Written by The New Western Team

New Western is committed to delivering opportunities to aspiring investors and keeping them well-informed with timely and relevant content that follows strict editorial integrity.

There are many ways to build wealth, but learning how to invest in real estate might be the best place to start, instead of, say, the stock market.

Why is that?

Investing in real estate vs. stocks is considered one of the safest investments anyone can make — especially if your long-term goal is to retire early while living off rental income. Yet, when it comes to learning the ins and outs of this particular investment strategy, there’s a lot to learn.

Although you can join an investor forum to ask for advice from experienced investors or Google "what are the best real estate books for new investors,” you might not receive the best advice.

Even if you try looking up the basics of real estate investing on your own, you’ll waste hours going through dozens of articles that might not even answer all your questions.

That’s where we come in.

We aim to provide aspiring investors with all of the information they need to start building wealth through real estate. This ultimate guide will highlight the basics to get you started, the other real estate investing strategies, and much more.

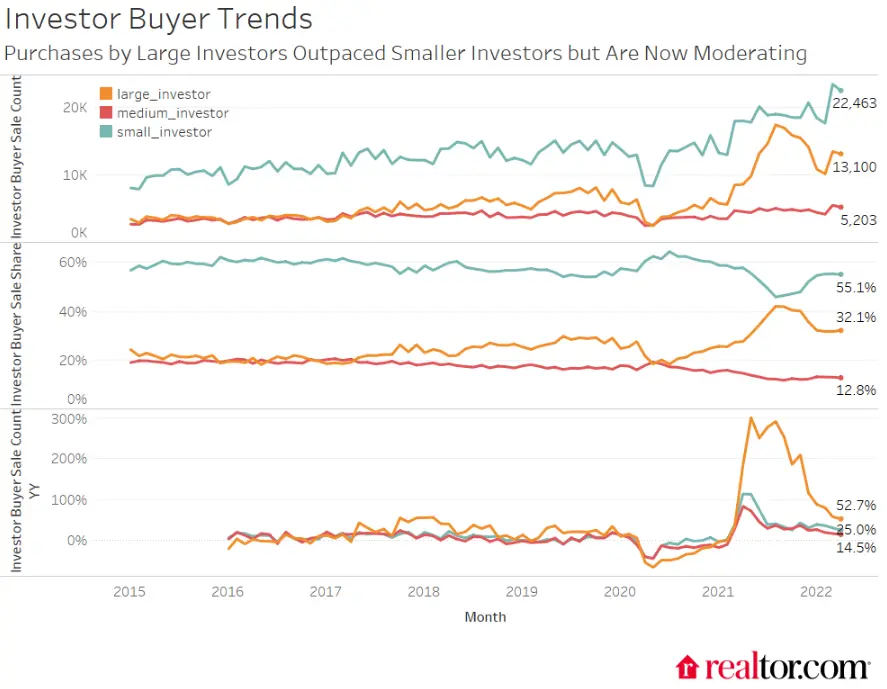

Did you know that in 2021, the number of properties bought by real estate investors grew by 64% from 2020, with prominent investors making up 35% of those purchases?

Credit: Realtor.com

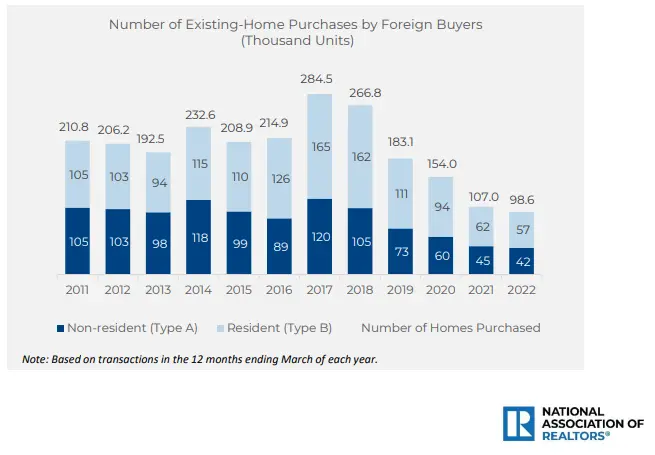

If that wasn’t shocking enough, between April 2021 and March 2022, foreign investors purchased $59 billion worth of US residential properties (57% of those foreign investors either live in the US as recent immigrants or were non-immigrant visa holders).

The top destinations of those foreign investors include:

Credit: NAR

Even though many of those purchases were made by large investors, small investors still have a foot in the game — even against 44% of foreign investors who paid cash for their investment properties.

It’s also worth noting that international buyers only accounted for 2.6% of the $2.3 trillion in existing-home sales during the same time period.

It’s true that many people are looking for investment properties for sale, but don’t let that discourage you. There are many reasons people choose to begin investing in real estate.

We asked a few experts their opinions on why people want to become real estate investors. Here are some of the responses:

"The biggest reason people invest in real estate is to build their income from passive income or even have more assets and financial leverage."

- Mr. Loren Howard, the Strategic Financing and Real Estate Investing Advisor at Real Estate Bees

"There are a few reasons why people might want to invest in real estate. Some people may see it as a good way to get exposure to the stock market, while others may believe that the real estate market is likely to continue to grow in value." "Additionally, real estate can be an interesting investment for people looking for long-term returns. Finally, some people may want to buy a property as an investment and then use it for personal or rental purposes."

- Mr. Nick Biggs, the co-founder of LifeUpSwing.com

"The two primary reasons are portfolio diversification and generating passive income. 49% of clients want to gain extra income for their property just sitting."

"They decide to rent it, which offers stable money each month. The rest of the clients are trying to improve their portfolios through diversification for a better return on investment (ROI)."

- Mr. Alex Capozzolo, the co-founder of Brotherly Love Real Estate

"There are many reasons. One is that 95% of Americans fail to retire by age 65. Saving your way to retirement doesn’t work. Plus, real estate accounts for 70% of the millionaires in the US. Everyone should have some real estate in their portfolio that produces monthly cash flow." The main reason is to generate an active or passive income that comes in monthly for the rest of your life. This allows you to retire at any age. We all eventually have to retire, so cash flow-generating real estate is the best option by far, and it produces over three times the rate of return that the stock market produces."

- Mr. Steve Davis, the CEO of the real estate education center, Total Wealth Academy

"The main reason people want to begin investing in real estate is to gain financial freedom and win back time." "Early in your career, you will be doing less passive real estate as you have to do a lot of the leg work yourself to learn. However, once you stabilize your first value-add residential deal, you will be able to make money collecting rents easily."

- Mr. Ari Shpanya, CEO of the commercial real estate financing firm, LoanBase

"People invest in real estate for many reasons: as a hedge against inflation, to balance an investment portfolio, or to create current or retirement income." "A lot of our flipper clients invest in real estate for current income, but also because they enjoy turning an aging property into an appealing, modern home. Our landlord customers get satisfaction from running a business that offers people housing."

- Mr. Jeff Phelan, Senior Vice President and Commercial Lending Rehab Consultant of Planet Renovation Capital

"Most people have heard multiple statistics about how real estate ownership and investments create huge amounts of wealth while also offering tax benefits." "A lot of first-time investors start investing to diversify their portfolio because until then their investments are usually only into stock and bond markets either through direct or indirect investing. Over a period of time, those goal change to generate passive income and possibly to get rich and build some serious wealth."

- Mr. Shashank Shekhar, founder and CEO of InstaMortgage

Passive Income

The money you receive from your investment properties is a relatively reliable source of income that you can expect every month, providing that your property isn’t vacant and your tenant pays their rent on time, of course.

Long-Term Financial Security

Real estate investments are usually part of a long-term investment strategy. On top of monthly rental payments, the longer you hold onto a property, the more value your property will gain over time. When you decide to sell your property, the larger the profit will be.

Build Equity

Your remaining balance will decrease as time passes and your monthly mortgage payments are paid on time. At the same time, the value of your property is increasing, thus building equity. If you need to, you can borrow against that equity. If you don’t need to tap into the property’s equity, the profit you stand to gain when you sell will get higher.

Fun fact: Homeowners who have owned their properties for less than a year often overestimate how much their properties have increased in value. Typically, they’ll estimate that the value has increased by 10.2% when in reality, it’s more like 3.5% to 3.8%.

This may seem confusing because home price appreciation across the nation increased by 13.5% in August 2022, but on a month-to-month basis, home prices actually declined by less than 1% (0.7% to be exact). Experts estimate that by August 2023, price increases will slow considerably—a mere 3.2%.

The true rate of appreciation actually depends on where it’s located. For example, of the largest 20 metro areas in the country, Miami home prices increased by 27.1% in August alone. On the other end of the spectrum, Washington, DC, ranked last with a meager 2.4% appreciation.

If we were to look at the data for a 50-year period, we can clearly see that investing in real estate has the return potential to make a huge profit, no matter where you are. In 1972, the median price for a home was $26,200. Fast forward 50 years and now the median home price is $433,100! That’s an astounding 1553.05% increase!

Tax Benefits

You can claim many tax deductions while managing the property as a landlord. These deductions include property taxes, property management fees, mortgage interest, maintenance, and more. Just be aware that if and when you sell, you will be expected to pay the capital gains tax. SmartAsset has a capital gains tax calculator you can estimate how much you’ll have to pay.

Along with those deductions, an important deduction you’ll want to take advantage of is rental property depreciation, which can be claimed over a 27.5-year period. Instead of taking one large deduction in the tax year that you’ve bought (or improved) a rental property, depreciation will distribute that deduction over the course of the property’s useful life.

Rental property depreciation is a complex topic that your tax advisor can walk you through. However, if you’d like to read up on your own, here’s a link to the IRS’s publication on the subject: Publication 946 (2021), How To Depreciate Property.

Inflation-Proof

Investing in real estate is a wise move that can help you retain the purchasing power of your money while also safeguarding it from the effects of inflation. Just like the cost of other goods, real estate prices tend to go up during periods of inflation. However, when you lock in a low-interest rate, you’re going to pay less for your mortgage over time during an inflationary period.

Let’s say you bought an average size home in July 2020 for $330,600 (the median price for the time) at the 30-year fixed-mortgage rate of 2.99%, thus making your monthly payment $1,392. Your mortgage payments will stay the same, regardless of today’s interest rates.

Conversely, if you bought the average size home in July 2022 for $440,300 (2022’s median price), not only are you getting less house for the price (the average size being 1,890 sq. ft.), the interest rate has almost tripled, thus bringing the monthly payment to a staggering $2,722.

July 2020

1,987 sq. ft.

$330,600

2.99%

$1,392

$501,135

July 2022

1,890 sq. ft.

$440,300

6.29%

$2,722

$980,088

Inflation is generally good for investors since it increases the price of housing, as well as increases rents and, thus, their profits. This is due to the fact that a rising number of people are choosing to pay high rents rather than take on an overwhelming mortgage in the current economic climate.

LeveragePerhaps one of the biggest real estate myths you might hear is that you need a lot of money to buy an investment property. That’s not entirely true. You will need some money to make a deposit and cover closing costs, but you can finance the rest. We’ll go into more detail about financing investment properties later in the guide.

Although there are plenty of reasons for investing in real estate, you must be aware of the potential risks and drawbacks.

Undesirable Location

When you’re looking for real estate to invest in, you have to do your homeowner and choose a good location. A few factors that will make a location less desirable include:

So, what qualities make a location desirable?

The Market

A strong market is an ideal place to start looking for investment opportunities because you want to make sure there’s potential to turn a profit. If more people are moving out of the area due to a declining job market, stagnant (or declining) home prices, and rental rates are poor, those are clear signs that you should look elsewhere.

The Neighborhood

After choosing the right market, you’ll need to narrow down your search to choose a desirable neighborhood. Ideally, the neighborhood should be within a good school district, have a low crime rate, and be close to shopping centers, amenities, public transportation, and recreational activities (to name a few).

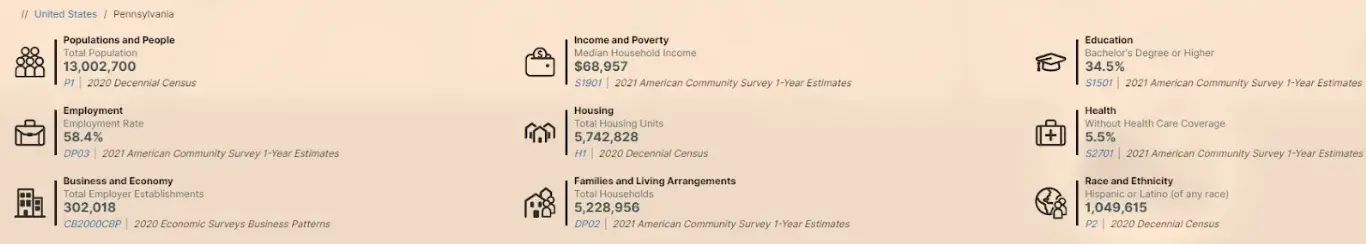

Investors should become accustomed to referring to the US Census Bureau to look at the neighborhood’s demographics to determine things like income and poverty level, education attainment, employment data, housing, and much more.

Here is a great guide that will show you how to collect and analyze data for a certain location. If you’re interested in commercial real estate investing, you can also use FFIEC GeoMaping to gather census data in a table format for specific counties.

Future Development Plans

When you’re choosing a neighborhood, you don’t want to look solely at what’s already there—you want to take into consideration any future development plans. If there are future plans that could improve a location’s desirability (ie. more public transit options, new shopping centers, more schools, and new residential construction), then you might want to consider investing there. Up-and-coming markets are full of potential, and it’s a good idea to get in while things are just taking off.

The Property

Suppose you’ve found a great neighborhood and you’ve narrowed down your search to a couple of properties. Do you choose the fixer-upper on a large lot or the turn-key on a smaller lot? Both are priced similarly. Which do you choose?

Regardless of how much work needs to be done, the property with the largest lot is usually the better option. You could tear down both houses and the larger lot would sell for more. Ugly or distressed houses can always be renovated, whereas you can’t change the lot they sit on.

Losing Money

Unfortunately, there’s no guarantee that your investments will generate enough money to cover your expenses, let alone net a profit. Investors can lose money if they cannot find suitable tenants or if the property requires a lot of maintenance or repair work. Even though the property’s value will increase over time, the lack of rental income could cause you to default on your bills.

Problematic Tenants

Unless you intend on using a property management company to manage your investment property, you have the task of screening tenants to find a reliable one.

Even if you agree to lease to someone who earns enough monthly income with a steady job, good credit, and no evictions on their record, you may still have problems. Unfortunately, life is unpredictable, and your tenant might run into issues that may cause them to miss rent payments.

Market Volatility

If the 2008 housing market has taught us anything, the market can come crashing down around us in the blink of an eye.

While sellers made out like bandits the past two years, experts who participated in Zillow’s Home Price Expectation survey report home prices are declining (expensive metro areas are declining faster than others) and 56% of respondents believe the market will favor buyers in 2023.

Responsibilities of Being a Landlord

Yes, investment properties are passive income sources, but being a landlord can be time-consuming, especially if you do it independently. Not only do you have to screen tenants, but you’ll also need to address maintenance or repair issues, collect rent, stay up-to-date with landlord/tenant laws, and more.

A property management company can do all of this for you, but that is an additional expense you’ll have to factor into your budget.

No Cash Readily Available

If the bulk of your money is tied up in real estate, it will be harder for you to access that money when you need it most. The only way you’ll be able to access that money is through a home equity loan, a cash-out refinance, HELOC (more about that later), or selling it.

Unlock access to our exclusive inventory of off-market investment properties.

Business isn’t about deals. It’s about relationships and we’d love to begin one with you. Interested in buying a property? Have a question about our process? Curious about a local market? Let’s talk.

You’ve probably come across television shows highlighting distressed properties‘ transformation into beautiful homes worthy of being in a magazine. While you’re wowed by the house flip before and after shots, you might think, “I can do that, no sweat!” They don’t show viewers the nitty-gritty stuff that investors deal with behind the scenes.

Unfortunately, becoming a real estate investor isn’t suitable for everyone. Learning how to invest in real estate is the “easy” part- the actual doing part will test your mettle.

While there aren’t a firm set of characteristics you must have to succeed; some traits are more beneficial than others… According to Mr. Howard, successful investors should have two essential characteristics: “patience and a learning mindset.”

“Real estate investing is not for the short-tempered as things can go wrong, and you need to be patient and learn from situations fast. If you can’t learn in real estate, it will be extremely difficult to be successful as it is the most important thing to learn, and the market changes fast,” he continues.

“No one knows the answer to everything, and the best way to learn is doing. It takes a lot of time to get real estate investing right, so learn from experienced people and learn more about the world around you.”

Mr. Bigg adds, “Many factors contribute to an individual’s success as an investor, including financial literacy, risk tolerance, and experience. However, there is also evidence that certain personality traits (such as judgment and entrepreneurship) can be important predictors of success.”

“For example, people who are confident and self-reliant are more likely to be successful investors than those who are shy or introverted. I don’t believe a lack of these traits eliminates the chances of success but diminishes them somewhat.”

Other than patience and a learning mindset, what are some characteristics of a successful real estate investor?

See the Broader Picture

Real estate investing is more than just buying properties and collecting rent. You need to be able to look at distressed homes for sale and see their potential because you may not be able to afford turnkey real estate when you’re just starting. You need to be able to see the best use for the property and follow through with that vision.

Some ways successful investors will turn a property into a great property include:

Time Management Skills

Time is money, and if you’re making investment deals, you don’t have time to dilly-dally. A good deal could be scooped up before you know it! How you manage your time will play a significant role in how well you do.

Laser-Sharp Focus

To be an investor, you need to know what you want and focus on not letting anything deter you from it. When you’re focused, even the most significant obstacles won’t get in the way because you live your life with the Pareto Principle (also called the 80/20 rule) mindset.

Under this principle, 80% of your results will be caused by 20% of your efforts. You’ll outperform and continue to grow while your peers hit a wall. Top investors understand the rule and dedicate their efforts to tasks that bring them closer to their goals instead of trivial tasks.

Credit: Investopedia

Resourcefulness

A successful real estate investor doesn’t just use their money for leverage. They have the right connections to people they can call for extra capital to use when they have a lot of deals in the works. People will invest in your vision if you have a track record of turning a good deal into a lucrative opportunity for growth, building wealth, and success!

Capital + Vision + Opportunity = Success

Ability to Ask for Help

Humility and being able to ask for help is an excellent trait to have because it shows that you’re human. As Mr. Davis explains, “The most important characteristic is to be humble and be willing to learn. Real estate is very complex and requires education beyond high school or college.”

Mr. Biggs says, “One of the most commonly held beliefs is that real estate is an easy way to make money. In reality, real estate can be a complex and time-consuming investment, and it requires a significant amount of financial knowledge and experience to be successful.”

Going into this business, you aren’t going to know everything right away. If you can’t ask for help or are willing to learn all you can from someone more experienced… You’re going to have a difficult road ahead of you.

If you don’t have many of these traits, don’t worry. “If an investor doesn’t have the traits mentioned, they can still be successful by finding a partner or mentor that embodies those qualities. Chances are, you will have other qualities that your partner or mentor lacks. As a result, you will both benefit and learn from your partnership,” Mr. Shpanya advises.

Simply having some (or even all) of the characteristics mentioned isn’t guarantee success. Influential real estate investors have several habits that lead to their success.

1. Have a Business Plan

Investors create business plans to help them map out their short-term and long-term goals. With the help of the business plan, they can focus on the things that matter instead of getting hung up on minor issues.

Fortune Builders recommends your business plan should include things like:

2. Understanding the Market

If you want to succeed in a particular market, you need to know it like the back of your hand by staying on top of the latest trends, the local economy, consumer spending habits, unemployment rates, and much more. When you know your market inside and out, you can predict when the market may change and prepare for potential opportunities.

3. Build a Solid Real Estate Investing Team

The secret of building a lucrative investment portfolio is to have a team of professionals you can work with throughout the entire process. Your team will help you find investment properties with potential, secure financing, keep tabs on the due diligence process, and manage the properties once the deal has been settled.

People you’ll want on your team include:

4. Always be Honest

Honesty is the best policy if you want to nurture relationships with people in your network. No one likes to be lied to, and no one likes to feel like they’ve been taken advantage of. In real estate investing, maintaining high ethical standards will boost your reputation and access more (lucrative) investment opportunities.

5. Niche Down

There are many different segments of the real estate industry, and although you may have big ambitions, you cannot try to dabble in everything. Real estate investors understand this and take great care to become masters in their particular niche. Once they’re a master in one market, they use the same methods to become a master in another specialty.

Examples of niches include:

6. Ask for Referrals

Referrals are a real estate agent’s bread and butter, but they can also be an investor’s. Influential investors rely on their reputations, and when others in the industry hear about an investor’s excellent reputation, referrals are almost guaranteed. You can never have enough people in your network!

7. Never Stop Learning

“One of the most commonly held beliefs is that real estate is an easy way to make money. In reality, real estate can be a complex and time-consuming investment, and it requires a significant amount of financial knowledge and experience to be successful,” says Mr. Biggs.

A successful real estate investor always stays on top of the latest trends, laws, regulations, terminology, and market predictions. You can’t be a master of your market if you aren’t on top of local and federal laws. You also need to familiarize yourself and stay on top of tax laws, lending laws, economic changes, and other regulations that will directly (and indirectly) impact your investment strategies.

8. Acknowledging the Risks

Investing in real estate is risky — there are no two ways about it. Seasoned investors block out all the get-rich investment scams because they know there is no such thing as “the lazy way to invest in real estate.” Investors understand the risks, legally and financially, and can adjust their investment strategies to mitigate them.

9. Hire a Real Estate CPA

Real estate investors don’t rely on H&R Block to handle their taxes — they have a real estate CPA (certified personal accountant). A CPA knows the tax code inside and out, and they will make sure to maximize your deductions.

The cost to hire a CPA varies widely — anywhere from $30 per hour to $300 per hour. That said, as your portfolio grows, they’re certainly worth the money!

10. Heed Advice from Experienced Investors

If you hadn’t noticed, asking for help is a big part of learning how to be a real estate investor. You can join real estate investor Facebook groups to help you with the simple stuff, but when it comes to complex transactions with grey areas, you never want to do it alone. You’ll want to hire a real estate attorney for legal concerns, real or perceived.

11. Networking Like a Champ

Real estate investors are constantly making connections. No matter where they go, they network, make connections, and foster good relationships with existing contacts. It doesn’t matter how far along your investing career is; you should always make the time to network like a champ.

Unlock access to our exclusive inventory of off-market investment properties.

Business isn’t about deals. It’s about relationships and we’d love to begin one with you. Interested in buying a property? Have a question about our process? Curious about a local market? Let’s talk.

Investing in real estate doesn’t necessarily mean you can only purchase single-family homes. There are many different categories of real estate investments that you could dabble in. Some of these investments will be “direct,” and some will be “indirect.”

Mr. Davis explains the difference between the two:

“You [first] must understand the difference between a business and self-employment. Many people believe they own a business when they are just self-employed. Nothing wrong with being self-employed; you just need to know the difference and understand that the goal is to own a business in the end.

You only own a business if you can disappear for a year and make the same amount of money as if you were there. If you make less, you are self-employed, not a business owner. Passive investing is a business; active investing is self-employment.

Active [or direct] investing is when you buy a group of single-family houses or an apartment complex, and you run it. You handle day-to-day problems and challenges. This is self-employment.

Passive [or indirect] investing is when you give your money to a competent active investor, and you do nothing but deposit profit checks. This is owning a business.”

Or, as Mr. Phelan sums it up, “Direct real estate investing is when you buy a property, indirect investing is when you buy a real estate fund that invests in real estate.”

Investing in residential properties is one of the most common and well-understood real estate strategies for new investors. This is a direct method of investing, meaning that you will be putting in a lot of effort and money to make your investment profitable.

Let’s look at the options available if you’re interested in residential investing.

Fixing and Flipping

If you’re a fan of the many television shows about flipping houses, you probably already know about fixing and flipping houses. The idea is simple: You buy a property that needs some (or a lot) of TLC, fix it up, and sell it for a profit.

“The most common mistake, in my opinion, is thinking investing in real estate or flipping is easy because it looks that way on television. Flipping a house requires knowledge of remodeling, the local real estate market, homebuyer preferences, permitting and zoning, and more.” Mr. Phelan warns.

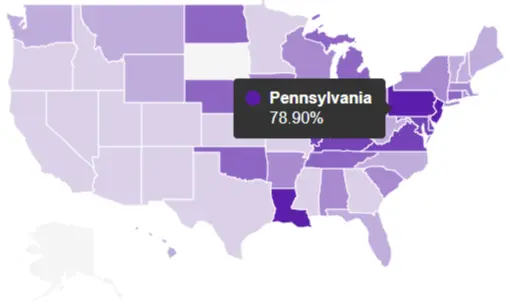

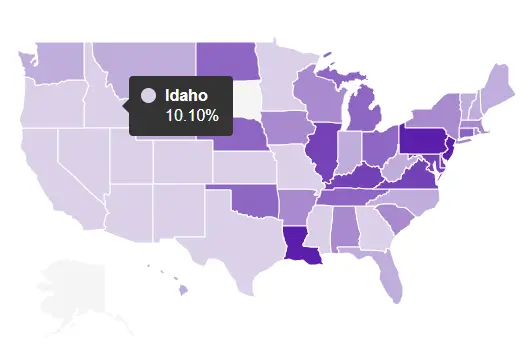

Credit: Good Bones on HGTV

That said, this type of investment can be pretty lucrative, depending on where you are. Pennsylvania flippers see the highest return on their investment (78.9% ROI), whereas flippers in Idaho see the lowest return (10.1% ROI). Of course, renovation mistakes could make your property harder to sell. So be wise when choosing your renovation projects.

Credit: Motley Fool and Attom Data

Long-Term Rentals

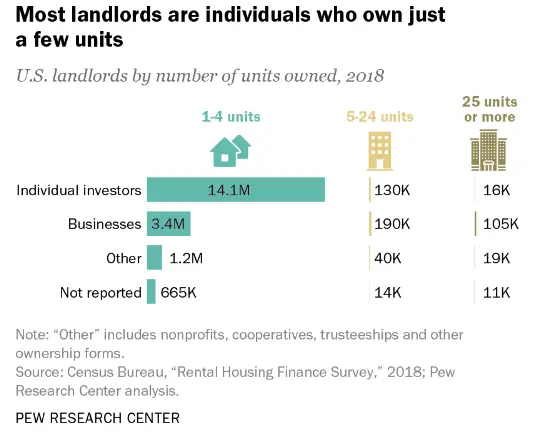

Did you know most rental properties are owned by individual investors like yourself? Of the 14.3 million individual investors (as of 2018’s Census Bureau Rental Housing Finance Survey), most landlords own 1 to 4 rental units, which can be either short-term rentals or long-term.

Credit: Pew Research Center

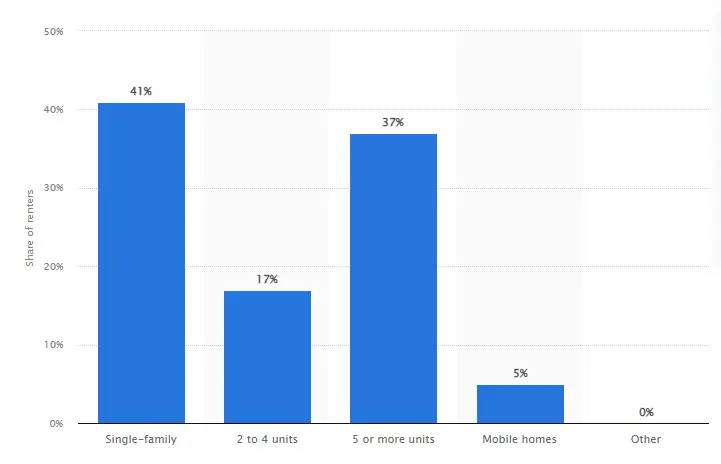

That said, approximately 35% of Americans are renters, with 42% living in single-family homes. Investing in long-term rentals can be single-family properties, but they can also include multi-family units and mobile homes, too.

Credit: Statista

If you decide to go this route, you are now a landlord, and you will be expected to deal with the tasks associated with it. As a landlord, you must screen potential tenants, collect rent, set up accounts for security deposits, handle maintenance calls, and more. All while adhering to local landlord/tenant laws.

Or, you could hire a property management company to do that for you — for a fee between 8% to 10% of the monthly rent.

BRRRR

If you want a robust portfolio of rental properties, then the BRRRR strategy may be right up your alley. BRRRR stands for buy, rehab, rent, refinance, repeat. So, instead of searching for easy flip houses for sale that you can sell quickly and for a one-time profit, you’re buying and holding the property.

You’ll still need to fix it up, but instead of selling them, you can lease them to tenants at a rate that covers your mortgage and do a cash-out refinance down the road. You’ll take the profit from the refinance and use that toward another investment property. Rinse and repeat.

Owner-Occupied Rentals

Investing in an owner-occupied rental (also known as house hacking) means you’re going to be purchasing a duplex, triplex, or quadplex (four units). These rentals are investment properties in which the person who owns the property (you) uses it as their primary residence and rents out the other units.

This is a great investment for first-timers because you won’t need a large down payment (if any). You’ll also get a lower interest rate on your mortgage because it’s a primary residence and not just a rental property. Renting out primary residence right after purchase is possible if you buy a multi-unit property or if you live in flip the property.

Also, if you are an owner-occupant, you can deduct the mortgage interest and property taxes (much like if you lived in a single-family home), but there are other tax deductions you can take advantage of too, like operating expenses, depreciation, and repairs.

Vacation (Short-Term) Rentals

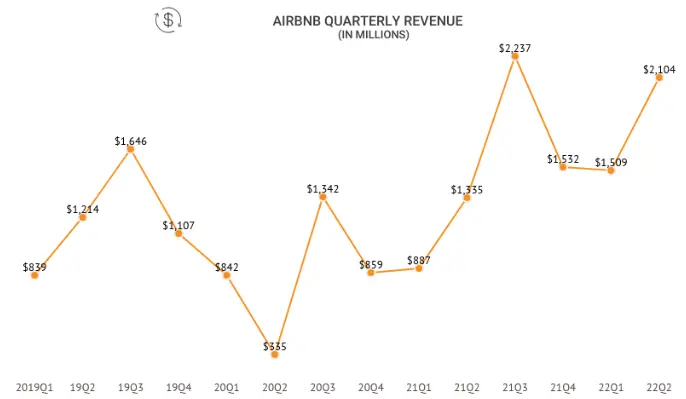

Vacation rentals, or short-term rentals, are growing in popularity. Airbnb alone earned $2.104 billion in revenue in the second quarter of 2022! Investing in a short-term vacation rental is ideal if you live in an area that sees a lot of travelers who want to stay near popular vacation destinations. You can use that short-term rental income to help pay off the mortgage or use it for another investment property.

Credit: iPropertyManagement

The United States has the most Airbnb listings and is the most expensive market. The average price per night for an Airbnb rental in the United States in 2021 was $216. If someone booked your rental for 7 days, that’s $1,512 — that could be a full mortgage payment! Surely you can see how lucrative turning an investment property into a short-term Airbnb rental is, right?

Credit: All the Rooms

Just be aware that short-term rentals present a higher risk for damage, theft, and illicit activity because you can screen long-term renters much more thoroughly than short-term renters. Also, you’re part of the hospitality industry now, and you’ll need to ensure your property is clean, with enough linens, towels, pillows, etc., on top of general landlord duties.

Note: If you are thinking about turning your investment property into a short-term rental like Airbnb, you may be required to put more money down and have several months of cash reserves to cover prolonged vacancies and maintenance.

Wholesaling

Real estate wholesaling involves more than simply buying the first rental income property for sale you come across, fixing it up, and renting it or selling it for a profit.

As a wholesale investor, you’re searching for deals on wholesale houses for sale, buying them, and before closing on the deal, selling it to another party for a little more than you paid.

It sounds easy, but you need to know what to look for in an investment property and how to write a legally binding contract. You’ll also need a robust network of eager investors or buyers who will buy it before you go to closing and must follow through with the deal.

Investing in commercial real estate is more like office buildings, apartment buildings, industrial spaces, and retail spaces. Although there is a lot of money to be made in this space, it comes with a lot of risks as well. These risks include tenants not paying rent, rampant inflation, higher interest rates, and more. You can learn more about these risks here and here.

Due to its complexity and the higher risks, new investors might find commercial real estate investing overwhelming and too much to learn.

Investing in raw land ultimately means you’re buying undeveloped land. There aren’t any roads, buildings, crops, utility connections, etc. Now, if you’re thinking that investing in empty land is pointless and there’s no money to be made, that’s not true.

Raw land investors can lease the land to farmers to grow crops, or you can hold the land until it appreciates and sell it to a developer for profit. However, there are few tax advantages available to you. And, depending on what the land is zoned for, it may be challenging to get the local municipality to approve the plans you might have for developing it.

Real estate investment trusts (REITs) oversee numerous real estate investments, and since you aren’t directly purchasing or selling real estate, this is an indirect form of real estate investing. When you give your money to a REIT, you generate income from the properties the company manages.

Investors who go this route are diversifying their portfolios, even though some REITs are publicly traded and are listed on the New York Stock Exchange. If you’re looking for a get-rich-quick investment opportunity, this is not it. Investing in a REIT is a long-term strategy that requires patience and time before you start seeing a profit.

Crowdfunding real estate is similar to REITs in that a group of investors combine their funds and invest in real estate that they otherwise wouldn’t be able to afford on their own.

Some crowdfunding is open to the average investor, but many require proof that you’re a serious investor with adequate income to begin investing.

There is no “best” type of real estate investment because each investor has unique circumstances and investing strategies. There are a lot of things that need to be taken into consideration when you’re trying to choose which investment is right for you.

If you’re trying to figure out which type of rental properties to invest in, here are some considerations:

Mr. Howard: “REITS are easy investments for first-timers and require the least amount of capital to get started, while more experienced real estate investors build their empire from flips and rentals.”

Mr. Davis: “I have no experience or interest in trusts or crowdfunding real estate deals because as an investor, you have little to no control over them. In my perspective, those are the “easy ways out,” much like the stock market. I also don’t do raw land since it produces no cash flow.”

“Single-family houses are the easiest to get into as a new investor. However, if you have enough money to skip single-family and go straight to apartments, you should. It is faster, and you can control the property’s value yourself.”

Mr. Capozzolo: “In my opinion, indirect investing would be the better option for new investors. Investing in real estate requires capital and time. A simple investment also takes thousands of dollars in starting capital. But, buying shares of a REIT is similar to buying stocks in a company. It requires less amount and offers less risk.”

Mr. Biggs: “It is difficult to say which type of real estate is easiest and most challenging, as every investment has its own set of challenges. REITs, for example, are excellent investments for people who do not have the capital to invest in other real estate types. REITs are usually considered quite safe investments, just like bond funds, but they have a potential for capital growth as well.

Buying a turn-key property isn’t challenging to find and close on. However, the house might need some work that the investor can’t do alone. Or the house may need to be sold to a tenant, which is no simple task.

On the other hand, buying raw land can be difficult because finding the suitable land can be tricky. The investor may need to do a lot of due diligence before investing in the land to ensure the property is suitable for development. Ultimately, it’s all about market timing and what type of market is in demand.”

Mr. Shpanya: “The easiest type of real estate for new investors is existing apartments that are one to four units. The one-to-four-unit residential space is how I and many other successful investors got started. A one-to-four-unit residential loan is far easier to attain as banks actively encourage homeownership.”

“This is the best way to start. Additionally, house hacking is where you live in one unit and rent out the others is a great way to start investing too.”

Mr. Phelan: “Most people who opt for direct investment start in residential real estate. There is plenty of inventory, the price point for entry is typically much lower than for commercial real estate and it’s familiar to the average person because we live in residential real estate.”

Mr. Shekhar: “Most people who own a home already will find residential real estate investing easier since they already understand some basics of residential real estate. They should be able to evaluate potential rental opportunities and be able to project cash flow. It should also be easier for them to work on remodeling or upgrades since they might have done something similar with their house.”

“The cash flow with commercial real estate investing may be harder to project and buying raw

land and construction could take years and involves several layers of complexities that may

be very difficult to plan around.”

Conclusion: REITs and residential properties are typically the easiest real estate investment for new investors.

You know what type of real estate you’d like to invest in. The question is, how do you find real investment opportunities? Do you look through Craigslist hoping to find a hidden gem? Do you cold-call distressed properties hoping that the homeowner will sell?

You can do these things, but there are better (and more effective) ways to find investment properties for sale.

There are no shortages of active real estate agents in the United States. The Association of Real Estate License Law Officials (ARELLO) estimates there are more than 4 million licensed real estate agents — 1.5 million are members of NAR (National Association of Realtors®) in the country, so there’s no shortage of agents.

A real estate agent (or Realtor®) can access the MLS (multiple listing service) to find properties already on the market and even share off-market properties for sale. They can negotiate on your behalf to get you the best price on a property and so much more.

Pros:

Cons:

Could be expected to pay a “finders fee” to the agent for off-market properties for sale

Need to build a strong rapport with an agent to get first dibs on deals

Although real estate agents have access to the MLS and you do not, you can use real estate listing sites like Zillow, Trulia, or Redfin to see what’s currently on the market. These sites may not have the most up-to-date information for all of the listings on their site, but it’s a good start.

If you’re working with an agent, you can show them the properties you’re interested in, or you can contact the listing agent directly.

Pros:

Cons:

Some sites require members to pay a subscription fee to access listings

Not all websites offer reliable, up-to-date information on properties

Inadequate source of information to determine a property’s ARV

As of July 2022, ATTOM Data shows that 30,358 properties are going through the foreclosure process. This figure is up over 143% from 2021, when foreclosures were at historic lows, thanks to the temporary policies to halt foreclosures and evictions during the 2020 coronavirus pandemic.

Public auctions are a good place to find good deals (often below market value) on properties. However, be warned that the properties may require extensive work because you cannot inspect the property before bidding. If this is your method of choice, keep extra money on the side to make repairs.

In addition to costly repairs, you also inherit all leans. Most of the time you don’t know about them until you go under contract, which is a big risk time-wise and money-wise. This is an important factor to consider since 10% down is typically required to get the property under contract after winning the auction.

There may be some situations where you’re bidding on a property that hasn’t completed the foreclosure process and the title is still in the previous owner’s name. This is called a zombie foreclosure and can present unique opportunities for investors.

Typically, you’ll need an “insider” to find zombie foreclosures. Still, you can research by looking through the county’s appraisal district website to find properties two or more years behind on their property taxes. Chances are, those properties are abandoned.

Pros:

Cons:

Don’t be afraid to tell the people in your life about your efforts to find a rental property for sale. Your network is one of your greatest resources because you know these people. You can relate to them on a level that you can’t with other sellers.

You can ask your friends, family, colleagues, and acquaintances if they or someone they know is looking to sell their property.

By using word of mouth to find investment properties, you don’t have to buy run-down houses for sale that no one else wants. You could work out an arrangement with the seller that is beneficial for you both without all of the hassles of a traditional transaction.

Pros:

Cons:

If you want to skip the hassle of dealing with a real estate agent and want to deal with a property owner directly, then you might be interested in an FSBO, or for sale by owner. In 2020, only 7% of sales were FSBO, so it’s not going to be easy.

Credit: Home Depot

You can drive around your target neighborhood to find properties with bright red FOR SALE signs on them. You can browse local social media groups, look for ads in the newspaper, and visit community centers, post offices, libraries, or municipal buildings for “Homes for Sale” signs.

You can even check ForSaleByOwner.com!

Pros:

Cons:

Firstly, real estate investing groups, or REIGs, are not the same as REITs because they don’t gave to adhere to specific limitations or disclosures, and one focuses on commercial real estate (REIT), and the other focuses on residential rental properties (REIG).

In an REIG, there are several partners and shareholders who pool their resources to purchase real estate. These groups can facilitate property financing, flipping properties, and lease rental properties to a property management company or directly to a tenant.

Pros:

Cons:

Now that we’ve looked at the different investment opportunities and where to find investment properties, let’s look at your options for financing.

Wholesalers are able to assist investors in locating foreclosed or otherwise troubled homes at favorable rates, which may then be remodeled and resold as “fix-and-flip” investments or converted into rental properties. A wholesaler (the assignor) will transfer their rights and obligations under the contract to a third party (the investor) through a contract called an “Assignment of Contract For Purchase of Real Estate.” Essentially, they’re acting like a middleman between the buyers and the sellers, bringing them together when a seller wants a quick sale and a buyer is ready to buy it “as is.”

Wholesalers sign contracts with buyers to buy homes, and they never really take full ownership of the property or put any money into it (down payment, ernest money deposit, or making repairs). They then show the property to prospective investors in exchange for a cut of the final purchase price.

Be aware that these deals tend to move quickly because they want to secure a buyer before the original agreement with the owner ends. This is very important because the wholesaler doesn’t want to be stuck footing the bill, so to speak.

Pros:

Cons:

Not all wholesalers are honest and there’s potential to get scammed

Property could need extensive work – more than you’re prepared to take on

Of all of the ways you can find an investment property, none of them simplifies the process like New Western can. We help you find investment properties, but we have cultivated a robust network of professionals who can work with you to make sure the buying process is as seamless as possible.

You can connect with real estate agents to help you find the right property (or you can request access to our exclusive inventory of incredible deals you won’t find anywhere else), lenders who can provide the capital to facilitate the purchase, and property managers to manage the property for you so you can focus on your investment strategy.

Of course, if you need advice about investment strategies, financing, market updates, or anything else, our blog is an excellent resource you’ll want to bookmark.

When it comes to securing financing or having enough money to buy your first investment property, there are a lot of misconceptions that we’d like to clear up first:

Myth: You need a 20% down payment.

Truth: This can be a hard one to debunk because it depends on the lender you go with. Some lenders require at least 15%, while others want 25%. However, the good news is that there are loan programs available that require little to no money down. But we’ll go into more detail about these options later.

Myth: You need a high-paying job.

Truth: While having a high income is beneficial, you can still buy investment properties on a modest income. Granted, lenders will have their own set of guidelines regarding minimum income or net worth threshold that a potential borrower must meet before being approved for a loan. It’s always in your best interest to research eligibility requirements when looking at lenders.

Myth: You need to be wealthy.

Truth: Wouldn’t we all love to be wealthy? Well, that’s the reason why you’re interested in learning how to invest in real estate, right?

“I have seen people start with $0 including myself. In a perfect world, we would all have $50k or more to start. But don’t wait. Start from wherever you are now- if you find the right mentor, you can still be successful,” shares Mr. Davis.

Myth: You need to pay off your primary residence (or other debt) first.

Truth: Debt, especially having an existing mortgage, is a big concern that a lot of aspiring investors are worried about. However, you don’t have to be debt-free to begin investing. In fact, our experts say that you shouldn’t pay off an existing mortgage because it’s “dead equity” and it’s not “serving your family effectively.”

All of that aside, our experts agree that you should have a decent amount of money set aside to begin investing. The amount varies, but Mr. Phelan recommends new investors “have at least the down payment, closing costs, contract and materials deposits, and enough cash in reserve to cover 3-6 months of payments.”

Now, let’s look at the many ways you can finance your real estate investment.

1. Conventional Mortgage

Conventional mortgages are loans you can get when you apply for a mortgage through a private bank, credit union, or loan associations. This is the most popular method of financing for real estate transactions.

Minimum requirements to qualify for a conventional loan:

Have a credit score of at least 620

2. Conforming Mortgage through Fannie Mae or Freddie Mac

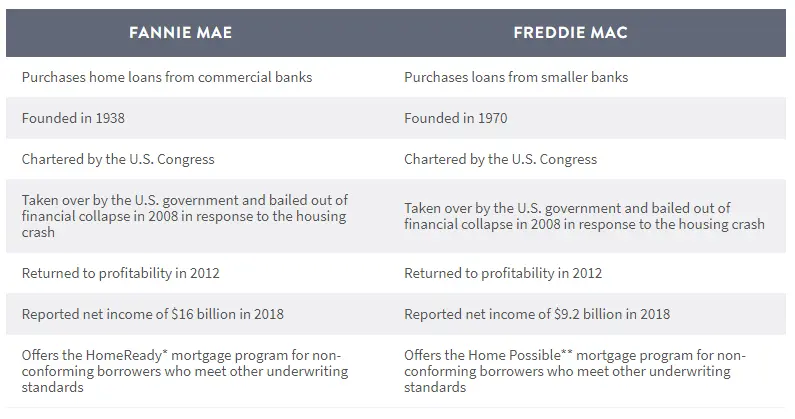

Some conventional loans will be sold to government-sponsored entities, Fannie Mae or Freddie Mac. These two agencies buy up large quantities of home loans and then will sell them to investors as mortgage-backed securities.

Credit: Money Geek

Although these programs may not have a direct impact on you as an investor, they do influence the terms of the loan. These entities have guidelines for the loans that they’ll buy, which means some conventional loans can also be considered conforming loans.

Minimum requirements for a conforming loan:

Have a credit score of at least 620 (640 in some cases)

3. FHA or FHA 203(k) Mortgage

An FHA loan is backed by the Federal Housing Administration (FHA) and these loans are designed to help people buy a primary residence. However, investors can still get this kind of loan if they intend to house hack (live in one unit and rent out the other units).

The FHA 203(k) loan is the same thing as a regular FHA loan, except the 203(k) allows you to add the cost of repairs or renovations a property needs. These rehab projects can include things like replacing the roof, making repairs to be the house up to code, replace systems like plumbing, electrical, or HVAC.

Minimum requirements for a FHA or FHA 203(k) loan:

4. VA Mortgage

If you’re a service member, veteran, or eligible surviving spouse, then you’ll want to look into a VA loan. These loans offer unique benefits that aren’t accessible to a civilian. These benefits include no minimum down payment, no private mortgage insurance, low closing costs, and low-interest rates.

Minimum requirements for a VA loan

5. Self-Directed IRA for a Non-Recourse Loan

Using a self-directed IRA (SDIRA) to fund your investment purchase is a good option if you already have a substantial amount of money in a retirement account. You can transfer a traditional retirement account, like a 401(k), and direct it into an SDIRA. You can then use that money for a down payment on a non-recourse loan.

A non-recourse loan does not allow the lender to pursue anything other than the collateral… In this case, the lender can only foreclose on the property if the borrower defaults. They cannot pursue any other legal action.

Minimum requirements for a non-recourse loan (varies by lender):

6. Home Equity Loan or Home Equity Line of Credit (HELOC)

A home equity loan or home equity line of credit (HELOC) allows you to borrow against a property that you already own without needing to sell it. A HELOC works similarly to credit cards, meaning you can access the equity when you need it, instead of in one large lump sum.

With a home equity loan, you can borrow up to 80% of the equity in your home and use the money for a down payment on an investment property, make repairs, or do some renovation projects. For example, if your property is valued at $250,000 and you have $150,000 left on your mortgage, you could borrow up to $80,000.

$250,000 home value – $150,000 mortgage balance = $100,000 equity

$100,000 equity x 80% = $80,000 home equity loan

Minimum requirements for a home equity loan or HELOC (varies by lender):

Note: Lenders may work with people with lower credit scores, but you’ll have higher interest rates, lower loan amounts, and short repayment terms

7. Investment Line of Credit / Portfolio Line of Credit

Investors can get short-term financing for a property through something called an investment line of credit. The lender places a lien on the property, and then the borrower will have a revolving line of credit that can be used for whatever they need. Essentially, this type of LOC works much like a HELOC, meaning you can use it to renovate an existing property in your portfolio or buy and renovate a new investment.

Borrowers will only have to pay interest on the money that is drawn, rather than the full loan amount (i.e., a mortgage). You’re able to make monthly payments toward the money borrowed, or you can pay the balance in one lump sum. This type of LOC is a good option for those with high credit scores and who have accumulated a lot of equity on the property they’re going to use the LOC for.

A portfolio line of credit functions much like an investment LOC and HELOC, but instead of using real estate as collateral, the borrower is borrowing “against a taxable brokerage account.” This means that instead of real estate being the collateral, the borrower’s stock holdings and other investments are used as collateral. This type of LOC is best for people with a robust portfolio or who have more than $1 million in equity.

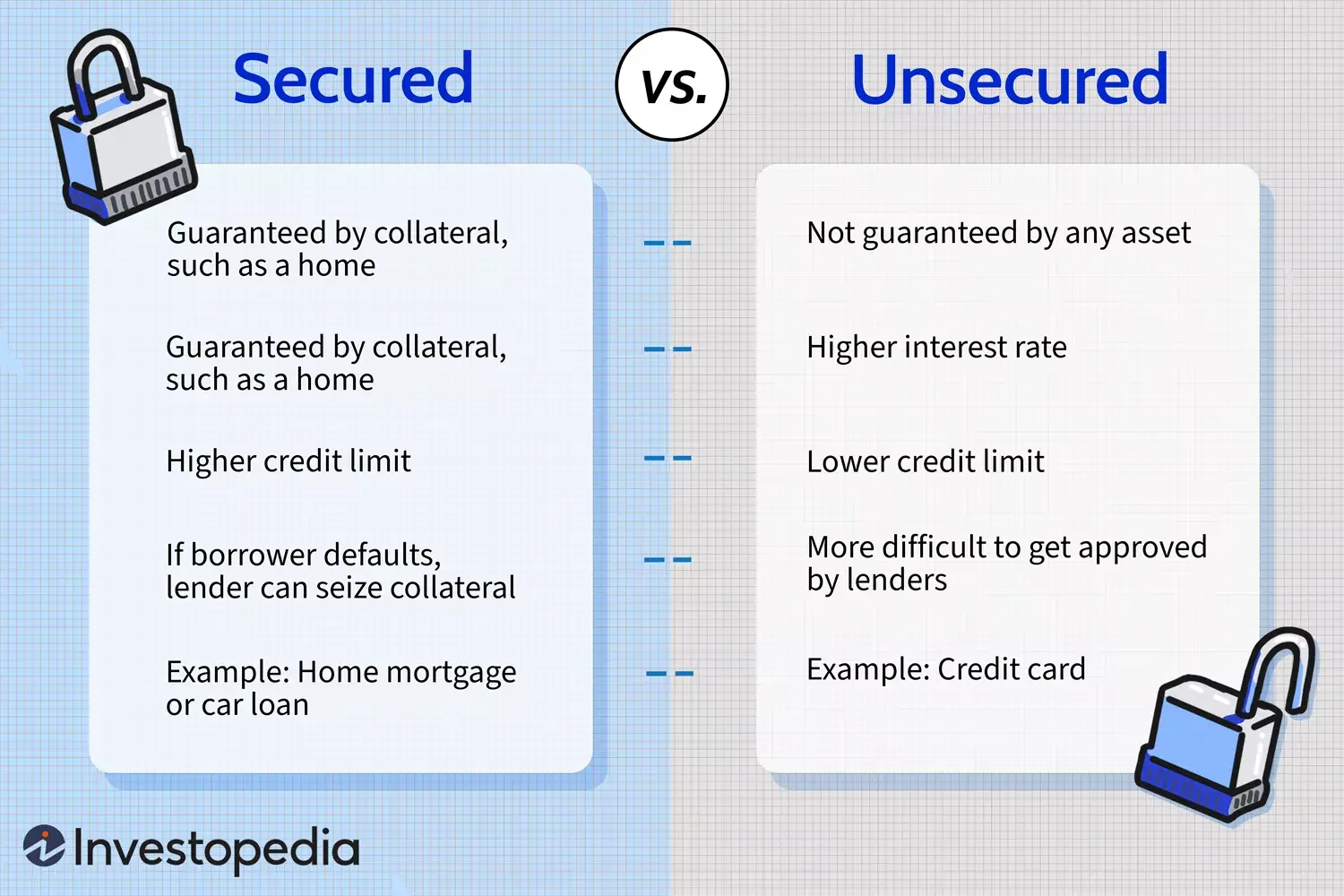

Most LOCs are unsecured, but HELOCs are considered secured. If you’re looking into different ways to finance an investment property, it’s important to know the difference between unsecured and secured.

An unsecured LOC is like a credit card in that it doesn’t have an asset that’s used as collateral, whereas a secured LOC does; in the case of real estate, that could be a piece of property. Unsecured LOCs tend to have lower credit limits and higher interest rates, while secured LOCs have the opposite (higher credit limits and lower interest rates).

Credit: Investopedia

8. Private Lender

Private lenders are generally people in your network (be they family, friends, colleagues, etc.) that you can borrow money from. Anyone can be a private lender, as long as they have money they’re willing to lend.

If you don’t want to ask the people in your life to lend you some money, there are other ways to find a private lender. There are a couple of steps you could take if you decide to approach an individual investor rather than a nationwide private lender for a private money loan:

Since private lenders can be anyone, the minimum requirements and terms for repayment will vary widely.

9. Seller Financing

Sometimes if a homeowner owns their property outright, they may be willing to provide an interested investor financing. Instead of paying the homeowner one large lump sum, the investor will give the homeowner a down payment and they pay monthly installments (including interest).

Seller financing can be complex and it’s recommended that you seek out professional help to make sure the deal is legal and above board.

Of all of these financing options, FHA and VA loans are great options for new investors with limited cash. You can use these loans to buy a multi-family property, live in one unit, and rent out the other units.

10. Commercial Loan

Commercial loans are only used for properties that bring in money, like stores, offices, restaurants, hotels, etc.

Unlike a loan used for buying residential properties, the repayment terms for these loans are often much shorter (ranging between 5 to 20 years) and are taken out by business entities (corporations, funds, land developers, limited partnerships, and trusts)—not individuals. However, if you are a small business owner, then you may be able to get approved for this type of loan.

These loans aren’t like residential loans, where you’re paying the same amount each month for the entire life of the loan—usually 30 years. Commercial loans are drawn up with shorter loan terms and a longer amortization period.

For example, an investor would make payments on the loan for a period of 10 years equal to an amount based on the loan being paid off over a period of 30 years. After these payments, there would be one last “balloon” payment for the rest of the loan.

Minimum requirements for a commercial loan (varying by lender):

To figure out the debt-service ratio, you’ll compare the annual net operating income to the annual mortgage debt service. This ratio shows whether your property generates enough income to service the debt.

For example, a business has an annual net operating income of $500,000 and annual debt payments are $365,000. The equation you’ll use will be:

Annual Net Operating Income/Annual Debt Payments = Debt-Service Coverage Ratio

OR

$500,000 / $365,000 = 1.37

11. Construction Loan

Construction loans are a good source of short-term funding to cover the cost of constructing a new property or making improvements to an existing one.

Construction loan borrowers only take out what they need for the timeframe needed to finish the construction or renovation project. These loans are disbursed in chunks called “draws” to the contractor rather than to the borrower. As some of the project’s phases are finished, such as pouring the foundation or erecting the frame, drawings are marked.

The main benefit of construction loans is the ability to build a new home, but the freedom to design a building comes at a cost. For instance, it is well known that construction loans have interest rates that are higher than typical.

Most of the time, the framework is made to protect investors who believe a project will be finished successfully and be worth a certain amount when it’s done. However, due to the benefits of this kind of financing, homeowners shouldn’t discount it.

Minimum requirements for a commercial loan (varying by lender):

12. Hard Money Loan

Borrowers can use hard money loans when they need to raise money quickly for a short-term loan. These loans typically have higher fees and interest rates than other financing options, so that is something to take into consideration. However, it may be a good choice for you if you have difficulty securing a loan or need flexible loan terms.

Minimum requirements for a hard money loan (varies by lender):

A: “No there is no need to pay off your home first. Home mortgages typically last 15 to 30 years, so you’d be putting off getting started for a decade or more,” advises Mr. Phelan.

Mr. Shekhar adds: “There is no reason for a real estate investor to pay off their home first. Real estate investing should be stand alone with its own return on investment and cash flow analysis. In fact, paying off the home could take years and would mean much less cash available for real estate investing. Hence, there is no reason for a potential investor to wait that long. Not to mention there could be tax advantages of paying a mortgage on the primary residence.”

A: Depending on factors such as stage of life, risk tolerance, and financial aggressiveness, what to do with $30k will range for every individual. If your portfolio leans heavily on traditional investments such as stocks and bonds, a large sum of money can help you diversify your portfolio into non-traditional investments such as precious metals, equity crowdfunding, or real estate.

A: The 1% rule in real estate states that the rent for a property should be at least 1% of the purchase price in order to give you a positive cash flow. Use the following equation to see how the 1% rule applies to a property:

| Purchase price x 0.01 = X | Monthly rent / Purchase price = Y |

If Y is less than 1%, than you do not have a 1% property and may consider adjusting your monthly rent.

Note: Sometimes you’ll hear investors talk about a 2% rule in real estate. This rule follows the same principles of the 1% rule. However, the 2% rule basically says the monthly rent should equate to 2% of the purchase price. It’s more aggressive than the 1% rule and is usually only used by investors who buy properties in neighborhoods with a D or F classification.

A: No, but it doesn’t hurt either. With a real estate license, you know the industry and can access the MLS to find properties. You can find your own deals (and skip the commission fees) and network with other agents who could tip you off about properties that may be coming on the market soon.

Additionally, you can save money on the backend by only paying 1/2 the commission when re-listing a property. It really boils down to what your goals and priorities are.

A: ARV real estate refers to a property’s value after repairs… or “after repairs value.” As an investor, you’ll want to know how to calculate a property’s ARV to determine if it’s a good investment or not. Ideally, the ARV should be higher than 10% of the purchase price plus repairs, otherwise you’ll have minimal profits. The equation for this is:

Purchase price + Value from Renovations = ARV

A: Flipping mobile homes can be a good investment strategy, especially because, for many, it’s a cheaper alternative to buying a house. Unfortunately, mobile homes have a low market value and you’re limited by the renovations that can be done.

A: Wholesaling yields higher profit margins but will require fewer deals, microflipping is done at a quicker rate with smaller profit margins. It’s important to ask, what is microflipping? Most micro-flippers buy and sell homes within a week or two without doing any work on the property.

A: Cap rate (capitalization rate) is the potential profit you can earn from an investment without including financing. Cash on cash refers to how much profit you’ll earn for every dollar you invest into the property. In terms of which is better, cap rate vs cash on cash, they work hand in hand.

Cap rate is used to find prospective properties and cash on cash is used to choose an investment that can generate the highest ROI.

A: This entirely depends on the investment strategy you use. Many investors have different definitions of a “good deal” considering there are many different ways of investing in real estate. Some of the more common methods are outlined below.

There are many factors to take into consideration when you’re trying to determine if an investment is a good deal or not. First, you need to choose a property that is in a good location because that will affect how likely it is to be rented out and how much money you could make from it.

After finding a property, you’ll want to compare the purchase price to the fair market value, you can do this through a real estate CMA (Comparative Market Analysis). It’s likely a good deal if the fair market value is higher than the price you pay, but you’ll want to get an appraisal to estimate the value of the property.

Next, you’ll want to figure out the cap rate (or capitalization rate). You’ll take the gross income and subtract your monthly operating expenses to get your net operating income. Then you’ll need to divide that by the fair market price. The resulting percentage will be the potential return on the investment property. This is the equation you’ll want to use:

(Net Operating Income)/(Current Fair Market Value) = Cap Rate

Of course, if you’re going to rent the property, you’ll need to factor that in when you’re figuring out the net operating income. Assuming the property is rented 100% of the year, you’ll want to use this equation to get the property’s true net operating income:

[(Gross Rental Income) x (Occupancy Rate)] – (Operating Expenses) = Net Operating Income

NOLO recommends a minimum acceptable cap rate of 5%, but other sites like Mashvisor, FortuneBuilders, and Stessa recommend 5% to 12%. Just remember that the higher the percentage, the higher the risk!

A: Technically speaking, there isn’t a limit to how many mortgages you can have. but the Federal National Mortgage Association (Fannie Mae) increased the limit of conventional mortgages a person can have to ten. However, it’s more challenging to get approved for mortgages after your first four. We highly recommend consulting your lender for more details and look at your options — if any.

A: Technically, yes you can rent from your own LLC. If you’re considering doing so, you should not focus on the lagality of self-rental, but rather the practical merits of the situation.

A: How many houses you can flip in a year relies on dedication and grit, starting out, you may flip one or two properties per year. Flippers with cultivated crews and systems who are still manageing projects on site may do three to six deals a year. Professional investors do anywhere from 12 to 50 deals.

A: A 1031 exchange, also called a Like-Kind exchange, means you can exchange one investment property for another without paying capital gain taxes. To avoid paying capital gains, your transaction must meet the requirements of a 1031, otherwise, your swap will be taxed as a sale. Consult your CPA for more details so you can avoid an accidental partial 1031 exchange.

Learning how to invest in real estate is the first step toward building wealth and you’re never too young to get started.

25-year-old, Sahil Mehta and his brother, 30-year-old Suyash, in Berkeley, California own five rental properties that are worth $9.4 million. One of those properties operates as an Airbnb and the other four are rented to college students and families.

By the time she turned 27 years old, Melanie Bajrovic shifted from residential investments and purchased her first commercial real estate property — catapulting her investment portfolio into the multi-million dollar club.

32-year-old, Michael Albaum, began investing at 23 years old. Over the course of nine years, his portfolio includes 61 rental units that garnered $431,000 in rental income last year.

The point of sharing these real estate success stories is that no matter your background, you can be a successful real estate investor. Sahil began his career as an executive assistant for a real estate agent. Melanie was a bartender before making her first investment. Michael was a fire protection engineer.

The key to investing in real estate is to have a vision and the desire to succeed. Mr. Davis points out that a lot of people think that real estate isn’t rocket science.

“It is. If you don’t know what you are doing, you will fail. Step one is to get educated. Find a mentor and learn the complete business model and best practices before you ever write your first offer. Join a real estate investor club to get around like-minded people that will keep you encouraged and motivated,” he advises.

Part of educating yourself is determining if real estate investing is right for you. You need to figure out why you want to become a real estate investor.

Are you interested in building equity and have long-term financial security? Or, are you more interested in earning a passive income so you can quit your 9 to 5 and enjoy what life has to offer?

After you understand why you want to invest, you’ll want to learn as much as you can about the industry. This guide is just the beginning. There are real estate investing courses from a community college or an online learning source like Udemy. There are online forums, YouTube, and books like:

Residential properties are the most common (and often the best) option among new investors because it’s the most well-known and easiest to get into.

The trick to residential investing is finding the right property and getting a good deal on it. A real estate agent can certainly help you find properties, but they aren’t the only way to find them.

If you’re not interested in paying a commission, you can bid on properties in foreclosure at a public auction — sometimes for pennies on the dollar. This can be risky because you can’t inspect the property before bidding, which means you could be buying a property that needs serious (and costly) repairs.

When you’re considering a property, you have to consider things like the property’s location and proximity to goods and services, but you also need to consider what you’re going to do with the property.

If you’re buying in an area that has seen better days, it might be a good idea to do a fix and flip or wholesale. If you’re buying in a nicer area that’s near tourist areas, you have a lot more options, like short-term rental, long-term rental, or be an owner-occupant.

There are many ways you can finance your investment, but choosing the best financing option will depend on what type of investment you’re interested in. If you want to start with residential properties, you’ll have to figure out if you’re going to go the fix-and-flip route, if you want to be a landlord, or if you’re going to be an owner-occupant.

This is important because it will determine the type of financing you can use to fund your investment. If you’re going to be an owner-occupant, you can use government-backed loans (FHA and VA) to purchase a multi-family property.

If you don’t intend on being an owner-occupant, or you’d like to buy raw land or try investing in REITs, you’ll need to look into other options, like going with a conventional loan, tapping into your home’s equity, crowdfund, or ask someone in your life for a loan. Don’t forget that hard money lenders and private lenders are good sources for funding if you’re going to fix and flip a property.

Deciding to invest in real estate isn’t something you should do without careful consideration. However, with proper guidance from an experienced investor, doing your own research, and paying attention to market trends, you’ll be able to make wise choices. At the end of the day, when you look at your diverse portfolio and rake in rental income, you can rest assured in knowing that your family will be taken care of for generations to come, all because you took the time to learn how to invest in real estate!

Unlock access to our exclusive inventory of off-market investment properties.

Business isn’t about deals. It’s about relationships and we’d love to begin one with you. Interested in buying a property? Have a question about our process? Curious about a local market? Let’s talk.