Have you ever stumbled upon a real estate deal that seemed too good to be true, only to find out the price history is shrouded in mystery? Welcome to the hidden world of non-disclosure states!

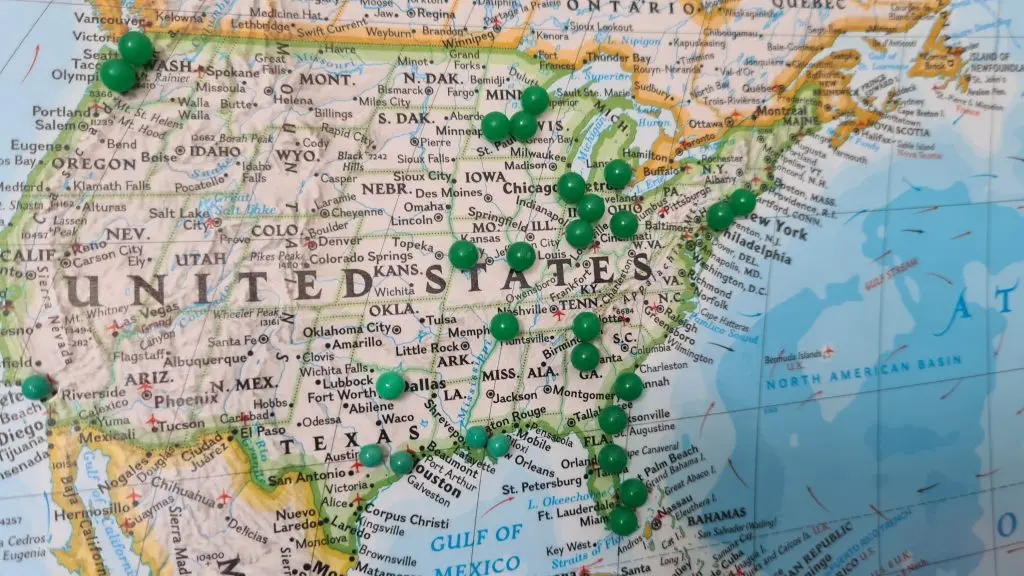

In some states across the U.S., the sale prices of properties are kept private and are not required to be disclosed to the public. These are known as non-disclosure states, and they operate with a unique set of rules that can catch even seasoned investors off guard.

This article will lift the veil on non-disclosure states and reveal the seven hidden dangers that every real estate investor should know. From limited access to property sale prices to unexpected hurdles in proper valuation, these hidden dangers are lurking in the shadows, waiting to trap the unwary investor.

My aim here is not just to tell a cautionary tale but to entertain, educate, and inform you. By the end of this article, you’ll be equipped with the knowledge and insights to navigate the tricky waters of non-disclosure states with confidence and success! So grab a cup of coffee, sit back, and let’s dive into this intriguing aspect of real estate investing.

What Are Non-Disclosure States?

Non-disclosure states, as the name suggests, are states where the sale prices of real estate properties are not required to be disclosed to the public. In other words, if you buy or sell a property in one of these states, the transaction price can remain a secret. It’s a real estate rule that’s both fascinating and perplexing!

In non-disclosure states, real estate agents, brokers, and other professionals may have limited access to past sales data. This can lead to challenges in pricing properties, conducting appraisals, and performing market analyses.

Here’s how it generally works:

- Limited Access to Data: Sale prices might not be recorded in public records, making it hard to determine market trends.

- Impact on Appraisals: Appraisers may have to rely more on private databases or use other methods for valuation.

- Negotiation Tactics: Buyers and sellers may employ unique strategies, knowing that sale prices are kept confidential.

I remember my first encounter with a non-disclosure state. I was eyeing a property that seemed promising, but something felt off. When I asked for the price history, I was met with silence and vague references. The deal eventually went through, but not without hitches and a sense of flying blind!

What I learned from that experience was invaluable. It taught me the importance of adapting, researching alternative data sources, and being prepared for the unexpected. It’s a lesson I carry with me, and it’s one I want to share with you to help you navigate non-disclosure states with finesse and understanding.

The 7 Hidden Dangers for Real Estate Investors

Danger 1: Limited Access to Property Sale Prices

Limited access to property sale prices is one of the first and foremost dangers in non-disclosure states. Unlike in most states, where sale prices are publicly recorded and accessible, non-disclosure states keep this information under wraps. This can create a fog of uncertainty around the real value of a property.

For real estate investors, limited access to sale prices can be like navigating a maze without a map. It affects various crucial aspects:

- Pricing Properties: Without comparable sales data, determining a property’s market value becomes guesswork.

- Analyzing Market Trends: Lack of price transparency makes it difficult to spot trends or shifts in the market.

- Risk Assessment: Investors may face increased risk due to the uncertainty surrounding property valuation.

In my own experience, dealing with this limitation was like trying to hit a moving target. During a recent investment in a non-disclosure state, I found myself second-guessing the property’s worth. I had to dig deep, utilizing private databases and networking with local realtors, to glean insights.

What seemed like a straightforward investment turned into a detective hunt, piecing together clues to form a complete picture of the property’s value. The deal was a success, but it taught me a lesson about the complexities and challenges that non-disclosure states can pose.

Danger 2: Difficulty in Proper Valuation

The lack of public sales data in non-disclosure states doesn’t just obscure individual sale prices; it can create a serious roadblock in proper valuation of properties. It becomes a major hindrance for investors, appraisers, and anyone looking to gauge the true worth of a property.

According to a study by the National Association of Realtors, appraisals in non-disclosure states were found to be 5% less accurate on average compared to other states. This discrepancy underscores the challenge in obtaining accurate valuations and can lead to mispriced properties and lost opportunities.

I recall an investment where the difficulty in proper valuation nearly cost a lucrative deal. Without access to sufficient sales data, the appraisal came in lower than expected. It was only through meticulous research and collaboration with local experts that we managed to rectify the valuation. This experience is a vivid reminder that understanding and adapting to the nuances of non-disclosure states is key to success.

Danger 3: Inconsistent Market Analysis

Inconsistent market analysis emerges as another hidden danger for real estate investors in non-disclosure states. The lack of publicly available sales data can lead to struggles in obtaining consistent and reliable market data. Where transparency usually paints a clear picture of the market landscape, non-disclosure states often present a fragmented and incomplete view.

The absence of standardized information may lead to:

- Flawed Investment Decisions: Without a complete data set, investors may make decisions based on partial or skewed information, leading to potentially unwise investments.

- Misjudgment of Market Trends: Identifying and predicting market trends becomes a guessing game. This can result in missed opportunities or investment in declining areas.

Allow me to share a real-life example that underscores this danger. While evaluating a potential investment in a non-disclosure state, I discovered alarming discrepancies between various sources of market data.

The challenge of inconsistent data turned a routine market analysis into an investigative endeavor, involving consultations with local experts, examination of private databases, and on-the-ground research. Eventually, we were able to form a coherent view of the market, but the experience was a stark reminder of the complexities non-disclosure states can add to what should be straightforward analyses.

Danger 4: Challenges in Negotiation

Negotiating in non-disclosure states brings its own set of challenges. With information such as previous sale prices and neighborhood trends being less accessible, investors are often at a disadvantage. They may find themselves armed with less data, and thus, less leverage, making negotiation more complex and potentially less effective.

The consequences of these challenges in negotiation may include:

- Difficulty in Achieving Desired Deal Terms: Without a comprehensive understanding of the market, investors may struggle to negotiate terms that align with their goals.

- Potential Financial Loss: Ineffective negotiation could lead to paying more than necessary or accepting terms that may not be favorable in the long run.

I once ventured into a real estate deal in a non-disclosure state where the negotiation phase felt like playing chess without seeing the entire board. I was faced with the arduous task of piecing together market data from various indirect sources.

Despite the challenges, I managed to negotiate a fair deal, but not without significant time and effort in research and consultation with local experts. The experience served as a stark reminder that negotiating in non-disclosure states requires a unique set of skills, determination, and often, a willingness to go the extra mile to uncover the hidden details that can make or break a deal.

Danger 5: Potential Legal and Compliance Issues

The veil of secrecy in non-disclosure states can lead to potential legal and compliance issues. Navigating the legal landscape without access to all the pertinent information may expose investors to unforeseen risks. This could encompass anything from misunderstandings about property lines to more complex legal disputes involving property rights or regulations specific to non-disclosure states.

The potential legal and compliance challenges might result in:

- Potential Legal Disputes: Limited information may cause misunderstandings that escalate into legal battles.

- Compliance Challenges: Regulations around non-disclosure might create additional layers of complexity, requiring specific reporting or adherence to unique local laws.

In a recent transaction, I stumbled upon an unexpected legal hurdle involving zoning regulations in a non-disclosure state. The property appeared to be zoned for the intended use, but the lack of accessible information led to an oversight.

Upon deeper investigation, it was revealed that there were specific local ordinances that had not been considered initially. The process of unraveling these legal intricacies took considerable time and legal consultation, turning what should have been a straightforward investment into a complex legal matter.

Danger 6: Increased Reliance on Local Expertise

Investing in non-disclosure states often necessitates a heightened reliance on local expertise. Due to the scarcity of publicly available information, investors may need to seek assistance from local real estate agents, appraisers, or other professionals who have access to private databases or specific local knowledge. While this can be beneficial, it also presents unique challenges and risks.

The increased reliance on local experts can have several implications:

- Additional Costs: Engaging local professionals may entail extra fees or commissions that would not be necessary in more transparent markets.

- Potential Biases and Conflicts of Interest: Depending on local relationships and the structure of the market, there may be potential biases or conflicts of interest that can affect the advice or information provided.

- Reliance on Third Parties: Entrusting critical decisions to local experts places significant responsibility on third parties, which may not always align with the investor’s best interests.

I recall a situation where I was exploring an investment opportunity in a non-disclosure state and found myself heavily reliant on a local real estate agent. While the agent provided valuable insights and access to otherwise hidden information, I also encountered challenges.

The agent’s connections with other local players raised questions about potential biases, and I found myself navigating a delicate balance between leveraging local knowledge and maintaining an independent perspective. The experience underscored the complexity of relying on local experts, the need for careful vetting, and the importance of understanding the local dynamics to ensure that decisions were being made in my best interest.

Danger 7: Difficulty in Benchmarking and Competitive Analysis

Benchmarking and competitive analysis are essential aspects of investment decision-making. In non-disclosure states, however, the limited access to key data makes it challenging to conduct these analyses effectively. Investors may find it tough to compare properties, analyze competition, or even gauge their performance relative to the broader market.

This difficulty in benchmarking and competitive analysis can lead to:

- Imprecise Investment Strategy: Without clear benchmarks, investors might struggle to set realistic goals or create strategies that align with market conditions.

- Missed Opportunities: The lack of clear competitive insights may lead to overlooking valuable investment opportunities or misidentifying threats.

- Challenges in Performance Evaluation: Without robust comparative data, evaluating the performance of an investment against market standards becomes more complex and may result in misguided assessments.

How to Navigate Non-Disclosure States

Navigating non-disclosure states can be a daunting task, but with the right strategies, it doesn’t have to be. Here’s how investors can be proactive:

- Build a Strong Local Network: Networking with local real estate professionals can open doors to valuable insights and data that might otherwise be hidden.

- Invest in Quality Research Tools: Utilize premium market research tools that cater specifically to non-disclosure states. This may require an investment but can pay dividends in terms of insights.

- Engage Local Expertise Thoughtfully: Consider hiring local experts, but do so with care, evaluating potential biases and conflicts of interest.

The right tools and resources can be a game-changer in non-disclosure states. Here are some essential elements to consider:

- Local Real Estate Agents and Appraisers: They can provide localized knowledge and access to non-public information.

- Specialized Data Providers: Some services specialize in providing data in non-disclosure states. Consider subscribing to them.

- Legal and Compliance Support: Engaging a local legal expert can help you navigate unique regulatory landscapes and avoid potential legal pitfalls.

Here are some real-world tips I’ve gathered from my own experiences in non-disclosure states:

- Stay Curious and Open-Minded: Every non-disclosure state has its unique quirks. Ask questions, and don’t be afraid to seek out local insights.

- Verify Information Where Possible: Don’t take all information at face value. Try to corroborate insights through multiple sources to minimize risk.

- Build Relationships, Not Just Transactions: Establishing trust and rapport with local experts can lead to more transparent and productive collaborations.

- Embrace the Challenge: Navigating non-disclosure states can be intricate and time-consuming, but with patience and persistence, it can lead to rewarding investment opportunities.

Conclusion

Investing in non-disclosure states presents unique challenges and opportunities. To summarize, the seven hidden dangers that real estate investors must navigate are:

- Limited Access to Property Sale Prices: Hinders transparency and accessibility.

- Difficulty in Proper Valuation: Adds complexity to the valuation process.

- Inconsistent Market Analysis: Leads to flawed investment decisions.

- Potential Legal and Compliance Issues: Exposes investors to legal risks.

- Increased Reliance on Local Expertise: Demands careful selection and trust in local professionals.

- Difficulty in Benchmarking and Competitive Analysis: Obfuscates comparisons and market understanding.

- Potential Manipulation and Misrepresentation: Risks of information being skewed or misrepresented.

Navigating non-disclosure states is undoubtedly complex, but with the right knowledge, tools, and strategies, it is not an insurmountable task. Consider leveraging local expertise, employing specialized research tools, and embracing a proactive and cautious approach to mitigate these dangers. The rewards can be significant for those willing to put in the effort and navigate the landscape with care and diligence.

As we conclude this exploration of non-disclosure states, it’s worth reflecting: How will you approach your next investment opportunity in a non-disclosure state? What strategies will you employ to turn these hidden dangers into potential advantages? Your insights and approach may be the defining factors in your success.

FAQs

Why is Texas a non-disclosure state?

Texas is a non-disclosure state because the state’s laws do not require the disclosure of real estate sale prices to the public. This has been justified on the basis of privacy rights and competitive interests but has also led to debates over transparency and market access.

Is Florida a non-disclosure state?

No, Florida is a disclosure state, meaning that real estate sale prices are a matter of public record.

Is Alaska a non-disclosure state?

Yes, Alaska is a non-disclosure state, and the sale prices of real estate are not required to be disclosed publicly.

Is Georgia a disclosure state?

Yes, Georgia is a disclosure state. Real estate sales prices are publicly recorded and accessible.

How many non-disclosure states are in the US?

There are approximately 12-13 non-disclosure states in the US, though this can vary depending on specific regulations and interpretations.

Is Ohio a disclosure state?

Yes, Ohio is a disclosure state, with real estate sale prices being public information.

Is New York a disclosure state?

Yes, New York is a disclosure state. Sale prices of real estate are publicly recorded.

Is Colorado a disclosure state?

Yes, Colorado is a disclosure state, and real estate sale prices are a matter of public record.

Is Arizona a disclosure state?

Yes, Arizona is a disclosure state, with real estate sale prices being public information.

What are non-disclosure rights in Texas?

Non-disclosure rights in Texas refer to the legal protection that prevents the mandatory public disclosure of real estate sale prices. This includes the right of sellers, buyers, and agents to keep this information private.

Why doesn’t Texas make home sales prices public?

Texas does not make home sales prices public due to laws prioritizing privacy and competitiveness. The argument is that making these prices public could impact the competitive nature of the market and infringe on individual privacy rights.

Is Atlanta a disclosure state?

Atlanta is a city in Georgia, which is a disclosure state. Therefore, real estate sale prices in Atlanta are publicly recorded.

Is Hawaii a disclosure state?

Yes, Hawaii is a disclosure state, and real estate sale prices are a matter of public record.

Is Tennessee a disclosure state?

Yes, Tennessee is a disclosure state. Real estate sales prices are publicly recorded and accessible.