Housing continues to lead the way out of the recession with a third consecutive month of record growth. “The past few months have shown how valuable real estate is in the country, both to our nation’s economy and to individuals who have been given an opportunity to rethink their location and redesign their lifestyle,” according to National Association of Realtors ® (NAR) president Vince Malta.

Up, Up, Up

Existing home sales kept record pace in August with an annualized sales rate of 6 million units, the highest level since December 2006, before the Great Recession. August marked a third month of positive gains, up 2.4%.

Pending home sales continued their upward trajectory in August for a fourth consecutive month, up 8.8%. Year-over-year gains were even stronger at 24.2%.

Tight Supply

Inventory remains an issue and homebuyers must be ready to move – as homes averaged only 22 days on the market in August. Home showings are also up 20% over 2019, the largest year-over-year increase since October 2017, per the August Sentrilock® Foot Traffic report.

The number of homes on the market was down 18.6% annually — to a three-month supply. The last time our country witnessed such a frenzied sales pace, supply was more than double this amount. The situation has been exacerbated by a dramatic increase in lumber prices, fueled by a perfect storm of pandemic shutdowns, increased home renovation projects and the recent California wildfires.

True to form and economics 101, tight supply and strong demand continue to drive home prices to a record high and median price of $310,000, up 11.4% annually. August marks 102 straight months of year-over-year gains with double-digit increases in every region of the country.

Closing the Gap

Homebuilders continued to address the shortage in August. Single-family housing starts advanced 4.1% to 1.02 million units, a level not seen since February. And, according to the Commerce Department, sales of new homes rose to more than 1 million in August for the first time in 14 years.

The shift to the suburbs and reality of remote work have driven new construction, according to the National Association of Home Builders. NAR’s August Work from Home Study supports this trend and identifies counties most ripe for a new normal. The Lone Star State in particular appears to offer opportunity for homebuilders.

How Low for How Long?

“Tremendously low mortgage rates – below 3% – have again helped pending home sales climb in August,” notes Lawrence Yun, NAR chief economist.

“Additionally, the Fed intends to hold short-term fed funds rates near zero percent for the foreseeable future, which should in the absence of inflationary pressure keep mortgage rates low, and that will undoubtably aid homebuyers continuing to enter the marketplace,” Yun continues.

While down slightly from July, August mortgage applications were up more than 33% compared to last year.

Will Fall Fall?

Moving into autumn, inventory does not appear to be opening up. “In early September, new housing supply took a hit from the wildfires and hurricanes, and sales activity weakened. But because the impact of natural disasters has been more supply-oriented than demand-oriented, prices are expected to remain high,” reports Danielle Hale, chief economist at realtor.com.

With leading economists largely predicting a “V”-shape recovery, the future looks bright for housing as more return to work and spending increases. More than 80 percent of economists polled by the Wall Street Journal believe the recovery is well underway with unemployment in August falling below the 10% mark for the first time since March.

“I have been encouraged that many of the economic indicators have come in above consensus, perhaps suggesting that the U.S. economy is bouncing back stronger than expected,” according to Chad Moutray, chief economist for the National Association of Manufacturers.

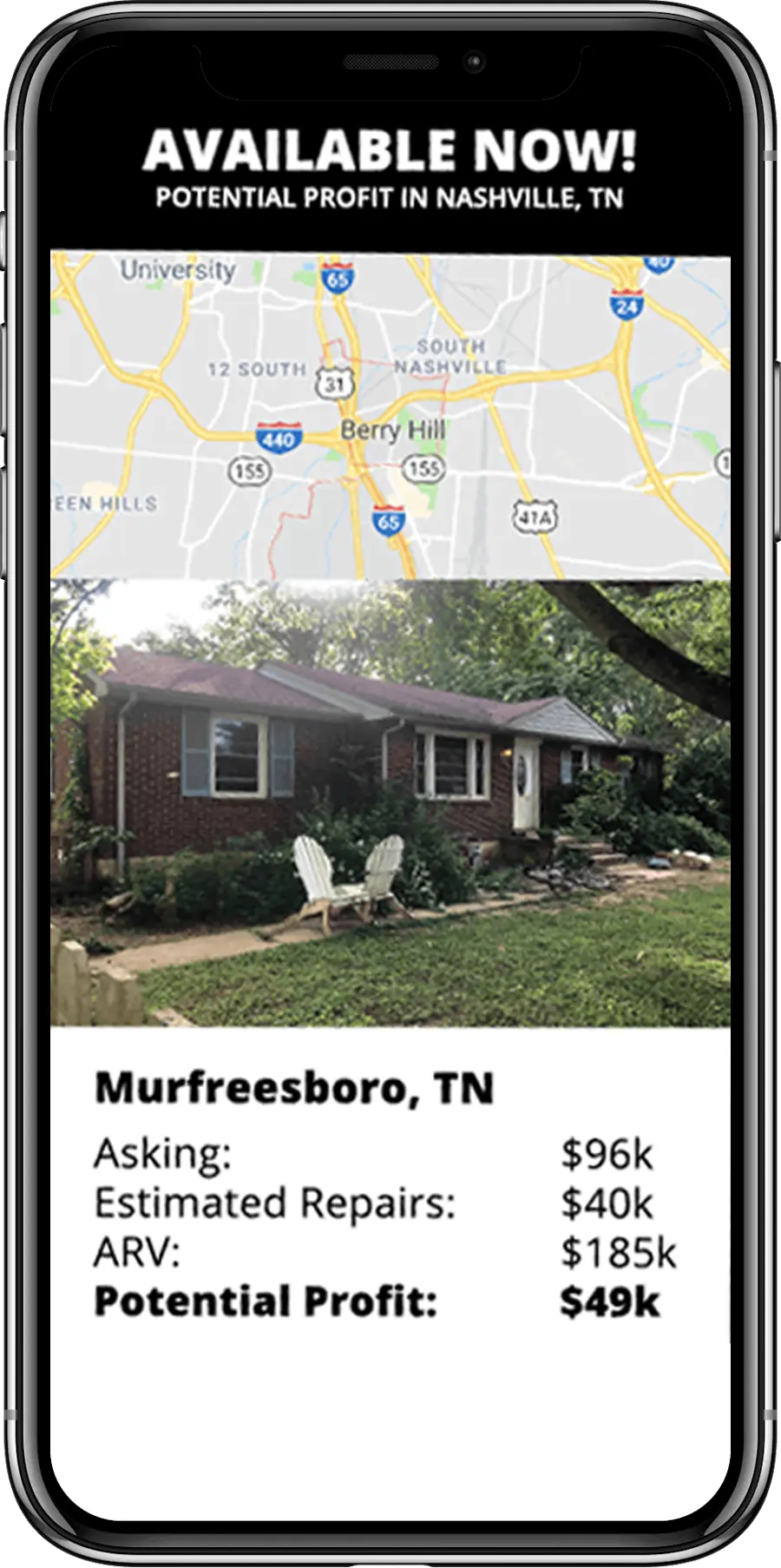

New Opportunity. New Western.

The real estate warriors at New Western are scouring markets across the country to uncover value-rich opportunities for our investors. Let us help you find one that fits your investment strategy. Contact us to see if you qualify for access to our exclusive inventory.