Six months into the pandemic and the housing market continued to set a record pace in September. “Home sales traditionally taper off toward the end of the year, but in September they surged beyond what we normally see during this season,” reports National Association of Realtors® (NAR) chief economist Lawrence Yun.

A September to Remember

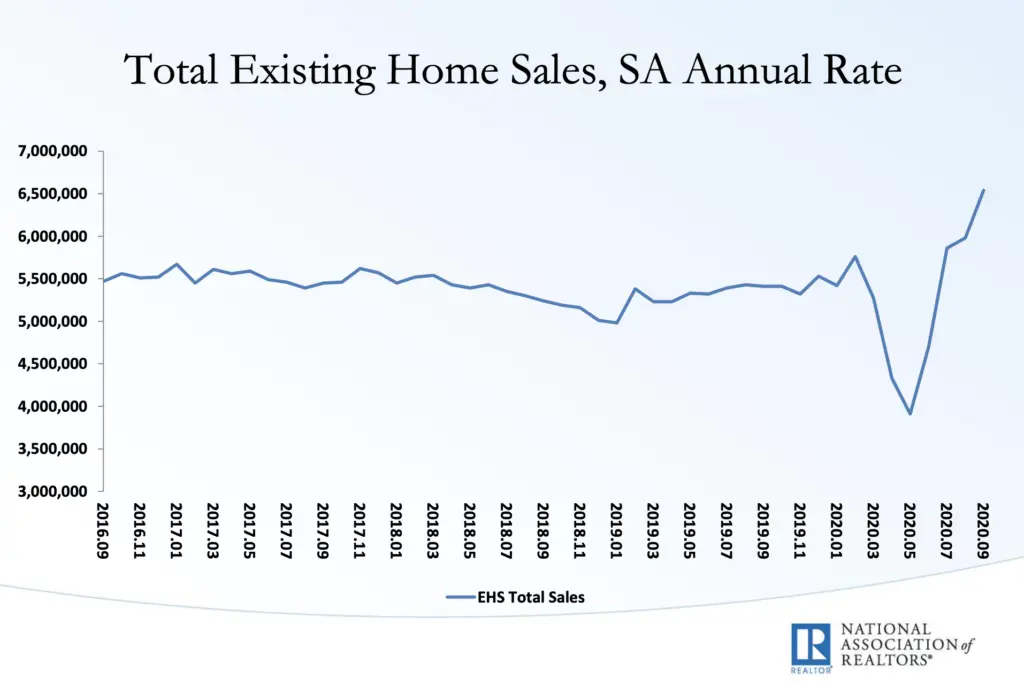

In fact, existing home sales jumped by 9.4% to 6.54 million units in September, the highest level since May 2006.

Month-over-month and year-over-year gains were seen across the country, with the strongest growth in the Northeast.

A number of markets have rebounded particularly well compared to pre-pandemic conditions. According to Realtor.com®’s Housing Market Recovery Index, Seattle, Boston, Los Angeles, Las Vegas, and San Jose are showing the strongest recovery.

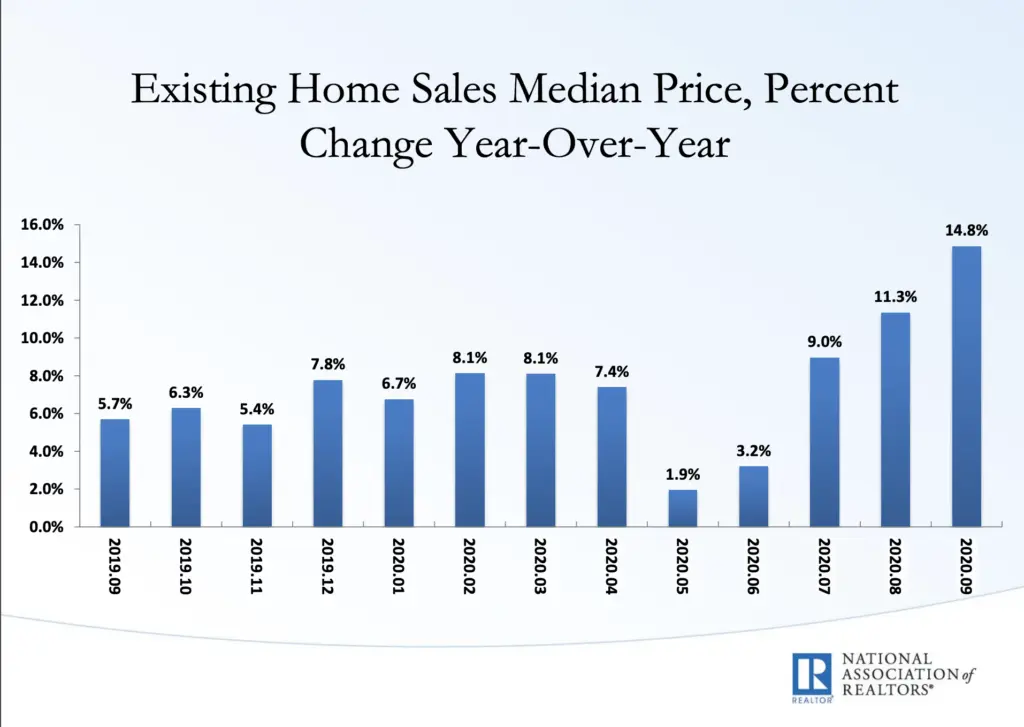

While pending home sales dipped slightly in September (-2.2%), contract signings were up more than 20% when compared to this time last year. The median home price rose once again to $311,800 – up almost 15% from 2019 – marking 103 straight months of year-over-year gains. Over the past year, the National Association of Realtors reports that every region of the country experienced double-digit increases.

No Time to Wait

More than 70 percent of homes sold in September were on the market for less than a month – at an average of 21 days, an all-time low.

Constrained supply continues to drive demand and price. Housing inventory is down 19.2% annually, to a 2.7-month supply. Inventory in the 50 largest U.S. metros was down more than double that figure at 39%. Record low mortgage rates beckon prospective buyers – to the tune of 2.89% on a 30-year, conventional, fixed rate mortgage in September.

Construction Production

Housing starts slowed slightly in September by 1.9% month-on-month to 1.42 million units. That said, the overall outlook remains positive, even in light of skyrocketing lumber prices, according to TD economist Johary Razafindratsita. “The turnaround in homebuilding activity, especially in the single-family segment, remains one of the main highlights of the economic recovery thus far,” Razafindratsita reports.

New home sales took a dip in September (down 3.5% vs. August) but are up 32% compared to last year. Mortgage applications for newly built homes are also up 38.2% year-over-year. “Demand for newly built homes is strong, as many buyers appear to seek more space for work, in-home schooling, and leisure,” notes Joel Kan, economist with the Mortgage Bankers Association (MBA).

With high demand for new homes but tightly constrained inventory, real estate investors have the opportunity to provide hungry buyers with move-in ready homes in desirable neighborhoods.

With quarantine and work from home, buyers are also more willing to look outside the traditional urban core. “In the past you would see some hesitancy of buyers willing to go out to the outer ring market because the commute time was so bad. But now there are an awful lot of buyers saying they don’t want to be close in and want the elbow room,” says Dallas-based housing consultant Ted Wilson.

Fourth Quarter Forecast

Yun predicts a winning winter ahead. “The demand for home buying remains super strong, even with a slight monthly pullback in September, and we’re still likely to end the year with more homes sold overall in 2020 than in 2019,” he notes. “With persistent low mortgage rates and some degree of a continuing jobs recovery, more contract signings are expected in the near future.”

New Opportunity. New Western.

The steady increase in home selling prices and lowered average time on market are optimistic signals for investors wondering if making a profit during a pandemic is still possible. However, with the high demand of buyers and low inventory levels, it may be more difficult than usual to secure a great deal.

Investors can prepare themselves to take advantage of this seller’s market by having their funding in place so they can act quickly on a good opportunity and beat the competition or by partnering with wholesalers and real estate agents who specialize in finding investment properties in their market. The needs of the buyer have changed over the past few months as well, and savvy investors can use these new demands to create homes that fit the desires of a post-pandemic buyer.

New Western agents across the country are constantly uncovering value-rich opportunities for our investors. Let us uncover the deal that fits your strategy. Contact us to see if you qualify for access to our exclusive inventory.