Winter is here and home prices continue to set records amid tight supply. The frenzied pace of new construction continues as well, as builders dig out of the hole. With inflation and rates rising, what does this all mean for homebuyers and sellers? Read on to learn more.

Sales Cool, Prices Rise…Again

Existing home sales rose 1.9% in November for the third straight month of growth with three of the four major regions experiencing month-over-month increases. “Determined buyers were able to land housing before mortgage rates rise further in the coming months,” noted NAR chief economist Lawrence Yun.

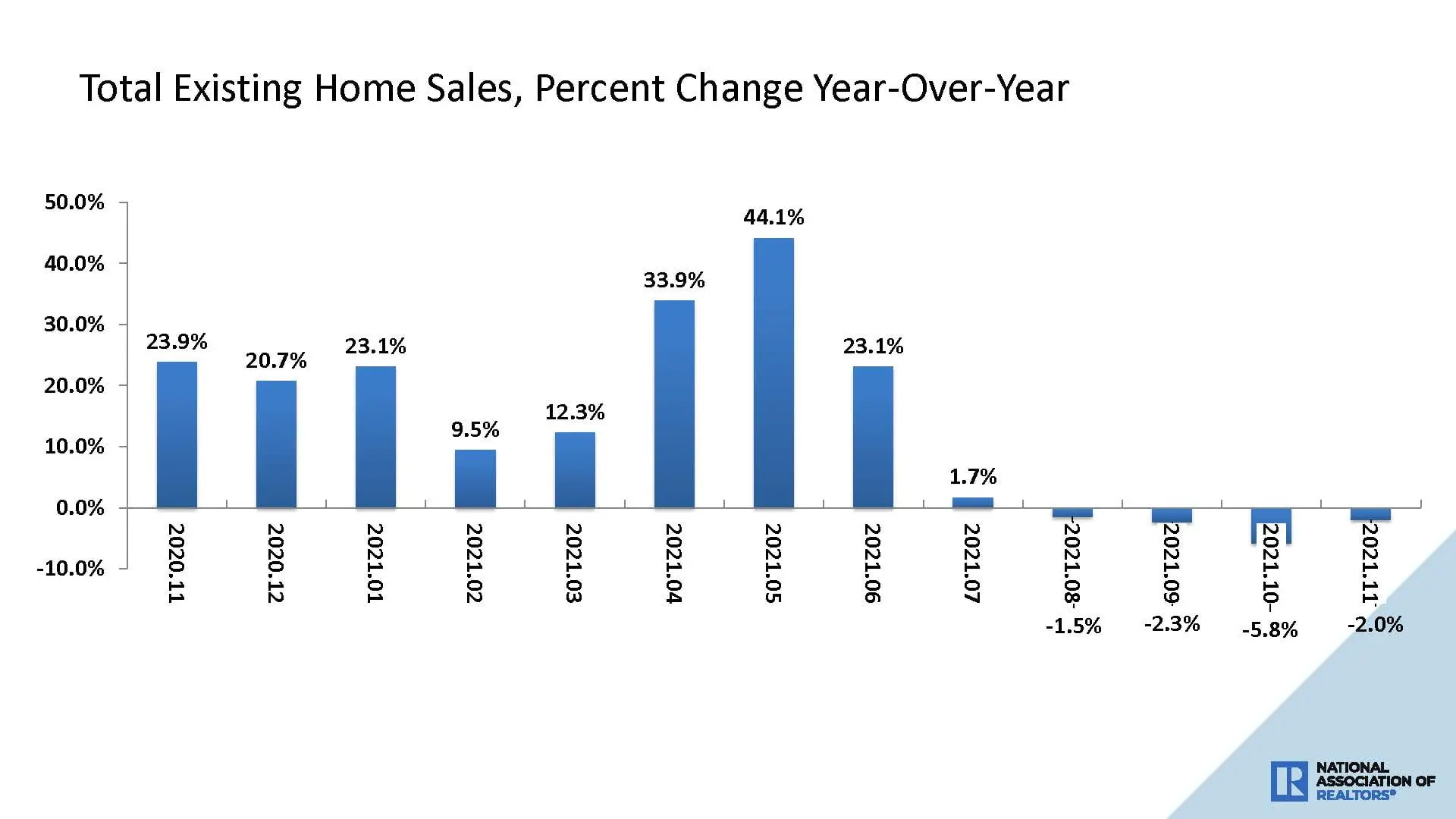

Sales continued to be down versus 2020 for the fourth month in a row.

Pending home sales dipped -2.2% in November, reversing October’s increase with all regions down month-over-month. “There was less pending home sales action this time around, which I would ascribe to low housing supply, but also to buyers being hesitant about home prices,” Yun noted.

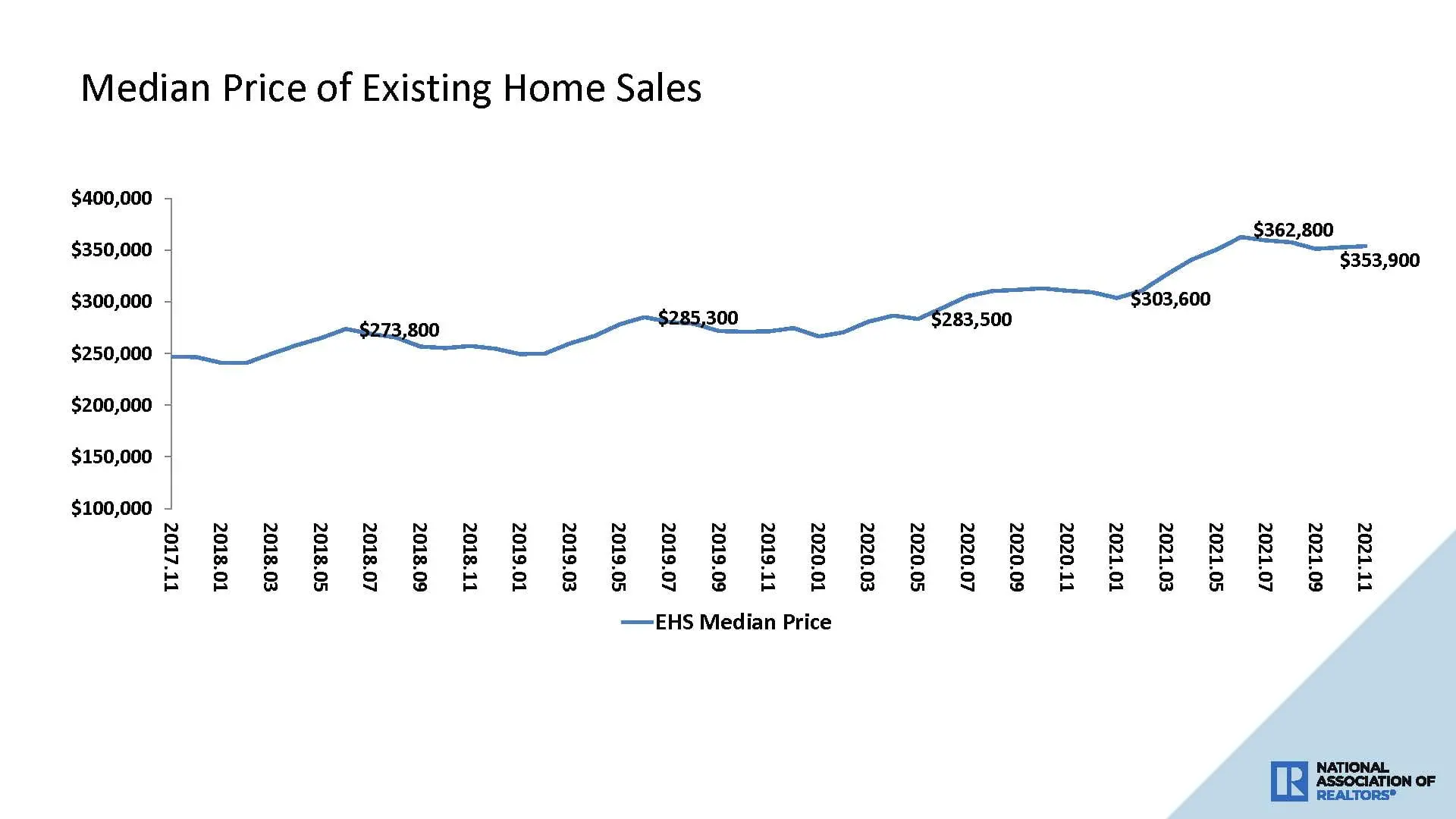

The median home price held steady at $353,900, up 13.9% vs. 2020 for 117 straight months of year-over-year gains, the longest-running streak on record. “With rate hikes now on the horizon, buyers may be trying to get ahead of higher monthly housing costs, in turn driving up competition and prices,” commented Realtor.com chief economist Danielle Hale.

Investors continue to be a force in the housing market—purchasing 15% of homes in November. All-cash sales represented 24% of transactions, equal to October and up from 20% a year ago.

The Sunbelt Rules

According to a new report from Realtor.com, asking prices ended the year up 10% vs. 2020 with the greatest increases in Las Vegas (32.4%) and Austin (28.8%).

Sunny destinations continue to top the list for strong housing markets moving into 2022. According to a recent NAR report, the following markets are expected to experience stronger price appreciation than other markets this year.

Hidden Gems

- Dallas-Fort Worth, Texas

- Daphne-Fairhope-Farley, Alabama

- Fayetteville-Springdale-Rogers, Arkansas-Missouri

- Huntsville, Alabama

- Knoxville, Tennessee

- Palm Bay-Melbourne-Titusville, Florida

- Pensacola-Ferry Pass-Brent, Florida

- San Antonio-New Braunfels, Texas

- Spartanburg, South Carolina

- Tucson, Arizona

The Supply Situation

Housing inventory was down 9.8% in November to 1.11 million units with unsold inventory remaining at a 2.1-month supply. Properties continue to remain on the market for 18 days with 83% sold in less than a month.

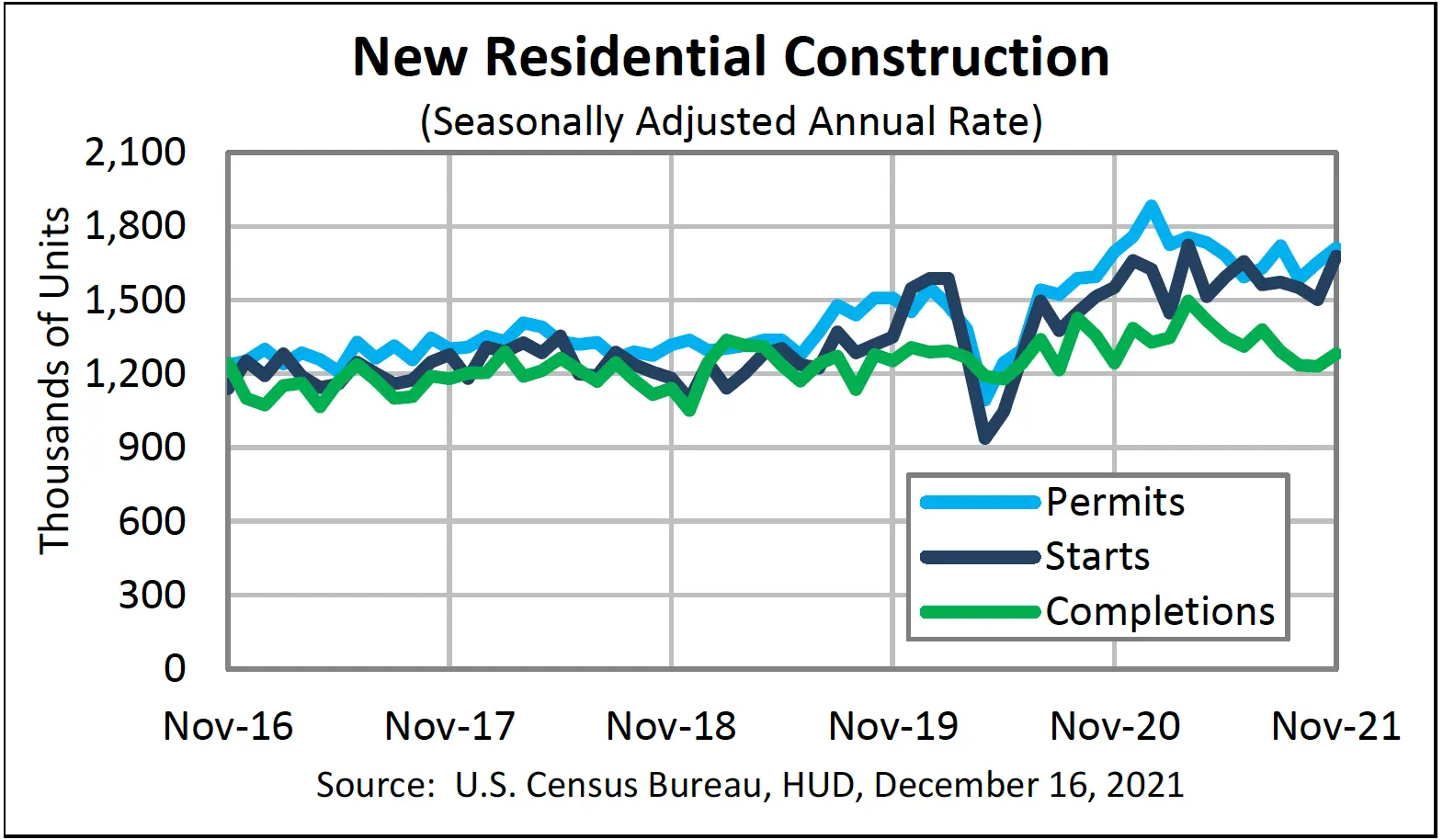

Builders are still playing catch-up to meet demand—surpassing previous building booms. Housing starts jumped 11.8% to an adjusted annual rate of 1,679,000 units.

“The homebuilders are not building as many speculative homes because they don’t have to,” according to James Gaines, an economist with the Texas Real Estate Research Center at Texas A&M. “They are selling them faster than they can build them.”

Rates Rise

Mortgage rates ended the month at 3.1% for a 30-year fixed mortgage with mortgage applications down 7.2%. Looking ahead, experts predict the rate to rise to 3.5% as the Fed raises interest rates to control inflation.

With that said, experts are fairly consistent in the view that price appreciation will slow from last summer’s unsustainable levels. “While I expect neither a price reduction, nor another year of record-pace price gains, the market will see more inventory in 2022 and that will help some consumers with affordability,” Yun predicted.

New Opportunity. New Western.

There is no time like the present for real estate investors to lock in rates and capitalize on timely opportunities. With an ever-changing market, it’s critical to have a pro in your corner who can uncover the right deals to fit your investment strategy.

New Western agents are constantly identifying value-rich opportunities for our clients. Let us help you discover the one that fits your strategy.

Contact us to see if you qualify for access to our exclusive inventory.