Whether you’ve saved, inherited, or won it, $30,000 is a significant sum. In fact, most Americans would call that amount of money “life-changing”, according to a poll commissioned by Self Lender.

If $30,000 truly has the power to change your life, the question becomes: How can you make that happen? A new car or a world cruise might both have a 30K price tag, but one-time spending doesn’t exactly fit into the category of “life-changing”.

To really change your life, you’ll need to focus on making $30,000 into a much larger sum, one that could truly make an impact on your quality of life for years to come.

By exploring investment options and looking at time-tested growth data, we’ll help answer the question of what to do with 30K –– and the answer might just change your life.

Before You Invest $30,000

All right, slow down. Before we discuss strategies to build long-term wealth with $30,000, we’ll need to cover the basics of present financial security. Thinking about the future is great, but not at the expense of today’s wellbeing.

Pay Down High-Interest Debt

High-interest debt, such as credit card debt or short-term loans, should be the number one priority when considering what to do with 30K.

Credit card interest rates can soar well over 17%; short-term loans can rack up interest rates upwards of 13%. Those fees are well above what average investment plans can yield, which means that your debt losses would outweigh your savings gains.

That said, not all debt is created equal. Mortgages and other long-term loans (including student loans) may only charge 3%-5% in interest, a figure that good investments can definitely beat.

The point here is to zero in –– quite literally –– on high-interest debt. It’s impossible to get ahead with high-interest debt eating up investment profits.

Create an Emergency Fund

Before thinking about long-term, life-changing investments, you need to ensure that any short-term emergencies could be managed from a financial point of view. Why?

Because the investment strategies that bring in the highest gains often have the least liquidity. In the event of a crisis, such as an illness, accident, or job loss, you need funds to be immediately accessible. But many long-term investments tie up your money for, well, a long time.

To best prepare for emergencies, keep three to six months worth of your current expenses in a high-yield savings account.

Yes, the interest gains will be relatively low, usually around 1%-2%. But you’ll avoid dipping into long-term investments (which can sometimes bring a penalty) or using credit cards to pay for emergencies.

Factors That Influence How to Invest $30,000

Assuming those basics are squared away, you hopefully will have the bulk of $30,000 to invest. Before looking into all the options, let’s consider some factors that could inform the next steps in choosing what to do with 30K.

1. Stage of Life

The stage of life influences the overall goals of every investor. People in their twenties may be more oriented toward saving for a downpayment, whereas people in their forties might be looking at funding their children’s education.

Self-employed individuals might have to focus more on retirement goals, whereas employees with a good 401K plan may have more freedom to explore non-traditional options.

Assessing your stage of life means taking a hard look at where you are now, projecting where you plan to be in the decades to come, and forming goals that incorporate the complete scope.

2. Risk Tolerance

Your life stage circumstances help to form your risk tolerance. Risk tolerance refers to your lifestyle impact in the event of a complete loss. Say your $30,000 sum was lost overnight.

Would it affect your current way of life? If so, you have lower risk tolerance. But if you have a secure income and decent savings in place, then you can operate with a higher risk tolerance when looking to invest that $30,000.

3. Financial Aggressiveness

Both stage of life and risk tolerance determines how aggressive you can be with your investment strategy. Older individuals with established retirement accounts may be able to put a whole $30,000 sum into a risky startup venture.

They can afford to be aggressive with their 30K. Younger individuals may choose to diversify more because their goals are split between a downpayment and retirement savings. They don’t have the luxury of financial security yet, so they can’t be as aggressive with their 30K investment.

How to Invest $30,000

With life circumstances, risk tolerance, and financial aggression in mind, you can make a better decision about what to do with $30,000. Consider the pros and cons of these options.

Retirement Accounts

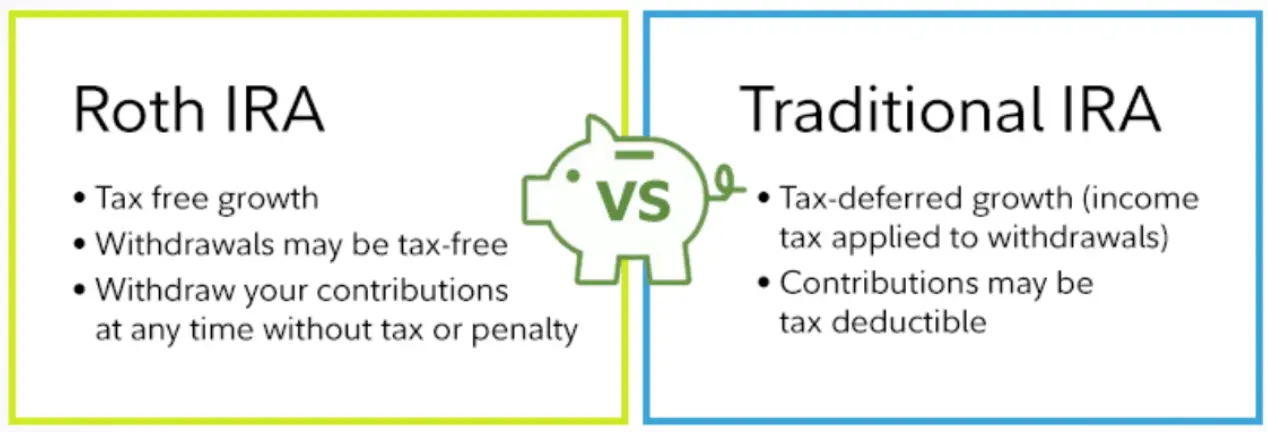

Aside from 401K accounts, which are available through employers, there are two main types of retirement accounts.

- Traditional IRA: With a traditional IRO, you contribute funds pre-tax, then pay taxes when you access the funds during retirement. This type of account is best suited for those in higher tax brackets because it reduces your amount of taxable income now.

- Roth IRA: With a Roth IRA, you contribute funds post-tax, but you don’t pay taxes when you access the funds during retirement. This type of account is ideal for those who have lower salaries, assuming that your current tax bracket is lower than what it could be in the future (if/when you get a higher-paying job). It’s better to pay the taxes now (at a lower rate) rather than later.

Source: Fidelity Investments

IRAs are low risk, and saving for retirement is a good idea at any stage of life. In fact, the earlier the better, thanks to compound interest. Below, we’ll look at the effects of compound interest over time.

Both types of IRAs have a $6000 maximum yearly contribution. That means, with $30,000, you could fully fund your IRA account for the year and still have money left over for other investments.

Government-Backed Investments

There are several types of government-backed investments available, depending on an investor’s goals and needs.

- 529 college plan. These types of accounts allow parents to save money for their kids’ higher education. Money is contributed pre-tax, grows tax-free, and can be used to fund tuition and other education expenses. There are a few different varieties of 529s, depending on what state you live in.

- Treasury bills. T-bills are some of the lowest risk investments, but they also carry a low return: only about 1%-3%.

- Government bonds. Bonds yield around 6% on average. Your money is tied up for the duration of the bond, but the risk of default is extremely low since they are backed by the federal government.

Stock Market Investments

Stock market investments carry a range of risks and varying returns.

- Brokerage accounts. You’re probably familiar with these types of investments. E-trade, Ameritrade, and others have become well-known for their ads, right? Investing with a brokerage will yield between 6%-12% over time, though the market can shift dramatically in the short term. Brokerage accounts are great for investors who want a hands-on approach to their stocks.

- Mutual funds. Mutual funds leverage money from many investors to purchase a diverse portfolio of stocks, bonds, and securities. Gains usually sit in the 7%-8% range, and risk is relatively low due to diversification. Mutual funds are not as easy to access as a local savings account, but money can be made liquid fairly easily.

- ETFs. Exchange-traded funds track with a certain market index and are traded like normal stocks. Because their scope is more broad, returns are usually around 10% over several years. EFTs are highly diversified and therefore considered low risk. Using a robo-advisor can be a great way to invest in EFTs, due to the low costs of entry (sometimes free!) and management.

Non-traditional Investments

To further diversify your $30,000, you may also want to consider these non-traditional investments.

- P2P lending. Peer-to-peer lending sites allow investors to “be the bank” for entrepreneurs and others seeking loans. The risk is higher (many borrowers seek P2Ps because they don’t qualify for traditional loans), but the returns can be too.

- Equity crowdfunding. With this type of investment, start-up companies offer shares in return for individual investments. Again, the risk is higher, but many investors have found success in this area. Equity crowdfunding is best suited to investors who have the experience to spot a great business plan.

- Precious metals. Because its growth is based on inflation-resistant commodity appreciation, there may not be a more solid investment than gold or silver. Over time, gold tends to have an average annual return of over 10%, and those familiar with precious metal trading consider it second in liquidity to cash. For this reason, many financial advisors recommend precious metals as part of a balanced portfolio.

Real Estate Investments

Investing in real estate can involve a couple of different strategies, each with its own merits.

- Buy and hold. An investor purchases a property with the intention of renting it out to tenants and selling it at a later date.

- Fix and flip. An investor purchases a distressed and undervalued property with the intention of renovating quickly and selling at a higher price.

- REITs. Real estate investment trusts offer ways for investors to gain income from real estate indirectly by investing in large real estate firms. Investors typically enjoy regular payouts but very little gains over time.

- Short-term rentals. Properties purchased in popular destinations can be used as short-term vacation or executive rentals, while also being utilized by the investor personally.

Real estate investments are considered a valuable part of an investment portfolio for the following reasons:

- Cash flow. Monthly rent generated from tenants helps to increase the investor’s income while also paying for any property-related expenses.

- Appreciation. Growth in market value causes a real estate asset to appreciate over time. Over time, the national real estate market usually appreciates by 3%-4% per year. However, this figure fluctuates widely, as indicated by the more than 13% appreciation experienced during the Covid pandemic.

- Equity. The difference between market value and the amount owed on the property is considered the owner’s equity. Investors can access that equity (through refinancing, HELOCs, etc) to make more investments.

- Tax breaks. Most property expenses are tax-deductible. Investors can also take advantage of tax-deferred depreciation to offset rental income.

Thirty thousand dollars is not enough to purchase a property outright, but in some markets, it is enough for a downpayment on a mortgage. With a good real estate investment, cash flow from rental income should exceed any mortgage loans taken on the property, so “good debt” is used as leverage to gain income, appreciation, and equity.

Real estate investing is also an excellent way to build and multiply generational wealth, due to the tangible asset that can be passed on as an inheritance. Not only can real estate impact your life now, but it can also impact the lives of your children and grandchildren.

By developing and implementing a sound, data-infused strategy, many real estate investors have seen incredible returns in a short amount of time. For example, Macario Escamilla experienced a 41.8% ROI on his historic Texas home flip in just thirteen days. Read more about his story here.

How Can $30,000 Change Your Life?

In order for $30,000 to truly be life-changing, you have to view it in light of your life as a whole. Whether it be through stocks, precious metals, or (our personal favorite) real estate, investing is the best way to increase the impact of $30,000, because long-term investing turns $30,000 into so much more.

To visualize what 30K will be worth in ten, twenty, or fifty years, consider this hypothetical scenario that illustrates the effects of investing money over time.

This illustration represents any investment strategy that yields a 4% annual return, which, as we’ve seen, is a quite conservative gain.

Source: Vanguard

According to these figures, a single $1 investment would turn into $1.48 in ten years or $2.19 in twenty years. Now apply that to $30,000. In ten years, $30,000 would become $44,400; in twenty years, the total rises to $65,700.

So what are you going to do with 30K?

If your plans for $30,000 –– or any other amount –– involve real estate investing, reach out to one of our agents near you. At New Western, we specialize in matching investors with properties that fit their needs.