These solopreneurs and career-rehabbers continue to buy outdated properties and bring a fresh supply of homes back into the market.

In this report, we reveal how these SFR investors do it and the variance that exists between the investment market and the traditional real estate market.

Born out of the 2008 housing crisis, New Western leveraged data to help identify investment opportunities.

Today, New Western is the largest private marketplace for fix-and-flip and fix-and-rent residential investment properties in the U.S.

Garnering $15 plus billion in transactions in over 40 markets with 150,000 investors in its marketplace.

New Western has exclusive insight and proprietary data into how the real estate investment market performs and co-mingles with the retail real estate market.

New Western’s investor survey was conducted in November 2022. It consists of 886 real estate investors ages 18 and up from around the United States who have previously purchased property through New Western or plan to in the future.

The 2022 real estate market was all about rising interest rates, Fed-effect on inflation, lack of inventory, sellers staying put, buyers exiting, large-scale brokerage downsizing, rental price increases, Airbnb algorithm changes; and institutional investors, iBuyers, and tech companies exiting the business.

And this change began in 2021 – an outlier year historically – with a large increase in real estate transactions because people were moving and taking advantage of historically low mortgage rates. As a result, home prices skyrocketed.

The market activity in 2021 made it difficult for investors to not only get offers

accepted but to even find a property to purchase.

The numbers weren’t making sense.

Demand rises in new markets.

Raleigh, NC, continues to show increased housing demand year-over-year across both the investor and retail market landscapes.

(Data source: New Western (44.1%) Investor Redfin (35.2%) Retail )

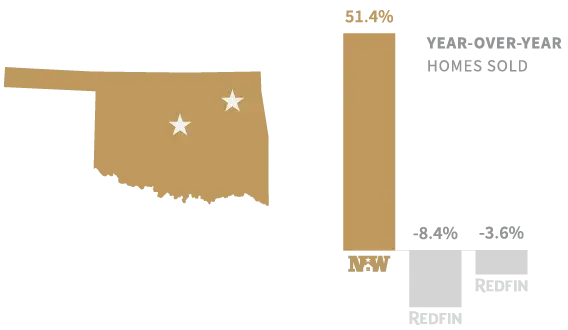

Demand rises for investor properties and decreases for the traditional market.

According to New Western data, Oklahoma City and Tulsa are ripe areas for growth in 2023 with an increase of 51.4% each in year-over-year homes sold, even though Redfin shows a decline of 3.6% and 8.4% in homes sold.

Data source: New Western and Redfin

Major declines across both investor and traditional markets.

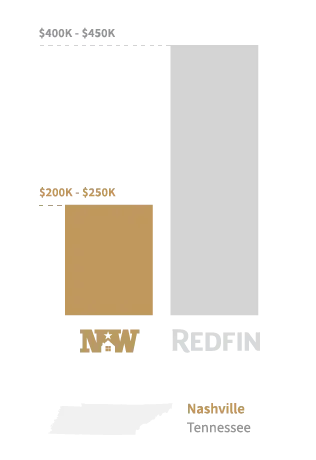

Denver, Nashville, and Austin were pandemic hotspots. Since Q2 2022 all three markets experienced a major decline in volume of homes sold, signaling cooling that will continue into 2023.

Data source: New Western and Redfin

The experienced rehabbers with local expertise who fix-and-flip for a living and have the resources to continue doing business will lean into the investor market.

Knowing that 2021 was an outlier, the pros understand that they need to adjust their strategy, know their neighborhoods and stay in the market.

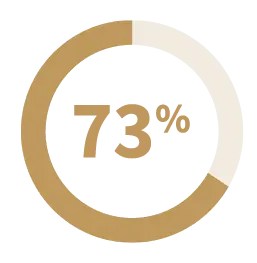

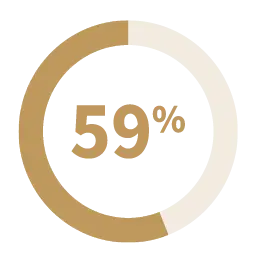

said their business grew from 2021 to 2022

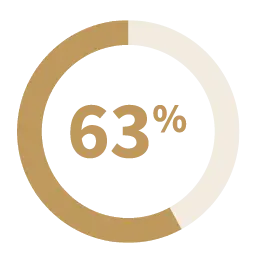

said they plan to invest in 2023

of investors who are interested in purchasing for the first time said interest rates are not too high

plan to use cash or private money

It turns out, Gen Zers are not the forever renters you thought they were, and this generation is poised to impact the near-future of the housing market.

Gen Z will make up 30% of the workforce in 2023.

From a traditional real estate perspective, Gen Z has location-flexibility because of remote-work options. Affordability is the key driver when it comes to purchasing a home and this generation is prioritizing lifestyle and weather when it comes to choosing a city to live in.

86% are ready to enter the market once mortgage rates show signs of stabilization.

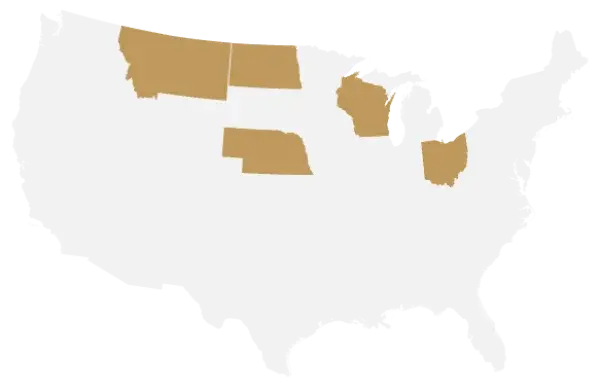

Gen Z is participating in the investor market, looking for buy-and-hold rental income properties in affordable mid-metros and is not afraid to invest outside their own backyard.

of investors who have purchased investment properties before are 18-29 years old.

of investors who have purchased investment properties before are 18-29 years old.

From New Western’s investor survey.

The New Western survey revealed that in 2022 investors used both fix-and-flip and fix-and-rent strategies.

Historically, fix-and-flip was the dominant strategy for New Western investors and it’s now more balanced with the change in market.

The biggest challenges for investors in 2023

Finding Property

Funding Property

Cost of Labor

The top reasons investors give for buying investment property in 2023

Appreciation

Passive Income

Buyer’s Market

The shortage of inventory for the first-time home buyer category will continue in 2023, and rents are becoming more affordable than monthly mortgage payments. This has caused investors to shift strategies and take advantage of opportunity.

In 2023 Investors will lean into fix-and-rent more often than fix-and-flip.

While many of the career-rehabbers, mom-and-pop, and semi-pros will take a somewhat conservative approach and look for even better deals, they won’t make drastic changes to their strategies overall for 2023 and will remain in the market.

Large-scale investors came into the market and identified communities where they could invest and profit on a large scale. But interest rates rose, creating a need for the big guys to pull back as they find it difficult to service new debt.

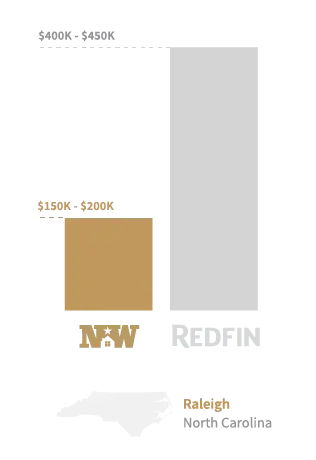

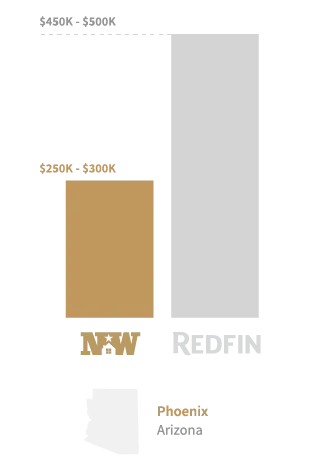

Investor-bought homes sell for 31% less than retail homes for sale in the same market.

These numbers represent median home prices.

Predictions for 2023 are on the table for the retail market– the challenges that arose in 2022 will filter into 2023. But, there is room to pivot and opportunity for investors.

Kurt Carlton, president and co-founder of New Western

Demand will remain. And home prices will moderate to make room in buyer’s budgets for rising rates.

The outlook for mortgage rates has changed since the peak of just over 7% in November 2022. With 85% of existing mortgages carrying a rate below 5%, expect homeowners to remain in place, limiting new listing inventory.

Mortgage applications will pick up but it will take time to educate consumers on the new rate environment. Useful tools like mortgage rate buy-downs will offer consumers more options when financing and allow lenders to become competitive.

We can expect traditional real estate market headlines to focus on the macro environment, which

won’t appear favorable.

New Western’s investor survey was conducted in November 2022. It consists of 886 real estate investors ages 18 and up from around the United States who have previously purchased property through New Western or plan to in the future.

New Western data represents a comparison of the year-over-year, daily average amount of deals from 2021 to 2022 and median acquisition prices were grouped by market.

About New Western

New Western makes real estate investing more accessible for more people. Operating in most major cities, our marketplace connects more than 150,000 local investors looking to rehab houses with sellers. As the largest private source of investment properties in the nation, we buy a home every 13 minutes. New Western delivers new opportunity for all—a fresh start for sellers and exclusive inventory for investors.

For more information, read our story here.

All Redfin data was obtained from their publicly available resources.

Redfin is a national real estate brokerage