As we look towards April 2024, what do real estate investors, wholesalers, and real estate agents need to know about the current market?

Slow and steady progress defines the state of the housing market and optimism is on the horizon. Inventory is up and mortgage rates have receded from reaching over 7%. The Fed is still projecting rate cuts by the end of 2024 and those factors are contributing to a small sigh of relief in the traditional market.

Housing is still expensive for most would-be homebuyers. The typical housing payment hit $2721 near the end of March, which is up 10% from a year ago, according to Redfin.

But rates have come down slightly since the beginning of the year, and that is enough to stir up some market movement. As of the first day of April the 30-year fixed rate sat at 7.06%. Sellers are taking advantage of rising home prices and putting their homes on the market, and that equals more inventory.

The prevailing message to investors? There are opportunities in the market and buyers and sellers are getting strategic and a bit creative about how to purchase a home this year. Most importantly, buyers and renters are eager to make moves now.

What are the key factors for investors entering April 2024?

Boomers are planning to age in place and have stock-piled equity as home prices continue to rise. They could use a creative solution to cash out on equity and exit their old homes in need of major repairs.

50 million Millennials and Gen Zers are forming households and 36% of them expect to receive a cash gift from family to buy a home this year, according to a Redfin survey.

The buyer’s agent commission conversation could present an opportunity for investors to creatively utilize agent commissions as a bargaining tool when they are both buying and selling properties.

Homebuyers are ready and willing to buy. Redfin’s homebuyer demand index reports that showings and home tours are up 28% from the beginning of the year.

Builders are listening to middle-income buyers and are constructing more smaller homes with affordable designs.

What’s happening in the New Western investor market?

New Western tracks investor activity and reports results on a month-over-month basis in addition to surveying investors about their businesses.

And these are the markets with the highest deal activity growth in the New Western marketplace from February 2024 to March 2024.

Dallas Fort Worth

Charlotte, North Carolina

Houston, Texas

Atlanta, Georgia

Kansas City

Stats from the traditional market:

Pending sales and sold homes

Existing home sales had the largest monthly increase in over a year, rising 9.5% from January to February. Contract signings for pending sales posted an increase of 1.6% overall but were down in the Northeast and West and up in the South and Midwest.

The median existing-home sales price is up for the eighth consecutive month and sits at $384,500 as of the March data release from NAR. The median price was $363,600 a year ago. Unsold housing inventory increased from January to February and there is 2.9 months supply of unsold homes.

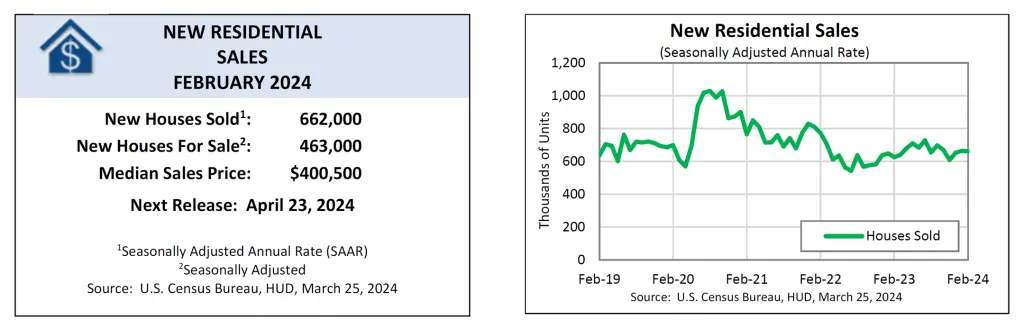

What about new home sales?

The supply of new construction homes went up in February and the median sales price was $400,500. There is still an 8.4 months supply of new construction homes. And this would normally signal a pause for builders.

But demand for homes remains, and the builders keep building new homes. And just as single-family investors continue to flip homes that the average family needs and can afford, the builders are responding, too. In addition to offering more affordable designs, more than a third of builders say they built smaller homes in 2023 and 26% plan to go even smaller in 2024, according to the NAHB.

Single-family investors can benefit from demand near new home communities. Builders can’t keep up with demand and the lack of home inventory on their own. Builders and investors continue to be the only active problem-solvers putting inventory back on the market to satisfy middle-income and first-time homebuyers in the market.

What about those mortgage rates?

Mortgage rates were overall lower in March than in February. The 30-year fixed hit a high of 7.57% during the final week of February and as of April 1st, the rate hit 7.06 after dancing around 6.9% during the month of March.

Rates will obviously continue to be a factor for homebuyers but ironically, rising home prices are not only motivating sellers to put their homes on the market, which is increasing inventory, but fear of higher prices is encouraging buyers to buy now, according to Redfin.

Fed cuts are still on the horizon for the end of the year which could stir even more buying activity. The bottom line is that investors have an opportunity to potentially sell a rental and lean into completing more fix-and-flips for the second half of the year.

The good news for investors is that while deals may be hard to come by because of higher interest rates, there is demand for both rental units and home ownership.

Where are rental rates headed?

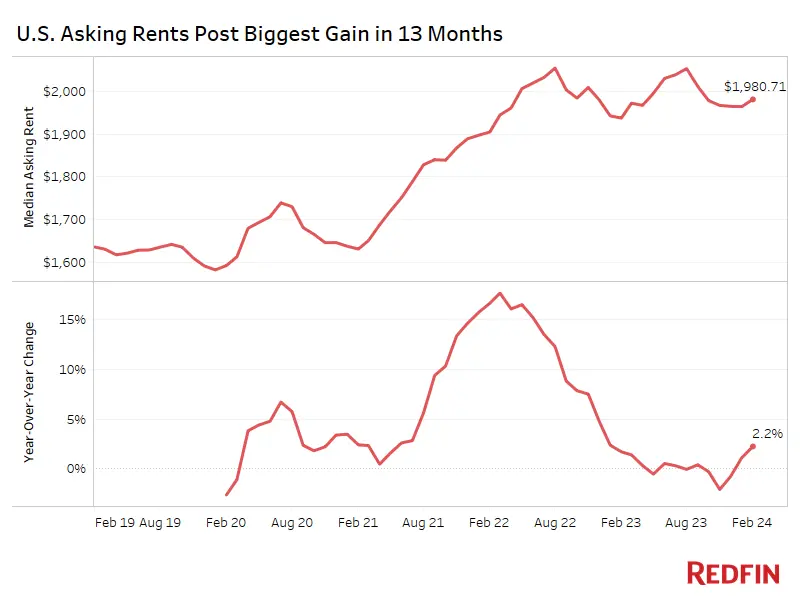

The U.S. asking rent rose 2% year-over-year in February. This was the largest price gain in over a year causing rent to rise from $1964 in January to $1981 in February 2024.

Rents were headed towards flattening out last month but the rise in mortgage rates at the beginning of the year increased demand in the rental market. Would-be homebuyers are waiting and renting while they make plans to purchase later this year.

If the Fed does make expected rate cuts later this year, mortgage rates could come down and homebuyers will jump back into the market. This could lead to another flattening phase for rental rates but rents are at historic highs and still very much a viable option and strategy for investors looking to expand their portfolios.