January 2024 has come to a close. What do real estate investors, wholesalers, and real estate agents need to know about the current market?

Home sales and home prices grew in January. There are 5% more pending homes for sale compared to last year and the median sales price is up 6.8%. Despite the uptick, the recent data released from the National Association of Realtors showed that December was a slower month for real estate sales and the freeze across the country kept buyers and sellers inside. It’s also important to note that home sales were historically low in 2023 as a whole, so while sales are up now, that doesn’t mean we’re off and running for rapid growth in 2024. But we’re just getting started and anticipation for growth is warranted.

What are the key factors investors should consider as we enter February 2024?

- Some buyers and sellers are waiting for spring–both for rate drops and more inventory.

- Inventory of new homes has grown because buyers are waiting for mortgage rates to drop near the end of the year. This typically causes builders to pause, and many have across the country.

- The share of U.S. homebuyers looking to move to a different metro area declined for the third straight month in November, dropping to 23.9%, the lowest share in a year and a half, according to Redfin.

- Mortgage rates have come down, faster than expected according to analysts, but 6% appears to be the new normal. Waiting for rate drops is not a strategy for 2024.

- First-time home buyers continue to lack options for affordable homes below $300,000.

- And as always, follow the investor activity. An uptick in flipped home sales leads to more buyers and proven comps.

What about the single-family investor market?

New Western tracks investor activity and reports results on a month-over-month basis in addition to surveying investors about their businesses.

New Western saw the biggest increase in investor activity from December 2023 to January 2024 in these markets.

Raleigh, North Carolina

Denver, Colorado

Houston, Texas

Los Angeles, California

Oklahoma City, Oklahoma

Let’s take a look at the stats on the current housing market:

Existing Home Sales

A historic phenomenon continues to unfold into 2024 around home sales. Existing home sales are down to their lowest level since 1995 but the median price reached a record high of $389,800 in 2023. Inventory is tight and prices continue to rise. What needs to change in 2024 to break this cycle? First, projected rate cuts by the Fed may begin as early as May 2024 and a little help from home builders and single-family investors could be the solution to get more homes on the market.

In December, existing home sales were down 1% month-over-month and 6.2% year-over-year. And as of December, the median existing home sales price is $382,600, according to the National Association of Realtors. This median price is down from the record high of $389,800 but still represents the sixth consecutive month of year-over-year price increases.

Not surprisingly, inventory is still tight and sits at 3.2 months of available homes. This is higher than a year ago, when inventory sat at 2.9 months in December 2022. Currently, the total housing inventory sits at 1 million units, down 11.5% from November.

Fifty-six percent of homes sold in December were on the market for less than a month and properties typically remained on the market for 29 days, up from 25 days in November 2023.

“Obviously, the recent, rapid three-year rise in home prices is unsustainable. If price increases continue at the current pace, the country could accelerate into haves and have-nots. Creating a path towards homeownership for today’s renters is essential. It requires economic and income growth and, most importantly, a steady buildup of home construction”, said Lawrence Yun, Chief Economist for the National Association of Realtors.

Pending Home Sales

In December 2023, pending home sales rose 8.3% month-over-month. And the National Association of Realtors forecasts a 13% increase in existing home sales from 2023 to 2024.

The Midwest, South, and West posted monthly gains in transactions while the Northeast recorded a loss.

“The housing market is off to a good start this year, as consumers benefit from falling mortgage rates and stable home prices,” said Lawrence Yun, NAR chief economist. “Job additions and income growth will further help with housing affordability, but increased supply will be essential to satisfying all potential demand.”

Pending home sales give investors and homebuyers a timely look at what is actually happening in the market because these transactions will be closing with current mortgage rates.This is in contrast to existing home sales that look backward to the prior month

With 88.5% of homeowners holding onto mortgages with rates below the 6.6% weekly January average, the lock-in effect is still keeping some sellers on the sidelines. But they aren’t going to wait forever. As the reality of 6% mortgage rates becomes more normal, sellers will put their homes on the market and buy at the new rate because waiting just isn’t realistic any longer for people needing to move.

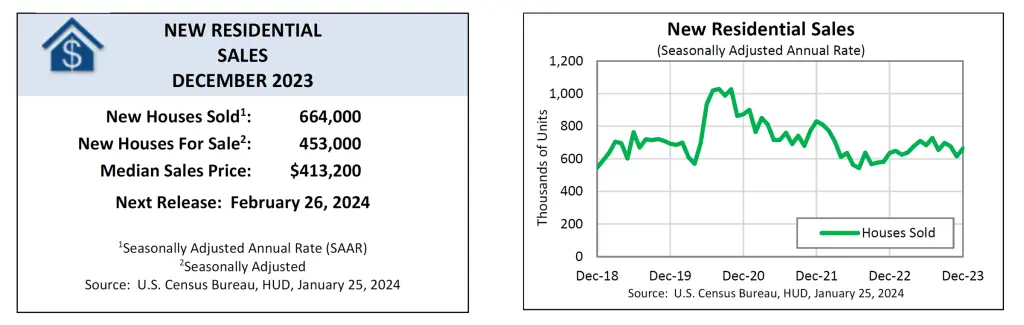

What about new home sales?

Sales of new single-family homes were up in December and 8.0% higher than November 2023. The median sales price of new houses sold in December was $413,200 and there are 8.2 months of supply. By the end of December, there were an estimated 453,000 new houses for sale.

The top challenges for builders continue to run on similar themes from 2023 to 2024.

Labor and material costs, inflation, and buyer’s expectations for mortgage rates were the top three concerns in 2023, according to the National Association of Home Builders.

But the biggest concern builders have for 2024 is that buyers are planning to wait for rates to drop. With just over 8 months of supply, this could cause new construction to pause which will have a ripple effect on the construction industry and the economy.

And while the inventory of new homes has grown, 19% of that inventory is actually move-in ready while 58% of that inventory is still under construction in January.

The availability of entry-level homes priced below $300,000 has been steadily falling in recent years with new homes primarily being priced between $300,000-$500,000. On the brighter side, a decline in home size and more stable building material costs, primarily lower lumber prices, have contributed to a fall in new home prices. But, new construction is not actually meeting the current demand.

For Sale Inventory and Months’ Supply

Who are the buyers in the market according to the December data release by NAR?

First-time buyers were responsible for 29% of sales in December, down from 31% in November 2023 and December 2022.

It isn’t unusual to see fewer first-time buyers in the market during the holiday season but it’s more likely that buyers were waiting to see what 2024 would have to offer when it comes to mortgage rates.

All-cash sales accounted for 29% of transactions in December, up from 27% in November 2023 and 28% a year ago. Of note is an uptick in all-cash sales for the luxury market.

Individual investors or second-home buyers, who make up many cash sales, purchased 16% of homes in December, down from 18% in November.

Distressed sales – foreclosures and short sales – represented 2% of sales in December, virtually unchanged from last month and the previous year.

What about those mortgage rates?

The 30-year fixed rate mortgage fluctuated in a narrow range over the last month with Freddie Mac reporting a 6.6% average as of January 18th. Fannie Mae is predicting that mortgage rates will dip below 6% by the end of the year and they are forecasting home prices to increase 2.8% in 2024 and 2.0% in 2025, nationally.

Tracking mortgage rates is a daily activity, no doubt. Yes, trends are developing, like rates sitting comfortably below 7%. But when it comes down to it, when you find a deal, lock in and go forward. Refinancing is always an option but rate chasing could become a full-time chore that keeps investors and homebuyers from their ownership goals in 2024. Kicking back and waiting for 3%-4% mortgage rates is not a worthy activity.

The good news is that affordability has gotten better. With a mortgage rate of around 6.7%, a prospective homebuyer with a $3000 budget can afford a $453,000 home compared to a $416,000 home when rates sat at 7.8% in October 2023.

Those hit hardest by affordability issues are first-time home buyers under 35. Homeownership rates decreased by 0.6% in Q4 year-over-year for this age group who are primarily looking for entry-level homes.

This category of homebuyer continues to be attractive for single-family investors.

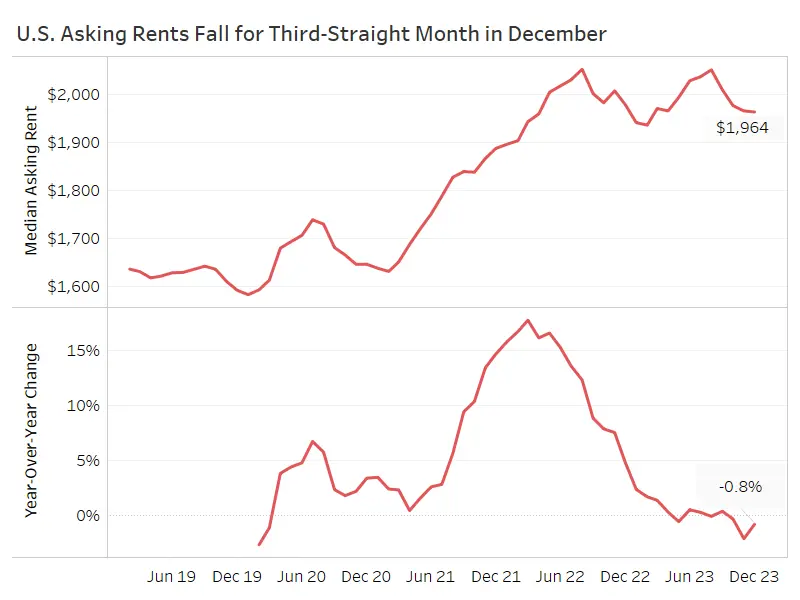

Where are rental rates headed?

Landlords are making slight rent adjustments across the country. But while rental prices have decreased in the South and West, they have increased in the Northeast and Midwest.

December marks the third straight month that national rents had a slight decrease. The U.S. median asking rent fell 0.8% year-over-year in December and currently sits at $1964. In November 2023, the rent rate dropped 2.1% year-over-year, marking the largest decrease since 2020.

Decreases obviously help renters, but only slightly in this environment. Rental prices are down just 4.4% from their record highs, signaling that there is still plenty of potential for investors looking to buy, hold, and rent as a strategy. Choosing a market and considering vacancy rates and new construction in the area will be key.

According to Redfin, the median asking rent in the Midwest sits at $1434 and $2439 in the Northeast. Rents in the South sit at $1632 and $2346 in the West.

With home prices still rising and mortgage rates declining slowly and steadily, declining rent rates, however small, will keep people in the rental market while the price to finance remains somewhat high.

There are more newly built apartments in the U.S. than there were a year ago and currently near the highest level in 30 years. This new inventory is affecting vacancy rates because renters have an increasing number of buildings to choose from.

The rental vacancy rate rose to 6.6% in the third quarter—the most recent period for which data is available—the highest level since the first quarter of 2021.

Investors looking to choose a rental market should make note of new apartment construction in the neighborhoods they are considering buying a property to rehab. Experimenting with long-term, short term and mid-term rental strategies is also key.