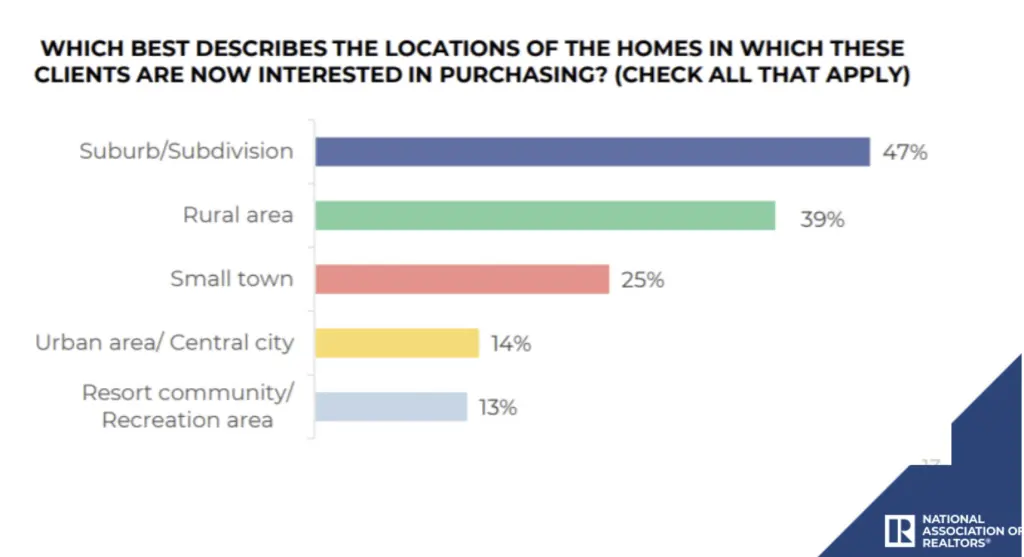

COVID Impact: The Urban to Suburban Flight

As we enter the fall with remote work, virtual learning, and social distancing still very much a part of the “new normal,” many homeowners find themselves dissatisfied with their current arrangements and are seeking space and safety in the suburbs. The flight to the burbs isn’t just talk, according to recent industry data. Find out more on our blog.

Buyer and Seller Confidence Rose in August

Sellers are starting to share homebuyers’ more optimistic outlook, according to the Fannie Mae Home Purchase Sentiment Index® (HPSI). For the first time since the pandemic started, sellers who think it’s a good time to sell outnumber those who think it is a bad time to sell. The change in sentiment could mean more homes coming to the market, notes Realtor.com.

Q2 Trends In Construction Materials and Labor

CoreLogic recently released its Quarterly Construction Insights report, which digs into critical pieces of the construction economy, such as changes in material labor costs, permits for new construction, and construction employment. Before you plan your next rehab budget, take a look at their recap to see which costs are on the rise, and which are holding steady.

Mortgage Demand Surges 40% From A Year Ago

Mortgage purchase applications rose 3% the week ending September 4 and were “a stunning 40% higher from a year ago,” CNBC reports. The Mortgage Bankers Association’s seasonally adjusted index year-on-year comparison is usually in single digits. “There continues to be resiliency in the purchase market,” said Joel Kan, an MBA economist. “The average loan size continued to increase, hitting a survey high at $368,600.”

Fannie Mae Predicts Record-Breaking 2020 Lending Volume

The world’s largest mortgage financier said mortgage lending this year probably will reach an all-time high of $3.9 trillion, according to a recent HousingWire article. The forecast also predicts the annual average U.S. rate for a 30-year fixed mortgage will be 3.1% in 2020 and 2.7% in 2021. Both would be the lowest annual averages on record.