Early-Hit Markets Provide Clues To Market Recovery

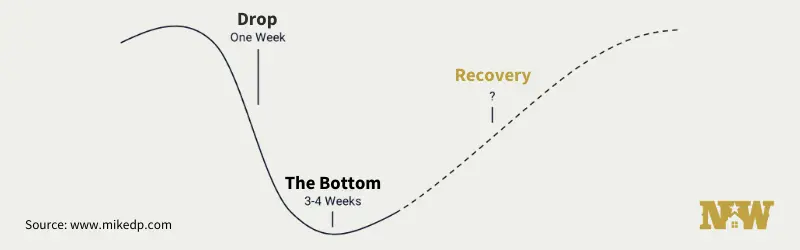

After analyzing data in U.S. markets hit early on by the coronavirus pandemic and the associated lockdowns, real estate tech strategist Mike Delprete sees signs of a checkmark shaped real estate recovery. “It only takes one week, maybe two, to hit the bottom of the curve in new listing volumes,” says Delprete. “The good news is that if you’re in a market that has seen a drop in new listing volumes, the first few weeks are as bad as it should get. The stay on the bottom of the curve isn’t long. Most markets begin to see a recovery after 3-4 weeks.” After that, it’s a steady recovery of about 20-30% each week. Check out the full article for a deep dive into the data.

The Question On Everyone’s Mind: Will Home Prices Fall?

Economists for Lending Tree and the National Association of Realtors® discuss what monthly home sales, low inventory and pent-up buyer demand mean for home prices. “It’s not a question of slashing your prices; I think what’s really holding back buyers right now is the stay-home/shelter-in-place directive,” said Gay Cororaton, a senior economist and director of housing and commercial research at the NAR. Tendayi Kapfidze, LendingTree’s chief economist agrees: “The market friction is not due to pricing, so lower prices will not necessarily help.”

March Home Sales Increased Year-Over-Year Despite Impact Of COVID-19

According to a report from the National Association of Realtors®, March existing home sales decreased from February as expected, but were still up from March 2019. “Unfortunately, we knew home sales would wane in March due to the coronavirus outbreak,” said Lawrence Yun, NAR’s chief economist. “More temporary interruptions to home sales should be expected in the next couple of months, though home prices will still likely rise.” Read on for the full report and to see the regional numbers.

Economist Weighs The Impact of The Credit Crunch On Housing

First American’s Chief Economist, Mark Fleming, explains how tightening credit will affect demand and what that means for home prices in the future. Long story short, he predicts “the immediate impact of the coronavirus pandemic on the housing market will be a reduction in spring sales activity and a moderation of price appreciation.” Read the full article to find out why.