As we look towards May 2024, what do real estate investors, wholesalers, and real estate agents need to know about the current market?

Just last month, slow and steady progress with a hint of optimism was the theme for the housing market. Mortgage rates were expected to dip at least into the 6% range after anticipated Fed rate cuts in the spring of 2024. And while optimism is still on the table, the Fed did not make cuts at the May meeting and the mortgage rate remains at 7.42%.

Existing sales are down but contract signings for pending sales are up, and inventory has increased. An increase in pending sales could be the indicator to watch for that bodes well for the housing market, but rates aren’t likely to take a dive any time soon. Inflation is not making progress and that leaves the Fed at a pause. Housing is expensive for would-be homebuyers and rents increased again this month.

The prevailing message to investors? There are people that need to move and they will move because of life events and regardless of rates. They will also rent and wait. And the one constant that won’t change for the foreseeable future is that there are not enough affordable homes on the market for the average homebuyer. But independent investors are uniquely positioned to solve the problem.

What are the key factors for investors entering May 2024?

Nearly 40% of renters think they’ll never own a home according to a Redfin-commissioned survey of roughly 3,000 U.S. residents.

Keep an eye on Gen Z who’ve been living with their parents and saving money for an eventual home purchase.

With the fear of a housing crash subsiding, people who need to move because of divorce, a job in another city, or families in need of more space are ready to buy and sell regardless of mortgage rates.

Builders are trying to help the government solve the housing affordability crisis with a newly released 10 Point Plan from the NAHB that will benefit independent investors too when it comes to labor, supply chain and zoning.

The current rate of inflation is 3.5% and shelter inflation, which includes rent and homeownership, is sitting at 5%. More than half of overall inflation in the economy has been due to rising housing costs.

Redfin’s homebuyer demand index reports that showings and home tours are up 33% from the beginning of the year.

What’s happening in the New Western investor market?

New Western tracks investor activity and reports results on a month-over-month basis in addition to surveying investors about their businesses.

And these are the markets with the highest deal activity growth in the New Western marketplace from March 2024 to April 2024.

Oklahoma City, Oklahoma

Tampa Bay, Florida

Washington D.C.

Greenville, South Carolina

Boston, Massachusetts

Stats from the traditional market:

Pending sales and sold homes

Existing home sales actually retreated 4.3% in March after having the largest monthly increase in over a year of 9.5% in February. Contrary to existing sales, contract signings for pending sales posted an increase of 3.4% in March.

The median existing-home sales price is up for the ninth consecutive month and sits at $393,500, up almost 5% from March, as of the April data release from NAR. The median price was $363,600 a year ago. Unsold housing inventory increased from March to April with 3.2 months of supply compared to 2.9 months supply last month.

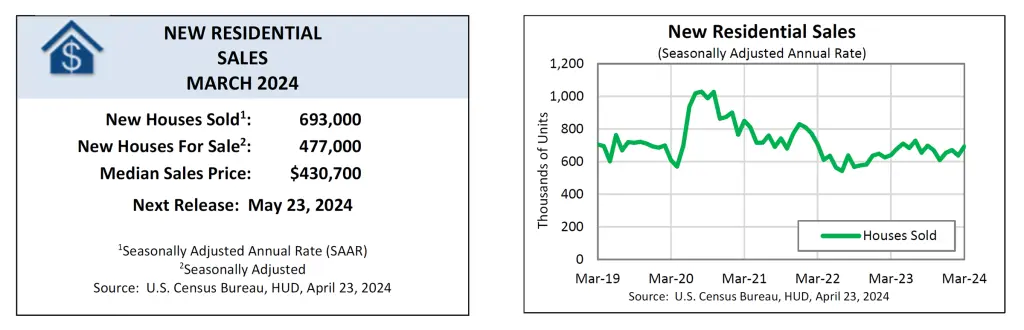

What about new home sales?

The supply of new construction homes went down slightly in March and the median sales price was up from $400,500 to $430,700. There is an 8.3 months supply of new construction homes. This sounds like a large supply, even with a small decrease from last month but the builders will push ahead with more construction.

Builders are facing challenges but the NAHB is attempting to work with congress to offer some key solutions to solve shelter inflation. On top of their list is promoting careers in the skilled trades. In any given month, there is a shortage of roughly 400,000 construction workers, and home builders will need to add 2.2 million new workers over the next three years just to keep up with demand, according to the NAHB.

The cost of building materials is also on the list of ongoing challenges for builders. Building materials have surged 38% since the pandemic and the NAHB is urging the government to help with tariffs on lumber from Canada and ask that they increase the domestic supply of lumber from federally owned lands.

The 10 Point Plan created by the NAHB will no doubt appeal to and help out single-family investors. Builders may have larger issues that don’t impact independent investors but the issues that do overlap are vital to both industries to tackle housing affordability.

What about those mortgage rates?

Mortgage rates were overall elevated in April, similar to March, and higher than expected. The 30-year fixed hit a high of 7.57% during the final week of February and as of the first week of May sits at 7.42%.

High prices and rates drove the median monthly housing payment to a record $2,890, up 15% year over year. The news sounds negative but only appears that way because headlines were pushing the anticipation of multiple Fed cuts and lower rates during the spring housing market.

Inventory is up but home buying demand has softened as mortgage rates remain higher than expected. Because of the lack of progress on inflation, the Fed didn’t make cuts at their May meeting but at least projected a potential cut, instead of a rate increase, in the near future.

The Fed is not counting out cuts for 2024 but the chance of several cuts is not likely. The good news for investors is that while deals may be hard to come by because of higher interest rates, there is demand for both rental units and home ownership. People are also adjusting to current rates and making moves.

Where are rental rates headed?

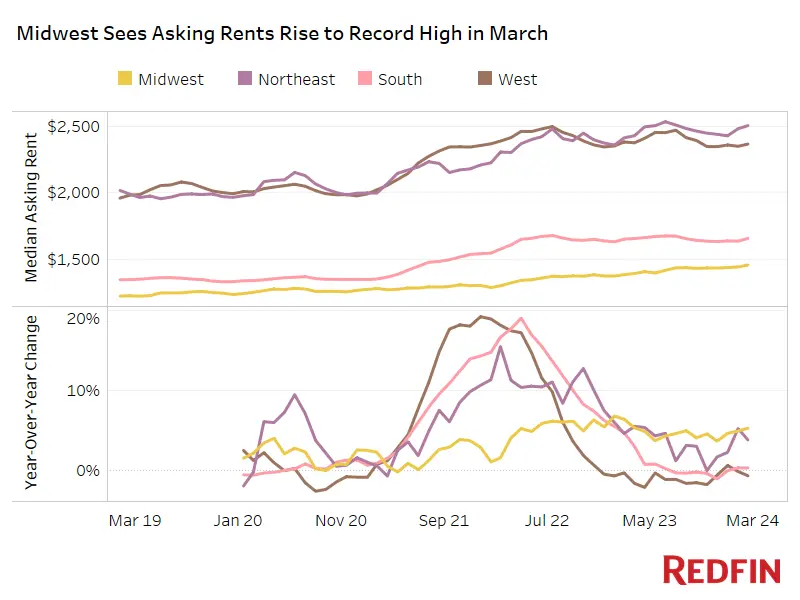

The U.S. asking rent rose 1% year-over-year in March. This marks the third month in a row that rent rates increased and it was driven primarily by a 5% increase in the Midwest. The national median rent is currently $1987 and $1465 in the Midwest, a record for that region.

The Midwest is the most affordable region to live in and rents are likely holding up because there hasn’t been as much housing construction as the South and West.

Mortgage rates also continue to be the main contributing factor to rising rents. Would-be homebuyers are opting to rent and wait for mortgage rates to recede and that is pushing demand for rentals.

The good news for investors is that the rental market remains a solid option when buying properties to rehab and hold. And currently it appears that cities like Columbus and Chicago in the Midwest and Boston and Philadelphia in the Northeast are strong market candidates.

Good news for both investors and buyers is that rent might be rising but by very small percentages which indicates less volatility. And with the Fed projecting minimal rate cuts in 2024, flattening rents might not come until 2025.