With all the news circulating these days, we know it can be hard to keep up. That’s why we’re collecting the most up-to-date and relevant information to help you stay informed.

Real Estate Recession? Not So Fast

Late last week, Forbes contributor and CEO of Local Market Monitor, Ingo Winzer, gave his take on what a 2020 recession may look like and what it means for real estate investors.

“If we do see the pandemic peak in a few months, if the government does steer more funds to consumers and does help people with mortgages, there’s no sense in getting out of real estate because it’s one of the goods that will be in short supply for years to come,” Winzer states. “In fact, I think that real estate, and especially rentals, will be a dynamic area for development and investing.”

How Deep & How Long Will This Economic Crisis Go?

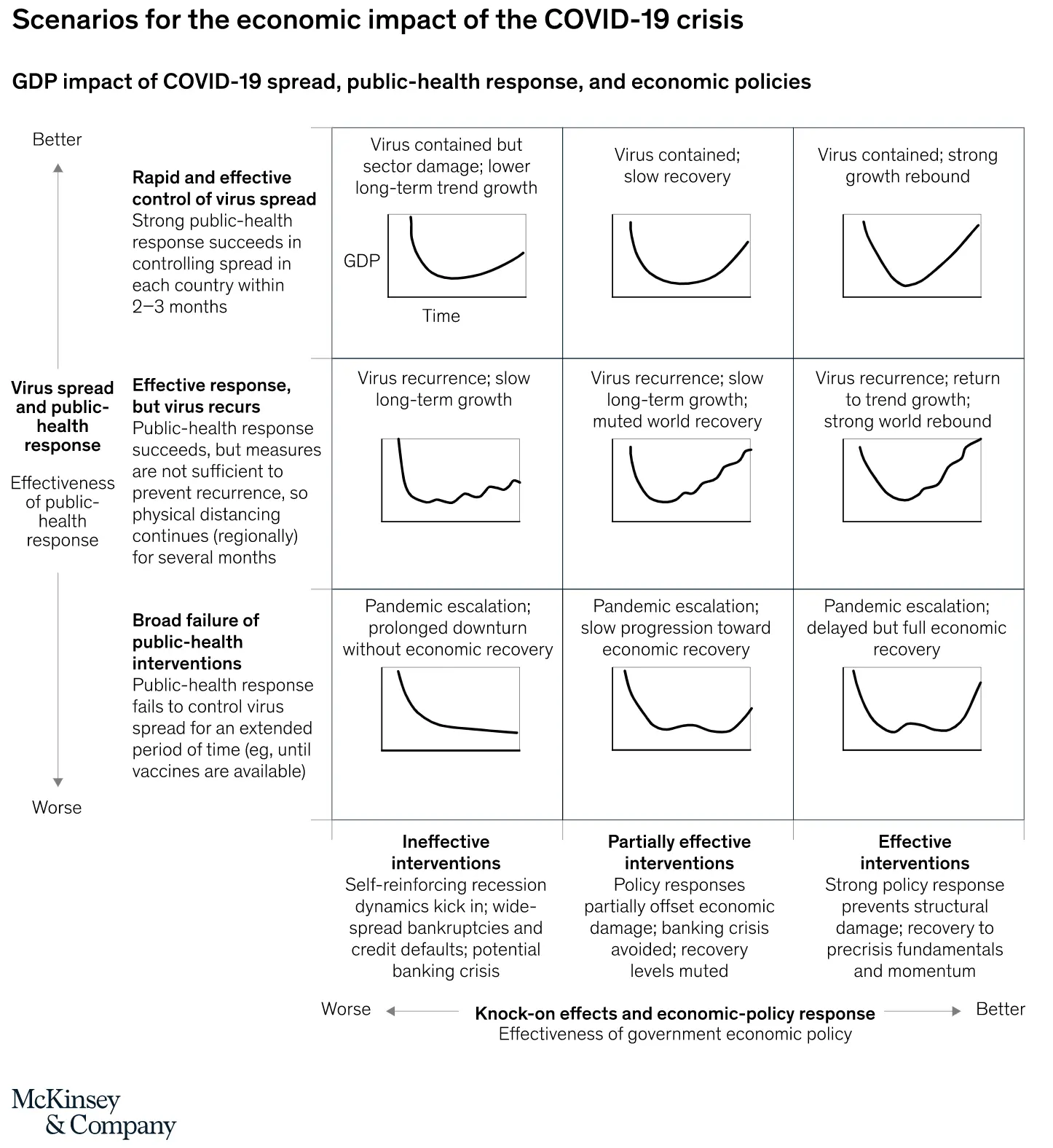

McKinsey & Company published an in-depth look at the economic fallout caused by COVID-19. In it, they take a deep dive into the global response to the pandemic and share scenarios developed by the McKinsey Global Institute that conceptualize the course of the pandemic and the potential paths to public-health and economic recovery.

Why Real Estate Beats Stocks During A Recession

You already know our story, so it won’t come as a surprise that we are in wholehearted agreement with this blog article we came across over on BiggerPockets. Landlord and personal finance expert, G. Brian Davis, put together a data-driven look at why real estate investing is an even more attractive proposition during a recession.

“Ultimately, people still need housing — even in a recession,” Davis argues. “They may not be willing to go into as much debt to buy it, but demand for a roof over your head doesn’t go away. Some folks downsize, others sell their homes (at lower prices) and become renters. But demand doesn’t disappear, even as new supply stops being built.”

Realtor.com Argues Now Is Still A Good Time To Buy

Whether buying a primary residence or an investment property, realtor.com offers advice buyers will want to hear. According to Lawrence Yun, Chief Economist for the National Association of Realtors®, “The temporary softening of the real estate market will likely be followed by a strong rebound, once the quarantine is lifted.” Realtor.com argues that “this pent-up demand could eventually push home prices higher. That could mean that the time to strike for bargains is now.” Another expert suggests as unmotivated buyers drop out of the market, the lack of competition will give committed buyers a serious advantage.