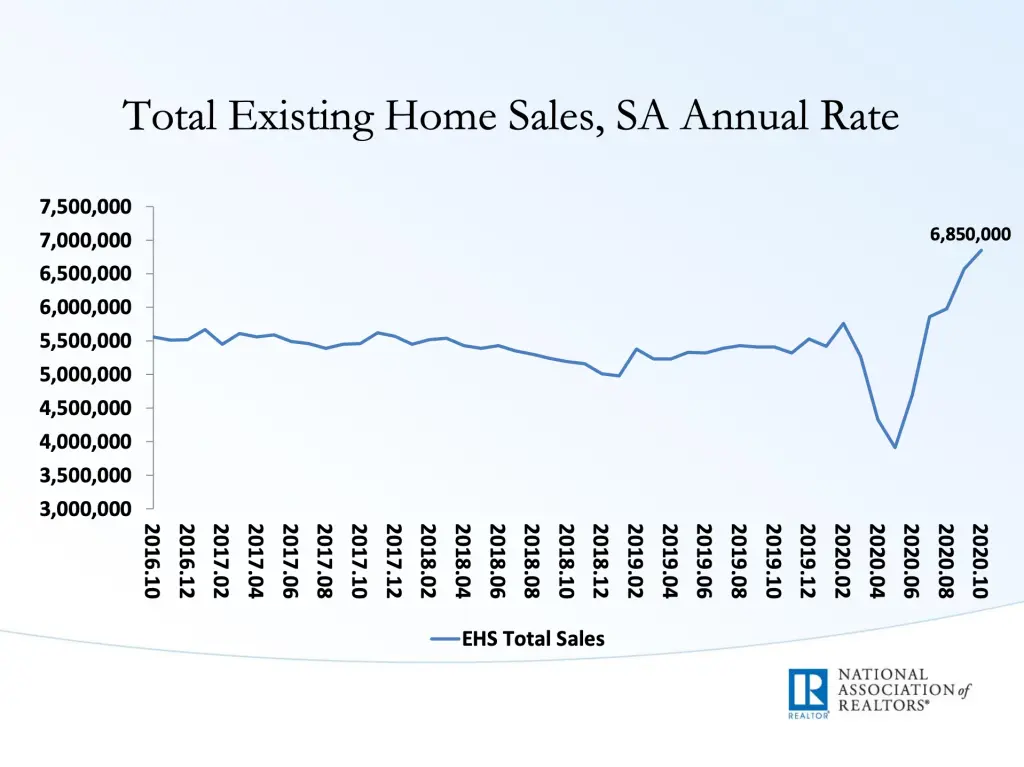

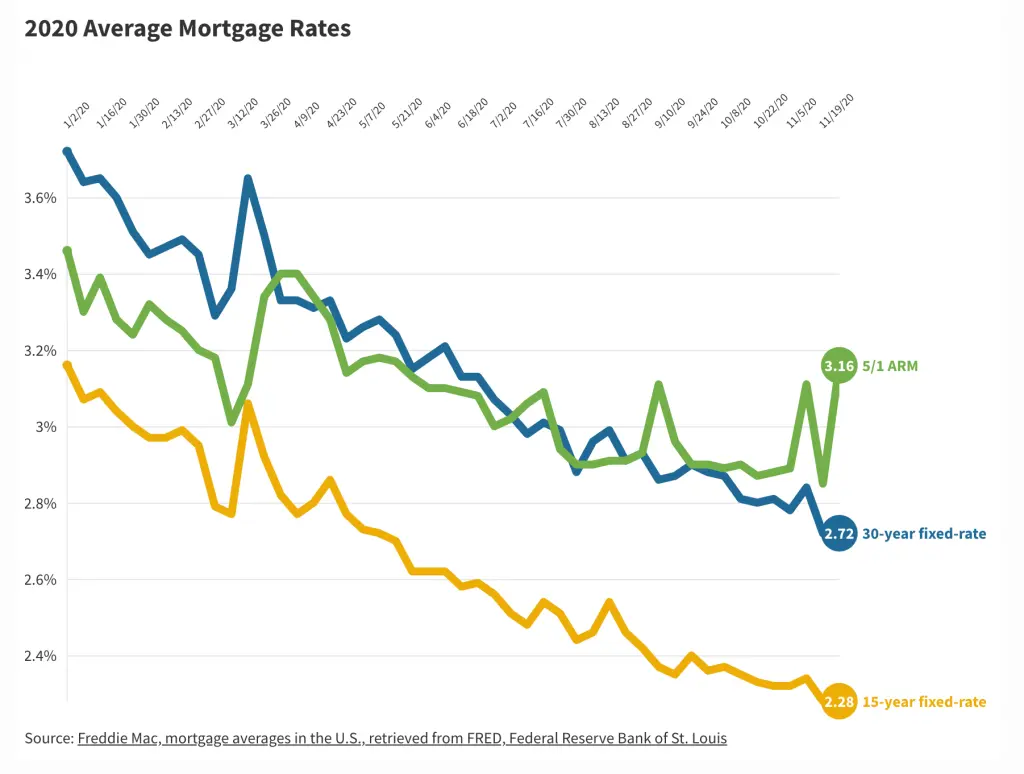

The weather may be cooling, but it’s still a hot market for housing. Robust demand, tight inventory, and record-low mortgage rates continue to fuel the fire in the real estate realm, leading the way for the nation’s economic recovery. “The surge in sales in recent months has now offset the spring market losses,” according to National Association of Realtors® (NAR) chief economist Lawrence Yun.

Oh, What an October

October marks the fifth consecutive month of positive gains for existing home sales, up 4.3% versus September and 26.6% versus one year-ago. The good news continued across the country with gains in all major regions, and the Midwest experiencing the greatest monthly increase.

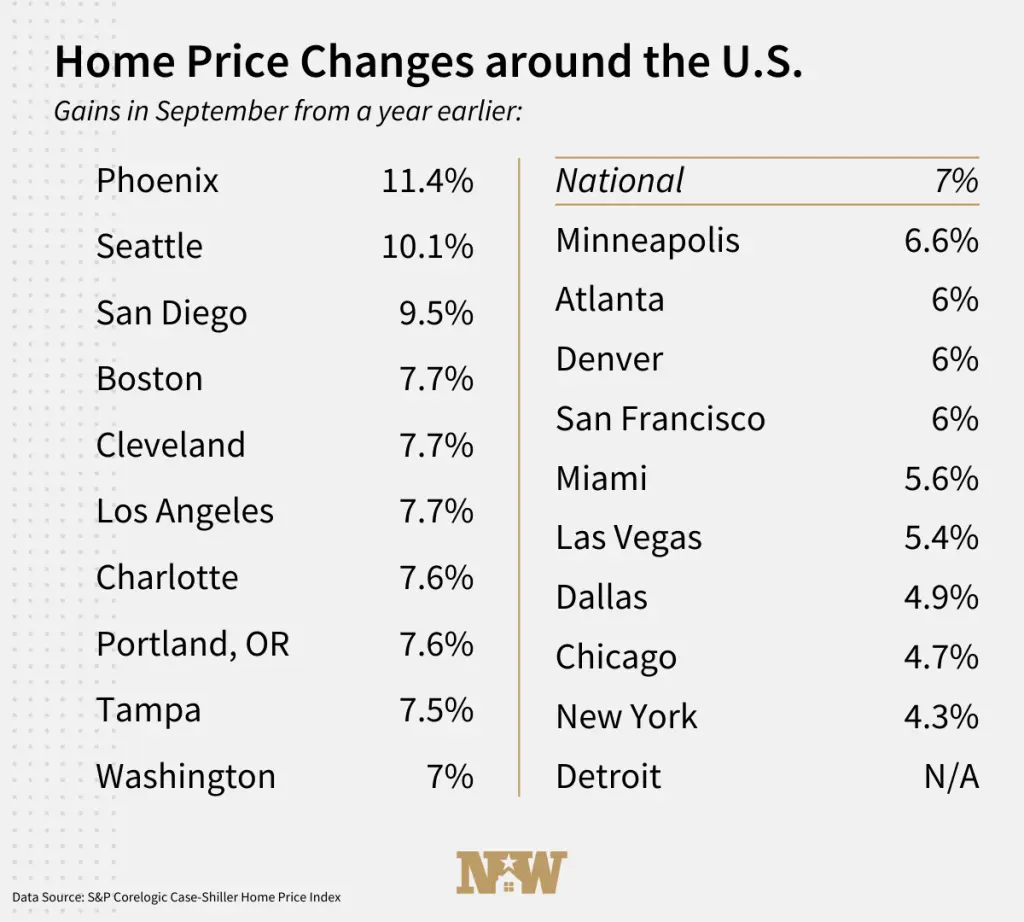

Pending home sales fell slightly again in October (-1.1%), but contract signings remain up more than 20% from last year. “The housing market is still hot, but we may be starting to see rising home prices hurting affordability,” Yun notes. Consider this: the median home price is now $313,000, an increase of more than 15% vs. last year—for 104th straight months of year-over-year gains.

In fact, October’s increase more than doubles the recently released S&P CoreLogic Case Shiller September increase of 7%. Phoenix, Seattle, and San Diego continue to top the charts with the highest year-over-year gains.

Inventory Woes

Supply and demand continue to shape real estate realities. Inventory is at an all-time low, 2.5-month supply. Compare that to 2.7 months in September and 3.9 months in October of last year.

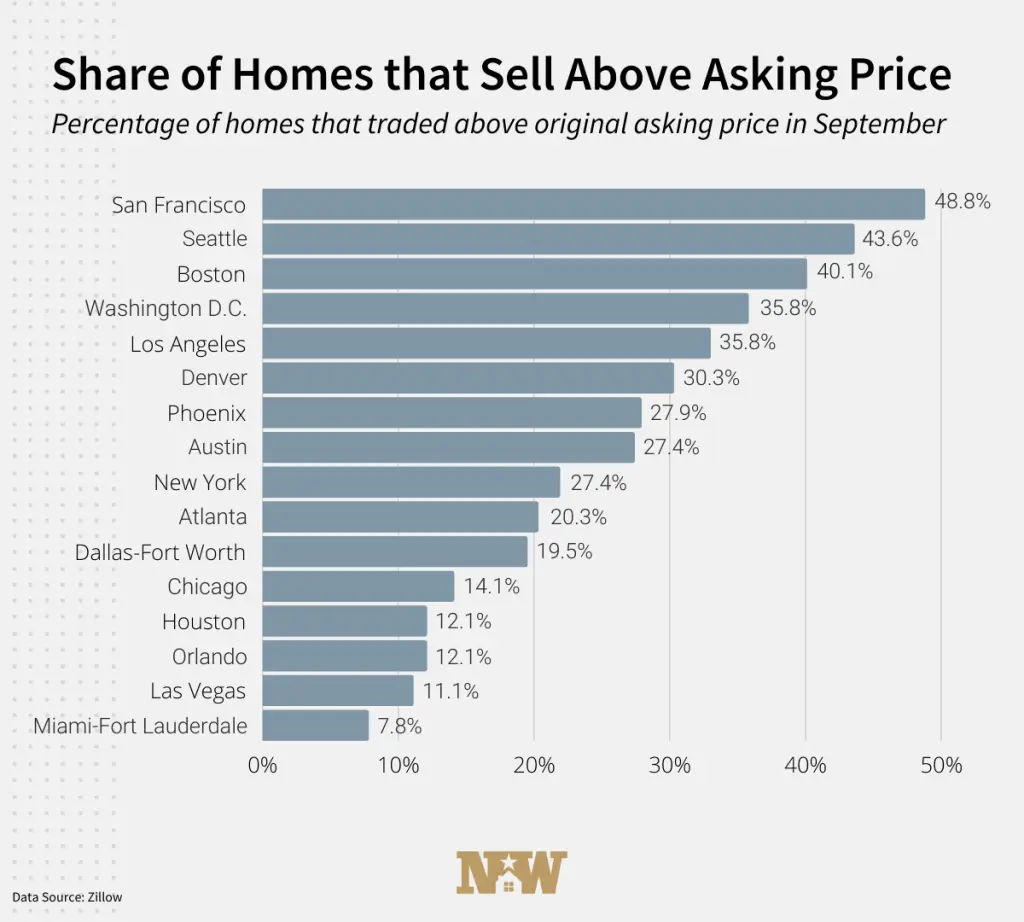

With most houses on the market less than a month, buyers are not delaying. And, many are paying above-ask: one in five according to a recent Zillow report. The coasts are seeing strong demand with more than 40% of houses going for more than the asking price in San Francisco, Seattle and Boston.

“This heightened competition for the few homes on the market has placed consistent, firm pressure on home prices for months now, and there are few signs that this will relent any time soon,” reports Zillow economist Matthew Speakman.

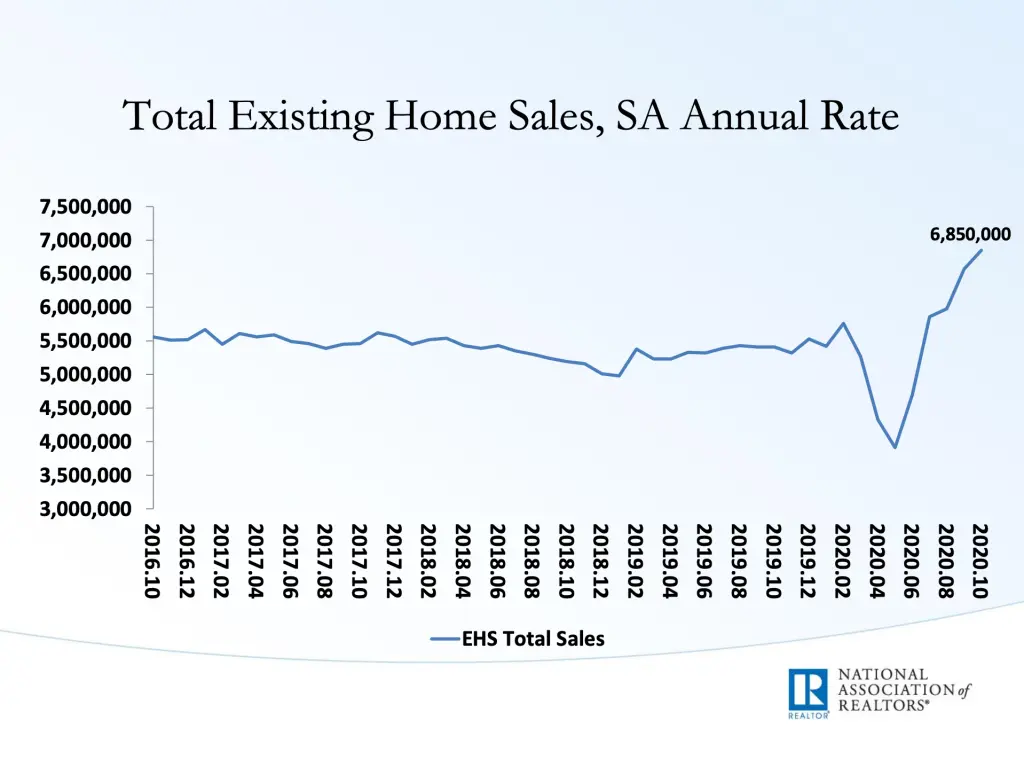

Rock-bottom mortgage rates continue to drive the flurry of activity. October saw 30-year rates of 2.8% and the end of the month marked 14 straight weeks of rates below 3%.

Housing Starts Surprise

Homebuilding was also up more than anticipated in October. Starts increased nearly 5% to 1.53 million units. “Unless demand suddenly sinks, builders will be playing catch-up for the foreseeable future,” according to Stephen Stanley, chief economist at Amherst Pierpont Securities.

Mortgage applications for new home purchases continue to show strong gains year-over-year, up 32.9% versus 2019. “October is usually when home buying activity slows as the weather turns colder. However, this fall has been a different story, with delayed activity from the spring, and more households seeking larger homes with more indoor and outdoor space, driving demand. Additionally, the average loan size in October increased to $355,684, a new survey high since 2013” notes Joel Kan, economist with the Mortgage Bankers Association (MBA).

What’s Ahead

“With news that a COVID-19 vaccine will soon be available, and with mortgage rates projected to hover around 3% in 2021, I expect the market’s growth to continue into 2021” predicts Yun. In fact, he is forecasting existing home sales to rise by 10% to 6 million in 2021.

New Opportunity. New Western.

For real estate investors, now is not the time to wait. It’s more important than ever to have a professional in your corner who can uncover the right opportunity for your investment strategy. Our agents are constantly scouring the market to find value-rich opportunities for our investors. Let us help you discover the deal that fits your strategy. Contact us to see if you qualify for access to our exclusive inventory.