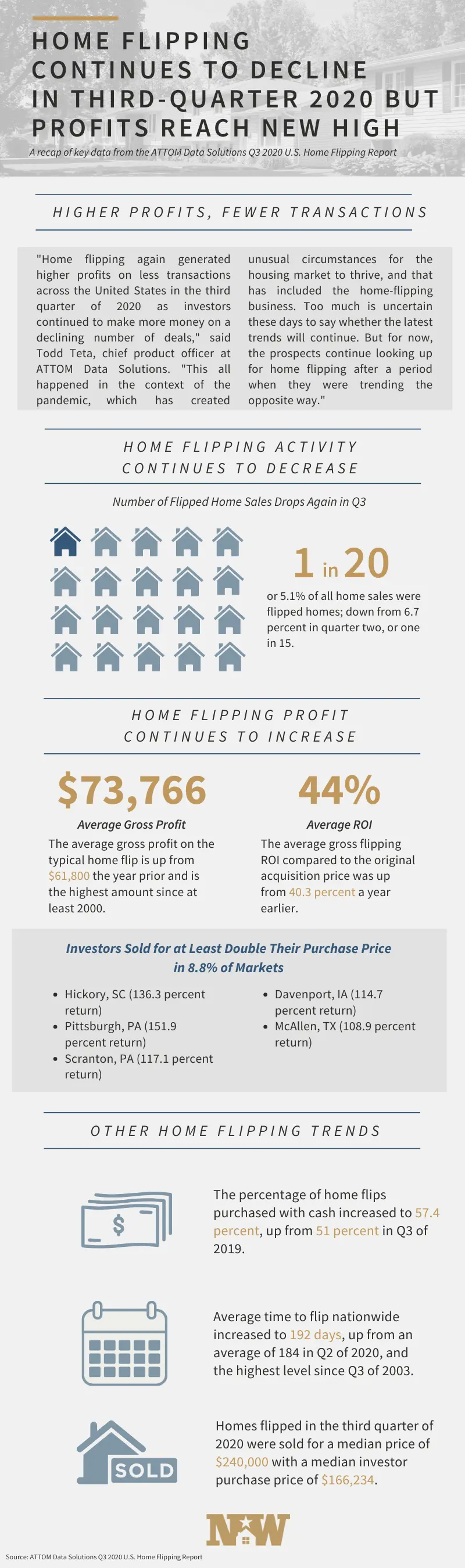

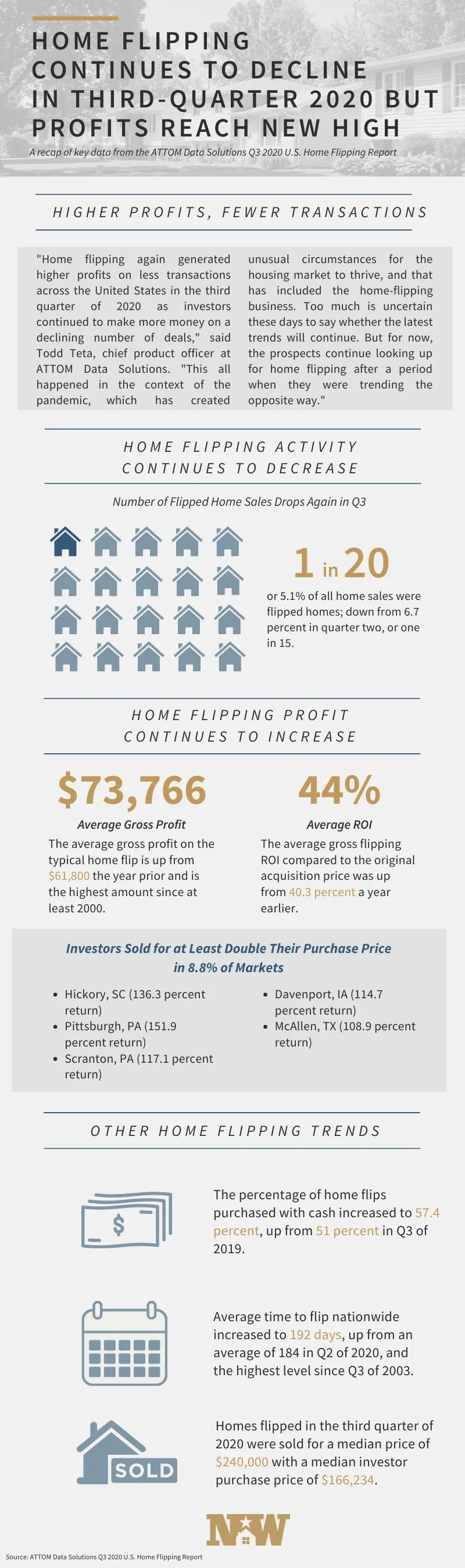

ATTOM Data Solutions recently released a report of home flipping trends seen in the third quarter of 2020. While the home flipping rate is down for the second straight quarter and is the lowest it’s been in four years, investment returns have increased to the highest level since early 2018.

The drop in home flipping rates throughout the pandemic is indicative of the overall housing market trends — lower inventory, higher demand and prices.

“Home-flipping again generated higher profits on less transactions across the United States in the third quarter of 2020 as investors continued to make more money on a declining number of deals,” said Todd Teta, chief product officer at ATTOM Data Solutions. “This all happened in the context of the pandemic, which has created unusual circumstances for the housing market to thrive, and that has included the home-flipping business. Too much is uncertain these days to say whether the latest trends will continue. But for now, the prospects continue looking up for home flipping after a period when they were trending the opposite way.”

While record-high profits are alluring to many investors, the low levels of inventory on the market could pose new challenges for investors looking to purchase discount properties. Especially in this competitive market, utilizing your team and resources could be the key to finding a profitable opportunity.

At New Western, our agents continue to work tirelessly to do the heavy lifting and match you with deals in your area that meet your investment criteria. We are continuing to acquire new off-market properties and are meeting with investors, either virtually or from a safe physical distance, to bring you more opportunities.