As we look towards March 2024, what do real estate investors, wholesalers, and real estate agents need to know about the current market?

A shortage of houses for sale continues to prop up home values. Ironically, a continued strong economy has pushed mortgage rates higher than expected in the second month of 2024. Not surprisingly, housing demand is sluggish. Mortgage rates and inventory continue to be the culprits. No one expected mortgage rates to rise into the 7% range and yet on the last day of February, the 30 year fixed rate sat at 7.10%.

Pending home sales are down from December to January but new listings are up in February– a good, forward-looking sign for activity in the spring housing market.

What are the key factors investors should consider as we enter March 2024?

The same buyers and sellers who were waiting in January, continue to wait for rate drops and more inventory in the spring.

Even with another rise in inventory of new construction homes in February, builders plan to increase production in the second half of 2024 to meet the demand.

Mortgage rates came down at the beginning of the year but rose again in February, hitting a high of 7.5%, potentially signaling an unpredictable road to stabilization.

Homebuyers are ready and willing to buy. Redfin’s homebuyer demand index reports that showings and home tours are up 10% from last month.

Rent rates are stabilizing and are currently more affordable than a mortgage. This is a good marker for investors looking to grow their rental portfolio while preparing for spring flips.

What about the single-family investor market?

New Western tracks investor activity and reports results on a month-over-month basis in addition to surveying investors about their businesses.

And these are the markets with the highest deal activity growth in the New Western marketplace from January 2024 to February 2024.

Dallas – Fort Worth

Charlotte, North Carolina

Atlanta, Georgia

Oklahoma City, Oklahoma

Raleigh, North Carolina

Let’s take a look at the stats on the current housing market:

Existing Home Sales

December home sales may have been down month-over-month, but existing home sales rose 3.1% in January 2024.

“While home sales remain sizably lower than a couple of years ago, January’s monthly gain is the start of more supply and demand,” said NAR Chief Economist Lawrence Yun. “Listings were modestly higher, and home buyers are taking advantage of lower mortgage rates compared to late last year.”

The median sales-price is $379,100 compared to $382,600 in December, according to the National Association of Realtors.

The sales price may have declined month-over-month, but $379,100 still represents a 5.1% increase from a year ago and marks the seventh consecutive month of year-over-year price gains. Inventory is still tight, but improving, with a 3.1 month supply in January and up 2% from December.

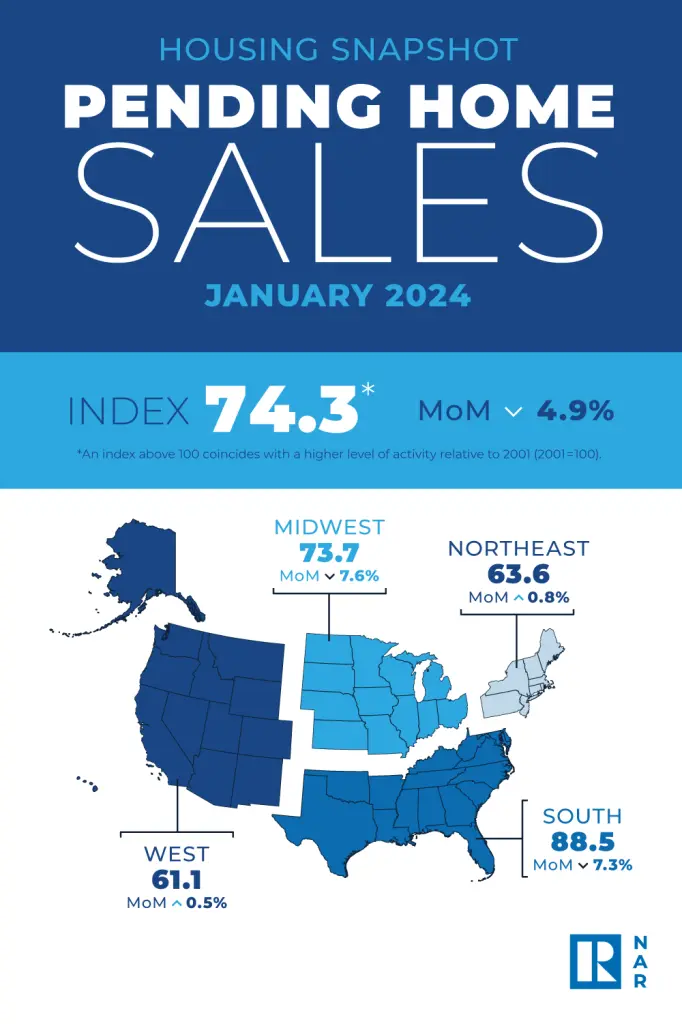

Pending Home Sales

Pending home sales showed a decrease of 4.9% in January. But contract signings were up month-over-month in the Northeast and West, and could indicate a positive outlook for home sales in the coming months.

“The job market is solid, and the country’s total wealth reached a record high due to stock market and home price gains,” said NAR Chief Economist Lawrence Yun. “This combination of economic conditions is favorable for home buying. However, consumers are showing extra sensitivity to changes in mortgage rates in the current cycle, and that’s impacting home sales.,” said Lawrence Yun, NAR chief economist.

According to Redfin, new listings rose in the month of February resulting in a 13% year-over- year increase. This is also the biggest increase in new listings in almost three years and as a more current metric than pending sales could show potential for more sales in February and March.

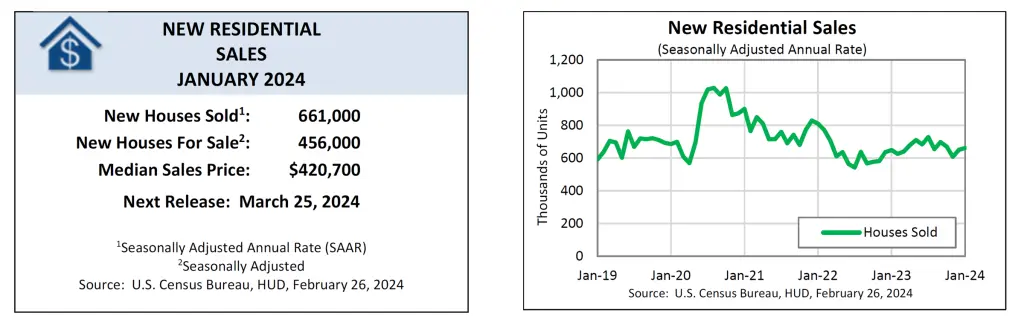

What about new home sales?

The median sales price for new construction homes sold in January 2024 was $420,700. This is an increase from $413,200 in December 2023.

There were 456,00 new homes for sale at the end of January and that represents an 8.3 month supply. Inventory of new homes is rising, there was an 8.2 month supply at the end of December 2023. A rise in inventory that surpasses six months causes builders to make a solid pause in construction but the current housing market is in a unique economic position.

“Shelter inflation—rent and homeownership costs—are still rising at a 5.4% rate, and for the past year, more than half of overall inflation in the economy has been shelter inflation. The only way to tame shelter inflation, and get overall inflation lower, is to build more housing”, said Robert Dietz, the NAHB Chief Economist.

And so builders are optimistic about the second half of 2024, with Dietz forecasting single-family starts to increase 4.7% to fill the current need for 1.15 million homes a year to reduce the deficit.

With optimism also comes reality. Developers expect to experience more supply-side challenges in the form of lumber, labor and regulations as demand rises when mortgage rates go down.

Builders and single-family investors continue to chip away at housing inventory, developing and rehabbing in new markets across the country. There is plenty of room for both players in the housing market.

Who are the buyers in the market according to the January data release by NAR?

Homes stayed on the market for 36 days in January compared to 29 days in December. First-time buyers are still out there in the market and responsible for 28% of sales in January, down from 29% in December.

First-timers might still be waiting to see what happens with the market in the second quarter of 2024 but just a year ago, they represented 31% of buyers, so not too far from normal.

All-cash sales accounted for 32% of transactions in January, up from 29% in both December and one year ago.

Individual investors or second-home buyers, who make up many cash sales, purchased 17% of homes in January, up from 16% in December and January 2023.

Distressed sales – foreclosures and short sales – represented 2% of sales in January, virtually unchanged from last month and the previous year.

What about those mortgage rates?

Higher interest rates in recent weeks have made a dent in housing activity, bringing down mortgage demand.

There is a lot of talk and speculation that the Fed will make rate cuts by the end of the second quarter that will push mortgage rates down. But how far will they actually go?

During the final week of February, mortgage rates hit 7.57% on a 30-year-fixed, and hovered above 7% the entire month. To put into historical perspective, and potentially ease the stress of the current rate climate, the 30-year-fixed mortgage was 7.51% in March of 1994.

A silver lining? Less demand is creating more housing inventory. And since expectations are being set for a less dramatic and volatile shift in mortgage rates, even a slight shift should bring anxious buyers back into the market.

This is always good news for investors whether the strategy is fix and flipping or renting. Those buyers that still perceive mortgage rates to be too high will look to rent while they wait.

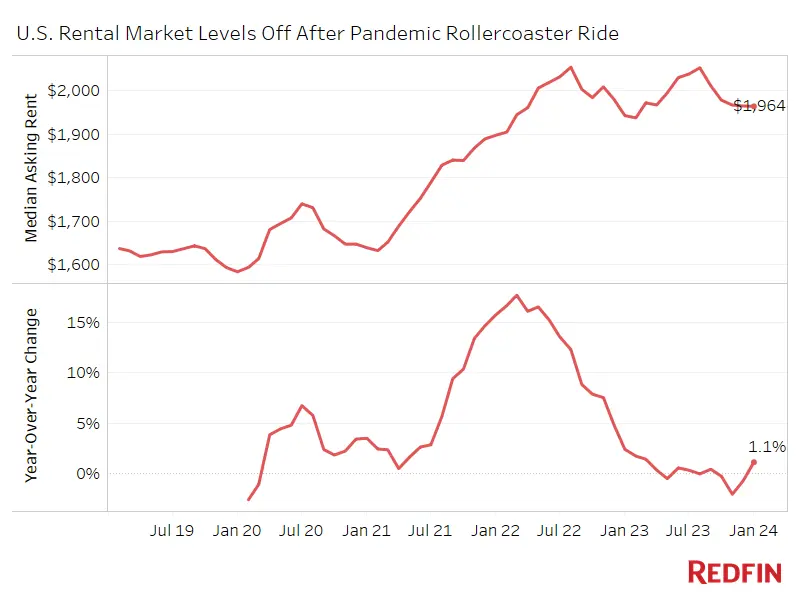

Where are rental rates headed?

The median asking rent rose 1.1% year-over-year in January 204. The median national rent rate currently sits at $1964 nationally.

Rents are headed towards flattening across the country. There has been a jump in apartment supply and a rise in vacancies. In fact, the number of recently completed apartments is near its highest level in more than 30 years.

Rents may have stopped rising but they are not declining, either. Home prices are rising much faster than rents, motivating would-be homebuyers to wait and rent instead.

“There’s not a huge incentive for renters to buy right now. Asking rents are stable, and while mortgage rates have dipped in recent months, they haven’t fallen enough to make the financial equation of homebuying feasible for many people,” said Daryl Fairweather, Redfin Chief Economist.

Rental prices in the Midwest sit at $1437 and $2427 in the Northeast. Rents in the South sit at $1637 and $2358 in the West.

Investors who buy and hold single-family homes have an opportunity to offer a different type of rental unit that could be more appealing to families or couples not wanting to live in the larger, new construction apartment complexes.