Written by The New Western Team

New Western is committed to delivering opportunities to aspiring investors and keeping them well-informed with timely and relevant content that follows strict editorial integrity.

Learning how to find investment properties is an exciting step towards achieving financial independence and working for yourself.

Getting organized and streamlining your plan will make the process of finding that rent-and-hold or fix-and-flip property successful and get you on your way to building a business.

This detailed guide for selecting the best investment properties for your needs will get you started on the right path.

A tried-and-true way of generating income and diversifying a portfolio is real estate investing — there’s no two ways about it.

As a beginner, you’re not going to know the trade secrets about the best places to find investment properties, and that’s okay. you want to become a real estate investor.

This may seem simple, but defining your “why” helps to keep you motivated. When you allow yourself to really dig deep and think about all that you want to achieve, and actually write it down, you might discover how important this investment journey is for attaining the life you want to live.

The process of finding an investment property to suit your needs is a long-term plan. And once you’ve locked that plan down, it becomes a tool that you can use again and again.

What are some personal goals you could achieve as an investor? Why a lot of things! Investing in real estate could allow you to:

It doesn’t matter what your “Why” is, treat it as a motivational tool. Print it out, make it a reminder on your phone (or even your wallpaper), whatever works for you.

If ever along this journey you feel discouraged, you can look back at those goals and remind yourself why you’re doing this.

Helpful Tip: Develop Market Research Analyzation Habits:

It can be easy to understand both your personal reasons for wanting to invest in real estate and the tactical reasons.

You may have a pretty decent idea about the type of properties you want to invest in, but you need to confirm your thoughts with research.

The only way to truly define your investment property goals is to educate yourself, research continuously, and develop an analysis habit.

You need to become an expert in the local market you want to invest in. Not just casually perusing listings and occasionally researching properties to buy-but develop a habit of studying and analyzing deals.

Creating a daily or weekly habit of analyzing properties and studying your market is not only good practice but it will help build the confidence needed to take action, no matter how many properties you want to buy.

Don’t let analysis paralysis stop you from moving forward — habit and practice will keep you prepared to act.

When you’re investing in real estate, there’s always the risk that you’ll lose money. That alone should be enough to get you motivated to learn all that you can about this industry — especially since the potential reward could be so great.

The following is a list of some of the most common reasons people favor investing in real estate when they want to diversify their portfolio.

Property tends to appreciate in value because of time or physical improvements. If your investment strategy involves buying and holding, then your tenant pays the mortgage while your property increases in value over time.

And if your strategy is to fix and flip, the cosmetic and structural improvements you make allow you to physically “appreciate” the value of the property before putting it back on the market and selling at a profit.

The rent payments you receive each month from your tenant pay down your mortgage and increase your equity. That equity also becomes leverage if you need to pull out cash or qualify for credit to purchase another property or make improvements or repairs.

Your equity continues to grow as the property appreciates and your tenants pay down your loan. And if you fix and flip? The loan payoff and profit are pretty instant and obvious.

You can earn a profit every single month that a tenant pays the rent. The more long-term rentals you own, the more income you’ll receive. And if you consider switching from a steady long-term rental to a short-term rental, you have the ability to increase your cash flow every month.

You’ll have more flexibility to adjust nightly rates and control how many days a year the property is occupied with the potential for increased profits for vacation rentals or destination spots.

Short-term and long-term rental income is taxable income. You can write off assets such as furniture, appliances, and décor as well as equipment, your time, and travel to your properties, home office, and computer.

Write-offs help reduce your taxable income, and when tracked and documented properly, can help you maintain maximum profitability. Working with a tax strategist and real estate lawyer will help you make the most of your rental income.

Inflation decreases the purchasing power of a dollar, and this continues to happen over time. If the income you’re making does not outpace inflation, the value of your dollar is decreasing.

There will always be a demand for homes in any economic climate and when inflation rises, so do property values.

When you buy a property with a fixed-rate mortgage, your monthly payment stays the same and is based on the value of the dollar at the time of your purchase. As your property appreciates in value, your interest rate stays the same.

And the same goes for rental income. Rental income also keeps pace with inflation. Rents rise over time but your mortgage stays the same. When you keep your rents competitive with the market and raise them over time, you create more income.

The best location is likely the one you know the most about. Your knowledge of an area is an extremely valuable asset. So a simple place to start researching and analyzing deals is to look where you live.

You know your local market better than people who don’t live there. You know the neighborhoods, grocery stores, highways, hot spots, schools, businesses, parks, and the local government-the list is extensive and should boost your confidence.

That also means that you’ll know if your market has opportunities. It might not.

If your local market doesn’t have the kind of deals you’re looking for then consider branching out and choosing communities within a radius that you feel comfortable driving to, often.

Job opportunities, a strong economy and a growing population are great places to start.

When researching a potential location, ask yourself:

In other words, get to know that market. The goal to choosing the right market to invest in is to become the local expert. But, how?

Drive the streets, go to the grocery store, attend a city council meeting. Go to the restaurants and retailers and ask them about their community—talk to vendors, contractors, bankers and check out the local paper.

You can do research online to determine school ratings, crime, public transportation, shopping and subdivisions.

Remember, there is no substitute for spending time in person, meeting locals, neighbors and other business owners to see what they have to say about the neighborhood.

You need to evaluate neighborhoods based on what will draw potential buyers or renters. And that’s why restaurants, schools, crime and transportation are important.

But what about the type of property in that neighborhood?

You could consider:

There is quite a bit of work that goes into choosing a location to find an investment property that suits your needs. And that’s why it’s an important aspect of defining your investment goals.

With these location parameters in place, around the location and type of property you think you’d like to invest in, it will be that much easier to establish and outline a strategy.

If you think today’s interest rates are too steep (the average rate being 6.69% as of December 1, 2022), they’re a long way off from the 16.63% homebuyers and investors were saddled with in 1981.

Don’t get us wrong, the rates today aren’t anything to sneeze at; especially when you take into consideration that 2020 and 2021 saw record low interest rates — 3.1% and 2.96% respectively.

Average 30-Year Rate over Five Decades

Credit: The Mortgage Reports

Other than interest rates, what other metrics should you look at to determine whether now is the right time to invest or not?

At both the national and local levels, the Housing Affordability Index (HAI) evaluates how easy it is for a family to obtain a mortgage loan for purchasing a home that costs the median amount. In most cases, this is determined using one’s salary in conjunction with the most recent pricing data.

When the score is equal to 100, it implies that a family earning the median income has sufficient incoming cash or salaries to qualify for a mortgage on a property priced in the median price range.

If the value is more than 100, it implies that the income for the same household is more than enough income to qualify for a mortgage with a 20% down payment. If the value is less than 100, then that household’s income is less than necessary to qualify for a mortgage.

According to data provided by the National Association of Realtors, the national HAI score was 96.6 in September 2022, which is a dramatic drop from its previous value of 146.8 in April 2021. However, the regional HAI score will paint a different picture. The data shows that the purchasing power in the Northeast (100) and Midwest (130.4) is higher than in the South (96.5) and West (67.6).

Note: Homeowners should be able to purchase a property that fits within their budget (no more than 30% of their monthly income should go toward housing costs) and they’ll have enough money left to cover any other living expenses, such as the utilities, food, child care, and transportation. Based on the most recent data, the average American cannot afford to buy.

The number of days a house is on the market is referred to as its “days on market” (DOM). This number is calculated from the moment the property is initially put up for sale until the date the sales contract has been signed by the seller.

In essence, it identifies the time it takes for a property to be purchased. You can gauge how active the local market is by the average number of days a property is on the market.

Homes that were purchased in 2021 and 2022 sold quicker than previous years because of the historically low interest rates and dwindling inventory. According to information provided by the St. Louis FED, the median number of days a house stayed on the market was 31 in May 2022, whereas in November 2022, Realtor.com reveals that number has increased to 56 days.

In short, the faster properties sell, the stiffer the competition and higher the asking price.

Housing supply indexes count the number of unoccupied homes that are currently on the market for purchase.

There are separate housing inventory indexes for new construction and another for existing homes. These indexes are updated annually and you can evaluate how in-demand the properties are in your market.

The number of available homes is a significant factor that influences pricing. If there is less housing available in a particular region, this implies that more individuals are moving to the area and buying real estate.

When there is a rise in the supply of housing, it suggests that individuals are leaving the region or that there is an excessive amount of development; both of which will cause housing prices to decrease.

The impacts of seasonality on the housing market vary by area and occur at different periods of the year. The Northeast and Midwest real estate markets, for example, are more busy during the summer months, when demand is strongest.

Because of heightened demand and a higher volume of property sales, spring and early summer are frequently the busiest seasons of year for real estate transactions.

The calendar year, the weather, and the school calendar are all factors that determine seasonality, and a result, the months of April through August are the busiest of the year. On the other hand, housing demand is often lower between November and February.

In other words, buying during the slower months may be more beneficial because you’ll have less competition for properties and may even be able to negotiate with sellers to get the best deals.

This relates to if the market is driven by buyers or sellers. A buyer’s market benefits homebuyers and investors since there are so many active listings to select from.

A seller’s market, on the other hand, is lucrative for sellers because there are far more buyers than properties available for sale, allowing for greater demand and pricing.

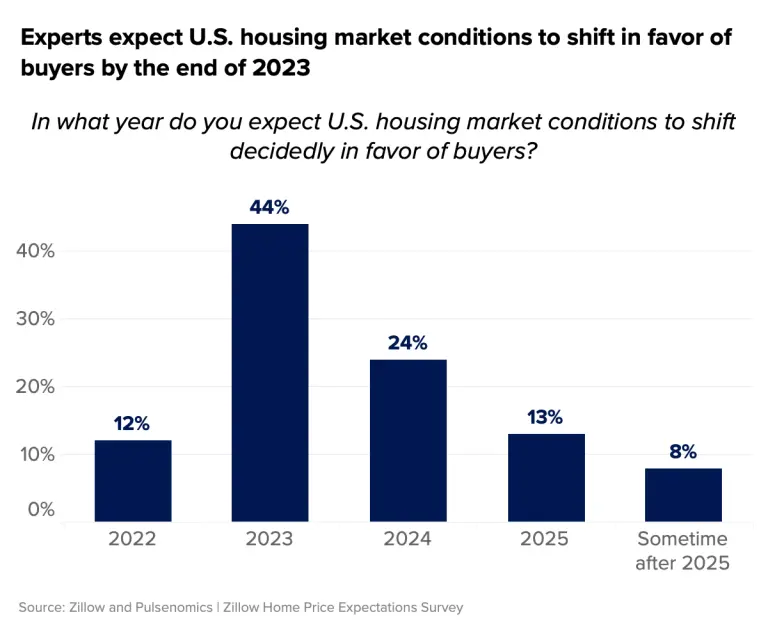

The past few years have strongly favored sellers, but it’s predicted that the market will shift in 2023 and buyers will be the ones with all the power.

According to the Zillow Home Price Expectations Survey, 44% of economists and housing experts predict that home prices in areas that saw the largest growth during the pandemic will experience swiftest declines.

Credit: Zillow Home Price Expectations Survey

The term “rental affordability” refers to the number of people who have the financial ability to afford a rental property. Statistics on rental affordability make the assumption that the average tenant will spend no more than 30% of their monthly income on rent. That said, approximately 40% of renters spend 35% or more of their total income on rent.

When an area’s rental affordability is high, that means renters are spending less than 30% of their monthly income on rent. When an area’s rental affordability is low, that means renters are spending more than 30% of monthly income on rent.

When you’re deciding on where to invest, you have to pay close attention to rental affordability. If you’re buying in a high-rent area, you’ll have more rental applicants but may not be able to get as much in rent. However, if you invest in a low-rent area, you could charge more for rent but it’ll be harder to find qualified tenants.

The United States Census Bureau publishes a monthly statement regarding the spending activity for new development projects in the country, measured in dollars.

The report divides spending into residential and nonresidential categories, as well as private and public spending. It also provides data from the previous 12 months.

The survey has been undertaken by the Bureau for more than 50 years, and it includes information for new construction or renovation projects in both the public and private sector.

The data covers everything from the cost of labor and supplies, architectural and engineering services, as well as administrative costs, interest, taxes, and contractor profits.

Why does construction spending matter? The National Association of Home Builders (NAHB) reveals that builder confidence in the market has dropped eight points, making it the lowest confidence reading in a decade (not including the 2020 pandemic).

NAHB Chairman, Jerry Konter, stated in a press release: “High mortgage rates approaching 7% have significantly weakened demand, particularly for first-time and first-generation prospective home buyers.

Another housing starts report from the United States government tracks building activity across the country by tracking the issuance of building permits and the commencement of construction on new single-family homes. The data includes a regional breakdown, as well as monthly and annual totals.

In the same release, NAHB Chief Economist, Robert Dietz, states: This will be the first year since 2011 to see a decline for single-family starts. And given expectations for ongoing elevated interest rates due to actions by the Federal Reserve, 2023 is forecasted to see additional single-family building declines as the housing contraction continues.”

Sales activity and the rate at which properties in a particular region are bought are analyzed by home sales indexes. Most databases are evaluated, revised, and updated to reflect current market trends. These indexes are useful because you can compare the current data to the data of the previous year.

When there’s a surge in home sales, it indicates an increased demand for housing. This, unfortunately, means that you’ll have less negotiation power. But when it’s a buyer’s market, you could negotiate lower prices, assistance with closing costs, and more.

One way to measure the health of the mortgage market is to look at the origination activity of mortgages and related products. Generally speaking, the origination of a mortgage loan is the first step in the process. When the number of mortgages originated is high, housing prices and interest rates tend to be more affordable.

People often apply for mortgage loans when their household income increases and they are able to save up to begin the process of buying a house. If you’re interested in investing in a low-cost area, look for regions where there’s a higher rate of mortgage originations.

Note: Areas with a high number of FHA loans being originated may cause home values to be lower than average for the area. Be mindful that when there are more FHA loans issued in a given location, the average income and credit ratings of the residents could be less than ideal. This is crucial data for prospective investors who are looking to purchase a rental property.

Mortgage delinquency indexes record the number of homeowners who have fallen behind on their mortgage payments. A buyer in standard delinquency isn’t in foreclosure yet because they’re only 30 days late on their payment. However, when a homeowner is more than 90 days behind, then they are now considered “seriously delinquent.”

A rise in mortgage delinquencies is a strong indicator that the average income for locals is declining while the cost of living continues to rise. This could also mean that mortgage companies are approving too many loans to unqualified buyers, much like they did in 2008.

As an investor, if you’re considering purchasing property in an area where the number of seriously delinquent borrowers is on the rise, run away. It could be an indication that house prices were too high when the borrower took the loan or the economy isn’t doing too well.

While this could be good for investors who are looking for low-cost foreclosures, it’s worth noting that there’s a chance that these properties may need extensive work before they can be rented.

There are many ways you can invest your money and some investment opportunities are better than others, it really depends on a few factors that you need to think about.

A person’s risk tolerance refers to how much they are able to tolerate whenever there are changes to the value of their investments.

Are you prepared to take major risks in the hopes of gaining significant rewards? Or do you want a portfolio that isn’t going to keep you on edge? Tolerance for risk might be a psychological trait or it can simply be determined by the demands of your own unique financial circumstances.

Investors who are more cautious or who are getting close to retirement age may feel more comfortable putting a greater proportion of their portfolios towards assets with lower degrees of risk. These are good options for those who are budgeting for both short-term and long-term objectives.

For example, if you have CDs or other accounts that are FDIC-protected, they will maintain their value even if the market gets erratic, and they’ll be accessible to you whenever you require them.

People with a higher risk tolerance and are still saving toward retirement, or who have more than a decade before needing their money, could choose riskier investments. If you have time, you might be willing to take larger risks and (hopefully) reap larger returns.

How much capital do you have available to contribute to an investment? The more capital that you have available for investment, the greater the likelihood that it will be profitable to study higher-risk, higher-return options.

That said, when you’re comparing commercial and residential finance, investors who are interested in either option may develop a preference for one over the other.

Many investors are under the impression that it’s easier to get funding for residential investment deals since the total amount of cash required is typically lower.

On the contrary hand, some investors believe that it is easier to secure financing for commercial deals since the large profit margins are appealing to lenders. This is the case because commercial deals often have a longer holding period.

Overall, both ventures have their advantages and disadvantages; the trick is to keep a robust network and use a range of funding sources to your benefit.

What you invest in is largely determined by the amount of investment expertise that you possess. Investing in anything like a savings account or CD’s requires very little expertise, especially considering the fact that your account is insured by the Federal Deposit Insurance Corporation (FDIC).

However, extra knowledge is necessary when dealing with market-based items such as stocks, bonds, and of course, real estate.

You should learn more about the properties you plan to invest in, and if they need a higher level of expertise. If you want to invest in mutli-family properties (a property with more than five units), for instance, you need to have extensive information regarding the ins and outs of managing such a large residential complex — it’s going to be a lot more challenging than managing one or two single-family properties.

Despite this, there are strategies that can help you profit from the current real estate market, even if you don’t have an in-depth understanding of it. One of the most effective ways you can gain insight is by reaching out to fellow investors on real estate investor forums, Facebook groups, or even the experts at New Western.

In short, when considering investments, it is important to be aware of the boundaries of your expertise and knowledge base.

When you talk about your time frame, what you really mean is when you’ll need the money. Do you want the money today, or do you think you would need it in 30 years?

Do you plan to utilize the money you save for a down payment on a house in three years, or are you putting it away for retirement? The investor’s time horizon is a critical factor in determining the kind of investments that are most suitable.

If your time range is somewhat limited, it is important that the money be available in the portfolio at a particular moment and not be allocated to anything else.

Because of this, you should put your money into more secure assets including savings accounts, certificates of deposit, or even bonds. These are less volatile and, in general, safer investments.

When you have a longer time frame, you have the option of taking on greater risk with assets that have the potential for higher returns but also higher volatility.

Because of the length of your time frame, you are positioned to ride out the highs and lows of the market, which should presumably lead to higher long-term returns. When you have a longer time frame, you’re able to make investments in real estate and hold onto those income-earning properties for many years.

It’s imperative that whatever money you’re using for your investments aren’t needed for immediate expenditures. For example, you shouldn’t use the money you’ve put aside your rent or mortgage just because a good deal came your way.

Business isn’t about deals. It’s about relationships and we’d love to begin one with you. Interested in buying a property? Have a question about our process? Curious about a local market? Let’s talk.

You’ve defined your initial goals for investing in a property. You know why you personally want to invest in real estate, you understand the practical reasons to invest in real estate and you now truly understand the importance of analyzing market data and becoming a local expert.

Now it’s time to outline your strategy. The question is, what will your investment strategy look like? Are you going to buy and hold, or will you fix and flip?

Getting started is what really matters and becoming an expert in one strategy will help you master your investing goals sooner. But that’s the beauty of real estate investing.

You don’t have to choose one or the other because you can do both. However, when you’re doing your first few deals, there could be a benefit to choosing a strategy and sticking to it.

So consider this…

If holding onto a property and managing long term or short term tenants sounds like too much commitment and you want to move quickly, then you may need to go for a fix-and- flip.

But if the work and fast turnaround that goes into quickly fixing and selling an investment property doesn’t appeal to you as much as holding onto an appreciating asset then consider the long or short term rental.

There isn’t a right or wrong way to choose a strategy. Knowing your initial gut feeling about which strategy suits you best will help to evaluate every property you consider purchasing. This is a great way to eliminate or add a potential property from your list.

You can always pass along that amazing fix-and-flip to an investor friend who will, in turn, send that buy-and-hold your way. Now that’s a networking strategy, to boot.

Determining your strategy will also help you determine locations, neighborhoods and communities that support a fix-and-flip or buy-and-hold rental. This will save you quite a bit of time when analyzing deals and searching for locations.

One of the advantages of investing in real estate is that there are multiple exit strategies available to investors. Not only can investors opt to flip their property, they can also choose to rent it out and generate passive income.

Having multiple exit strategies gives investors options and flexibility in the event that the market shifts, or the property takes longer to sell.

This makes real estate an attractive investment due to its potential for a high return on investment and the ability to be adapted to changing market conditions.

When investing in a home, “buy and hold” means purchasing a property with the intent of keeping it for a significant amount of time (typically five to thirty years).

Not only is there appreciation in value, but providing that you’re in a good market and are able to find reliable tenants, you could generate passive income by renting the property.

To make a profit, an investor must wait until the sale price of an asset is higher than the amount originally invested in it. Of course, you can also keep collecting rent.

In most cases, you can’t just skip the “rental” part of buy-and-hold investing. Real estate investors rarely see a return on the investment of empty rental units. If that happens, the property may deteriorate to the point where the investor loses money on the sale.

The cash flow from a buy-and-hold investment in a rental property should, at the very least, cover the mortgage payment each month. In other words, the rental income is greater than the monthly ownership cost.

Therefore, the investment property generates a positive cash flow for the investor every month.

That’s why a buy-and-hold strategy can generate profits in the long and short term.

The BRRRR method is widely used by investors, even if not everyone is familiar with the acronym. The acronym stands for:

Along with the BRRRR method, you could try something called “house hacking.”

The term “house hacking” refers to the practice of looking for ways to make money without leaving the comfort of one’s own home. To “house hack,” one would typically invest in a multifamily building (usually a duplex or triplex), residing in one of the units while renting out the others. This would allow the renters to cover the mortgage while the owner accumulated equity.

Savvy investors have long understood that purchasing a multi-family property is a simple method to learn more about property management and what it means to be a landlord while having their mortgage (and associated fees) paid for by their tenants.

There are a few different ways you can house hack:

You can use this investment strategy for all sorts of property types. The most common property types include:

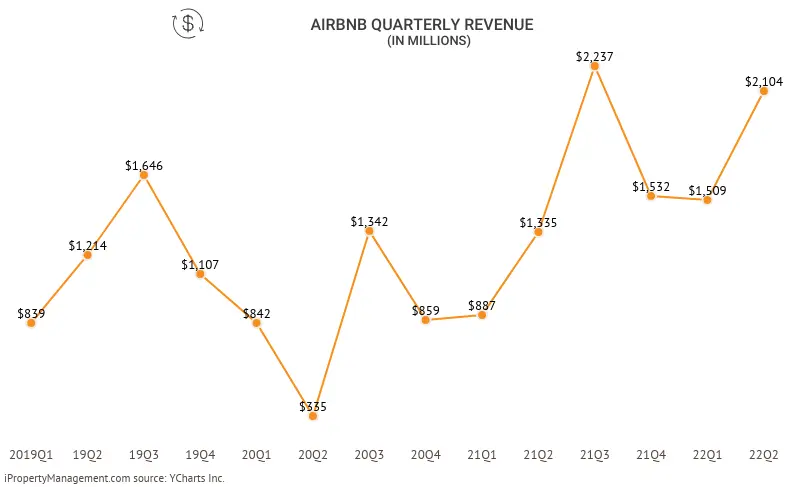

In recent years, there has been a rise in the number of people opting for short-term rentals like vacation homes. Heck, Airbnb brought in $2.104 billion in profits all by itself in Q2 of 2022.

Credit: iPropertyManagement

Cash flow is becoming increasingly hard to get, primarily because home prices are rising so much faster than rents. But STRs still offer great cash flow potential.

Of course, you need to have a good property in a good market—just like with any investment—but STRs have proven to offer cash flow even in markets that typically don’t have cash flow, like Denver, Austin, and Seattle.

Second, the markets that tend to do well for STRs are also high-appreciation markets. Think about where people go on vacation, like ski towns, lake houses, or big cities like Miami.

There are markets that have grown immensely over the last several years. STRs offer the options to get cash flow and be in great markets that have big potential for property appreciation.

So, if you live in a region that draws many tourists who wish to stay near a popular tourist spot, then investing in a short-term vacation rental is a wise choice because you can use the money you make from those vacation rentals to help pay off your mortgage or to buy more investment real estate.

When considering short-term rentals, it is important to be aware that some areas and Homeowners Associations (HOAs) may have specific rules or regulations regarding rental length.

It is important to do your due diligence beforehand to ensure that you are compliant with any applicable laws or regulations. Depending on the region, certain areas may not allow for the rental of properties for less than a certain amount of time.

To avoid any potential issues, it is important to review any applicable regulations before beginning a short-term rental. This will ensure that you are in compliance with local laws and regulations and that your rental is successful.

A single-family residence is a dwelling unit that does not share a lot with any other buildings. An investment in a single-family home is essentially an investment in a house or a condominium with the intention of renting it out to a single tenant.

An easy way to think about investing in single-family rental properties is as a way to earn money from your property. There are some benefits and drawbacks to the property, but they will vary depending on your needs.

Buying a house in a cheap neighborhood and fixing it up to rent out is a common strategy. Those who want to put their money into single-family rental properties have a lot of leeway in how they choose to rake it in.

Buying single-family rental homes has many benefits, including substantial tax deductions, passive rental income, and long-term capital appreciation.

New real estate investors can enter the market with relative ease by focusing on single-family rental homes. The asset may appreciate in value over time, and investors may see a return on their initial investment right away. Investing in real estate that generates passive income is an excellent means of preparing for your golden years.

Similarly to the buy-and-hold strategy, the turnkey approach involves no renovations or maintenance on the part of the investor. It entails purchasing properties that are ready for immediate occupancy and are already being managed by a property management firm.

It’s possible that there are already occupants there. Due to the low barrier to entry, this investment approach is very popular among both new and experienced investors.

After making the purchase, you can immediately begin collecting rent. A turnkey provider is a great resource for locating turnkey real estate.

Local real estate agents and managers specialize in locating, acquiring, and maintaining residential rental properties. This is a common strategy for first-time investors who want to get into the real estate market without first having to deal with any maintenance, repairs, or renovations.

If you already have some rental properties or single-family homes but want to diversify your holdings, a multi-family dwelling could be the way to go.

In this buy-and-hold strategy, the investor purchases a structure with multiple dwelling units. These require a larger initial investment, but the monthly rent you collect from multiple families will more than make up for it.

If you’re ready for a new challenge, you can take your buy-and-hold investment plan in the commercial real estate sector.

Emerging real estate investors should generally avoid this type of investment because of the complexity of the lease agreements, the struggles of the regular maintenance, and the higher costs involved. Although risky, a long-term investment in this type of real estate could pay off handsomely if you’re up for the challenge.

Fix-and-flip refers to the practice of buying a home at a low price, making necessary repairs, then quickly reselling it for a profit. Remember that if a house is purchased at its full asking price, the resulting profit will be substantially smaller.

Investors are advised to quickly resell the property to avoid having their assets being tied up into a single property while still paying for things like property taxes, interest on the mortgage, and so on.

The best time frame for purchasing, fixing, and selling a home is 12 months, but for experienced investors, it can be done in as little as one or two months — depending on the work that needs to be done and the local market.

Finding homes with strong flipping potential can be difficult if you’re just starting out in the business. House flipping is one of the most lucrative investment strategies since it exposes you to one of the largest and stable asset classes while also giving you the means to diversify your income.

Thus, countless inexperienced investors will snap up the first property that becomes available, regardless of its value.

Unfortunately, many of these eager investors give up on real estate investing entirely after facing difficulties in completing renovations and finding buyers.

Rehab experts base their house-buying decisions and actions on the knowledge that a certain property’s condition and other factors will determine whether or not it will be a profitable flip. Location, size, condition, and other aspects of the property all play a role in determining a home’s market worth.

Investors in the real estate market typically choose between two strategies: “Fix and Flip” or “Buy and Hold,” depending on the property’s potential for profit. Both sorts of real estate investments have their advantages and disadvantages, leaving first-time investors unsure of which to choose.

The reality is that there isn’t a right answer because every investor’s situation will be different. To determine which method might work best for you, ask yourself these questions:

House flipping lenders and hard money lenders have no trouble funding either type of investment. Buyers who plan to flip a home will require a larger cash down payment to cover the costs of repairs, construction fees, and other maintenance.

Be aware that there will be vacancies in the buy-and-hold strategy, and you’ll need to have cash on hand to cover them. You have to choose an investment strategy that works best for your budget and available funds.

There won’t be many ups and downs in the housing market. However, after a few months, there may be a noticeable shift. Since the average house can be fixed up and sold in a few short months regardless of the market, house flipping is unlikely to be affected by market fluctuations.

The buyer must exercise caution when engaging in buy and hold. It is important for them to investigate local real estate trends and see where real estate values are heading before making a purchase. Don’t put your money into a property if there’s little hope of reviving the market.

Investors who flip houses typically only spend a short amount of time at each property they manage, whereas a buy-and-hold investment can take years, so frequent visits are essential for effective property management. Make sure the property isn’t too far from where you currently live so you don’t have any regrets down the road.

Note: If you plan on using a property management company to handle your rental properties, this may not be a concern.

The returns from fix-and-flip investments typically materialize in under six months, while those from buy-and-hold investments don’t materialize until much later. High returns can be earned from holding a property for a long time, but only if you’re patient.

Flipping homes is a good strategy if you really want to make a profit quickly, but buying and holding is a better strategy if you’re interested in building wealth over the long term.

House flippers who are in the highest tax bracket will likely pay more in the long run than those who plan to keep their purchases as long-term investments. Be sure to pay a sizable portion of your profits in taxes and make smart financial plans.

Business isn’t about deals. It’s about relationships and we’d love to begin one with you. Interested in buying a property? Have a question about our process? Curious about a local market? Let’s talk.

There is no universally accepted way of defining a good rental property; nonetheless, there are a number of signs and benchmarks that may help you determine whether or not a certain property is a desirable addition to your investment portfolio.

Here are a few things to look out for when you’re trying to identify a “good” investment property.

One of the most important factors in a property’s profitability is its location. A property’s location is crucial because it will impact how much rent you collect, who moves in, and how often your unit is vacant.

If you’re planning to keep on to the property and rent it out in the future, then you should opt for a location that is close to plenty of multiple services.

Tenants will be more interested in your rental if it is located near preferred amenities like good schools, a robust job market, public transit, parks, restaurants, retail complexes, post offices, medical facilities, libraries, and other entertainment options.

Before buying a house, check the local crime statistics. Here are a few helpful websites you can use:

When you’re doing a market analysis, you will analyze a variety of factors, including the economy, employment rate, educational level, and even the environmental status of the area. Consider the local economy, population, and demographics, as well as the state of technology and politics to see if moving there is a good idea from a financial and lifestyle standpoint.

To find this information, you can use sources like:

Other information that you’ll want to look at when doing a market analysis includes:

Plans for Future Development

If you’re looking to build in the region, or if you’re interested in learning about potential future developments, you should contact the local municipality’s planning department.

The more building that is being done, the more development is taking place. Think about any recent changes that could cause property values to drop in the neighborhood. You should view any upcoming construction projects as potential rivals to your rental property business.

Job Market and Outlook

More people will want to live in areas where more jobs are being created. The U.S. Bureau of Labor Statistics (BLS) can provide information on the percentage of the working-age population that is now employed in various metropolitan regions.

Average Rent Prices

Obviously, the potential for rental income is going to be a major consideration when choosing an investment property. The typical rental income in your desired location can give you a good idea of how much you may anticipate to make.

It’s important to be sure that the rent you charge will be sufficient to cover your mortgage, property taxes, and any other costs that may arise. Look into the future of the region and predict how it will look in five to ten years. A big tax rise on a cheap property may spell insolvency down the line.

Note: Real estate market analyses, like comparative market appraisals (CMAs), are subjective, but in-depth analyses take into account more variables and data. They are also not the same as the appraised value of a property, which is determined by a licensed appraiser. You can read more about real estate CMA’s here.

It is common for inexperienced buyers to overlook the impact that a property’s condition can have on their investment. Of course, there are also some who let fear prevent them from making otherwise worthwhile property investments, too.

For example, regardless of how unsightly the property appears, it is still possible to gain some kind of value simply by doing cosmetic upgrades. Even properties with termite damage or foundation issues could still be rented.

The regular costs of maintaining the property are another factor that should not be overlooked. If you’re planning on renting out the property, you’ll want to consider things like:

The value of the property is important, but what’s more important is the value of the property in relation to how much money you’ll be spending on it.

When compared to other sorts of investors, real estate investors clearly prioritize a different set of factors. Some investors look for wholesalers they can work with to get really cheap deals. Other investors will only invest in luxury properties where they can charge a lot in rent or resale.

Appreciation is great, but cash flow is king and speculating on future value should be a secondary focus. For some investors, buying a pre-built new construction property may not make a lot of sense, whereas it may make sense for others.

It really depends on the location because property values are always shifting, making it difficult to nail down a building’s potential for generating income.

If you’re just starting out in the real estate market, you might decide on a place to invest based solely on how an area makes you feel. That’s an easy trap to fall into, so be careful.

You should keep in mind that you won’t be staying at this property, so your personal preferences don’t really matter. Data is what really counts.

You’ll want to develop a comprehensive financial plan before buying. Don’t forget that you have more than just the mortgage payment to keep in mind. Other factors to think about should include things like typical vacancy rate, operating expenses, and property taxes.

Remember, higher rent prices in one location isn’t a guarantee that you can count on a steady cash flow. You’ll need to think of your investment in terms of financial gain. Think about the return on your investment in terms of both time and money.

It’s not uncommon for reasonably priced investments with affordable rent to outperform high-profile rentals in the long run.

How involved do you plan to be in managing your investment? The time and money spent managing the property is up to you, but if you’d rather take a hands off approach, a property management company may be the best option.

They’ll do all the work and you can reap the rewards — minus a small management fee (usually between 8% and 10% of the monthly rent).

That said, you shouldn’t assume that the property management fees will cost more than if you’re self-managing your own properties. Why, the property management company could even save you some money.

How can they save you money?

If you have a couple short-term rentals, you’ll have to pay for advertising on each property. If you’re advertising on several websites, you may also be charged booking or leasing fees. However, if you’re using a property management company, the fees will cover that and more.

Your search for an investment property can begin once you’ve figured out which investment strategy . While “For Sale” signs on front lawns are a good place to start, there are plenty of other places to look for potential investment properties.

In this section, we’ll go over some of the most common approaches to locating investment properties; by no means is this a comprehensive list, but it should serve as a solid foundation for any novice real estate investor.

Do you want to find out about investment properties before they are put on the market? If that means there’s a chance that you’ll get a good deal, why wouldn’t you want to get the word out that you’re interested in investing in real estate?

Talk to everyone you know, including your friends, family, coworkers, and neighbors. Explain that you’re in the market for investment property and would want to hear about any suitable options. You should provide the location and the number of units you’re interested in purchasing as an investment property.

Perhaps they have a friend or family member who is selling their home, or they have noticed a property for sale in the area. If they know you’re in the market to buy, they may also suggest a seller they’ve come across. One of your contacts may be thinking about selling their own home and may be willing to help you out if you just ask.

Newspapers are another time-tested option for finding potentially lucrative real estate investment opportunities. Browse the real estate or classifieds sections of your local paper.

As you go through the ads, you’ll come across all sorts of real estate, but the most common tend to be single- and multi-family houses, apartments, condominiums, and mobile homes.

Most listings will be for properties being sold by their individual owners, but real estate brokers may also offer homes for sale. Just keep in mind that the newspaper shouldn’t be the only way you’re looking for properties because the ads aren’t updated daily.

Wholesalers collaborate with homeowners to find prospective buyers for their properties. They accomplish this by entering into a contract that grants them the right to buy the property, and then they turn a profit by selling the home to the buyer at a price that is higher than the original purchase price.

They basically act as a middle man who makes a profit by connecting a homeowner with an investor.

Wholesalers will post the properties for which they have a contract and will search for purchasers in a variety of different methods. You can discover undervalued properties that can turn a good profit and investment possibilities by going through New Western to find wholesale investment properties.

Property that has entered foreclosure because the homeowner defaulted on their mortgage is typically auctioned off to the person with the highest bid. After the bank recoups its costs and pays off any liens, any remaining funds must be returned to the homeowner in accordance with the law.

While auctions can be an effective way to purchase foreclosed properties, they are not without risk. The primary risk is that you are not aware of all the liens against the property and could end up owing more than you initially bid. Additionally, it’s important to thoroughly research the property before bidding, as auctions are generally sold “as is”.

In most cases, you aren’t going to see the property before making an offer on it, nor will you be able to get a decent look at the interior. However, while these sales may appear to be incredible bargains, there may be significant work that has to be done on the house behind the scenes.

Investing in rental property is less of a hassle than ever before because of the internet and other forms of modern communication. The Multiple Listing Service (MLS) is a useful tool real estate agents use to browse active listings, as well as those that will be coming to the market soon, which properties are under contract, and so on.

That said, the MLS is only accessible by real estate agents or those who have a real estate license.

Fortunately, MLS databases aren’t the only online resources available to real estate investors. On these sites, you can browse through thousands of available property listings.

In most cases, in order to gain access to the listings, you will be required to pay an annual or monthly subscription fee. To get the most out of your money, it’s crucial to pick the right website.

Some of the most popular real estate sites include:

Real estate speculators use the term “driving for dollars” to describe the practice of driving around particular areas in search for off-market properties that their rivals have overlooked.

Given that you’ll have to physically drive around and jotting down the facts of each distressed home you spot, this isn’t the most efficient method for finding off-market deals; but, it can be a valuable addition to your arsenal nonetheless.

Since it is difficult to scale, it’s not uncommon for real estate investors to use driving for dollars as a secondary approach. Every day, people “drive for dollars” on their way to and from work, the gym, and other activities. Then you’ll have other investors might even hire other folks to drive around for them.

Crowdfunding in real estate is one approach for small investors to have access to assets that were previously only available to wealthier investors.

These sites and other real estate investing platforms connect private investors who want exposure to the real estate market without taking on the responsibilities of owning or maintaining property with real estate developers and other industry professionals.

Investopedia has compiled a list of, what they feel, are the the best and most reliable real estate crowdfunding platforms. They include:

The private real estate investment trust (REIT), Home Partners of America focuses on the rent-to-own market. To help responsible people who are unable to get mortgages, the company will buy their homes, rent them back out, and eventually give the tenant the option to buy the house from the company. HPA currently oversees over 17,000 single-family rental properties in the United States.

A similar tactic can be used by smaller investors by having potential renters find a home they would like to acquire, agree to a long term lease, and then purchasing the home with a renter already arranged.

Either a percentage of the rent paid each month can be allocated to the home’s purchase price in the future, or the lease agreement can include an option to buy the property at a later date.

Real estate owned (REO) by banks is another option for investors looking for a property to buy. Having foreclosed on a home, the bank is keen to get a non-performing asset (the foreclosed property) off its books since it does not want to remain in the real estate industry.

Buyers of REO properties, like those of auction properties, should come prepared to make significant repairs and either have the funds available to purchase the home outright or have pre arranged financing in place.

Properties that have been foreclosed on, are in default, or are otherwise in a state of disrepair can be found by calling the bank’s REO department or by using a website like RealtyTrac.

The National Association of REALTORS® estimates that there are more than 3 million active licensed real estate agents in the United States, but not every agent has the expertise to work with real estate investors.

An investor-friendly agent is someone who is familiar with the goals and requirements for investor purchases of rental property.

They devote themselves full-time to the field, have a keen eye for finding good investment opportunities, have a large network of professionals in the industry, and can have knowledge of off-market homes or pocket listings.

A homeowner in serious debt is another potential source of leads for off-market properties. If this is the case, you could try getting in touch with them in a friendly and polite manner to see if they’re interested in discussing the possibility of a short sale (the property is sold for less than the remaining balance of the mortgage), which could be beneficial to both parties involved.

The seller would avoid the ramifications of going into foreclosure and you would get a potentially lucrative real estate investment.

Investors in these properties should be aware that short sales often imply that the property is being sold in “as is” condition. With that in mind, you can find short sale properties via a real estate agent, a real estate brokerage, or the local courthouse.

You may also have some luck posting online that you’re looking for short sale properties or use sources like the newspaper or Craigslist

Business isn’t about deals. It’s about relationships and we’d love to begin one with you. Interested in buying a property? Have a question about our process? Curious about a local market? Let’s talk.

Regardless of the state of the market, selling a rental property may be a major pain thanks to the complicated tax regulations, the terms of any existing leases, and the general wear and tear caused by tenants. But, you have to take some action because when the moment is right, you could stand to make a lot of money from the sale without much hassle.

Money is always going to be a difficult barrier for first-time real estate investors, and many will start to worry that real estate investing is out of their reach.

But, that’s not the case at all. There are a lot of options out there that can get you one step closer to achieving your investment goals.

Here are some of the most popular ways new investors get funding for their investments.

Many investors’ understanding of conventional mortgages comes mainly from their personal experience buying and owning real estate, but this doesn’t mean they always give these loans the care they require.

Securing a conventional mortgage loan is feasible through various methods, as long as they adhere to Fannie Mae and Freddie Mac’s standards.

Although these loans tend to have lower interest rates there are some disadvantages, like a tedious application process, a long (and unpredictable) screening procedure, and sizable cash reserve that increases as you accumulate more debt with high balances.

As you get the property ready to be occupied by a tenant, hard money loans may be used as a temporary fix until an investment loan can be arranged on the property.

Hard money loans are different from standard loans in that you pay interest only rather than the loan’s principal. The length of the loan term can be up to 36 months, but the interest rate can be as high as 18%.

Unfortunately, these loans are an expensive short-term solution due to the overall high costs associated with their origination and closing.

Even though the loan can be approved in as little as a few days, they may be the most challenging to qualify for because your property is used as collateral and your credit history is scrutinized. Also, the ARV (after repair value) of a house is used to determine a borrower’s capacity to repay a loan.

Private money loans are loans made between two parties, typically between close friends, relatives, or business partners. Alternatively, joining real estate investment networking events is a good idea if you don’t have any family or friends that are willing to lend you money but still want to use private money loans.

The specific details and interest rates for private money loans can be beneficial for the investor, but they can also be quite predatory, depending on your connection with the private lender.

However, these loans are typically secured by a legal contract that gives the lender the right to foreclose on the property and seize it as collateral in the event that the borrower is unable to keep up with the payments on the loan.

Keep in mind that not everyone has your best interests in mind when choosing a private lender. If the lender is a loved one, your relationship with them may also suffer if you can’t make good on your end of the deal.

You may be able to utilize the equity in your primary residence or any other investment property that you own as a source of financing if there is a substantial amount of it. There are a few different routes that you can take in order to access the equity in your house.

A home equity loan is one way you can make use of the equity you’ve built up in your home. The fact that these loans are backed by the equity in your house is one of the benefits associated with receiving one of these loans.

Because of this, the interest rates can be kept at a reasonable level, and the repayment durations can be as long as 30 years. People who have a history of paying their bills on time are eligible for lower interest rates.

The equity in a property can also be accessed through the use of a home equity line of credit, sometimes known as a HELOC. These loans are likewise guaranteed by the equity in your house; however, in this scenario, you take out the money as you need it as opposed to receiving it all at once.

There is a possibility that the interest rates on HELOCs will be lower than those on home equity loans; nonetheless, the majority of HELOCs have variable interest rates. As a result, there is a possibility that in the future, the interest rate that you pay on your HELOC will be greater.

A cash-out refinance replaces your current mortgage with a new one that is for a higher amount of money and pays off your present mortgage. After that, you will have access to the monetary equivalent of the difference between the existing mortgage and the new one that you have taken out.

You’ll be able to put that cash toward the financing of your investment homes. Through the process of refinancing, it is possible for you to obtain a lower interest rate or a shorter payback term than what you are presently paying for your loan.

A fix-and-flip loan could be ideal if you’re ready to make a purchase without a lot of initial financial commitment.

With this loan, you could rehab a property without worrying too much about a high monthly mortgage payment. You’ll need a loan to pay for the repairs, and then you can sell the house for a profit.

You won’t have any trouble being approved for one of these loans because they are exclusively designed for investment properties. After the lender has taken their portion of the profits, you can receive a payment from the sale of the property.

Waiting to hear from a lender that you’ve been approved for a loan can be nerve wracking, to be sure. Here are a few tips that can help improve the likelihood of receiving a “You’re Approved!” notice.

To secure conventional financing from a lender, you’ll usually be required to make a down payment of at least 20%. This is due to the fact that mortgage insurance will not cover investment properties.

If you’re able to make a larger down payment (25% and up), not only can you forego the mortgage insurance, you might be eligible for a lower interest rate.

To put it another way, if the investment fails, you will have “more skin in the game” if you put down a greater down payment.

This can be a tremendous incentive, and if the down payment is larger, it also offers the bank with greater security against the possibility of losing its investment. The risk of total loss to you is greater than the risk of loss to the bank in the event of a bad investment outcome.

You should check your credit score before trying to make a deal even though numerous variables, such as the loan-to-value ratio and the lending company’s regulations, might affect the conditions of a loan on an investment property.

When your credit score is below 740, it may start to cost you more money for the same loan rate.

That can range anywhere from a quarter of a point all the way up to two points in order to maintain the same rate. You can choose to either pay points or accept a higher interest rate as an option.

Lenders also look favorably at borrowers who have enough cash reserves to cover expenses (both personal and investment-related) for at least six months.

Note: One point is equivalent to 1% of the total amount of money being borrowed. For example, if you’re borrowing $100,000, one point would equal $1,000.

If your down payment isn’t quite as much as it should be or if you have other special circumstances, you might want to consider going to a local lender for financing rather than a huge national financial institution if you need money for your investment.

Local lenders tend to have a little bit more flexibility when they’re making their decision. They may also have a better understanding of the local market and a stronger interest in making local investments.

Mortgage brokers are also another good choice because they have access to a wide variety of loan products. However, you should take some time to do your due diligence before deciding on which lender to ultimately go with.

The ratio of your debts to your income plays a significant role in determining whether or not you are approved for a loan to purchase an investment property.

Debt-to-Income (DTI) is a ratio used by lenders to analyze a borrower’s ability to repay a loan based on their income and current debts. In doing so, they can determine whether or not the price of the home is affordable for you.

DTI equals the sum of all monthly obligations divided by gross monthly income. To figure out your DTI, you can use this equation:

Total Monthly Debt / Gross Monthly Income = DTI

Your total monthly debt should include any payments you make each month. They can include:

Depending on which lender you’re going to be working with, you might need to have an income that is lower than a particular level. One rule of thumb is to keep your DTI below 50%, but if it’s 36% or below, you’re more likely to get approved.

Some lenders will allow you to include a portion of your expected rental income in your gross income to make things easier. However, you can’t always rely on this, and it’s important for your financial security to be in a position where you can afford the rental property if it’s unable to generate a steady income.

If you’re just getting started, being part of an investment partnership can be quite helpful because when you’re working with someone who has more experience, you have a better chance of succeeding than if you’re trying to figure things out on your own.

When putting together your first venture, it might be difficult to know where to start looking for an investing partner. You’ll want to find a reliable partner who has a strong will to strive for success and isn’t afraid of the potential risks that could arise.

Also, since your partner is (presumably) more experienced with how real estate investments work, you need to trust that they’ll keep a close eye out for any hiccups that could otherwise derail the deal. They should be able to answer any questions you may have throughout the process.

Oh, and don’t forget that they should be a skilled negotiator! Poor negotiations could mean you’re paying more for a property or worse

We at New Western want our readers to have all of the information they need to get started on the path to becoming a successful real estate investor. Let’s go over the information we covered in this guide.

If you’re looking to diversify your portfolio, consider investing in real estate. Here are some of the most common reasons people choose real estate over other investments.

The best location is likely the one you know the most about. You know the neighborhoods, grocery stores, highways, schools, businesses, parks, and local government-the list is extensive.

There is no substitute for spending time in person, meeting locals, neighbors and other business owners.

Interest rates aren’t the only metric you should focus on when you’re trying to decide when to get into the market. Other facts you’ll want to consider include:

You set property investment goals. You now understand why you want to invest in real estate, the practical reasons, and the value of market data analysis and local expertise. What will your investment strategy look like? Will you buy and hold or fix and flip?

“Buy and hold” is an investment strategy for buying a home with the intention of keeping it for a long time. Not only will the property’s value go up, but you can rent it out and make passive income. The cash flow from a buy-and-hold rental property investment should at least cover the monthly mortgage payment.

There are a few ways you can use the Buy and Hold strategy:

Fix-and-flip is the practice of buying a home, making necessary repairs, then quickly reselling it for a profit. This investment strategy exposes you to one of the largest and stable asset classes while also giving you the means to diversify your income.

Location, size, condition, and other aspects of the property all play a role in determining a home’s market worth. Many inexperienced investors will snap up the first property that becomes available, regardless of its value. That said, you could buy, fix, and flip a property in 12 months, but for experienced investors, it can be done in as little as one or two months.

There isn’t a definitive definition of a good rental property, but there are indications and standards that may help you decide if a property is a smart investment. Here are some signs of a “good” investment property.

After choosing an investment strategy, start looking for a property. There are several venues to find investment properties, including “For Sale” signs on front lawns. Here are some of the most common methods for finding investment properties. It’s not exhaustive, but it should give new real estate investors a good start.

Money is always going to be a big problem for people who want to invest in real estate for the first time, and many of them will start to worry that they can’t do it. But that’s not at all the case. There are many ways to get closer to your investment goals.

Here are a few of the most common ways for new investors to get money to invest.

Certainly, it can be nerve-wracking to wait for word from a lender on whether or not you’ve been approved for a loan. Here are some suggestions that may increase your chances of getting approved.

This guide should get you started in the right direction, even if you are a new investor who doesn’t have a solid grasp on the many different ways to find investment properties. There are countless investment properties just waiting to be scooped up if you know where to look.

When you use several different strategies for finding a good investment property, the higher the likelihood of finding your first rental and start making money.

You can ask your friends if they know someone who may be selling a home while you’re also looking online for potential leads. That said, resist the urge to explore every possible method for finding properties at once.

While it’s good to keep your options open, you don’t want to spread yourself too thin. You don’t want to hurry the due diligence process when vetting properties because you could miss some red flags and wind up making a poor choice that could cost you thousands of dollars (if not more!).

If you want to learn more about how to find investment properties and other real estate investing topics, bookmark our blog for more educational articles and guides like this!

Business isn’t about deals. It’s about relationships and we’d love to begin one with you. Interested in buying a property? Have a question about our process? Curious about a local market? Let’s talk.