As we look towards June 2024, what do real estate investors, wholesalers, and real estate agents need to know about the current market?

Entering the midpoint of 2024, real estate investors are leaning into projects. In an April survey of 1300 New Western investors, over 50% expect their business to grow up to 25% this year. And while headlines about the housing market frequently point out the negative aspects of the real estate industry, there are areas of opportunity for investors to explore.

Mortgage rates are hovering around 7%–a consistent theme for 2024. Slight shifts in the mortgage rate have caused some buyers to sit on the sidelines for a couple weeks, but they are primed and ready to purchase.

The April data shows that home sales are down and inventory is up. First-time home buyers are ready to buy even with current rates but expect to negotiate with sellers who may have priced their homes aspirationally. The possibility of Fed rate cuts is fading but there is still movement in the market, especially for investors.

The prevailing message to investors? There is still a deficit of 2.5 million single-family homes that are needed to support family formation. New construction has not kept up with population growth and this signals consistent opportunity for investors.

This month, those opportunities could lie in emerging cities both in the for-sale and rental markets. Rent remains in demand and with traditional sellers still pricing their homes high enough to drive some buyers away, there is an opportunity to price flips competitively and draw in buyers.

What are the key factors for investors entering June 2024?

First-time buyers make up the majority of buyers historically and were responsible for 33% of sales in April up from 29% a year ago.

First-time home buyers are used to 7% mortgage rates and not waiting for rate cuts.

The portion of housing supply that’s newly built is roughly double pre-pandemic levels.

The percentage of active listings with price reductions is higher than it’s been for years and is increasing.

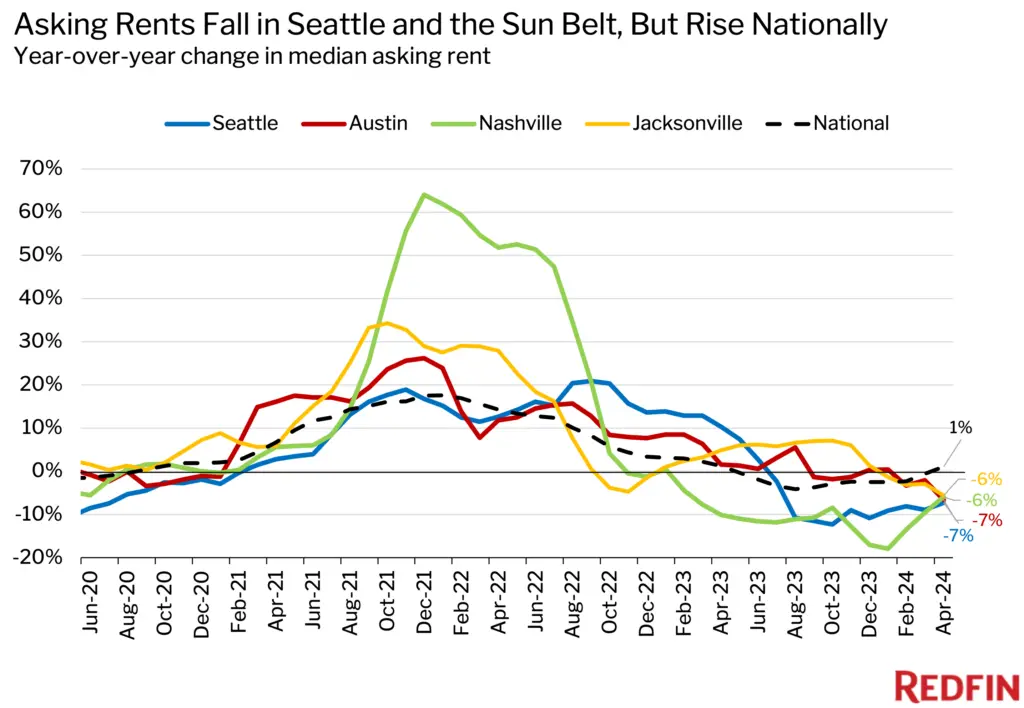

Rent is down significantly in the Sun Belt and up significantly in the Midwest.

What’s happening in the New Western investor market?

New Western tracks investor activity and reports results on a month-over-month basis in addition to surveying investors about their businesses.

And these are the markets with the highest deal activity growth in the New Western marketplace from April 2024 to May 2024.

Stats from the traditional market:

Pending sales and sold homes

The bottom line? Sales are down slightly, inventory is ticking up and home sale prices are hitting market highs.

After retreating 4.3% in March, existing home sales decreased by 1.9% in April. And while contract signings were up in March they decreased in April with pending sales down 7.7% month-over-month. Mortgage rates could be the driving factor as rates ticked up slowly this past month and are hovering above 7%.

But the median existing-home sales price hit $407,600 in April, up for the tenth consecutive month, and is the highest price ever for the month of April, according to the May data release from NAR.

Inventory continues to rise. In fact, every state in the country has more homes on the market than a year ago and the most homes on the market since August 2020.

Unsold housing inventory increased from April to May with 3.5 months of supply compared to 3.2 months supply last month.

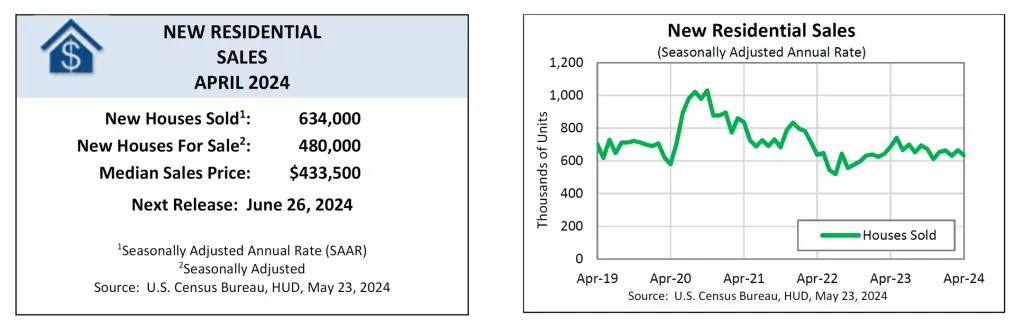

What about new home sales?

The bottom line? Builders pause housing starts to wait out mortgage rates but are selling existing inventory to buyers looking for smaller footprints and flexible mortgage options.

The supply of new construction homes went up from 8.3 months supply in March to 9.1 months supply in April. Builders are taking a pause on starting new builds at the moment to wait out the slight uptick in mortgage rates that is causing housing to be more expensive. But demand still exists for new construction. In a recent NAHB study, 61% of home buyers preferred a new home over an existing home. This marks the highest share of buyers leaning toward new construction since 2007.

A silver lining for builders is that existing home inventory remains low and new construction is helping fill the gap. The median sales price went up from $430,700 in March to $433,500 in April for a newly built home. New homes are typically about 9% more expensive than an existing home but the builders are now offering smaller footprints at lower price points and mortgage buy down programs that help buyers get into a home at a lower rate for the first few years.

Existing homes and new construction continue to be needed to help solve an historic inventory crisis. And investors will always have an edge on new construction when it comes to selecting homes in desirable and established existing neighborhoods to rehab when new development is often in new or outlying areas.

What about those mortgage rates?

The bottom line? Rates continue to sit just above 7%.

Mortgage rates slid just under 7% on May 15th and have steadily ticked up through the end of May. On the last day of May, the 30-year fixed was 7.29% and for perspective, the 30-year fixed was 6.79% at this same time, a year ago.

The May rate uptick is a bit perplexing since the increases haven’t been tied to the usual suspects: key inflation reports, jobs reports, or Fed announcements. But as we’ve come to realize, there isn’t anything common about the housing market over the last year.

Higher rates are helping bring more inventory onto the market but delistings are also up because of seller pricing. Buyers are unwilling to pay what some sellers perceive as a fair price for their homes, thus delistings occur at a higher rate.

And the Fed story continues. Financial analysts debate the possibility of a rate cut before the end of 2024 and that will help bring mortgage rates down. Investors can at least rely on first-time home buyers who were responsible for 33% of home sales in April. Many first time home buyers are also taking out mortgages for the first time and not waiting for rate cuts.

Where are rental rates headed?

The bottom line? Rental demand remains and opportunities exist in the Midwest.

While rents ticked up 1% nationally in April, rents actually decreased in 9 major metros in the Sun Belt.

Cities in the Sun Belt had room for rental rate decreases following pandemic-fueled rate hikes in Austin, Nashville, Miami, San Diego and Charlotte. Too much new construction is causing landlords to struggle to fill vacancies. Seattle saw the biggest drop among U.S. metros, according to Redfin, with a 7.3% decrease in median asking rent year over year in April.

Rents climbed the fastest in the Midwest as a result of very little construction and a lower cost of living. The biggest increase in rent rates in April were in Cincinnati, Chicago, Washington D.C., Indianapolis, Houston, Boston and Detroit.

Since the Sun Belt decreases appear to be a correction, investors who price rents competitively in the Midwest and Sun Belt could have an edge.

The good news for investors is that rent is still in high demand. Rental rates are more stable relative to the highs and lows of the last few years when asking rents rose as much as 17.6% year over year during the pandemic.