As forecasted in early 2023, individual investors leaned into the market and their business has grown despite the negative news and trends in the traditional housing market.

In this report, we reveal how local single-family investors continue to expand their business and sell properties while the traditional housing market is flailing due to lack of inventory.

93%

of investors plan to purchase a property in 2023 even though inventory remains low.

The number of homes for sale has dropped to the lowest level on record since 2012, according to Redfin in May 2023.

The National Association of Homebuilders projects 830,000 new homes will be built this year. But the 350,000 vacant homes expected to be flipped by rehabbers goes unnoticed.

No one else is solving the shortage problem.

Independent investors are strategically filling the gaps in housing inventory where the government and new home builders fall short.

They have expertise in high-demand locations

Investors are delivering much-needed supply where buyers are looking for more attainable housing options.

They provide mid-range priced homes

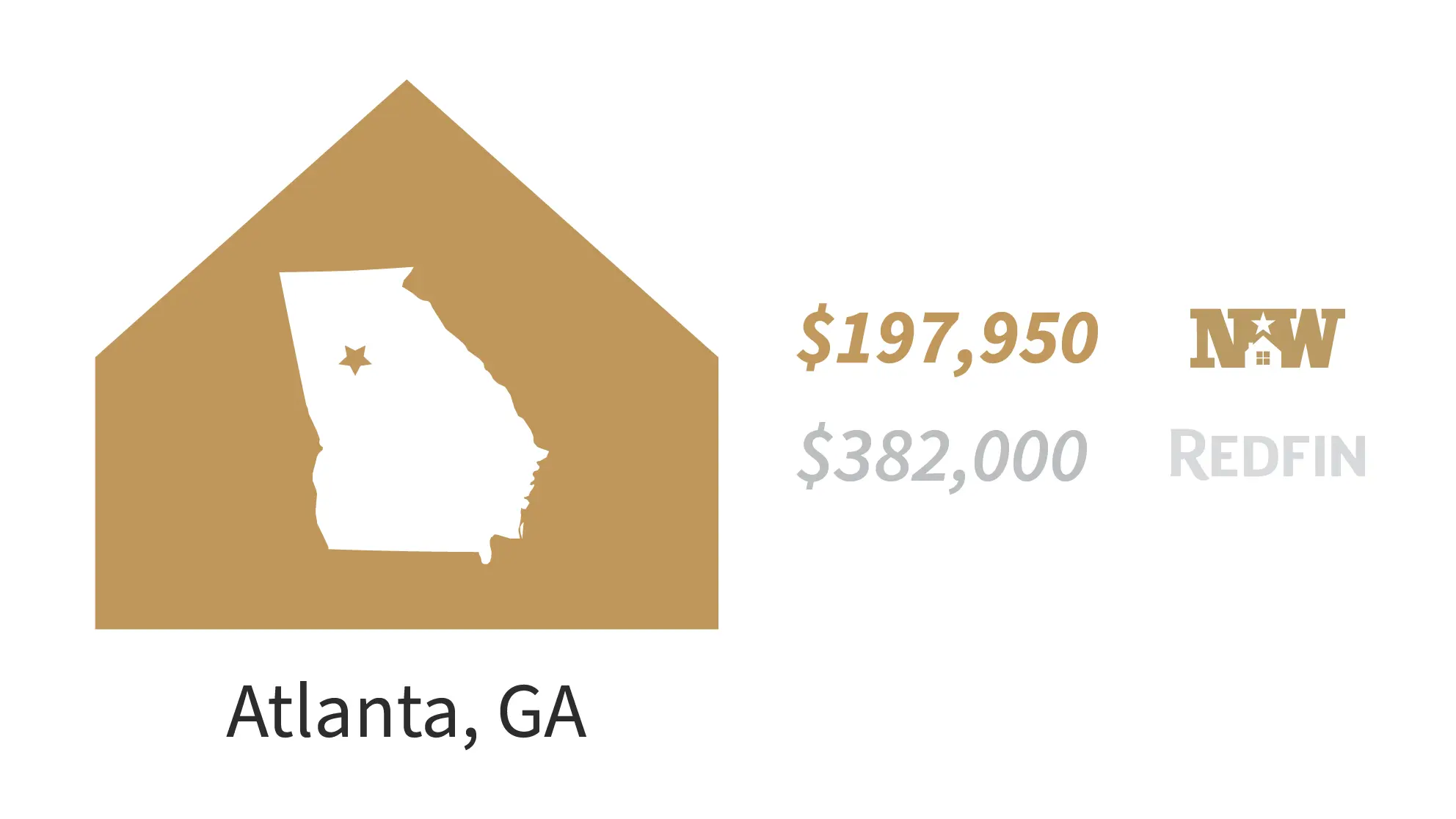

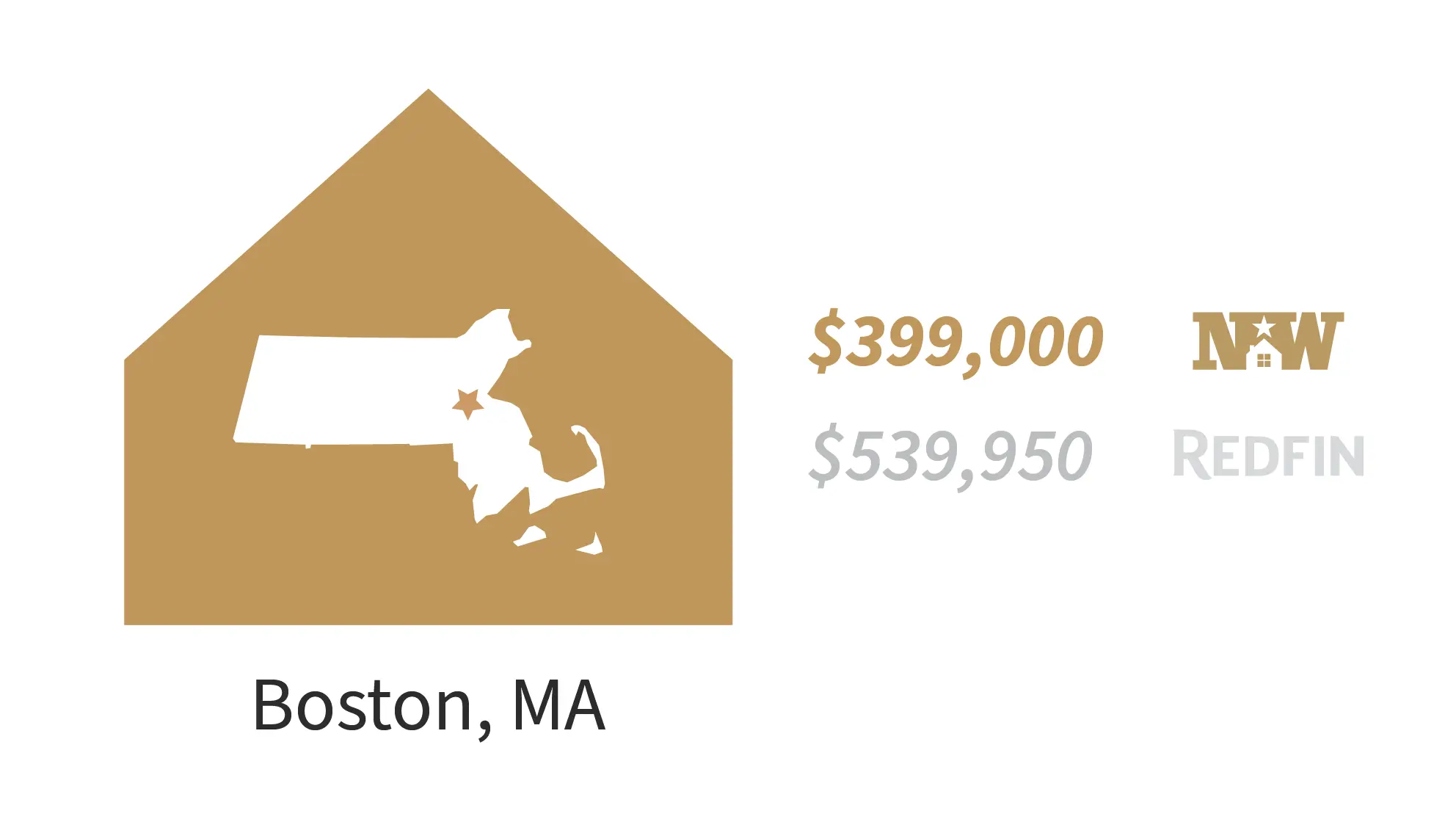

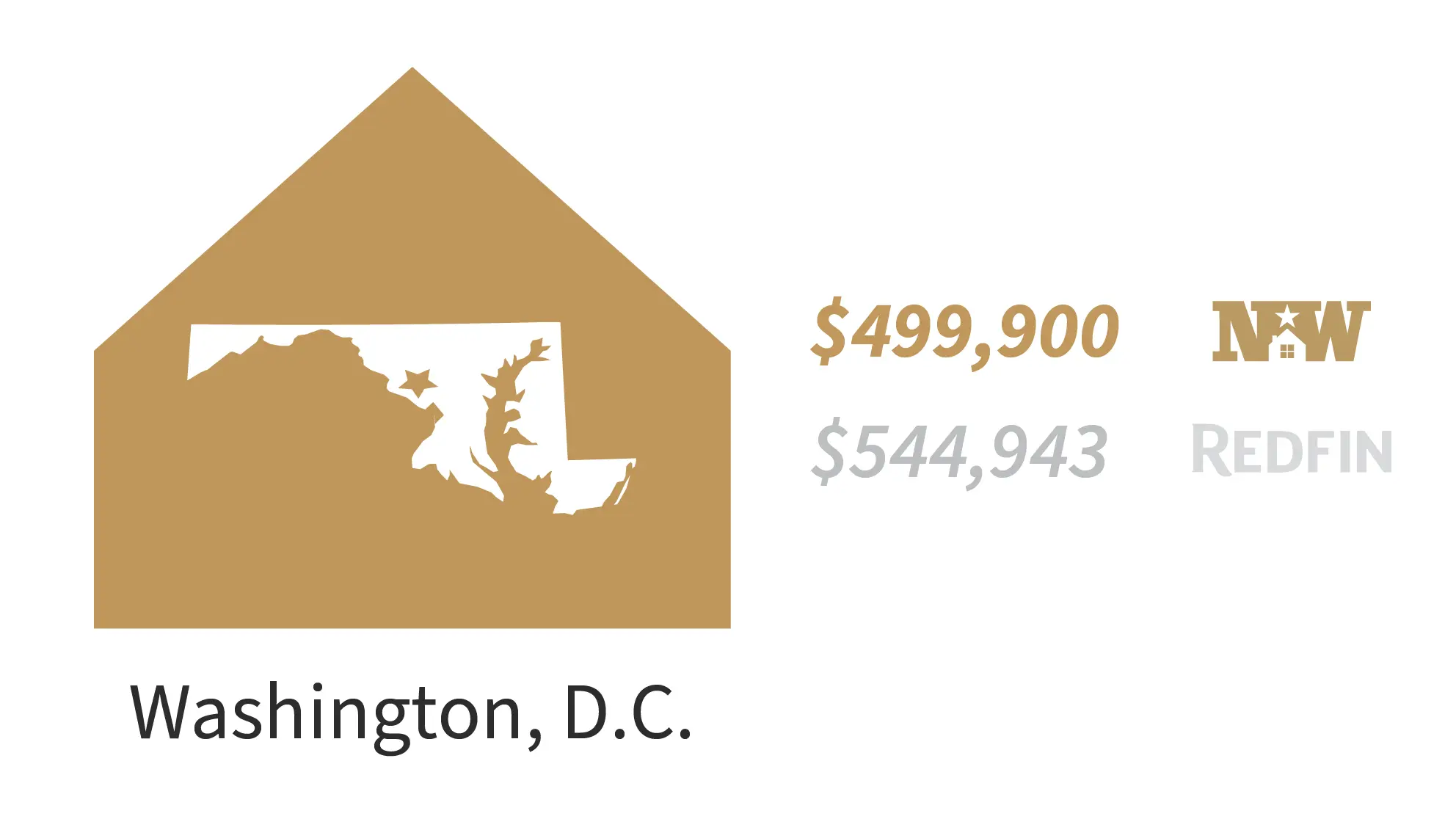

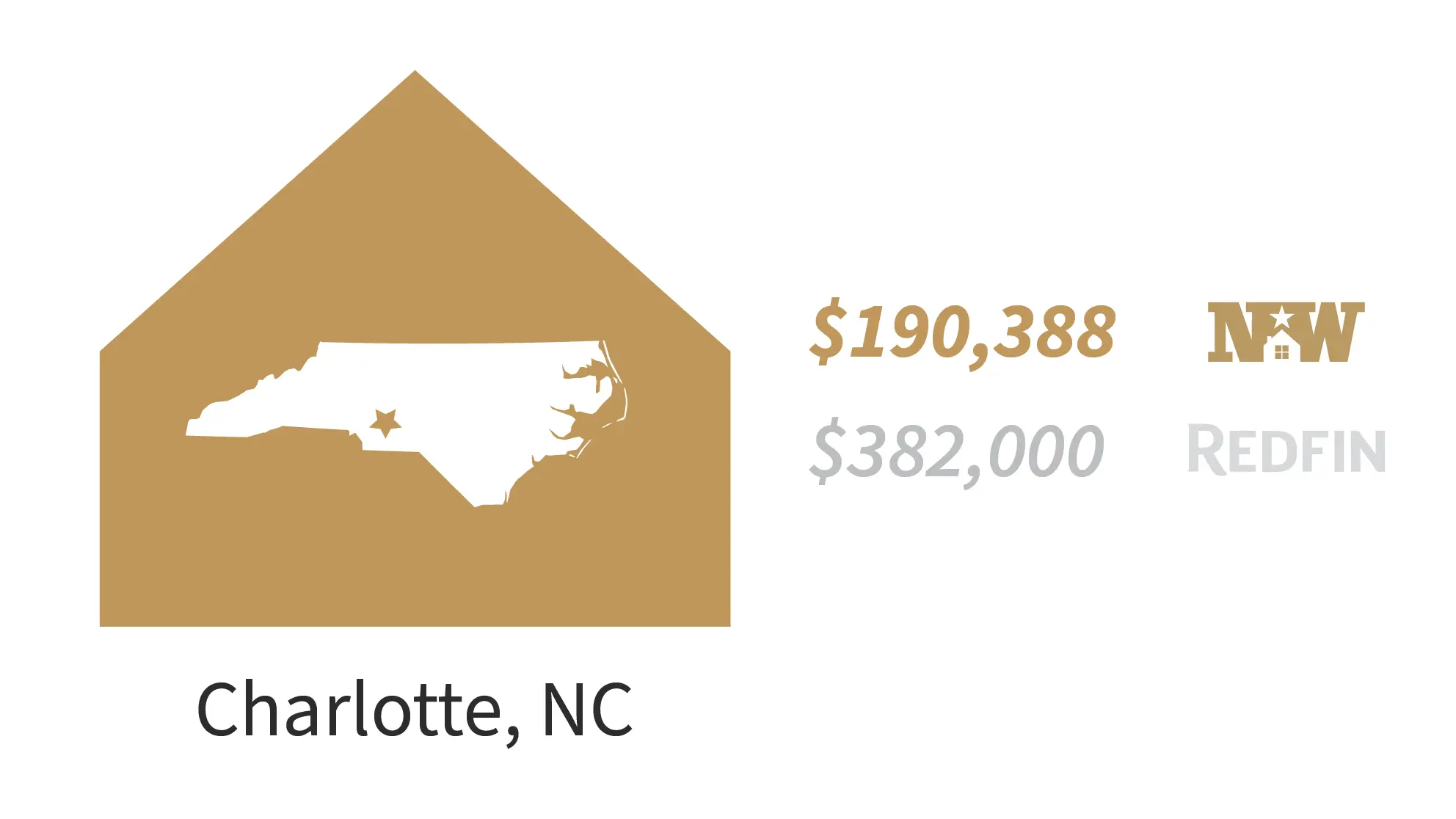

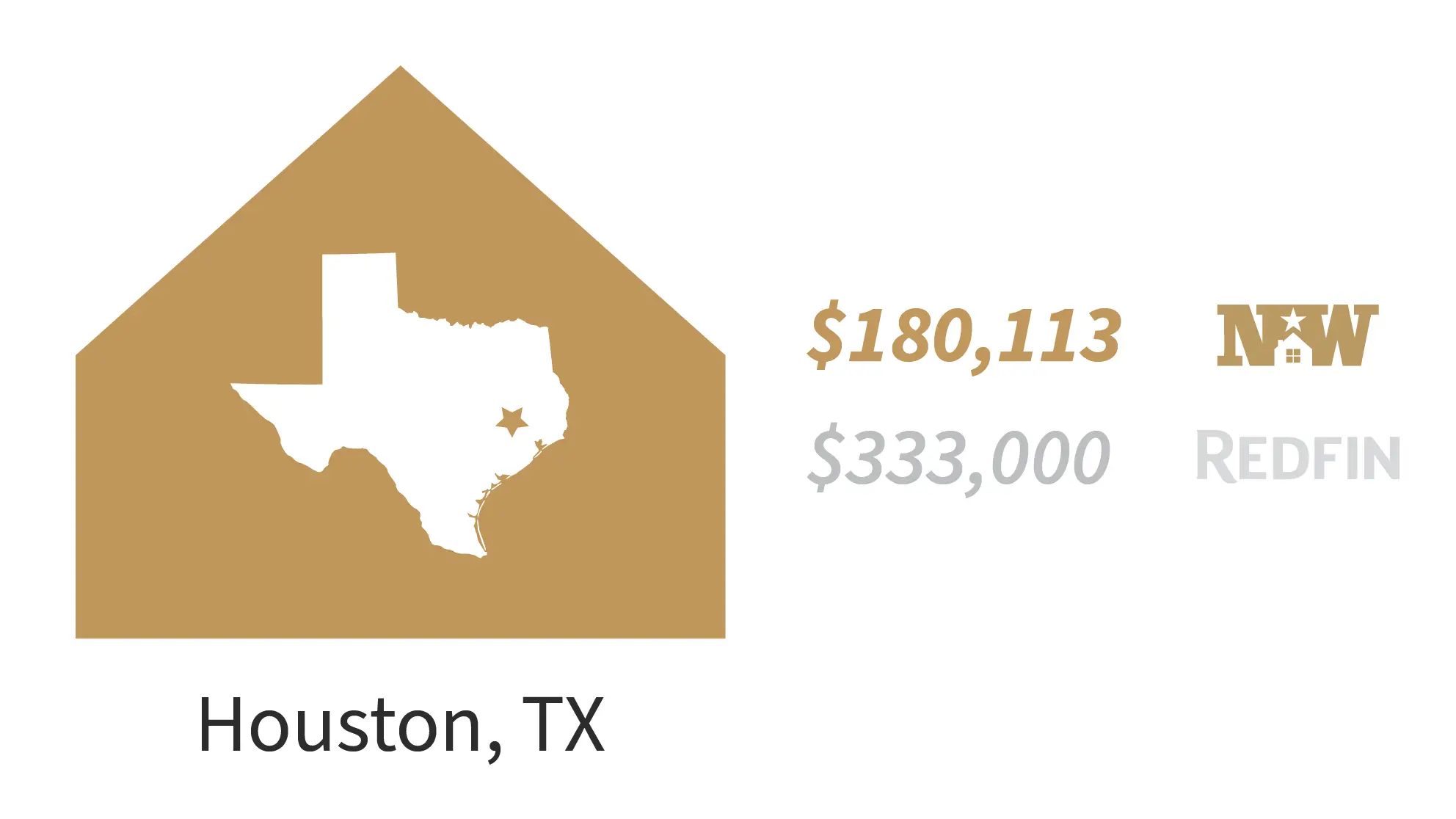

Investors are buying and rehabbing properties in neighborhoods that middle-income buyers can afford. And, investors are selling renovated homes for 31 percent less than the median home price in the same market.

They know what buyers want

Following the pandemic years, you might expect buyers to prioritize homes with great outdoor space and more square footage.

That's not the case

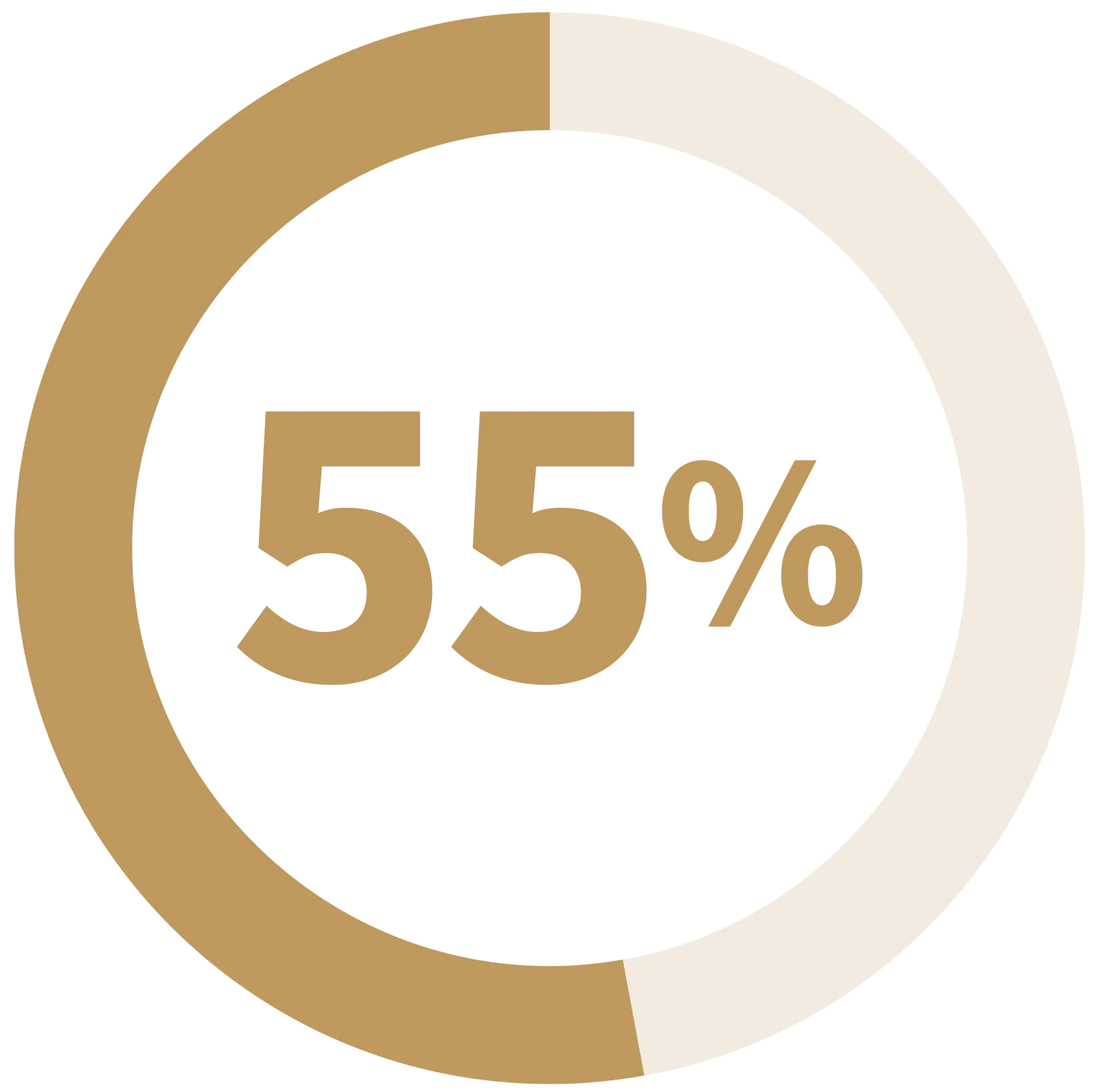

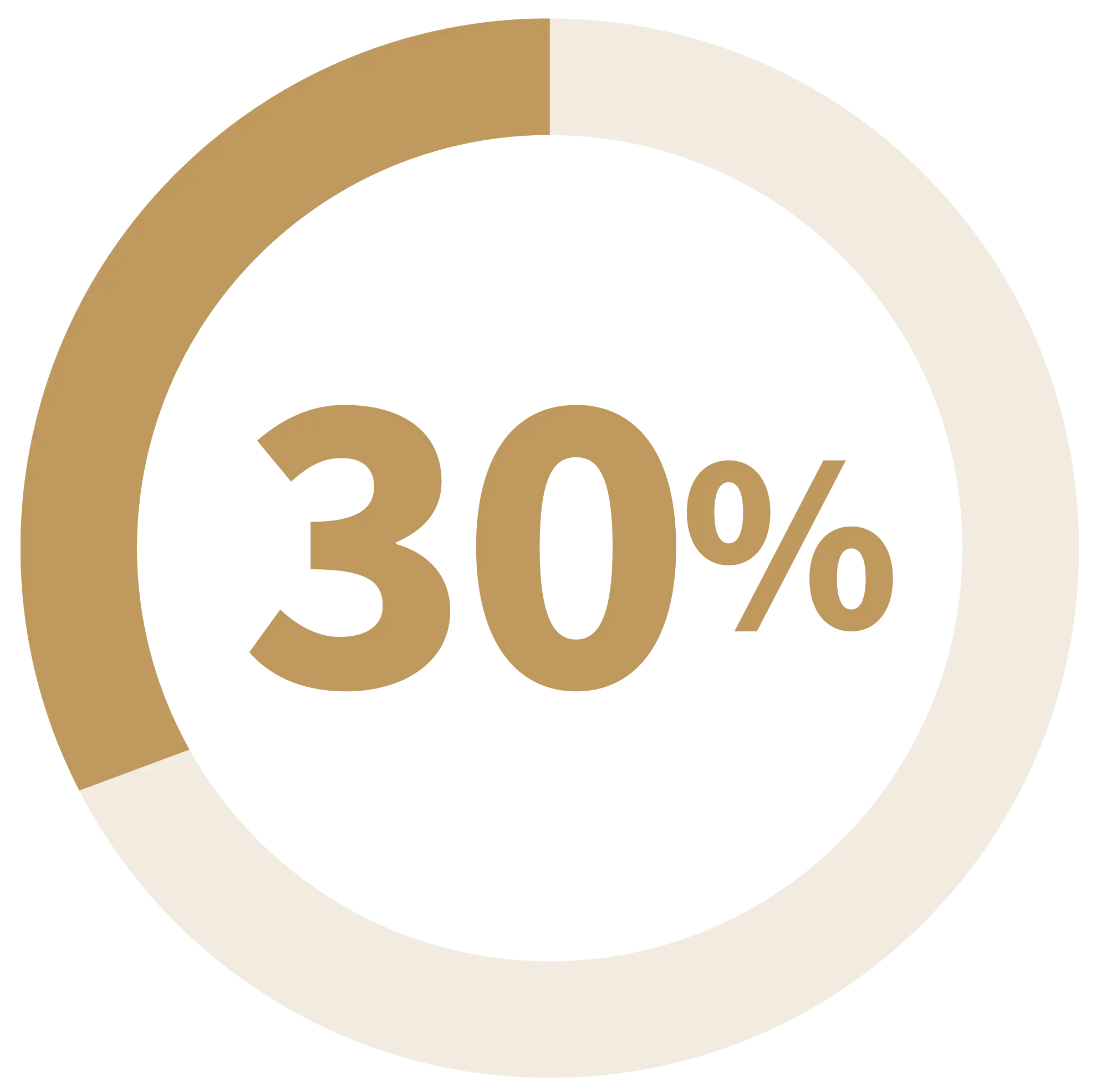

of investors said that location and neighborhood are the top priority for their buyers

of buyers wanted homes with good bones and desirable aesthetics

The #1 rule of real estate - location, location, location - came out on top

A proven success rate

Investors understand in-demand design trends and what buyer's want in a remodeled home.

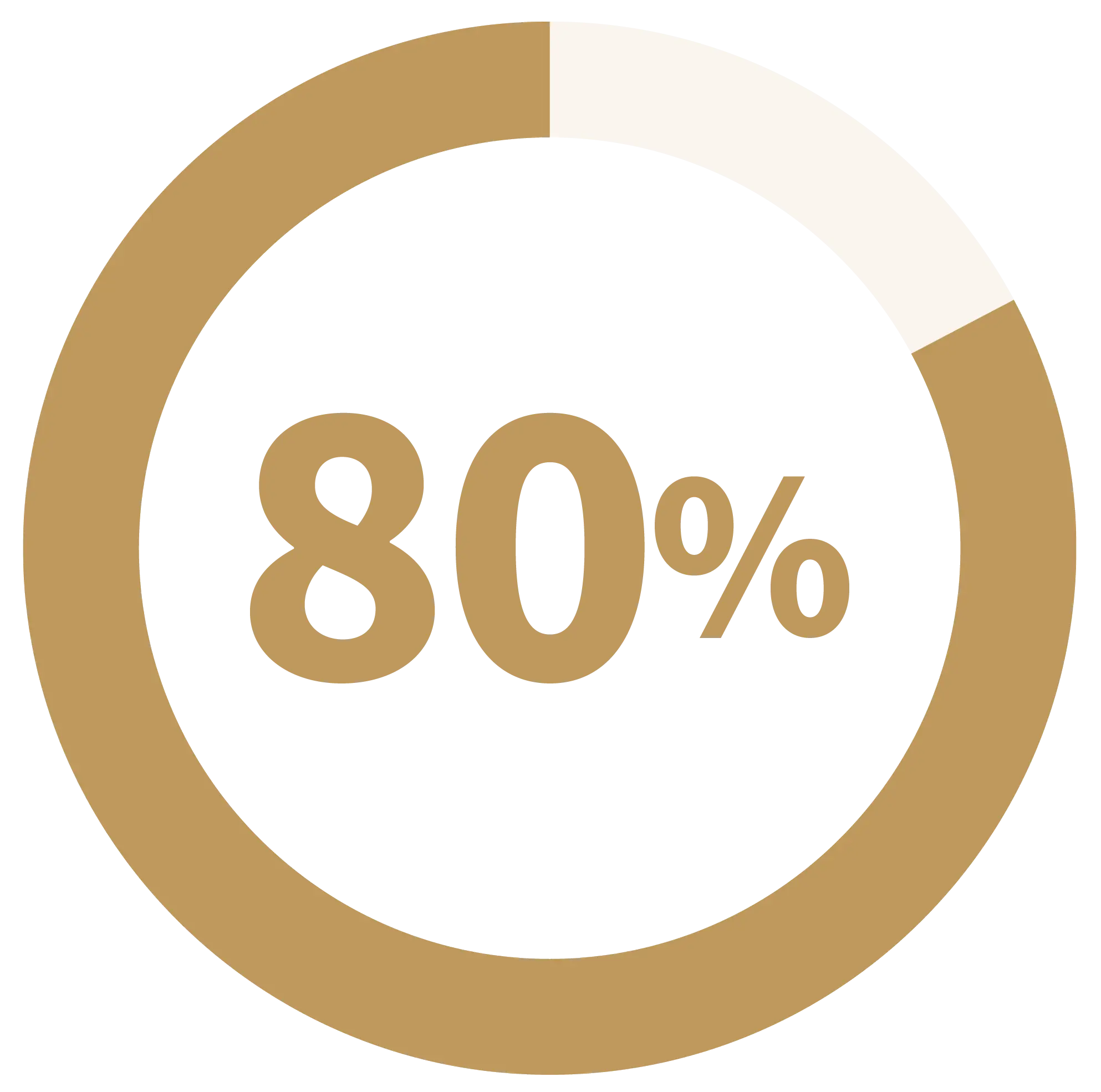

of homes rehabbed by investors are selling at or above the asking price.

Market Growth

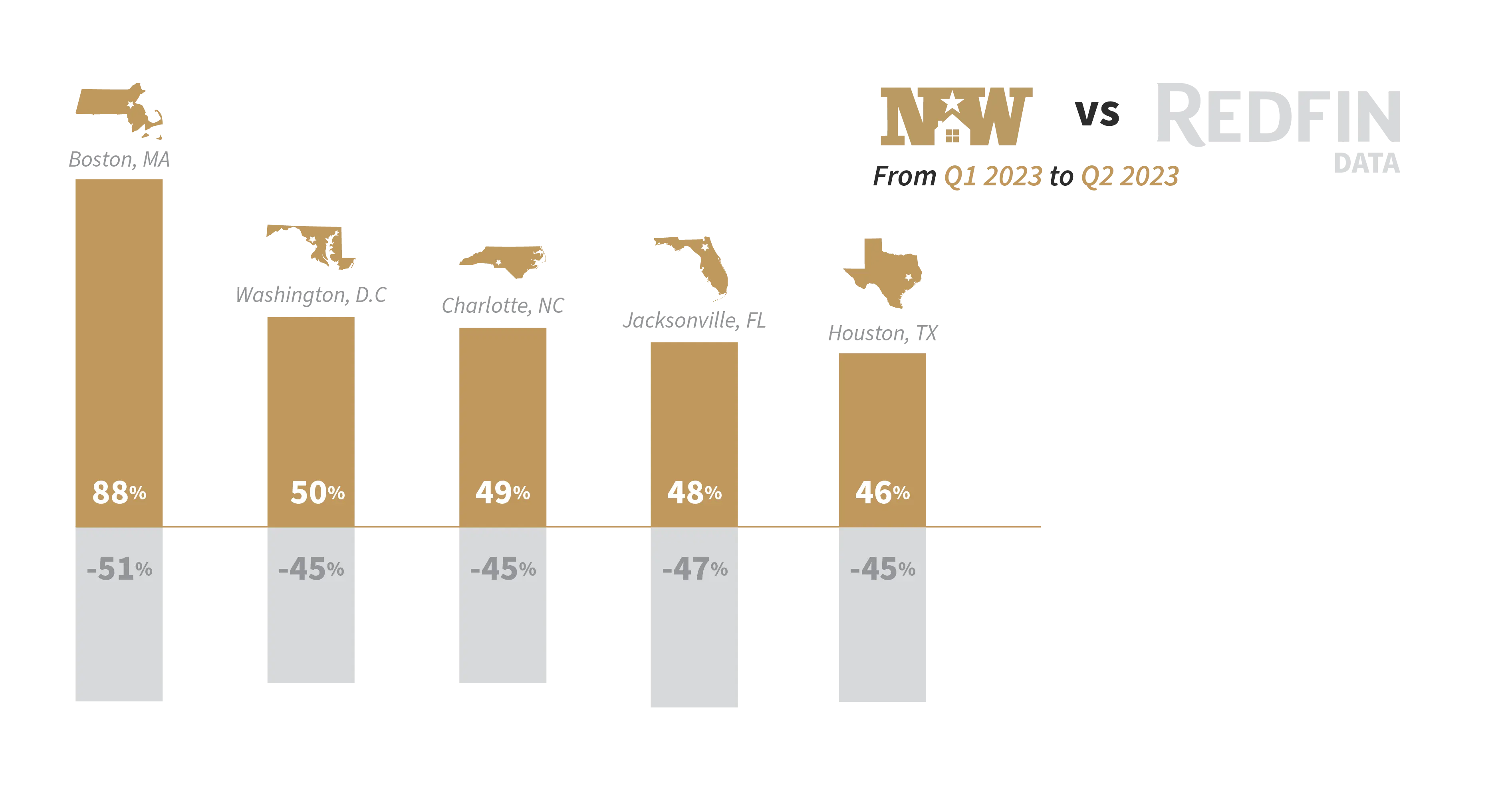

New Western, the largest real estate investment marketplace serving over 150,000 investors, a bellweather for the investment market, experienced double-digit growth in five markets from Q1 2023 to Q2 2023.

88%

Boston, MA

50%

Washington, DC

49%

Charlotte, NC

48%

Jacksonville, FL

46%

Houston, TX

Establish and Expand

As individual investors continue to thread the needle in the residential real estate market, their confidence grows.

75%

saw business growth from the second half of 2022 to date.

Almost 30% invest in real estate for a living.

And 3.5% exclusively invest as a creative outlet.

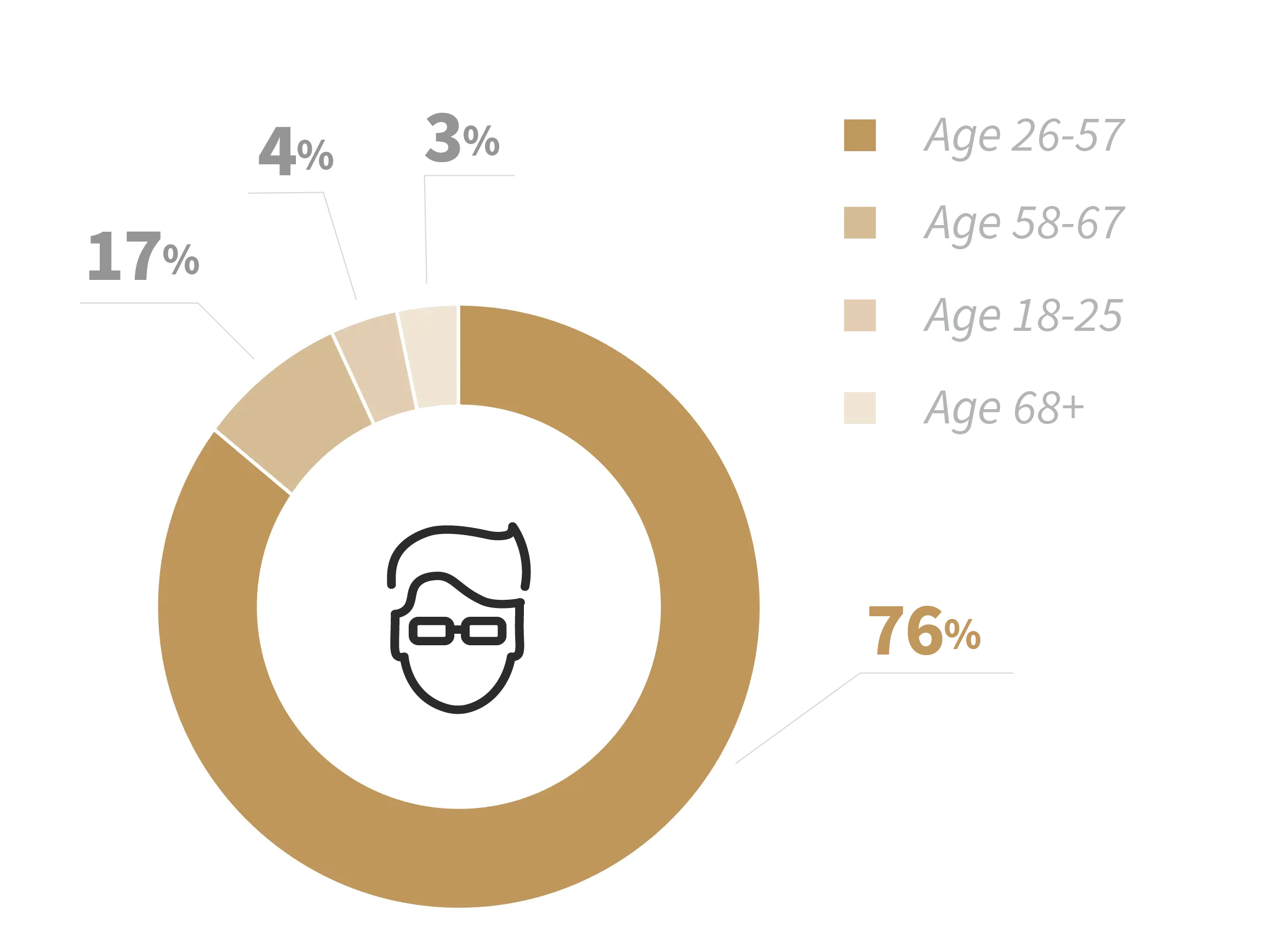

75%

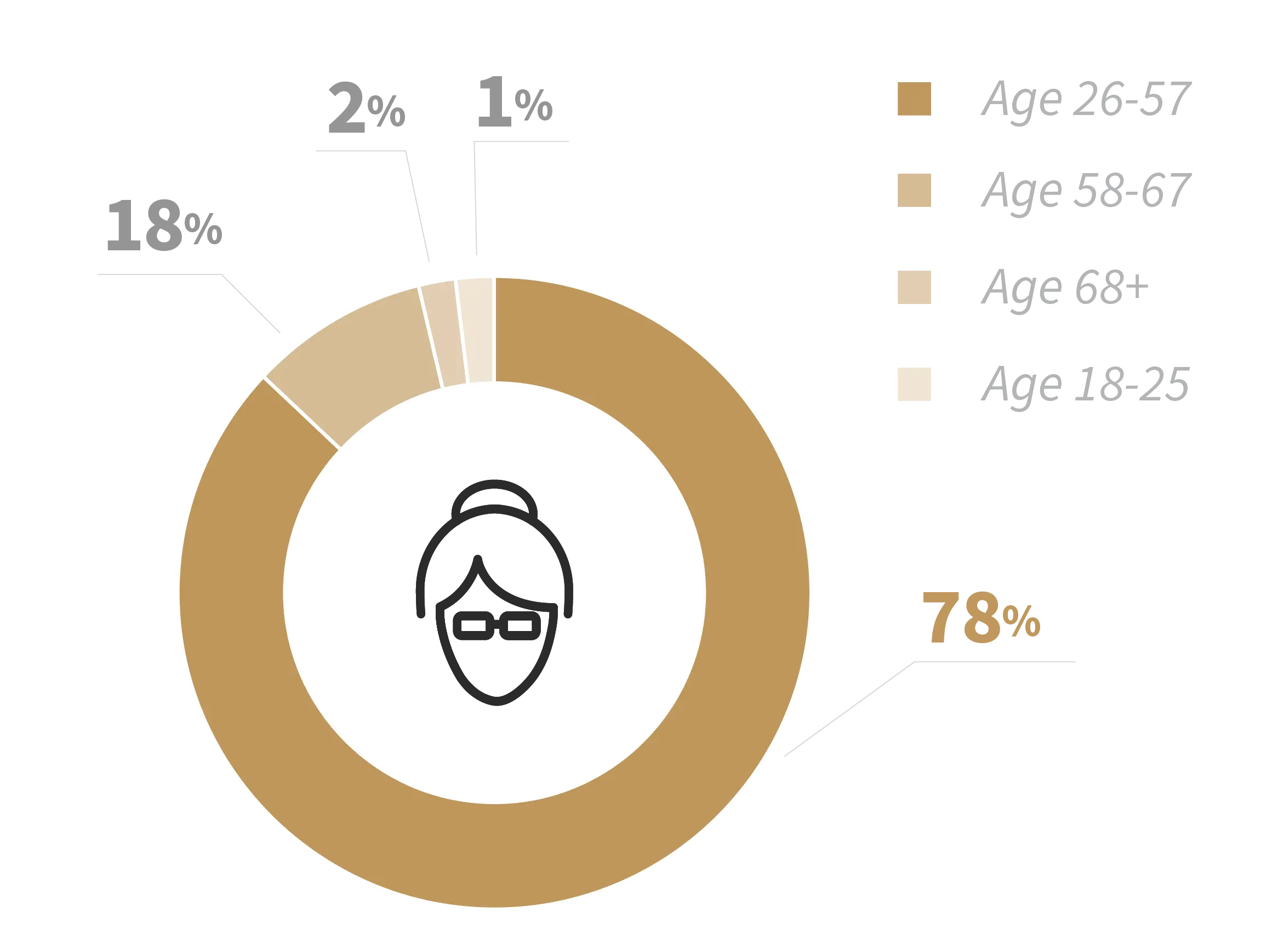

Male

25%

Female

A silver lining has developed

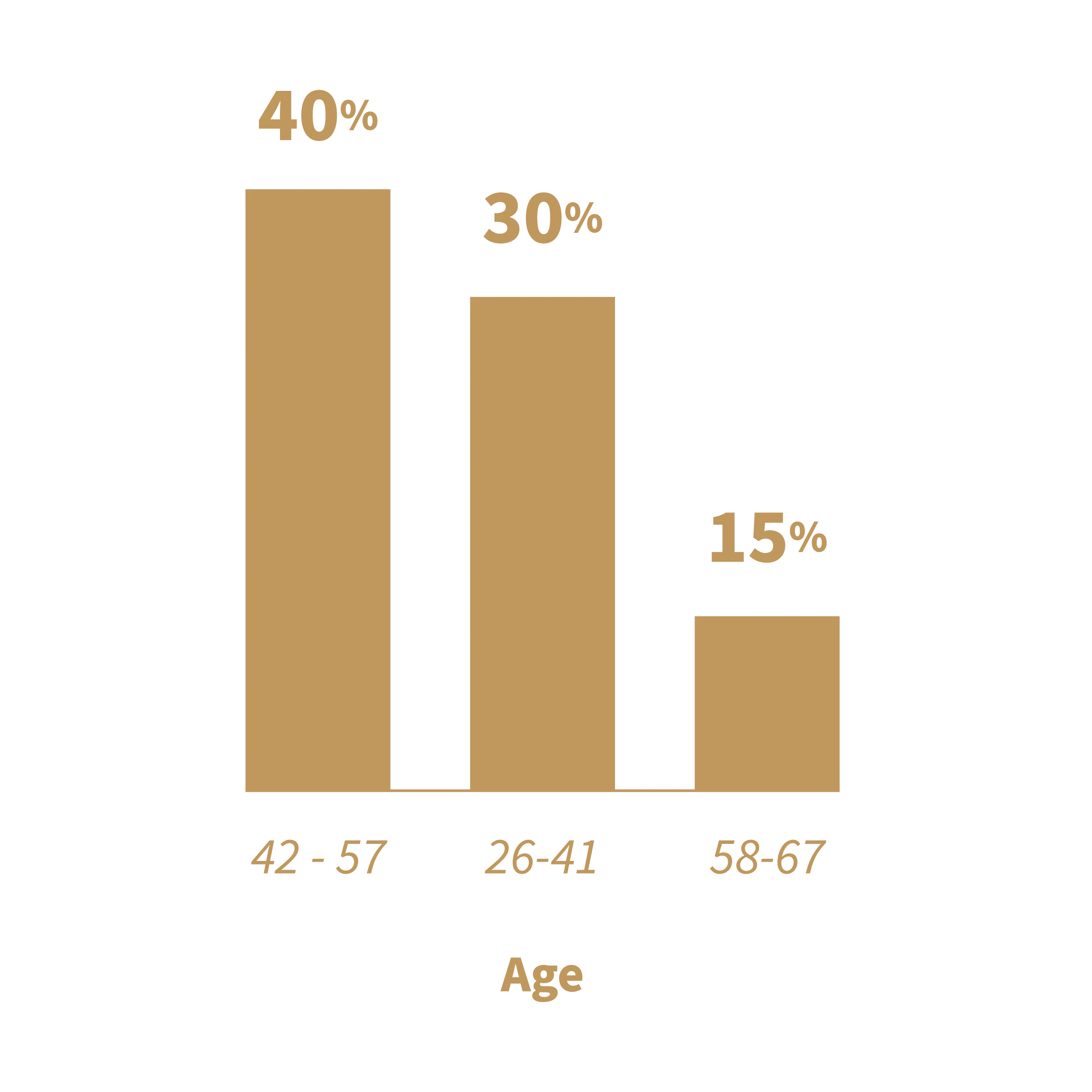

Nearly 5% of investors who rehab for a living are above the age of 68. Of that 5%, half of those investors are above the age of 77. And the primary reason those investors in the 77-and-up club invest in real estate is for a creative outlet.

Location

70% invest in the Southwest and Southeast regions of the U.S.

The Midwest comes in third place, followed by East and West coasts.

Biggest Challenge

Not surprisingly, the big challenges for investors remain the same year-over-year, finding more properties and securing financing.

Top Strategy

With a shift in the market, investors became more balanced in their investment strategy with nearly half utilizing fix-and-flip and half the fix-and-rent approach.

Funding

70% of investors use financing

30% of investors use cash

The biggest group of cash buyers are 18-25 year-olds and 58 and up.

Redfin data projects that the traditional market will see a decrease of 40 percent or more in homes sold from Q1 to Q2 2023. In contrast, New Western data shows that investors are bullish on finding opportunities despite negative market sentiment.

All Redfin data was obtained from their publicly available resources.

Redfin is a national real estate brokerage.

New Western originating data was calculated by comparing daily averages for the respective timeframes when comparing increase or decrease in unit sales.

Median New Western home prices are calculated based on the disposition of a home.

About New Western

New Western is a real estate investment marketplace that makes investing more accessible for more people. Operating in most major cities, our marketplace connects more than 150,000 local investors looking to rehab houses with sellers. As the largest private source of investment properties in the nation, we buy a home every 13 minutes. New Western delivers new opportunity for all—a fresh start for sellers, exclusive inventory for investors, and in doing so, creates housing that is more affordable for buyers. New Western was honored with a Glassdoor Employee's Choice Award in the U.S. small and medium company category, recognizing the Best Places to Work in 2023.