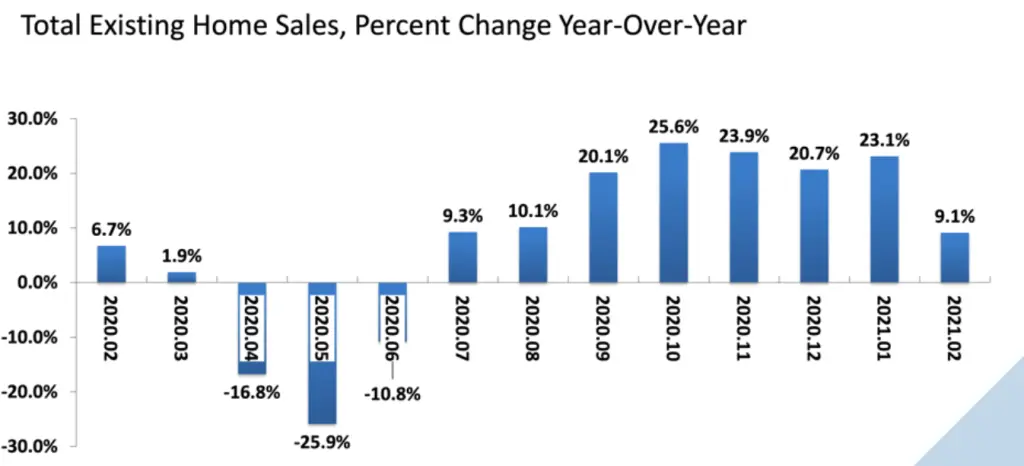

February marks the first month of a slowdown in sales in the housing market. Record low inventory continues to be the critical challenge—no surprise for those who’ve been following the market.

Slow but Steady

While existing home sales fell 6.6% in February after two months of gains, sales remain 9.1% higher than last year at an adjusted annual rate of 6.22 million units. Notably, the West was the only region with a month-over-month sales increase (4.6%).

“Despite the drop in home sales for February – which I would attribute to historically-low inventory – the market is still outperforming pre-pandemic levels,” noted National Association of Realtors® (NAR) chief economist Lawrence Yun.

Pending home sales were also down for the second month (-10.6%) and versus year ago (-.5%), marking the first year-over-year decline in nine months. “Only the upper-end market is experiencing more activity because of reasonable supply,” Yun noted.

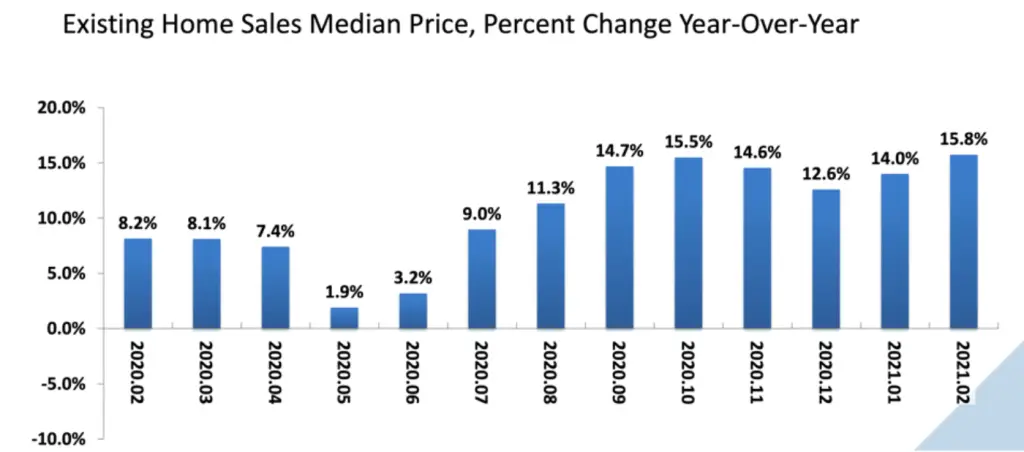

Limited supply continues to drive high prices with a median home price of $313,000 for a 108th straight month of year-over-year gains.

The Inventory Issue

Total housing inventory remains at a record-low 1.03 million units, down 29.5% vs. 2020, with unsold inventory at a 2-month supply. And properties are only sitting on the market for an average of 20 days, with 74% of homes sold in under a month.

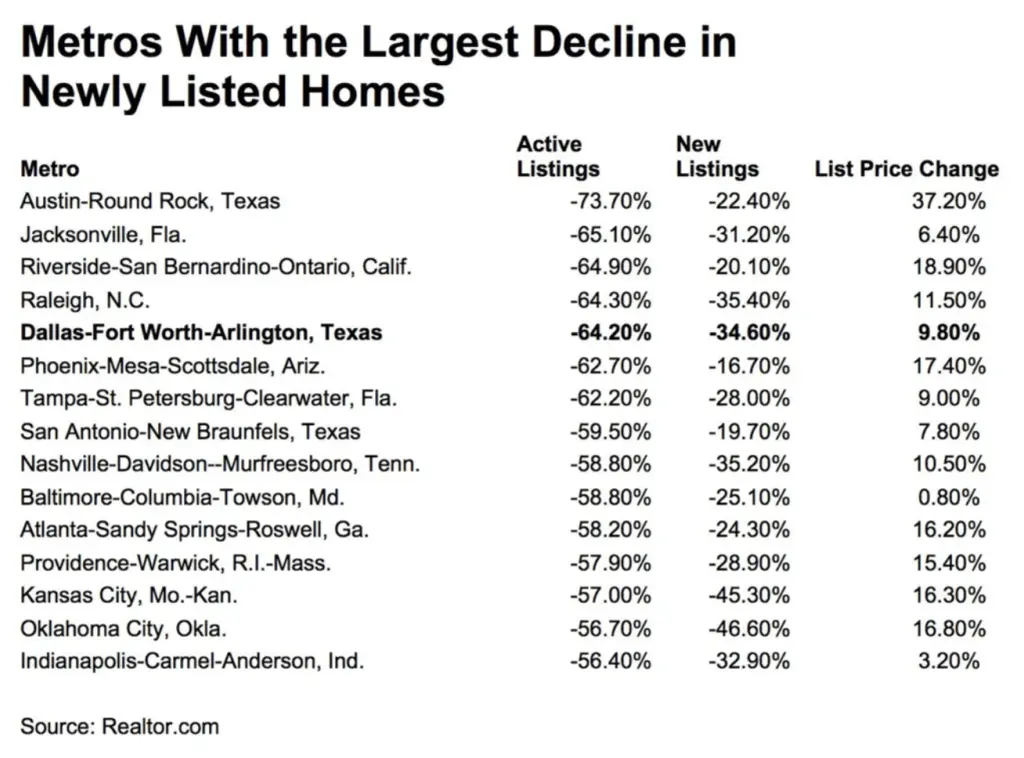

“Unless we see some big improvements in the new listings trends over the coming months, buyers can expect stiff competition,” according to Realtor.com chief economist Danielle Hale.

Texas and Florida in particular are home to the top metros facing steep declines in inventory.

Housing starts fell 10.3% to a six-month low in February—at an adjusted rate of 1.421 million units. Extreme winter weather in many parts of the country took a major toll on activity. Buyers seeking new homes are facing considerable waits. The country’s largest homebuilder ended 2020 with a backlog of 28,487 homes nationwide, double the backlog of the previous year.

Beyond building material shortages, builders are also dealing with a vastly different business dynamic than in the past decade. “Builders over the past 10 years, now fully aware of the risks to building too many homes, kept a lid on speculative building,” notes housing economist Ali Wolf. “That prudence led to really healthy and successful homebuilding companies over the years and has only recently caused some problems, the biggest of which is that builders don’t have enough homes built today to match the rampant housing demand.”

Mortgage Rates Rise

After months of record lows, the rate on a 30-year fixed approached 3% for the first time since July, according to Freddie Mac. That said, rates at the end of February remain significantly lower than pre-pandemic: 2.97% in 2021 vs. 3.4% in 2020. “As we head into mid-March, when the housing market typically hits its spring season stride, first-time buyers will be eager to find a home before rising rates push their search out of reach,” notes Realtor.com senior economist, George Ratiu.

Rising rates may have a positive impact on what may feel like runaway housing appreciation. “That’s one reason I think we will see a slowing in home price growth,” notes CoreLogic chief economist Frank Nothaft. It may also provide a bit of a reprieve for builders. “A little bit of moderation will allow builders to catch their breath,” predicts housing analyst Ted Wilson.

Mortgage applications are continuing to remain steady, up .5% the last week of February. “The housing market is entering the busy spring buying season with strong demand. Purchase applications increased, with a rise in government applications –

likely first-time buyers – pulling down the average loan size for the first time in six weeks,” reports Joel Kan, economist with the Mortgage Bankers Association (MBA).

Spring Forward

With widening vaccine access and the prospect of return to the workplace for many, economists foresee a promising year ahead for housing, albeit with a few unknowns.

“The housing market is still very strong going into the beginning of the year…The question is how does the buying public respond as those rates stabilize or maybe drift higher across the course of the year,” suggests Fannie Mae chief economist Doug Duncan.

HousingWire’s lead analyst Logan Mohtashami predicts that rising rates should “cool housing price growth and result in more inventory as homes spend more time on the market.” He also anticipates that the first-time homebuyer tax credit will continue to fuel demand.

Yun believes that rates will remain relatively low—no more than 3.5% in 2021—fueling a sunny forecast for housing. “I still expect this year’s sales to be ahead of last year’s, and with more COVID-19 vaccinations being distributed and available to larger shares of the population, the nation is on the cusp of returning to a sense of normalcy.”

New Opportunity. New Western.

Now is the time for real estate investors to lock in rates and take advantage of opportunities. It’s more important than ever to have a professional in your corner who can uncover the right ones for your investment strategy. New Western agents are constantly finding value-rich opportunities for our investors. Let us help you discover the deal that fits your strategy this year. Contact us to see if you qualify for access to our exclusive inventory.