After months of searching, you’ve finally found the right home. But what if you now need to convert this primary residence into a rental property?

Perhaps your life has changed and your home just doesn’t meet your needs or that job you’ve been eyeing suddenly materializes—but it’s out of state?

Rest assured: it’s doable. But you need to know those facts before you jump into becoming a landlord. Let’s break down the basics.

Renting out Your Primary Residence

Most lenders assume that owner-occupied transactions mean the homeowner will live in the home for at least 12 months. When you close, you sign documents attesting to that intention.

Financing a home as owner-occupied usually means significantly lower down payments, interest rates and other benefits. Additionally, you can often qualify for an owner-occupied refinance with less equity.

If you know that your plan has changed, you must be up front with your lender to avoid being accused of occupancy fraud, a form of mortgage fraud that happens when the borrower lies about the occupancy status of the property. Similar to banking fraud, this crime means fines, penalties and even jail time.

Lenders will usually require higher credit scores for renting out a primary residence. And buying a property to rent usually means a 15%-25% down payment vs. zero to 5% down for an owner-occupied residence.

Non-owner-occupied mortgage loans can mean interest rates .5-.75% higher than for owner-occupied homes. Asset reserves may also be required for principle, interest, taxes and insurance (PITI)—usually six months PITI or more.

Don’t forget to provide your new mailing address to your lender so that you receive all important documents directly.

While rental properties can create healthy revenue streams for property owners, it’s important that you continue to plan and save for mortgage payments. There will likely come a time when the residence sits unoccupied between tenants and you will need to be prepared to pay the mortgage yourself.

You also need to assess whether you will make enough to cover the rent and afford a mortgage or payment on a place for you and your family to live.

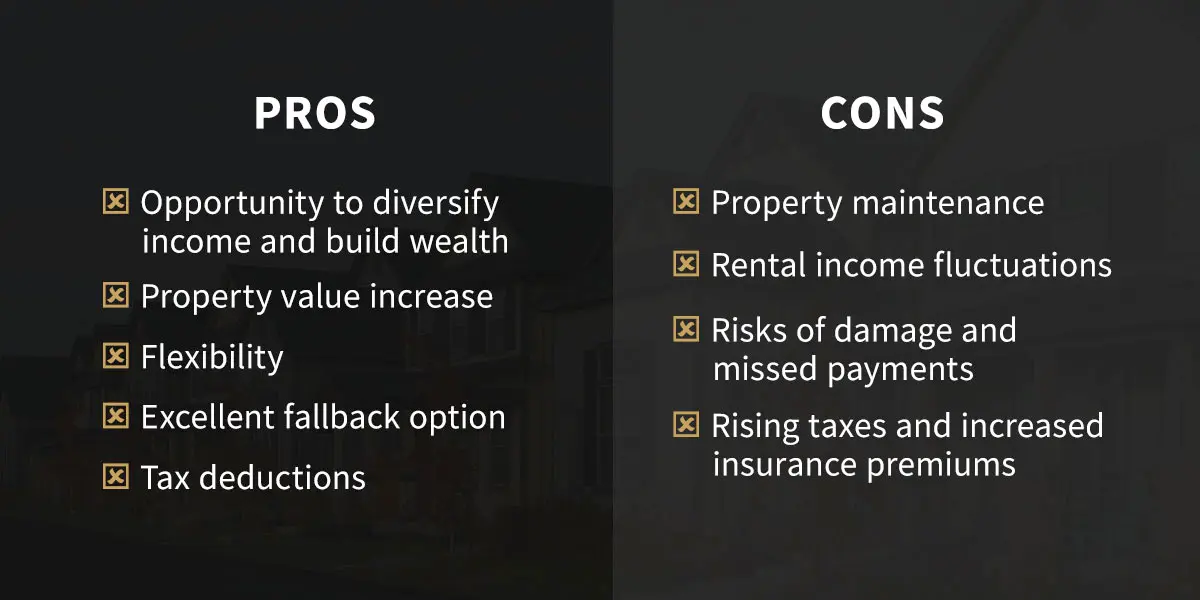

The Pros and Cons of Turning a Residence Into an Investment

It’s important to be aware of the advantages and challenges of turning a residence into an investment so you know what to expect and you can prepare. Below are some final pros and cons to renting out a primary residence immediately after purchase:

Pros

Converting a residence into a rental property offers the following benefits:

- Opportunity to diversify income and build wealth: With a rental property, you can build wealth and diversify your income.

- Property value increase: When turning your residence into an investment, improvements to the house and new amenities in the area can increase the property’s value, giving you more control over its final rental price.

- Flexibility: When you convert a residence into a rental property, you have the flexibility and freedom to move and live somewhere else without paying for the unoccupied home.

- Excellent fallback option: If you suddenly need to move for a job transfer or other personal reasons, your rental property becomes a great option to avoid paying a higher price when moving to your old neighborhood.

- Tax deductions: You must pay taxes on your rental income, but you can deduct certain expenses from your total rental income to reduce what you owe.

Cons

You should also be aware of the following challenges that can come with owning a rental property:

- Property maintenance: You may need to spend significant time, energy and money to repair and maintain the property. Potential damage is unpredictable, so you should always be prepared to address potential complications.

- Rental income fluctuations: With market fluctuations, rental income may be less than expected at times. Neighborhood decline can reduce your rental property’s value and the rental amounts individuals are willing to pay.

- Risks of damage and missed payments: Tenants may cause damage to the property or miss payments, which can increase your costs and decrease your overall profit. Carefully screening your tenants before renting to them helps prevent damage and missed payments.

- Rising taxes and increased insurance premiums: There may be cases where taxes increase faster than you can increase rent prices. If there is a rise in natural disasters, insurance companies may also increase costs, making it essential to establish how susceptible the area is to these events.

Preparing the Property

Preparing your property and turning it into an investment requires a combination of best practices that will allow you to gain a suitable amount of profit. Here are the most important steps you can follow to prepare your property for rent.

Get the Property Ready and Complete an Inspection

Once you have your mortgage set up properly and have researched all of the legal implications, it’s time to get the house ready for renters. Take a look at other rental properties in the neighborhood and see what amenities, appliances and features they are offering. But don’t overdo it!

Every additional amenity means an additional potential maintenance expense. While a Jacuzzi tub sounds nice, it probably won’t bring in any more rent but will bring in big repair costs if not properly maintained.

Go ahead and hire an inspector to assess your property for any issues that may require immediate attention. Clean the home thoroughly and consider staging it and hiring a real estate agent prior to listing it.

You can also look for tenants directly by posting ads online or promoting with friends and colleagues. There are many online platforms that make it easy to list your home for rent, from Zillow and Realtor.com to Craigslist.

Understand Insurance Impact

Your homeowner’s policy no longer applies to a rental property. You will need to reach out to your insurance company and let them know of your plans. You should secure coverage that protects you from damage and loss and offers liability coverage in the event your tenant gets hurt on your property. Landlord insurance is intended for rental properties, and it generally covers:

- Rental income loss

- Property damage

- Liability matters that can arise

Landlord insurance provides a specialized approach to protecting your investment. With landlord insurance, you can potentially save money on property expenses and cover unexpected damage if it occurs. Lenders may also request additional insurance coverage as you will have tenants moving in and out—and require that your tenants secure rental insurance prior to move in. Renters insurance covers the tenant’s injuries and personal property. This is essential because landlord insurance may only cover the property’s physical structure and landlord-owned furniture and equipment.

You can start by speaking with your insurance provider and asking them whether you can switch to landlord insurance with them. If the terms and conditions don’t meet your insurance and budgeting needs, you can explore other landlord insurance policies. You can also pursue additional coverage like earthquake insurance or flood insurance, depending on the risks of the location.

Research Housing Laws

There are a number of legal factors to consider which vary based on your state. Research landlord and tenant housing laws, and understand landlord obligations on factors such as the following:

- Lease agreements: A lease agreement outlines lease conditions and terms to protect yourself and your tenants.

- Security deposits: A security deposit is a certain amount a tenant pays that covers damage if the tenant causes it. If the tenants takes care of the property and causes no damage, you return the deposit to them at the end of their lease.

- Tenant screening: Different states have different tenant screening laws, so you must understand your state’s requirements before you begin the screening process.

- Licenses and permits: It’s important to understand your local government’s renting laws so you obtain the proper license and permit to rent your property.

- Inspections: An inspection ensures your property is safe to live in. Your property must meet state or local inspection standards and pass inspection before you can rent it to tenants.

- Fair Housing Act: Understanding the Fair Housing Act ensures you do not discriminate against potential tenants. This act prohibits you from discriminating against tenants based on religion, race, sex, disability or national origin.

- Tax requirements: Check which particular taxes you may owe to ensure you report the correct taxes on your tax return, such as rental income.

A real estate attorney can help you manage the transition from homeowner to landlord and develop a lease agreement for your tenants. Maximizing your tax savings is important, so you should talk to your accountant to learn about your location’s tax rules and housing laws to understand what you can and cannot claim. Interest deductions for investment properties are different than those for rental properties.

Establish a Homeowner’s Policy

You also need to understand if your homeowner’s association (HOA) allows rentals in your neighborhood. There is great variation in this: some HOAs prohibit them entirely, others allow only a certain percentage of rental homes and some may want to be involved in vetting potential tenants.

It’s also important to note that some communities restrict rental properties according to the location’s zoning laws. Be sure to confirm with your local zoning board whether you can rent out your property beforehand. Your local zoning board can provide you with your area’s specific zoning laws, and you can contact your HOA to provide information about their rules and requirements regarding the following aspects:

- Number of rentals permitted: Too many rentals in the area might make the community seem like it is mainly populated by tenants and may negatively impact the growth and value of the area.

- Rental income limits: HOAs might request regular fees toward maintenance of common areas, which may impact the amount you earn.

- Lease duration: Lease duration rules may include minimum and maximum lease terms, which may affect your ability to advertise your rental as a vacation home.

Determine Your Responsibilities

As a landlord, your job isn’t over once a renter moves in. You may need to serve as real estate agent, repairman and possibly an evictor. And of course you will need to pay the taxes. If you don’t have time to take care of the day-to-day responsibilities, you should consider hiring a property manager.

Evaluate Implications if You Sell

Before you get started on converting your primary residence into an investment property, consider whether you can handle the tax implications and depreciation expenses that come with selling an investment property. The IRS typically charges investors long-term capital gains tax. This amount depends on your taxable income and filing status.

Additionally, the government may recapture any depreciation you claimed on previous tax returns for the property when you sell it. Recapture allows them to tax depreciation as ordinary income. Be sure to determine and claim the depreciation expense during the process of converting your residence.

What to Consider When Converting Your Primary Residence

To rent out your property with fewer issues and concerns, you’ll want to research specific factors. By researching the appropriate areas, you can gain more potential renters, screen them effectively and ensure you receive the correct value for your property. Here are some effective tips for converting your primary residence.

Screen Tenants

Once the home is officially listed as a rental, you will start receiving rental applications. It’s critical to screen applicants and check on their credit report, employment status and status with past landlords. Here are some of the key questions you should ask when screening a tenant:

- Can they afford to pay the rent on time every month?

- Are they able to move in/move out when you need them to?

- Will they be a respectful and safe tenant and neighbor?

- Are they agreeable to reference, background and credit checks?

And on the flip side, here are some topics that you cannot probe on based on the Fair Housing Act:

- Age of tenant

- Family plans

- Disabilities

- Marital status

- Religious affiliation

- Place of birth

Be careful how you word your documents and screening questions — even seemingly harmless language such as ‘Perfect place for an older couple’ expresses a preference for a specific group.

There are a number of tenant screening services out there. Here are some of the top ones outlining their capabilities.

Determine Rent

Rent collection is one of the most important considerations when you convert your home to a rental property. Let’s take a look at all of the steps you should consider in determining rent. First up is to figure out income and all potential expenses.

It’s important not to fall into the trap of assuming the equation is simply rental income minus mortgage payment. Savvy landlords know to assume that expenses will eat up about 40%-45% of monthly income, not including principal and interest payments.

Factors to consider when calculating expenses include the vacancy rate in your area, the age of your home and anticipated repair and property management fees, if applicable.

In the words of one real estate investment pro on rent collection, “You should be highly focused on the investment aspect of your purchase to ensure that your home is truly an asset to your family and not a burden.”

Market Your Property

You can attract potential tenants fairly quickly when you use the right marketing tactics and advertising platform. Two of the most popular options for advertising are:

- In-person advertising: If you’re trying to reach the local audience, in-person advertising allows you to attract and get in contact with potential renters faster. Catch their attention with a “For Rent” sign explaining details about the property, and put flyers up on bulletin boards at neighborhood amenities.

- Online advertising: Online advertising is best done through rental listing websites, making reaching a broader audience easy. This also allows you to include professional photos and detailed information about the property, like the rental rate, location, size and a description of the property’s key features.

Find the Right Property

As the largest source of distressed property in the nation, New Western offers investors a steady supply of value-rich, off-market properties ripe for rental. Our agents serve as your boots on the ground, drawing on a wide array of data and unmatched local market knowledge to consistently source the best deals for you.

If you’re ready to turn your home into a rental property or invest in a new rental property, New Western can help. We feature an online marketplace where you can search for and discover properties. Contact us to learn more about the property investment process or find the right property.