Investors have long debated the merits of residential and commercial properties. The diversification of residential real estate investment, versus the big income of commercial real estate investment.

The heavy competition of residential, versus the high cost of commercial. There’s truth on both sides, and everyone seems to have an opinion.

For investors who are trying to make a decision on which type of property to pursue, it’s helpful to compare the good and the bad elements that come along with owning commercial and residential properties.

We’ll look at the pros and cons side-by-side to help you make a choice that’s in your best interest.

Residential vs. Commercial Property: What’s the Difference?

Before deciding on an investment strategy, it’s important to define the difference between residential and commercial real estate in general.

Residential Real Estate (RRE)

As the name implies, residential properties are used as residences. Typically, the term residential real estate indicates that the property is a place where people can live.

Residential real estate includes:

- Single-family homes

- Duplexes

- Triplexes

- Quadplexes

- Condominiums

- Townhomes

Commercial Real Estate (CRE)

Again, true to its name, commercial real estate is used for commerce purposes. Commercial properties are those used as a place of business, whether that be industrial, retail, public service, food service, or other types of commerce.

In addition, while the above list does include a majority of living spaces, it does leave a few types of living arrangements out. Apartment buildings, multifamily housing (of 5+ units), and hotels are all considered commercial real estate because a business within the property is operating to provide housing to individuals.

Commercial real estate can include the following types of buildings, though the list could be expanded to include other business specialties as well:

- Manufacturing spaces

- Retail locations

- Office buildings

- Storage units

- Shipping facilities

- Apartments and hotels

- Parking lots/garages

- Land zoned for commercial use

One more distinction: Mixed-use real estate is a type of property that is used for both residential and commercial purposes.

For instance, small downtown buildings may have retail shops or offices on the ground floors and rentable apartments on the upper floors. For the purposes of investment ownership, mixed-use properties are considered commercial real estate.

The Benefits of Residential vs. Commercial Property Investments

As with any decision, an investor should weigh the pros and cons of their real estate strategy before jumping in. Let’s look first at the benefits that residential and commercial properties each have to offer.

Pros of Residential Real Estate Investing

Low Cost of Entry

Residential properties can be a much easier first step for investors simply because the cost of entry is so low compared to commercial properties. For example, in many states, the average price of a three-bedroom home is just upwards of $100,000, whereas even a modestly-sized commercial storage facility could run upwards of $1,000,000.

Easy Financing

Residential properties are also relatively easy to finance. Most conventional lenders require a 25% down payment for investment properties. However, house hacks and multifamily residential properties may qualify for FHA loans or for more lenient conventional loan terms, as long as the space is owner-occupied for a specified period of time.

Consistent Demand

People will always need a place to live. Therefore, residential housing properties will always be in demand. The trick, of course, is to research the type of housing that most renters are looking for in your area in an effort to ensure that your particular property is in demand.

Do renters want a certain number of bedrooms? A certain location? Certain amenities? Maximizing your local demand offers a greater level of consistency.

Simpler Maintenance

Most of the maintenance and repairs on residential properties are familiar, basic-homeowner-type stuff. Need to repair a toilet or change an air filter? You can probably do it yourself if your property is local.

Yes, there will be more major things like roof or window replacement that may need to be contracted out to an expert, but even then the scale of the job will be more limited when compared to commercial property repairs.

Larger Buyer Pool

Most residential investments can be sold as a primary residence, a secondary residence, or an investment property.

That means, when the time comes to exit your residential property, you can pretty much guarantee that you’ll have a decent number of potential buyers. Your buyer pool would likely consist of both owners and investors.

Pros of Commercial Real Estate Investing

Greater Rental Income

Bigger risk definitely means greater return when it comes to investing in commercial property. For instance, the national average for office rents is around $40 per square foot. The national median residential rent is $1,827 per month which roughly translates to between $1 and $2 per square foot.

(Naturally, not all commercial properties are created equal, and not all markets support the same rental rates. Commercial investors should research normal returns for individual sectors.)

Longer Leases

While residential leases are usually signed for one year, commercial leases are typically signed for a minimum of five years (and sometimes significantly longer than that, depending on the type of business).

That type of longevity offers stability for the commercial property owner because they don’t have to look for suitable tenants every year.

Triple Net Leases

Lease terms vary within the commercial property realm. But perhaps the most attractive lease type is the triple net lease (NNN), where the tenant is responsible for maintenance expenses, property taxes, and insurance costs.

This type of lease offers financial benefits to the commercial investor that are not typically available under residential leases.

Business Tenants

Since commercial properties are rented to businesses, investors don’t have to deal with individual tenants. (The exception, of course, would be large multi-family housing, if you are acting as both the property owner and the business manager.)

As a general rule, business tenants can be easier to deal with. They are more easily screened, they have a less emotional investment, they issue complaints within business hours, and they’re more easily evicted if things go wrong.

Growth Potential

Overall, commercial properties may add more stable and substantial growth to an investor’s portfolio due to the way that they are valued. Residential property value is determined by fair market value, which relies heavily on comps in the area.

Since commercial property is so varied, comps aren’t really an accurate basis of valuation. Commercial property value is determined instead by financial data such as net operating income in addition to cash flow and cap rate. A savvy commercial investor can grow their property’s value by making good capital and tenant choices.

The Drawbacks of Residential vs. Commercial Property Investments

Obviously, both types of properties have several good qualities. But not so fast! Let’s take a look at some of the potential downsides to each type of investment.

Cons of Residential Real Estate Investing

Shorter Leases

As mentioned, residential leases are typically signed in one-year increments. That means every year you could be facing the prospect of going through tenant applications, showings, and screenings, not to mention the loss of income from turnover vacancy. On the flip side, though, shorter leases do allow investors the flexibility to adjust rent rates and lease terms as needed.

Individual Tenants

On a related note, residential investors do have to be prepared for the added stress of dealing with individual tenants. From interviews to security deposit disputes and everything in between, individual tenants can be a lot more work than businesses simply because a home is much more personal than a workplace.

Also, as the last few years of pandemic-related moratoriums have proven, individual tenants can be much more difficult to remove. It will likely take months to evict an individual tenant for non-payment, not to mention all the court fees.

Landlord Responsibilities

Similarly, residential real estate investors are on the hook for everything from leaky faucets to tree trimming. Are you prepared for the late-night call telling you that the garage door stopped working?

Landlord responsibilities can be somewhat overwhelming, especially for casual investors with a separate full-time job. Thankfully, many of the day-to-day stresses of landlording can be solved by hiring a property manager, but that cost will eat into your cash flow.

Greater Competition

The relative ease of entry associated with residential investing means that there are a greater number of potential investors vying for every property that hits the market.

In this current competitive atmosphere, residential investors need to be prepared to run numbers and make offers quickly. They also may not be able to negotiate on price and terms as much as they once did, which in turn makes the profit margins tighter.

Volatile Income and Valuation

In the benefits section above, we mentioned that housing is always in demand, which is true. However, just because tenants desire your property doesn’t mean they can pay for it.

According to Forbes, “any drop in economic activity in any area will first affect residential tenants.” When the economy dips into recession, rental rates may have to adjust to accommodate a market where tenants aren’t in a position to pay what they used to.

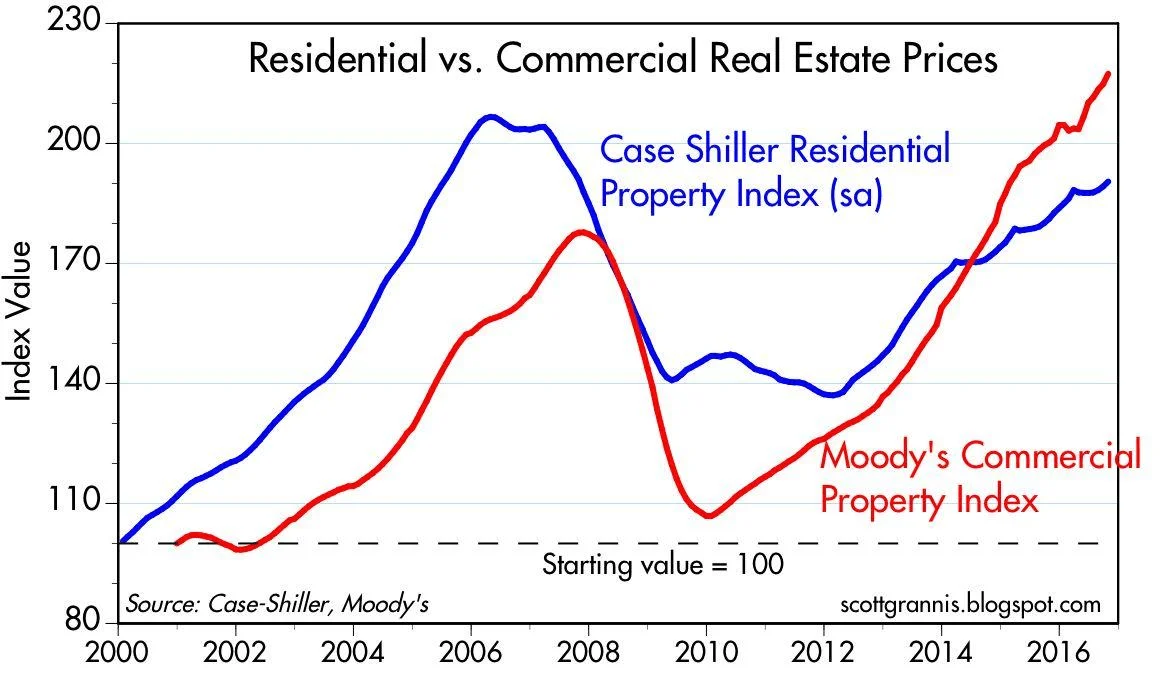

In addition, the market value for residential properties tends to be more unpredictable in the long run. Looking at the graph of the 2009 recession below, you can see that commercial property prices fell and recovered quicker than residential property prices, eventually leading the index by a significant margin.

Image source: KZB Real Estate

Cons of Commercial Real Estate Investing

High Cost of Entry

The commercial real estate industry is one of the largest in the nation, with a total estimated value of $20.7 trillion. But getting a piece of that enormous pie can be challenging, due to higher initial costs.

Many commercial investors ease the individual burden by pooling resources with a like-minded network in order to come up with the capital needed for purchase. Others may choose to partner with a REIT

Limited Financing

Overall, lenders view investment loans as riskier than home loans because homeowners aren’t as likely to default on the roof over their own heads –– thus, the higher down payment for investors. Commercial loans are considered even riskier than residential investor loans, possibly because of the larger scale and more unpredictable nature of the venture.

Therefore, commercial investors can expect higher interest rates and tighter term lengths (sometimes as low as five years). To apply for a commercial loan, lenders often require a business plan and possibly proof of previous experience.

Potentially Long Vacancies

Because commercial properties are rented to businesses, the pool of potential tenants is more limited. Only certain types of businesses can operate in specific spaces. As such, when your commercial property is vacant, it can take quite a while to find another business that is suited to the type of space you’re offering.

For example, the office vacancy rate in the first quarter of 2022 was 12.3% whereas the residential rental vacancy was 5.8% for the same time period.

Still Susceptible to Recession

While the residential sector may see more prolonged impacts to value during a recession, commercial properties are by no means immune to economic decline. When commercial tenants go out of business, they’ll obviously be forced to break their lease.

And filling a commercial property vacancy during a downturn could be difficult due to businesses operating on slimmer margins.

Stricter Zoning and Building Laws

Commercial properties are more regulated by authorities. Local land zoning can be very specific, which means that if you want to switch the use or purpose of your commercial property, you may run up against some red tape.

In addition, building codes are more stringent and permits could be harder to come by, so repurposing or adding on to your property may be difficult.

Slower Exit Strategy

Commercial real estate investors enjoy less competition in the marketplace than residential real estate investors. But the flip side of that freedom comes with a more limited buyer pool when you go to sell.

Since you’re likely only going to be able to sell to other commercial investors, your property may sit on the market for a while before that right buyer comes along.

Building a Residential vs. Commercial Property

Instead of purchasing property, some investors opt for new construction. This course of action can be a good choice for residential investors who plan to own for a long time because it means the materials and systems probably won’t need to be updated for quite a while.

New construction can also be a good choice for commercial investors who want to tailor their building for a specific purpose rather than retrofit the needs into an existing structure.

The first step, of course, is making sure the land is zoned properly for the project you have in mind. You can’t build a house in the middle of an industrial park and you can’t put a retail shop at the end of a cul-de-sac.

After that, when it comes to choosing whether to build residential or commercial property, there are some additional considerations to keep in mind.

Residential Building Codes & Costs

To ensure the safety of the inhabitants, residential buildings are subject to government codes, which provide a standard for new construction. Some basic building codes are mandated at the federal level, but most are stipulated at the local level to account for particular weather, soil, and atmospheric conditions.

In order to build a new residential building, investors can expect to have to pull permits and get code inspections done at various stages during the construction. With a little research for compliance, the average person could pull permits and schedule inspections themselves, though construction professionals are obviously more experienced with the procedures.

Residential buildings have codes in regards to things like:

Size and placement

Structural design

Building materials

Construction best practices

Systems (electric, plumbing, HVAC, etc.)

The cost of building a home varies depending upon the materials and finishes. In round numbers, investors can expect to pay between $100 and $155 per square foot for residential construction.

Commercial Building Codes & Costs

Commercial buildings, on the other hand, are more heavily regulated and have stricter codes both at a federal and local level. Commercial buildings are held to different standards in regards to all components mentioned in the residential section above.

The process is considered complicated and best left to a professional contractor who has experience with commercial building practices.

Because the building will be made available to a larger number of people, there are additional things that are subject to government codes, such as:

Parking lots or garages

Elevators and stairwells

IT systems

Handicap accessibility

Egresses (road access)

Commercial construction is more costly than residential construction because of the required materials. For example, most commercial building codes require steel and/or concrete rather than wood trusses and frames (which would be cheaper).

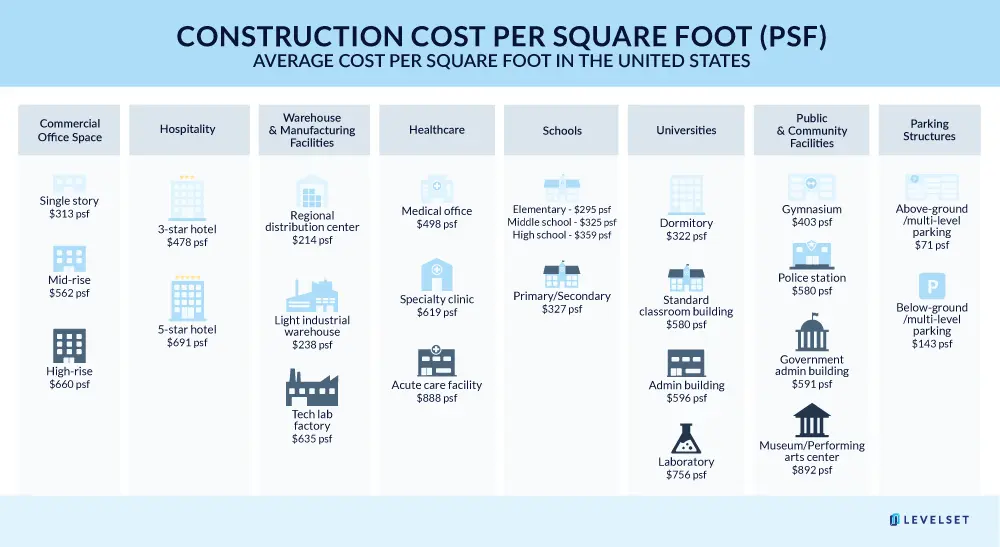

As you can see from the table below, commercial construction costs vary greatly by type of building, but investors can expect most expenses to be significantly higher than building a home.

Image source: Levelset

Residential and Commercial Investing FAQs

Can a residential property be used as commercial property?

It depends on the zoning and housing association rules. In general, residential property is not zoned for commercial use. But some locales allow exceptions for small businesses such as pet groomers, therapists, and barbers to operate in residential homes.

In addition, some downtown residential areas have been rezoned to allow accounting firms, lawyers, clinics, and others to convert a residential property into commercial.

If you want to use the residential property for business purposes, you may need to apply for a zoning variance and obtain permission from any HOA. Once the property is approved for commercial purposes, you may be subject to higher property taxes.

One important distinction: Usually, a home office does not qualify for commercial use. The line between residential use and commercial use is most often drawn when customers and/or employees regularly access the property for business purposes.

Is commercial property worth more than residential property?

It depends on the property. As mentioned above, commercial property and residential property are valued differently, so comparing their worth is somewhat like comparing apples to oranges. Even comparing price per square foot is difficult due to locational and usage factors.

For instance, a waterfront home could easily have a higher price per square foot than a small office building; but that same office building will probably have a higher price per square foot than a home in a less desirable neighborhood.

When looking at property, it’s important to consider the value it adds to your portfolio overall rather than looking only at the price tag. Look at net operating income, cap rate, and cash flow to get a more complete picture of what a property is worth.

Can you live in a commercial property?

The answer is yes, if it’s considered mixed-use real estate (with occupancy) or if it’s multifamily housing. Both are commercial properties that permit residency.

The answer is no, however, if the commercial property is not categorized for occupancy with the local zoning authorities. You can’t just start building a manager’s apartment in your storage facility without getting the proper occupancy permits.

Do commercial properties appreciate?

Usually, yes. Commercial properties tend to appreciate at a slow-and-steady rate over time. Of course, as the graph above shows, commercial properties are not immune to devaluing during an economic downturn. The upside in that scenario is that commercial properties tend to depreciate slower and recover their value faster than residential properties.

Residential vs. Commercial Property: Which is Right for You?

Both residential and commercial properties have their pros and cons. When weighing which is right for you, it’s important to take objective considerations, like ROI and cash flow, into account, along with personal considerations, like risk tolerance and involvement level.

The bottom line is this: What’s right for another investor may not be what’s right for you. Run the numbers, do the research, and think through how each investment would impact your life in the immediate and in the long run.

Keep in mind that our team at New Western can help match you with investment options tailored to your specifications. Whether you’re looking at residential properties or commercial properties –– or both! –– we can provide alternatives to meet your needs.