Finding the right investment property can be a challenge. As a real estate investment brokerage, New Western offers a vast inventory of value-rich properties for a variety of investment strategies.

We provide easy access to opportunities you wouldn’t have otherwise. We also work behind the scenes to eliminate problems, deliver a clear title and provide a fast, seamless process to close.

A licensed New Western agent will work hard to deliver the type of residential investment properties that meet your unique goals, plans and exit strategy. We’re here to help every step of the way through closing.

Our agents serve as your boots on the ground, drawing on a wide array of data and unmatched local market knowledge to consistently source the best investment properties for you.

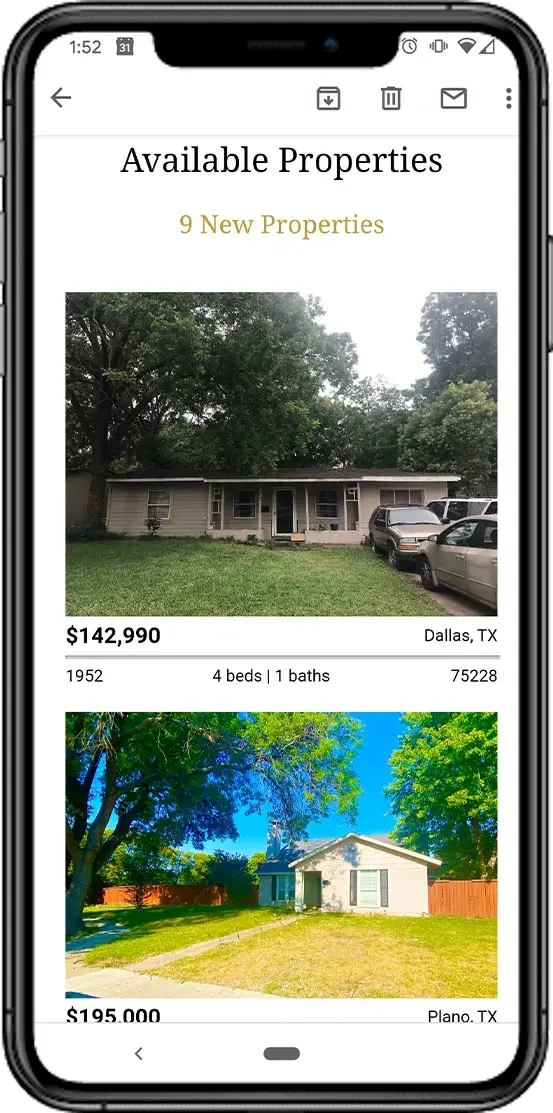

When you become a New Western certified buyer, you gain access to an incredible network of resources all focused on finding the best residential investment properties in your market — delivered straight to your inbox.

We buy a home every 13 minutes for our marketplace of over 150,000 investors who are actively looking to rehab houses and find deals.

Many companies charge a monthly membership fee to access their property lists. Not us.

We have hundreds of licensed agents around the country ready to help you find the perfect investment property.

Fill out our contact form and a New Western agent will call or email you within 48 hours to set up an initial no-obligation conversation.

Schedule a virtual or in-person onboarding meeting with one of our agents to discuss your real estate investing goals and strategies as well as learn more about working with New Western.

Start receiving property alerts for opportunities that match your criteria. When you find a property you’re interested in, work with your agent to acquire it.

Before

After

Before

After

Before

After

We bought two pieces of land through New Western and we will do again, all processes was very clear and fast, always with Samuel support.

Ronny Varghese has been an astute investment agent to work with. My wife and I have been in the business for years, and having worked with many individuals from both the retail and investment side, Ronny has made a name and impression for us both. Not only is he honest and transparent with what he is thinking or what he knows/doesn’t know, but the guy has a great work ethic and industry acumen. In the investment world, good deals always come on the heels of the 11th hour. Properties come and get sold within hours, and we recently had that exact experience with Ronny. Urgency and speed are always imperative to getting a deal locked up, and he was instrumental in getting us into an amazing opportunity. My wife was at a closing, and Ronny had just released a property his company acquired. Since Ronny normally works with my wife, he had no idea I was heading over there or about to call him. When I called, he picked up immediately. And even though he was in the middle of a meeting or something, he dropped what he was doing to meet me at the property that I was already on the way too. We were able to lock the property up within an hour of another investor group. My wife doesn’t get super excited about properties often… but this one was an amazing opportunity that she was in disbelief about. We would have missed it had Ronny not been Mr. Johnny on the spot. His aptitude for people and this business will take him to some great places in the future! Thanks Ronny – you deserve a raise!:)

Working with new western was great. I had a good contact Sam. He was excellent I would recommend him to anyone

“I spoke with several other companies at the same time I was talking with New Western, but what I found was a few just didn’t seem educated enough to answer my questions. I also noticed a lot of people would say anything to sell me an investment property. Even if what they said wasn’t 100% accurate. That’s a deal-breaker for me.”

"Finding a great investment house is a large time investment. With a regular W-2 job, there’s often even less time to dedicate to finding properties."

"We made the decision to work with New Western when we decided to start renovating houses to save our time and energy to rehab the properties. While we could make more money if we were to source the deals ourselves, we've found that working with suppliers, like New Western, saves us a significant amount of time in an area that's not our expertise. Now that we are more experienced, we have time to focus on managing multiple properties at a given time with leads on new properties still coming to our inboxes daily.

Compared to other investment property suppliers that we work with, NW offers the largest quantity of properties. We've also found that there tends to be a decent spread on the properties. NW also provides a good amount of details about the property in the info packet, so we can make an informed decision if we'd like to go see a house or if we'd like to pass."

"Purchasing investment properties through a professional supplier, like New Western, can set you up for a successful real estate investment because, typically, these deals are scrutinized before they are presented to investors. So they are investor-friendly properties."

"New Western is one of the better, convenient, and appropriate (but not exclusive) channels to build your supply network of investment properties."

"It's very, very time consuming to find investment properties that are in my price range, ready to be flipped or in appropriate condition to be rented while repairs are made.

I tried searching websites like Zillow for listed properties but they always sold before I found them. Only once was luck and timing on my side and found a property before it went on the market with minimal repairs after months of searching.

Buying investment houses and getting the info early on a property and at a great price is very sensible. Currently, rental properties are a great income source for me. Since affordable homes are difficult to find, it's pretty fast profit to buy, rehab, and sell these days. I knew I was ready to invest in something other than a savings account or the stock market. Banks and CDs are paying very little interest.

New Western has an amazing assortment of investment properties. There are enough properties to choose from that you can find something in the location that appeals to you. I have been very happy with my first investment - New Western made the whole process very smooth, they are very responsive, and I look forward to more investments in the future."

What are the benefits of working with a real estate investment brokerage?

A good investor eventually uses several different sources to acquire investment properties. Working with New Western will increase the number of properties you can analyze in a local market at any given moment. In other words, we’re simply another source of inventory.

How much does it cost to do business with New Western?

There are no membership dues or upfront fees required to work with us. Like typical real estate transactions, there are closing costs and associated fees when you purchase one of our investment properties. These costs vary depending on the property itself as well as the local market you’re investing in. One of our local associates can provide cost details in your specific market during your onboarding meeting.

What level of investors does New Western work with?

We work with every level and type of investor. Although the majority of the investors we work with are experienced, it’s not a requirement. We work with investors that are starting their first project as well as institutional buyers that purchase thousands of investment homes.

How do I gain access to your inventory?

After an initial virtual or in-person onboarding meeting, you will have access to our vast inventory of properties. Our associates will explain in detail how our properties are sold and how the transactions will be structured during that initial meeting.

How much cash do I need to buy a house?

It depends. Factors that influence how much cash you need include the market, the lender and the degree of work the distressed property requires. Investors need a down payment to purchase the property, money left in reserve for carrying costs (like interest, taxes and insurance) and enough capital to repair the property.