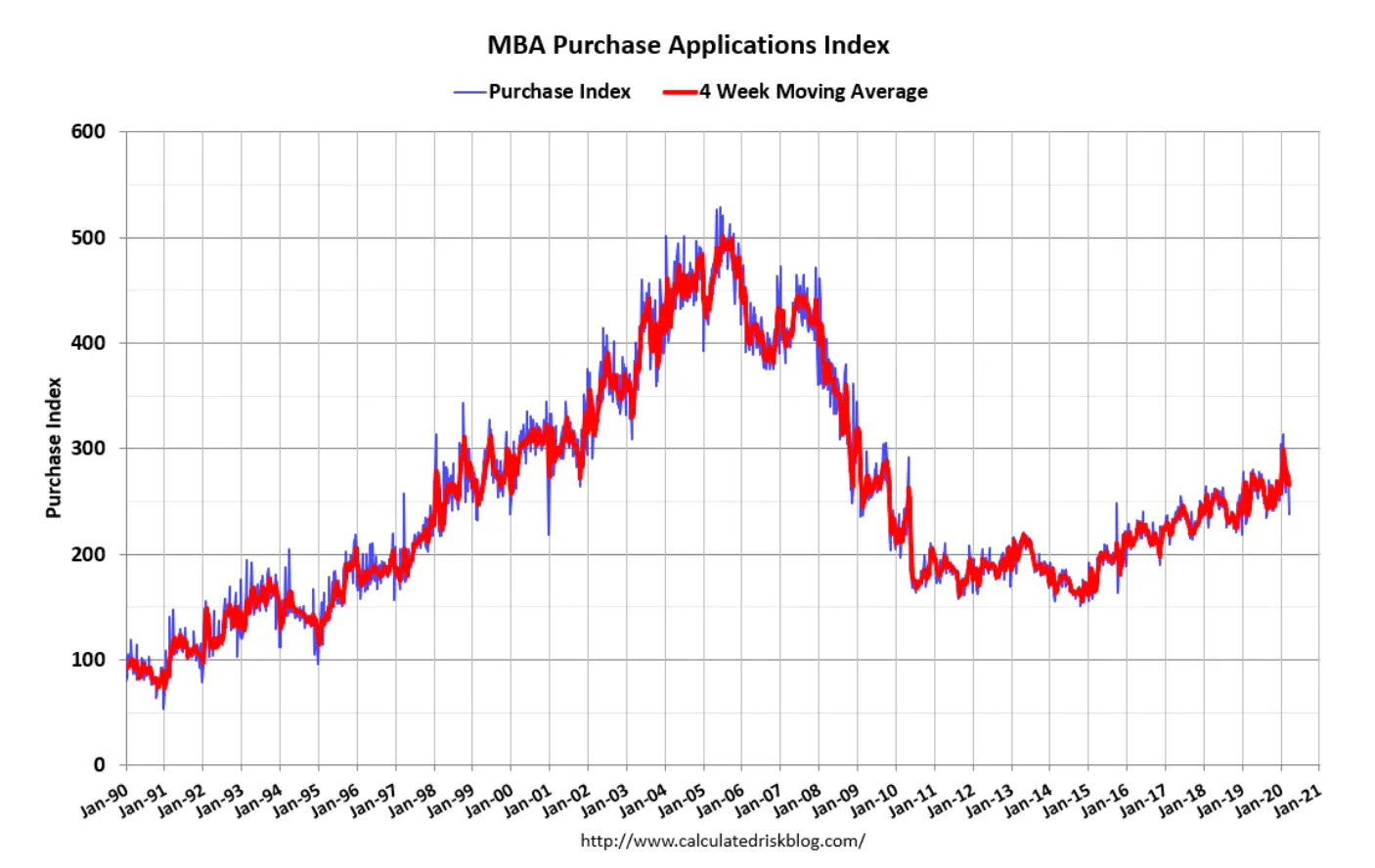

The real estate market was off to a big bang from January through early March: homes sales reports indicated 2.4 percent growth month over month, and 9.4 percent growth year over year. Analysts were projecting the real estate market would surpass 2019 performance–and then the pandemic arrived, wreaking havoc across sectors.

In the last week of March alone, mortgage purchase applications have dropped by 11 percent and a record number of Americans have filed for unemployment. It’s too early to tell how long the pandemic and related recession will last, but homebuyers, real estate agents, and analysts are all wondering the same thing–how much will the housing market slow?

Real Estate Market Health by the Data

The most recent real estate market reports straddle the pre- and post-pandemic realities. As recently as March 18, the economy was proceeding as normal. California issued a stay-at-home order March 20 and other states followed suit. Between March 18 and March 25, mortgage applications dropped off by 22 percent. Combining the pre-pandemic data with the March 20 drop-off delivers the 11 percent figure.

Analysts agree that the real numbers are likely to be far higher than 11 percent. They suggest that the true impact of the pandemic on the real estate market–namely, the stay-at-home orders that have disrupted real estate showings–will not be seen until next month.

The rolling spread of the pandemic means that some areas that are healthy now soon experience waves of sickness, while areas that were hard-hit early on (like New York or Washington) may get back to business as usual. Data may be wildly different week by week, depending on whether people are staying at home or resuming their usual routines.

Factors to Watch

As long as stay-at-home orders remain in place, home shoppers will be browsing online or via virtual home tour only, and real estate agents will not be able to host open houses.

Some scientists are predicting waves of the COVID-19 outbreak, which could lead to rolling periods of free movement and stay-at-home orders. Consider the second wave of infection in China as infected-yet-asymptomatic Westerners travel to the country and expose locals to the virus. If this pattern replicates within the US, there could be a series of false starts to the economy and the real estate market.

The current financial situation complicates things. Many home buyers have reassessed the need to purchase now. They may be out of work or acting conservatively due to fears of what’s to come.

Lenders are tightening up loan requirements and giving high-risk borrowers a second glance, and many non-qualified mortgage or non-QM lenders have gone out of business as credit has tightened. Some people who would have qualified for a mortgage without problem prior to the pandemic may not be able to find a lender who will approve their mortgage application.

Less Competition May Mean Opportunity for Investors

Ultimately, the pandemic will pass. People will resume business as usual and the economy will rebound. What remains to be seen is how long this takes. Some analysts are hoping for a V-shaped recovery, in which the economy recovers from the pandemic with the same rapidity that it went on life support, while others caution that the recession is closer to a depression and recovery will take quite a while. Many real estate investors are finding opportunities to grow their businesses by purchasing while home prices and competition is low.

If you’re considering investing in real estate, knowing what to watch can help you evaluate your options. When you’re ready to move forward, look to New Western Acquisitions was your investment real estate partner. NWA matches investors with off-market properties in 33 markets. To see how we can help you reach your real estate goal, contact us.