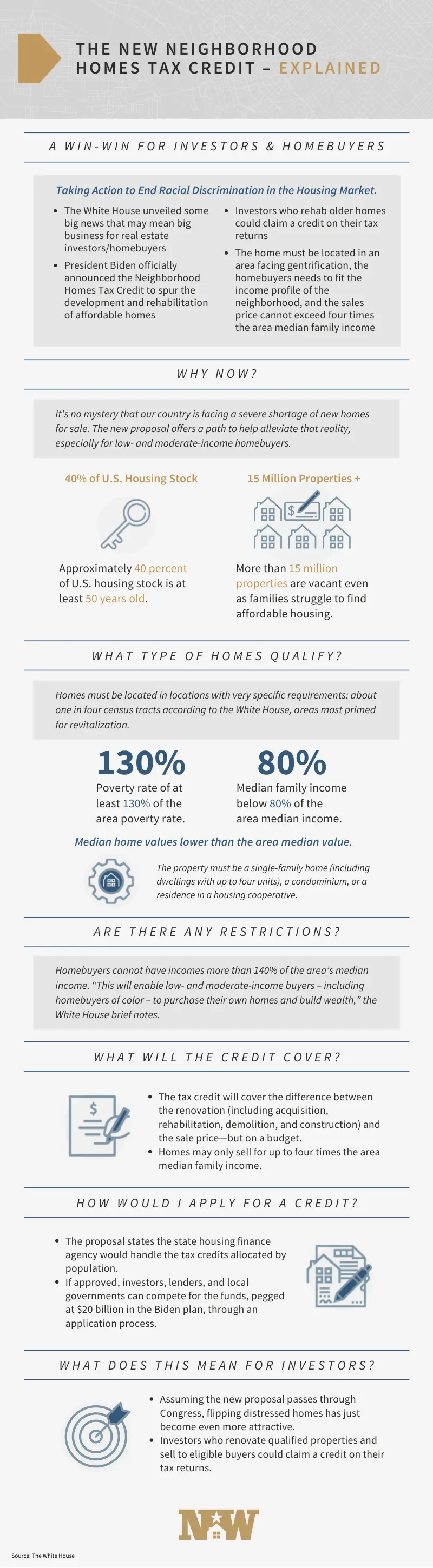

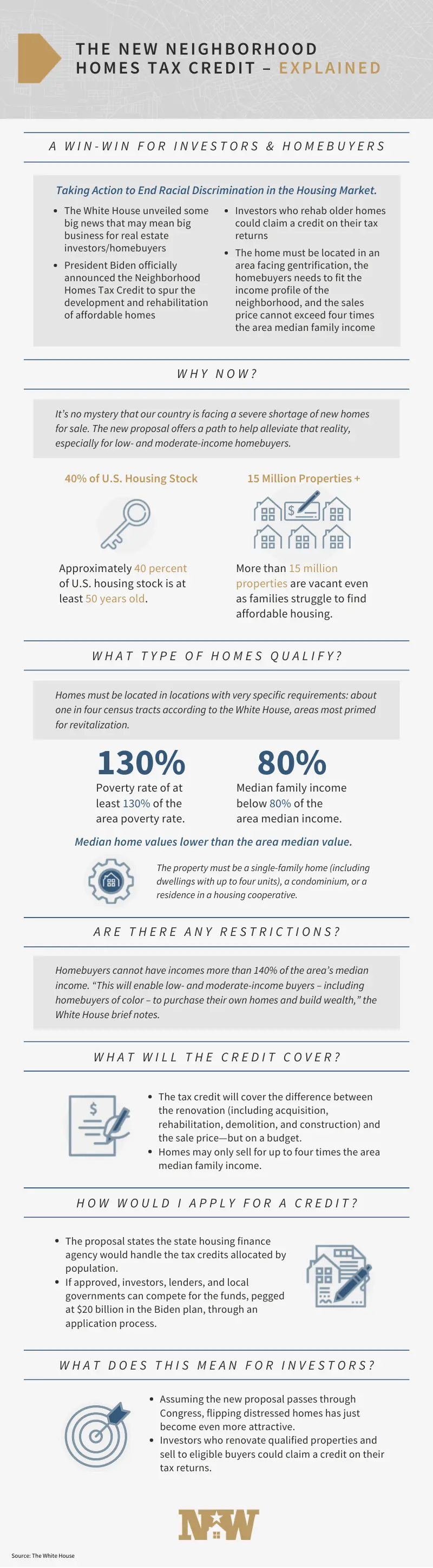

Recently, the White House proposed a new tax policy that could be very advantageous for real estate investors. As part of his trillion-dollar infrastructure package, President Biden has officially announced the Neighborhood Homes Tax Credit to spur the development and rehabilitation of affordable homes.

With the new tax credit, investors have the opportunity to reduce their annual tax payment if they’ve rehabbed an older home that fits the list of criteria. In a nutshell, these homes must be located in a gentrifying area, the homebuyers must fit the income profile of the neighborhood, and the sales price must not exceed four times the area median family income.

We’ve taken key information about the Neighborhood Homes Tax Credit and broken it down into a simple-to-digest visual. Assuming this new proposal passes, flipping homes could be an even more lucrative gig for investors than it is now, so it’s important to understand the ins and outs of the proposal.

The already fierce competition to find investment properties in the current market could potentially get even more intense with the introduction of the next tax credit enticing more people to invest in real estate. Fortunately, New Western is not experiencing an inventory shortage. In fact, we are continuing to grow rapidly within the markets we currently serve and in new markets across the country. Contact us today to see if you qualify to join our exclusive buyers’ network.