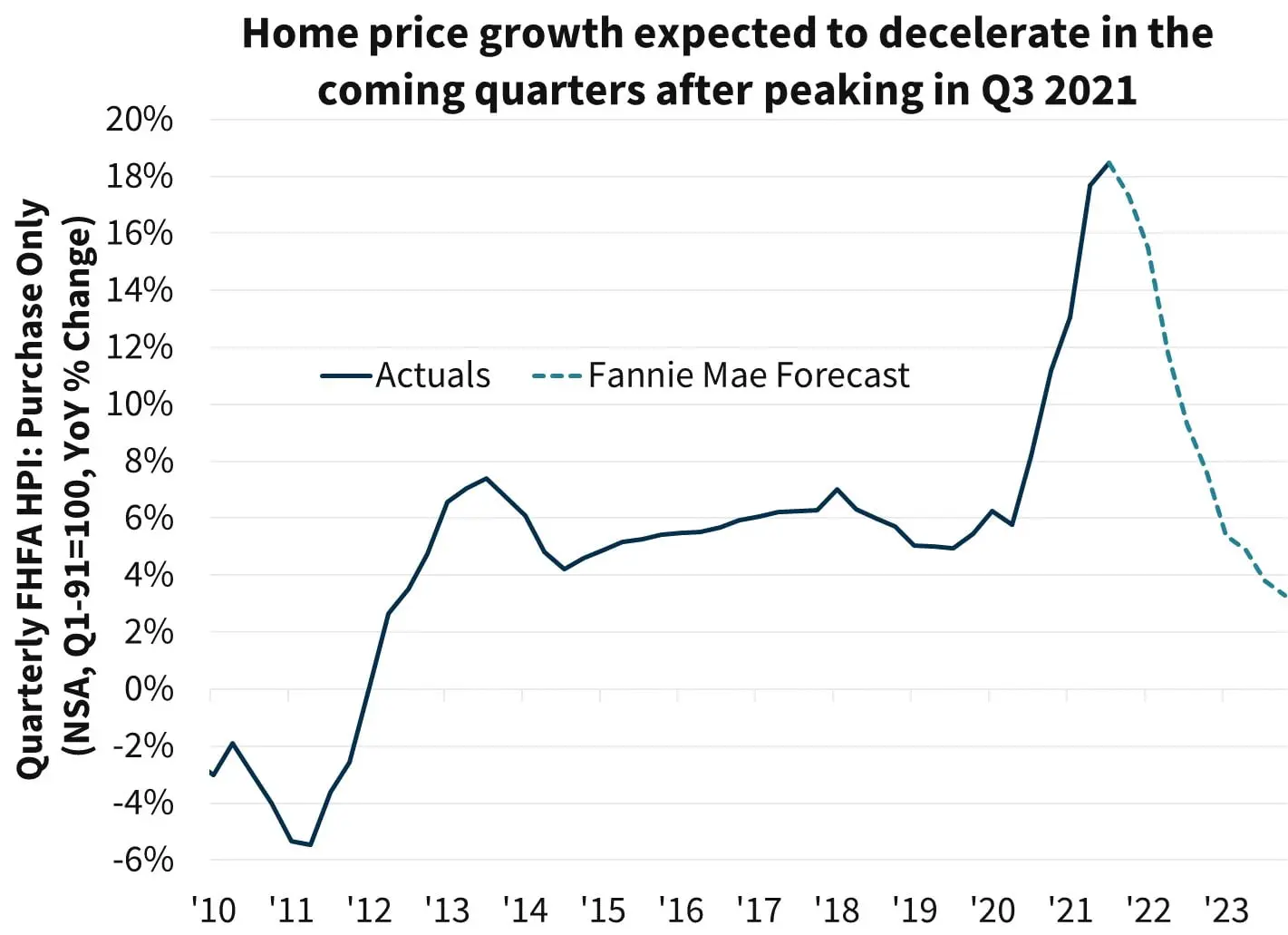

The experts are predicting that the housing market will steady this year. “As we move further into 2022, economic factors—such as new home building and a rise in mortgage rates—are in motion to help relieve some of this pressure and steadily temper the rapid home price acceleration seen in 2021,” reported Dr. Frank Nothaft, chief economist at CoreLogic.

CoreLogic also predicts that U.S. home price appreciation will ease with percentage increases in the single digits. Redfin economists concur, projecting price growth to slow to 7% by December with home sales mostly flat this year. Fannie Mae also anticipates a deceleration in the coming years.

New Opportunity. New Western.

There is no time like the present for real estate investors to lock in rates and capitalize on timely opportunities. With an ever-changing market, it’s critical to have a pro in your corner who can uncover the right deals to fit your investment strategy.

New Western agents are constantly identifying value-rich opportunities for our clients. Let us help you discover the one that fits your strategy.

Contact us to see if you qualify for access to our exclusive inventory.