An unprofessional property manager can be a huge hindrance to the success of a real estate investment portfolio. Being aligned with the wrong one can end up being a mistake that costs you dearly.

Unfortunately, bad property managers do exist. You don’t have to dig far into online forums to realize that both property owners and tenants have big feelings about local property managers.

Investors need to be sure they have the right property manager on their side. As such, we’ll examine the qualities that a property manager should and shouldn’t display, then walk through how to deal with an unprofessional property manager.

Characteristics of an Unprofessional Property Manager

As a real estate investor, you depend on your property manager to be the point person for renters, contractors, applicants, and more. You need them to maintain a standard of professionalism within business dealings. Here are a few ways that you can tell if your property manager is falling short of that professional standard.

Poor communication

A property manager should be accessible both to you and to your tenants. As a rule of thumb, that generally means prioritizing emergencies while also responding to all inquiries within twenty-four hours. Anything less would be considered unprofessional.

Property management tends to be a “feast or famine” kind of job, meaning your manager likely has some days where they can get to your call right away and other days where they’re swamped with communications from multiple properties.

So it’s not fair to expect your property manager to respond to every issue immediately. But a good property manager should be able to at least acknowledge your call/text within a day and let you know when they’ll get back to you in more detail.

Limited Hours

Similarly, a professional property manager should be available during non-business hours. In fact, emergencies often need to be addressed after work hours, because that’s when tenants are home to notice them.

Pipes don’t wait until morning to burst! If your property manager can’t be reached for emergencies in the evening, that’s not considered professional by industry standards.

Bad Tenants

In real estate investment, you’re bound to get a few tenants who fall behind on rent, break their lease early, or fail to keep up with HOA guidelines. But if you experience a constant stream of less-than-ideal tenants, that’s an indication that your property manager isn’t doing their job properly. They should be more professional in screening applicants and communicating lease terms.

Lack of Reports

Monthly reports (such as a P&L statement) should be sent to you automatically. Likewise, any additional information (such as receipts for work done) should be sent proactively or at least within a day of your request. If you’re having to beg for reports or you’re only getting vague answers to objective questions, that’s unprofessional.

Unexplained Expenses

Likewise, if your property manager gives you an in-house invoice with unspecific line items, you have reason to raise a red flag. You need to be able to trust your property manager to take care of all the little things that come up without bothering you.

But with that trust comes the need for accurate and thorough accounting afterward. Expenses should always come with a clear explanation (and receipts, if applicable).

Evictions

The process of evicting a tenant is unpleasant and costly. A good property manager should try to avoid evictions proactively by screening properly and communicating regularly.

Sure, the need to evict a tenant may arise even if your manager does everything right. But if a pattern of evictions emerges, you’re right to question the professionalism of your property manager.

Why Does It Matter That You Have a Professional Property Manager?

Legal Implications

Some real estate investors think that they can hire a property manager and then wipe their hands clean of any legal claims under landlord-tenant laws. After all, you put the manager in charge (and they’ve hopefully got liability insurance), so they’re held legally responsible, right? Wrong.

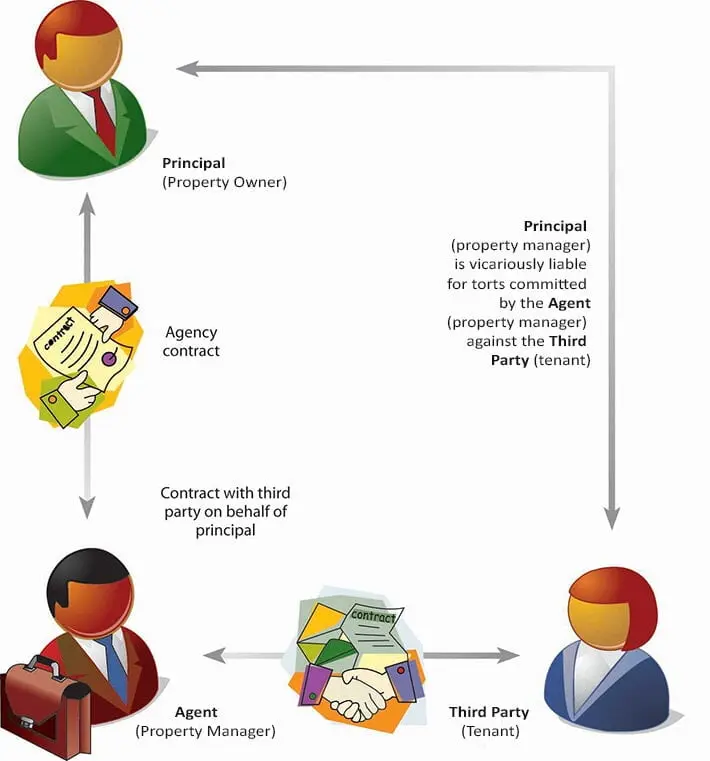

Since the property manager acts on behalf of the landlord, they are considered your agent. Under the legal principle of respondent superior, the principal (in this case, the landlord) is responsible for acts done by the agent (the property manager).

Therefore, any failure on the part of a property manager is legally assumed by the landlord. That means if you have a property manager who fails to uphold any state and local tenancy laws, you as the property owner could be sued for their negligence because you are vicariously liable.

Image source: NAIPO

Landlord-tenant laws vary by location, but here are a few ways that an unprofessional property manager might get you into very serious legal trouble.

Fair Housing Act (FHA) Violations. Discriminatory screening practices by a property manager could have you facing charges under the Fair Housing Act.

Improper Entry. Tenants have a legal right to privacy. If a property manager enters the property without reasonable notice, you could be held vicariously responsible even if you didn’t know it was happening.

Uninhabitable Conditions. If the property manager fails to keep up with maintenance and repairs, it could lead to uninhabitable conditions, a basic legal standard that tenants are entitled to.

Inadequate Hazard Disclosures. Failure to disclose potential hazards (such as possible lead paint) could put you on the hook for tenants’ medical issues.

Security Deposit Discrepancies. A property manager must return security deposits to tenants within the statutory timeframe, otherwise you could end up paying double or triple in damages. Similarly, if they withhold part of the security deposit improperly (for normal wear and tear), you can be held responsible.

Neighbor Lawsuits. Neighbor complaints against noise or other ordinances could fall on you, unless the property manager deals with them as they should. Their failure to appropriately screen for criminal backgrounds could cause issues for you as the landlord.

Money Loss

Legal issues aren’t the only problem when dealing with an unprofessional property manager. Bad management practices can also have a big effect on your bottom line. Since your goal in real estate investment is to increase cash flow and asset value, you need a property manager whose practices align with your interests.

A few ways that a property manager can negatively affect your profitability include:

Long Vacancies. A lackadaisical attitude toward marketing, screening, and signing leases could cause lengthy vacancies in which you lose rental income (and possibly have extra utility expenses).

Excess Service Fees. Some property managers want to throw money at problems rather than actually manage. For example, when tenants make simple maintenance requests, the manager should first try to troubleshoot with them rather than calling expensive service professionals right off the bat.

Evictions. Your property manager should actively be trying to keep you out of the eviction process by keeping up good relations with good tenants. Evictions are expensive. Experts say the legal process alone can cost between $1500 to $2500, not including any lost rent and damages.

Neglected Maintenance. Failure to perform routine maintenance could result in larger damages. For example, not changing the air filter will eventually cause the HVAC system to fail. Not fixing a dripping sink pipe will lead to mold and rot in the cabinet.

Improper Inspections. A property manager needs to keep track of property conditions before, during, and after a tenant’s residency. Otherwise, you could end up paying for tenant damages out of pocket.

How to Deal With Unprofessional Property Managers

Some may think that the easiest way to deal with an unprofessional property manager would be to simply terminate the relationship. But that’s not necessarily in your best interest.

Many property management companies charge onboarding or signing costs, fees that cover the administrative duties of beginning the management relationship. Seeing as you’ve already paid those fees, it may be better to make an effort to mitigate the relationship first.

The first course of action should be directed toward the individual. Write an email that details your issues and allow the property manager to make things right. (Written communication is best, since you’ll have a “paper trail” that way.) If that doesn’t work, then consider the following methods.

File a Complaint

- With the Broker. If your individual property manager is the problem (rather than the company), reach out to the broker or business owner in charge. Explain your situation, and if necessary, ask to be transferred to a different property manager. The broker is likely to be agreeable, since it’s their business’ reputation on the line.

- With the Association. If your problem is more at a company level, you may want to reach out to whatever local real estate association that your property manager belongs to. Associations tend to hold their members to certain standards, so filing a complaint here might get your property manager back on track.

- With the Public. If those two avenues don’t work, you’re probably at a point of no return with your management relationship. (See tips on terminating the relationship below.) Once you’ve ended things, be sure to either file a complaint with the BBB or leave an online review so that other investors can be spared from a bad experience.

Terminate the Relationship

When it becomes clear that your management relationship cannot be salvaged, you’ll want to take these steps to terminate the contract.

- Read Your Contract. Your management agreement should have directives about how to terminate. You’ll probably need to give 30-60 days’ notice in writing for the cancellation to take effect. But first…

- Calculate Any Outstanding Fees. Some contracts have a clause that says all fees will be due in full upon cancellation. Meaning, that you might need to pay any monthly management fees for the remainder of the contract period. In addition, you may want to request an updated P&L statement and a breakdown of any remaining fees. That way, you can make an informed decision before you decide to…

- Send Written Intent. If you determine that it’s best to cut your losses on any remaining fees, it’s time to send that letter of termination. Make sure to confirm receipt before you…

- Let Tenants Know. Notify your tenants of the upcoming management change. Make sure they understand where to send future rent checks, and amend the lease to reflect new management as necessary.

- Coordinate Data Transfers. By the end of the termination period, you should have all paperwork, statements, and funds (including security deposit) for your property in hand.

What Are Your Options After Firing an Unprofessional Property Manager?

Self-Manage the Property

With online payment resources and property management software, managing your own property has never been easier, at least from an administrative perspective.

Investors who are located near their property may find that self-management is a viable option, especially if they have an established network of contractors to help with on-site issues.

Hire Another Property Manager

Many real estate investors choose to hire another property manager. Property managers continue to be a great choice for investors who have full-time jobs or are located far away from their properties. The key is to look for the right property manager, as we’ll discuss below.

For more information about your management decision, see our Property Manager vs. Landlord breakdown.

Characteristics of a Professional Property Manager

If you choose to hire a new property manager, you’ll want to look for someone who will be professional and pleasant in business dealings on your behalf; after all, they’re acting as the “face” of your property in many ways. Here are a few qualities that you should look for in your next property manager.

Tenant Selection and Communication

As mentioned, marketing your property and screening the potential tenants is one of the biggest responsibilities that you trust your property manager to handle. Consider asking about the application process when looking for a new property manager.

Likewise, after the right tenant is placed in your home, a good property manager should help you keep them there. Tenant turnover isn’t in either of your best interests. Keeping good tenants in place is often a function of two types of communication.

- Reactive Communication. The property manager should be able to respond to tenant inquiries quickly and efficiently.

- Proactive Communication. The property manager should check in with the tenant periodically (at least annually) to make sure all is well. This could include scheduled inspections to also make sure that the property is in good shape.

Rent Collection and Distribution

A professional property management company will have systems in place to collect rent regularly and distribute it to you. They should also have clear protocols for what happens if a tenant is late on rent. Make sure you are clear on all these systems as you search for a new property manager.

Financial and Reporting Services

A big part of managing a property involves bookkeeping. A good property manager will provide monthly reports that reflect the financial health of your property. They’ll also provide year-end reports that can be used for tax purposes. Ask about the frequency and scope of the reports provided by potential property managers.

Well-connected Network

A professional property manager should have good connections with local contractors, including plumbers, electricians, cleaners, and specialty services. Be sure to ask potential property managers how they vet and pay contractors.

In addition, a good property manager should be a member of a respected real estate association or network. Association communication helps to ensure that the property manager stays up-to-date on local laws and regulations –– a facet that’s of utmost importance when trusting them with your property.

Why Does it Matter?

Minimize Risk

A good property manager can help you manage potential risks in the form of bad tenants, property damage, legal issues, and more. Minimizing risk should be a high priority when it comes to preserving the integrity of your real estate investment, so finding the right property manager definitely matters!

Maximize Wealth

Though it may seem counterintuitive (because of the fees you pay), property managers can actually help save you money and maximize your return on investment. A recent survey indicates that good property managers can cut vacancy rates in half –– 4.5% vs. the 9% national average. That’s money in your pocket!

How to Find a Professional Property Manager

When looking to replace an unprofessional property manager, consider the following methods of searching and vetting.

- Referrals. Ask other local investors who they use for property management.

- Reviews. Look for positive online reviews, though it’s important to consider the source of all reviews. (Property managers could get negative reviews from tenants that might be considered a positive for property owners.)

- Interviews. Inquire about the property manager’s business practices and track record. For more, see our list of property manager interview questions.

- Research. Look up your state’s real estate association/department and make sure that the company doesn’t have any unresolved complaints.

- Read. Read through the management contract thoroughly to make sure your goals are aligned with their services.

An unprofessional property manager can be a real setback for your investment portfolio. But with some intentional pivots, you can be back on track in no time. For more forward momentum in your real estate goals, take a look at our client-centered investment process today.