The month of March saw historic highs in home prices and continued constraint in supply. With increasing vaccine availability and decreasing COVID restrictions, the economy is recovering—with housing leading the way.

Marching Forward

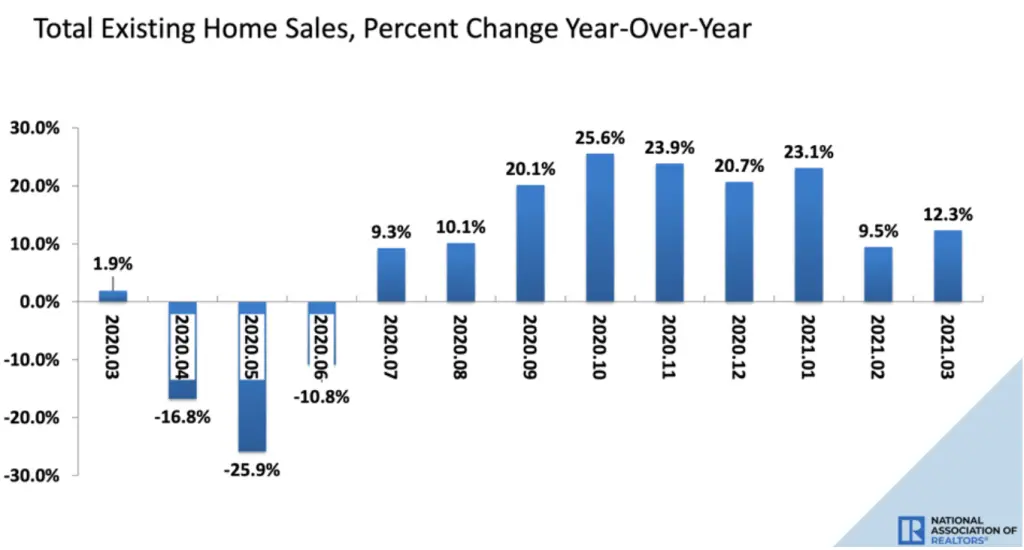

Supply continues to restrict existing home sales, down 3.7% in March to an adjusted annual rate of 6.01 million units but up strong (+12.3%) versus this time last year when sales began to drop due to the pandemic.

“The sales for March would have been measurably higher, had there been more inventory. Days-on-market are swift, multiple offers are prevalent, and buyer confidence is rising,” according to National Association of Realtors® (NAR) chief economist Lawrence Yun.

Pending home sales bounced back in March (+1.9%) after two months of decline with a strong 23.3% jump year over year. Sales were up across the country with the exception of the Midwest—with all regions experiencing double digit growth year over year. The Sunbelt continues to bring the heat with multiple markets seeing big jumps in interest according to Realtor.com®’s Market Hotness Index.

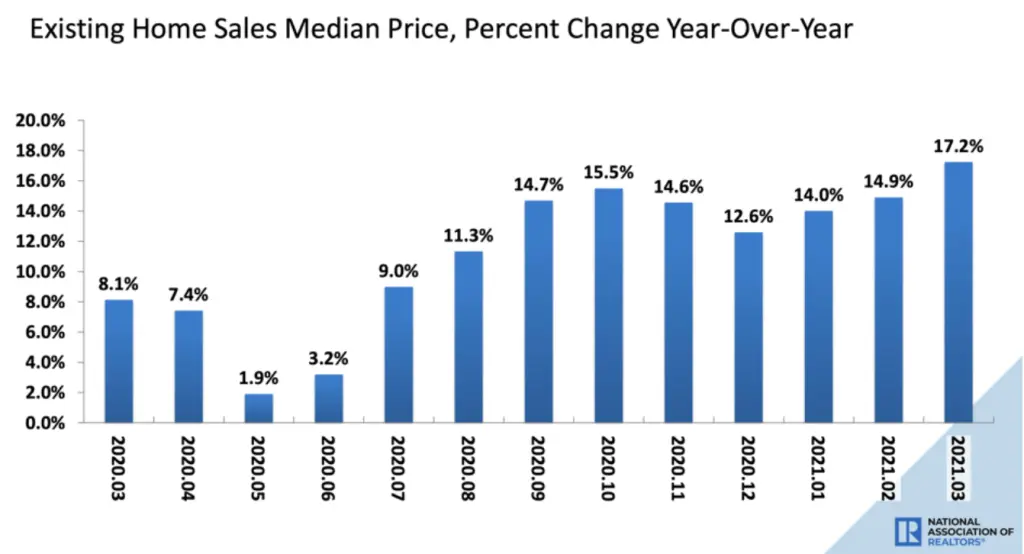

The median home price hit a record high of $329,100 in March, up 17.2% from 2020, marking 109 straight months of year-over-year gains. As one industry expert put it, “Sellers remain in the driver’s seat, ringing up great profits.” In fact, profits are up in almost 90% of metro areas across the country.

According to the latest Sustainable Housing Report from Fitch Ratings, home prices are overvalued by 10% or more in more than one-third of the country’s metro areas. “Favorable mortgage rates and demand/supply imbalance are causing home prices to continue to accelerate even as unemployment levels flattened and personal income levels received a boost from a new round of fiscal stimulus,” according to senior director Suzanne Mistretta.

The Supply Side

Total housing inventory rose slightly at the end of March to 1.07 million units—up 3.9% from February but down 28.2% from 2020. Unsold inventory is also up from last month to a 2.1-month supply. Properties continue to move rapidly, only sitting on the market for an average of 18 days, with 83% of homes sold in under a month.

“In many areas of the country, there are half as many available homes for sale than a year ago—and in some markets that number increases to less than one-third,” comments Realtor.com chief economist Danielle Hale. “For a buyer, that means if they had 10 homes in their price range to choose from last year, they have less than five, perhaps as few as three, available to them today,” Hale concludes.

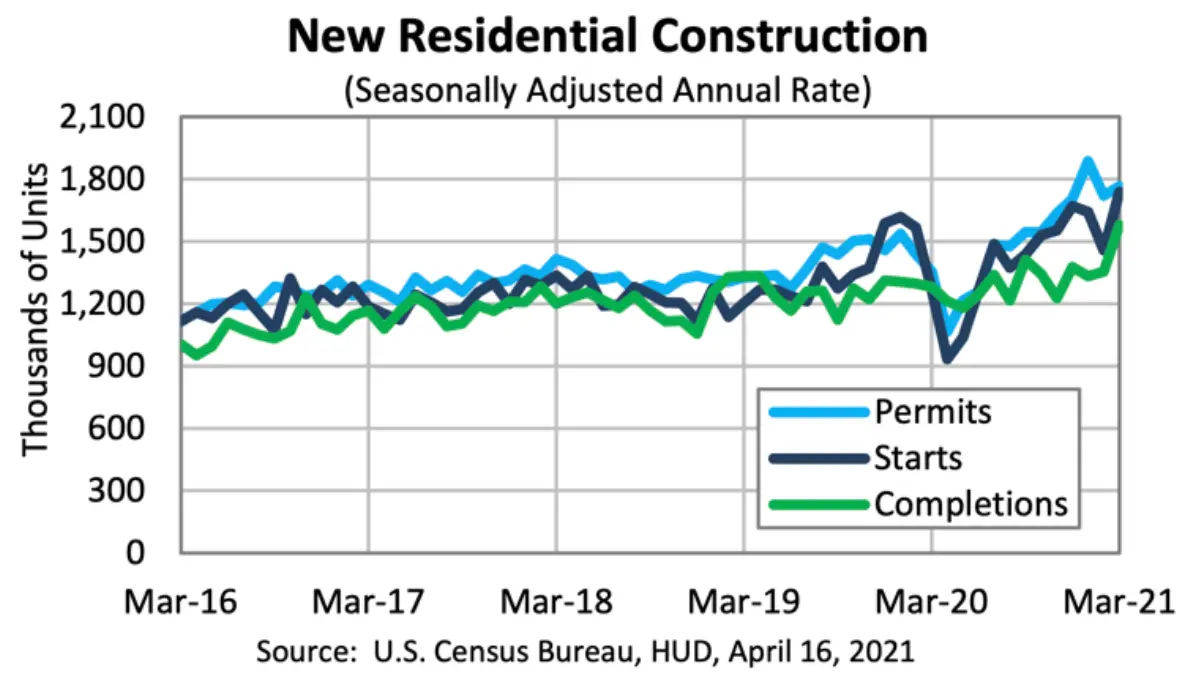

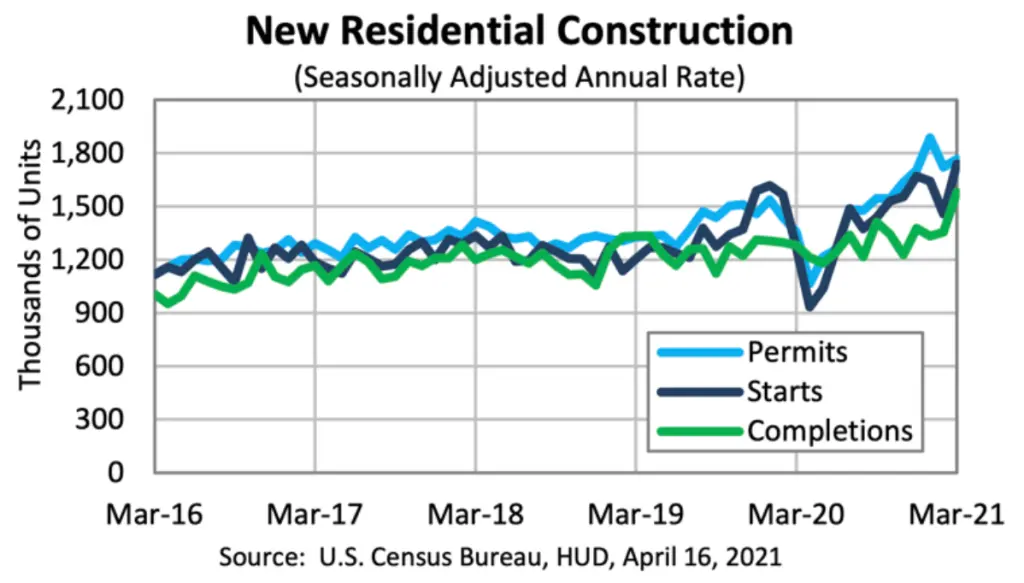

The good news is homebuilding is catching up. Housing starts were up almost 3% in March—and 30% versus year ago—to an adjusted annual rate of 1,766,000 units.

The Rate Reality

Mortgage rates have begun their ascent after months of record lows. The end of March saw a 30-year fixed mortgage rate of 3.17%, which is still below the 3.5% rate the same time last year. Freddie Mac anticipates rates to continue to rise this year to an average of 3.4% in the fourth quarter. “While higher mortgage rates will help slow the pace of home sales and moderate house price growth, we expect overall housing market activity will remain robust,” according to the corporation’s latest quarterly forecast.

Mortgage applications ended the month slightly down (-2.2%). According to Mortgage Bankers Association (MBA) economist Joel Kan, “Purchase activity was still convincingly higher than the pandemic-induced drop seen a year ago, as well as up 6 percent from the same week in March 2019.”

Time to Move

Now is not the time for real estate investors to sit on the sidelines, as the market continues to improve. “Fortunately, we are seeing more usual seasonal trends in the housing market this year, and that means we’ll likely see a big pickup in the number of options for buyers as we move toward summer,” predicts Hale.

CoreLogic CEO Frank Martell concurs, “Despite the severe slowdown last year, the 2021 spring homebuying season is trending strong—reflecting the many positive signs of economic recovery. With prospective buyers continuing to be motivated by historically low mortgage rates, we anticipate sustained demand in the summer and early fall.”

New Western agents have their fingers on the pulse, ready to pounce on timely opportunities that fit investor strategies. Let us bring you the deals that fit yours this year. Contact us to see if you qualify for access to our exclusive inventory.