Local investors are now adding more homes to the market than builders.

Most investors are small, local, and community-driven.

A new, diverse investor class is emerging, blending legacy experience with fresh energy.

It’s individual investors dominating the market — not large institutions.

The hidden market: most flips start off-market.

Revitalized (flipped) homes drive substantial business for real estate agents.

Revitalized homes directly expand affordable inventory.

This is more than a market trend — it’s reshaping communities and solving a crucial piece of America’s housing crisis.

Last year, we flagged that local investors were on the verge of surpassing builders in supplying new housing inventory. We wrote:

Now, that prediction has become reality.

In the markets analyzed, local real estate investors brought 30,852 renovated single-family homes back to market in 2025 - outpacing the 18,973* new builds sold in the same time frame.

New builds in New Western markets this year

18,973

It reflects a growing reality: builders can't build fast enough, especially in the affordable, entry-level segment. High construction costs, zoning constraints, and long timelines continue to limit new home supply. Meanwhile, investors are moving quickly - sourcing primarily vacant and uninhabitable homes, modernizing them, and returning livable inventory to the market.

This shift is fundamentally reshaping the housing landscape. These investors aren't just flipping homes - they're reviving them, breathing new life into neglected properties and helping meet the urgent demand for more affordable, move-in-ready housing.

And the opportunity isn't slowing down. In these same markets alone, there are over 2.8 million vacant homes - part of a staggering 15 million nationwide - with even more coming as homeowners age out or downsize. It all adds up to a deep pipeline of properties ready for transformation.

While builders struggle to keep pace, local investors are stepping in and scaling up, becoming a powerful, grassroots force in solving one of America's most pressing housing challenges.

*New Western identifies investment transactions using proprietary algorithms.

**New Build Sales Data from Zillow

***Vacant Homes Data from U.S Census

Builders aren't the only players anymore. A surge of women, younger generations, and first-time real estate investors are stepping in - bringing surprising confidence, strategy, and scale. These small-scale operators are having an outsized impact. They're not just buying and selling; they're reviving aging homes one property at a time - and reshaping the future of housing in the process.

The new real estate investor isn't a faceless institution - they're often your neighbor. Operating close to home, these investors are targeting real housing needs with precision, speed, and personal insight.

These are entrepreneurial operators with deep roots in their communities, reviving aging properties and returning livable housing to the market one project at a time.

Meanwhile, a new generation of entrepreneurs - many inspired by the Great Resignation to launch their own REI businesses - has surged into the market. In the first half of 2025 alone, over 30,000 new investors joined the New Western marketplace looking for properties to rehab - putting this year on pace to surpass last year's total. These aren't institutions buying 100-plus homes in a single community. They're small businesses, many just getting started, chasing the American Dream.

Once dominated by seasoned veterans and large firms, today's market is a dynamic mix of entrepreneurial newcomers, mission-driven locals, and savvy strategists from all walks of life. These investors aren't just surviving in a tight market - they're adapting, thriving, and driving meaningful change.

It's not a trend - it's a shift.

A surge of new, independent real estate investors has entered the space, bringing speed, flexibility, and ingenuity where builders and institutions can't. And they're solving local supply issues at scale.

Whether just starting out or 10+ revitalizations deep, today's investors share a common mindset: confidence in the opportunity ahead.

The market is powered by both legacy knowledge and fresh momentum:

While new investors are making noise, experienced operators aren't stepping back.

Gen Z and Millennials are the most confident generations, with the majority expecting prices to remain stable or increase.

Baby Boomers, by contrast, are significantly more pessimistic - 40% anticipate a price decrease.

Still, younger investors are leaning in - bringing tech, ambition, and modern strategies to the table.

Women are quickly becoming a force in real estate investing - and doing it on their own terms.

This signals a sharp, efficient, ROI-driven approach that's gaining momentum fast.

While headlines often focus on uncertainty, what's truly reshaping the housing landscape is momentum.

This isn't a fringe movement - it's a structural shift:

In today's market, affordability isn't just a problem - it's the problem. High interest rates, limited inventory, and decade-long underbuilding have made homeownership feel out of reach for many everyday Americans. Nurses, teachers, firefighters - essential professionals - are being priced out of the very communities they serve.

While builders increasingly focus on higher-end homes to offset labor and material costs, local investors are operating where affordability lives: in the starter-home band, in overlooked neighborhoods, and in properties that need work.

These small, independent investors are revitalizing the homes most buyers avoid - older, outdated, often neglected - and returning them to the market as livable, affordable options.

Across New Western markets, revitalized homes typically re-enter the market in lower price tiers than both existing home sales and new construction - directly expanding the pool of more attainable housing options.

The average existing home sale price is 54% higher than the average revitalized home price, showing how these renovated properties fill a more affordable bracket of the market.

The median existing home price is 17% higher than the median revitalized home, further underscoring this pricing gap.

When compared to new construction, the difference is even more pronounced. In most markets, revitalized homes are at least 35% to 80% more affordable than new homes, positioning them squarely within reach for first-time buyers and families who might otherwise be priced out.

*Median Home Price Data from Redfin

Here's what almost every headline misses:

The most critical force in today's housing market isn't even showing up in the numbers.

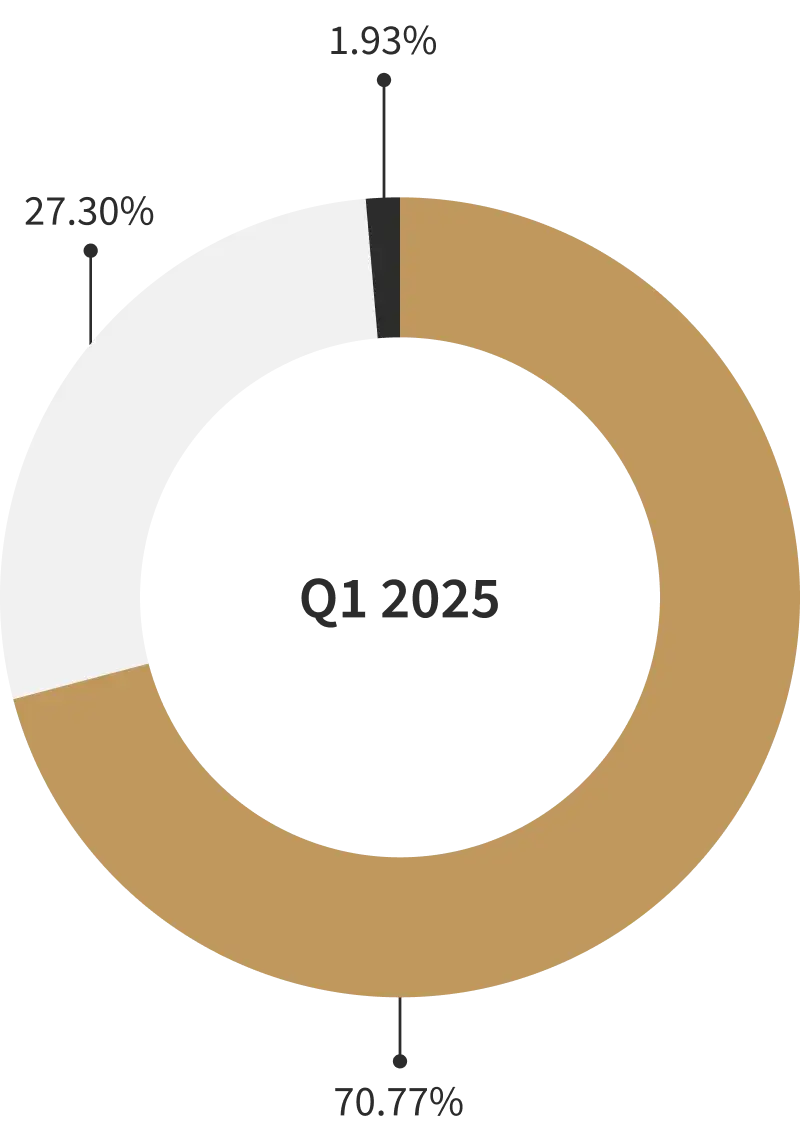

Over 70% of homes that end up revitalized are originally purchased off-market, completely outside traditional channels. These deals never hit the MLS, don't appear in public listings, and get zero airtime in national reports. Yet they're quietly transforming local inventory. This entire slice of activity flies under the data radar - it's the flip side, literally.

Why does this other market exist? Because for many homeowners, the traditional model simply doesn't fit. These sellers aren't calling a real estate agent; they need a different kind of solution. Their homes are often distressed, outdated, or tangled in personal complexities that make a conventional listing impractical.

The MLS isn't built for these situations. That's why a specialized off-market ecosystem has become a necessity, not just an alternative.

Consider the mechanics: every revitalization generates two transactions. First, when an investor acquires the property - typically off-market - to renovate it. Then again, when they complete the transformation and sell it on-market, where the MLS is the best channel to reach families and first-time buyers. This backend of the process is powerful: investor resales generated over $900 million in realtor commissions in Q1 alone. Those homes - and those commissions - simply wouldn't exist without investors bridging that gap.

This often-misunderstood dynamic flips the usual narrative. Off-market transactions aren't siphoning inventory away from communities; they're rescuing properties the traditional market can't reach, revitalizing them, and delivering them back through the MLS. It's a partnership, not a competition.

The result? Public housing data severely underrepresents the engine actually fixing supply. Local investors are reviving overlooked properties and adding affordable homes back into neighborhoods - but because so many of these homes start off-market, no one's counting them.

This silent transformation is reshaping communities across America. And it's far bigger - and far more essential - than the official story lets on.

*Federal housing data, including existing home sales reported by sources like FRED, primarily rely on NAR estimates derived from MLS-listed transactions. However, not all local MLSs are affiliated with NAR, and some report inconsistently or with delays. More critically, this methodology excludes off-market transactions, which represent a substantial share of the market. In 2024, for instance, NAR reported 4.06 million existing home sales, while New Western's MIDS analysis of recorded deed data identified 4.76 million - a 17% discrepancy that underscores the limitations of MLS-based reporting.

The affordability crisis is complex - but local investors are solving a critical piece of it.

By targeting hard-to-sell homes and making them livable again, these investors create real options for families who want to buy but can't compete at luxury price points. And it's working: revitalized properties not only deliver strong ROI for investors - they also expand access to homeownership, one property at a time.

But the stakes are even higher than they appear. There's an entire cohort of people now locked out of buying starter homes. That means they won't be able to upgrade in five years, or downsize in thirty. The ripple effects are massive - and potentially catastrophic.

Because this isn't just about money or market cycles. Take away the ability to own a home, and you undercut the very foundation of responsible citizenship. Homeownership builds more than personal wealth; it fosters long-term investment in neighborhoods, civic engagement, respect for laws and norms, and contributions to the common good. Without it, communities weaken, and society pays the price.

Local investors aren't just chasing returns. By revitalizing neglected homes and putting them back into circulation, they're safeguarding the pathways to ownership that sustain vibrant, resilient communities.

This report is an analysis of New Western market sales data and insights from opinion polling of 1,164 real estate investors in June 2025. New Western surveyed investors ages 18+ who have previously purchased properties through its marketplace or plan to in the future.

All new build data was obtained from Zillow's publicly available resources. Zillow - New Construction Data 2025 Q1.

All vacancy data was obtained from CensusReporter.org which aggregates data from the US Census Bureau.

All Redfin data was obtained from their publicly available resources. Redfin is a national real estate brokerage.

New Western identifies investment transactions using proprietary algorithms.

New Western is a real estate investment marketplace that creates opportunity. We make investing more accessible for over 200,000 investors looking for rehabs inside the largest source of value-add properties in the nation. We buy and sell a home every 13 minutes in most major cities. New Western creates an advantage for all - a fresh start for sellers, exclusive properties for investors, and new, affordable inventory for the housing market.

New Western is a licensed real estate brokerage that provides investors access to its marketplace of investment properties. The information provided within this material does not and is not intended to constitute legal, financial, tax, or real estate investing advice. New Western represents the seller in any resulting transaction and is not acting as an agent of the investor or any potential buyer in any resulting real estate transaction. The content published herein is provided “as-is” for informational purposes only. No representations are made that the content is error-free, and New Western does not make any representations or warranties as to the effectiveness of any investment strategy. This material does not create any warranty, contractual obligation, or agency relationship between any investor or potential buyer and New Western. New Western does not and cannot guarantee the accuracy of any information that was prepared by an unaffiliated third party. Buying real estate and engaging in real estate transactions involves varying degrees of risk, and investors and potential buyers should educate themselves on the potential risks by consulting their own advisors. Engaging in conversations with any New Western personnel does not constitute or replace the receipt of personalized advice from a professional engaged by the recipient of this material.